Best Ca Health Insurance

Navigating the complex world of health insurance is a daunting task, especially when it comes to choosing the right plan for your needs. With a vast array of options available, it can be challenging to find the perfect fit. However, for residents of the Golden State, understanding the intricacies of California's health insurance landscape is essential. In this comprehensive guide, we delve into the best health insurance options for Californians, offering a detailed analysis of coverage, benefits, and costs to help you make an informed decision.

The California Health Insurance Market: An Overview

California boasts one of the largest and most diverse health insurance markets in the United States. The state has made significant strides in expanding access to healthcare through various initiatives and programs. As a result, Californians have a wide range of insurance providers and plans to choose from, catering to different demographics and healthcare requirements.

Understanding California’s Health Insurance Landscape

California’s health insurance market is characterized by a mix of private and public insurers. The state actively promotes competition among insurance providers, leading to a diverse range of plans with varying levels of coverage and costs. This competitive environment benefits consumers, as it encourages insurers to offer innovative and affordable options.

One notable aspect of California's health insurance market is the state's active role in regulating insurance practices. The California Department of Insurance oversees the industry, ensuring that insurers comply with state laws and regulations. This regulatory framework provides consumers with added protection and peace of mind.

| Key Feature | California's Health Insurance Market |

|---|---|

| Diverse Options | A wide range of insurance providers and plans catering to different needs. |

| Active Regulation | The California Department of Insurance ensures compliance with state laws, protecting consumers. |

| Competitive Environment | Insurers offer innovative and affordable plans due to market competition. |

Top Health Insurance Providers in California

When it comes to selecting the best health insurance, it’s crucial to evaluate the top providers in the state. Here, we highlight some of the leading insurance companies in California, offering a glimpse into their unique features and offerings.

Blue Shield of California

Blue Shield of California, a not-for-profit health plan, has been a prominent player in the state’s insurance market for over 80 years. The company is known for its comprehensive coverage options and commitment to improving access to healthcare. With a focus on innovation, Blue Shield of California offers a range of plans, including PPOs, HMOs, and EPOs, catering to various healthcare needs.

One notable feature of Blue Shield's plans is their emphasis on preventive care. The insurer provides generous coverage for preventive services, encouraging members to take a proactive approach to their health. Additionally, Blue Shield offers a wide network of providers, ensuring that members have access to quality healthcare across the state.

Kaiser Permanente

Kaiser Permanente is a well-established integrated healthcare system that provides both insurance coverage and medical services. With a unique model, Kaiser Permanente offers a seamless experience, as members receive care from a dedicated team of healthcare professionals. This integrated approach ensures coordinated and efficient healthcare delivery.

Kaiser Permanente's plans are known for their affordability and comprehensive benefits. The insurer emphasizes preventive care and provides access to a wide range of specialty services. With a