How To Get Health Insurance In California

Health insurance is an essential aspect of healthcare coverage, and understanding the options available in California is crucial for residents seeking adequate protection. With a diverse range of plans and providers, California offers a robust healthcare insurance market, making it essential to navigate the options wisely. This comprehensive guide aims to provide an in-depth analysis of the process of obtaining health insurance in California, covering key aspects such as eligibility, plan selection, enrollment, and the benefits and challenges associated with the state's healthcare system.

Navigating the California Health Insurance Market

California, being the most populous state in the United States, boasts a dynamic healthcare landscape with numerous insurance carriers and plans tailored to meet diverse needs. The state’s commitment to healthcare accessibility has led to the implementation of several initiatives and regulations that influence the insurance market.

Key Factors Influencing Health Insurance in California

-

State-Wide Healthcare Reforms: California has actively promoted healthcare accessibility through initiatives like the California Health Benefit Exchange (also known as Covered California), offering subsidized insurance plans to eligible residents.

-

Diverse Insurance Carriers: The state is served by a variety of insurance providers, including major national carriers and smaller, regional health plans. This diversity ensures a range of coverage options and price points.

-

Affordability and Subsidies: For those with lower incomes, California provides financial assistance through premium tax credits and cost-sharing reductions, making insurance more affordable.

-

Network Coverage: Insurance plans in California often have expansive provider networks, ensuring residents have access to a wide range of healthcare professionals and facilities.

Eligibility and Enrollment Periods

Understanding eligibility and enrollment timelines is crucial when navigating the California health insurance market. The state follows both a standard open enrollment period and special enrollment periods throughout the year.

-

Standard Open Enrollment: Typically occurring in the fall, this period allows individuals to enroll in a health plan for the upcoming year. It’s essential to be aware of the specific dates to ensure timely enrollment.

-

Special Enrollment Periods: These are triggered by qualifying life events such as marriage, birth of a child, or loss of other coverage. During these periods, individuals can enroll outside of the standard open enrollment timeframe.

Comparing Health Insurance Plans in California

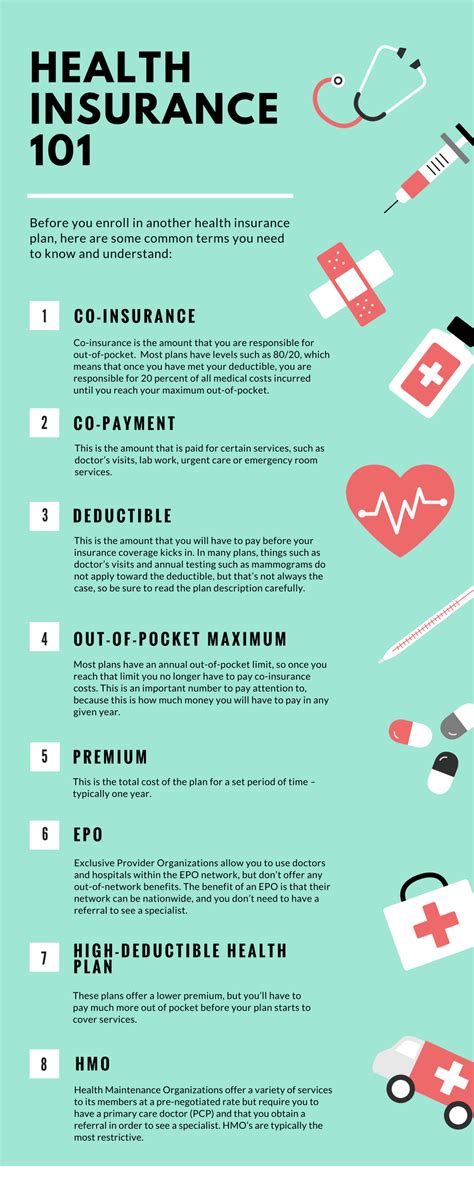

With a multitude of plans available, choosing the right health insurance in California requires careful consideration of various factors. Here’s a breakdown of key elements to help with plan selection:

-

Coverage Levels: Plans are categorized based on the percentage of healthcare costs they cover. From Bronze (covering a lower percentage) to Platinum (covering a higher percentage), the choice depends on individual healthcare needs and preferences.

-

Premiums and Deductibles: Premiums are the monthly cost of insurance, while deductibles are the out-of-pocket expenses before insurance coverage kicks in. Balancing these costs is crucial for financial planning.

-

Provider Networks: Understanding which doctors, hospitals, and specialists are included in a plan’s network is vital. Out-of-network care often incurs higher costs, so it’s essential to choose a plan with a network that suits your healthcare needs.

-

Additional Benefits: Some plans offer extra benefits like vision, dental, or prescription drug coverage. These can be valuable additions, especially for those with specific healthcare requirements.

| Plan Type | Coverage | Premium | Deductible |

|---|---|---|---|

| Bronze | 60% | $350/month | $5,000 |

| Silver | 70% | $400/month | $4,000 |

| Gold | 80% | $450/month | $3,000 |

| Platinum | 90% | $500/month | $2,000 |

Understanding the Enrollment Process

Enrolling in health insurance in California involves a series of steps to ensure a smooth transition into coverage. Here’s a breakdown of the enrollment process, including key considerations and potential challenges.

Step-by-Step Enrollment Guide

-

Assess Your Needs: Begin by evaluating your healthcare needs, considering factors like age, health status, and preferred providers. This assessment will guide your choice of plan and coverage.

-

Choose a Plan: Using the criteria outlined earlier, select a plan that aligns with your healthcare needs and financial situation. Research different options and compare premiums, deductibles, and coverage levels.

-

Gather Required Documents: Prepare the necessary documents for enrollment, which may include proof of identity, residency, and income. Having these documents ready speeds up the process.

-

Apply Online or by Mail: You can apply for health insurance through the Covered California website or by mail. Ensure all information is accurate and complete to avoid delays in processing.

-

Review and Confirm Enrollment: After submitting your application, carefully review the terms of your chosen plan. Confirm that the coverage aligns with your expectations and needs.

-

Make Timely Premium Payments: Premiums are typically due before coverage begins. Ensure you understand the payment schedule and make timely payments to avoid lapses in coverage.

Potential Challenges and Solutions

Navigating the enrollment process may present challenges, but being prepared can help overcome them. Here are some common issues and strategies to address them:

-

Complex Plan Options: With a wide range of plans, choosing the right one can be daunting. Utilize online tools, speak to insurance brokers, or seek advice from healthcare professionals to make an informed decision.

-

Document Verification: Ensure all required documents are easily accessible and up-to-date. If you anticipate difficulties in providing certain documents, reach out to the insurance provider or Covered California for guidance.

-

Enrollment Deadlines: Be aware of enrollment deadlines and plan accordingly. Missing deadlines can result in delays or gaps in coverage, so it’s crucial to stay informed and act promptly.

Benefits and Challenges of California’s Healthcare System

California’s healthcare system offers numerous advantages, but it’s essential to be aware of potential challenges to make informed decisions.

Advantages of California’s Healthcare Coverage

-

Extensive Provider Networks: Insurance plans in California often feature expansive provider networks, ensuring residents have access to a wide range of healthcare professionals and facilities.

-

Subsidized Plans: For eligible residents, California provides financial assistance through premium tax credits and cost-sharing reductions, making insurance more affordable.

-

Innovation and Research: California’s healthcare system fosters innovation and medical research, ensuring access to cutting-edge treatments and technologies.

-

Mental Health Coverage: Many insurance plans in California include mental health services, reflecting the state’s commitment to holistic healthcare.

Challenges and Considerations

While California’s healthcare system offers numerous benefits, it’s essential to be aware of potential challenges and make informed choices.

-

Cost of Care: Despite subsidies, the cost of healthcare in California can be high, particularly for those without insurance or with high-deductible plans. It’s crucial to understand the financial implications and plan accordingly.

-

Network Restrictions: Out-of-network care often incurs higher costs, so choosing a plan with a network that suits your healthcare needs is vital.

-

Waiting Periods: Some insurance plans have waiting periods for certain services or conditions, which can impact timely access to care.

Conclusion: Navigating the Path to Healthcare Coverage

Obtaining health insurance in California involves a thoughtful process of understanding eligibility, comparing plans, and navigating the enrollment procedure. With a diverse range of insurance options and a commitment to healthcare accessibility, California provides a robust framework for residents to secure the coverage they need. By staying informed, seeking expert advice when needed, and carefully considering individual healthcare needs, Californians can ensure they have the protection they deserve.

FAQ

What is the average cost of health insurance in California?

+

The average cost of health insurance in California can vary based on several factors, including the type of plan, age, location, and income. According to recent data, the average monthly premium for an individual plan in California is around 500, while family plans can range from 1,000 to $2,000 per month. However, these figures can be significantly reduced with the help of subsidies and tax credits, making insurance more affordable for eligible residents.

Can I enroll in health insurance outside of the open enrollment period in California?

+

Yes, you can enroll outside of the standard open enrollment period if you experience a qualifying life event, such as marriage, birth of a child, or loss of other coverage. These events trigger a special enrollment period, allowing you to enroll within a specified timeframe after the event occurs.

Are there any discounts or subsidies available for health insurance in California?

+

Yes, California offers financial assistance in the form of premium tax credits and cost-sharing reductions for eligible residents. These subsidies can significantly reduce the cost of insurance, making it more affordable for individuals and families with lower incomes.

How do I know which health insurance plan is right for me in California?

+

Choosing the right health insurance plan depends on your individual needs and preferences. Consider factors such as coverage levels, premiums, deductibles, and provider networks. It’s also beneficial to seek advice from insurance brokers or healthcare professionals who can guide you based on your specific circumstances.

What happens if I miss the open enrollment period for health insurance in California?

+

If you miss the standard open enrollment period, you may still be able to enroll during a special enrollment period if you experience a qualifying life event. However, if you don’t qualify for a special enrollment period, you may need to wait until the next open enrollment period to enroll in a new plan.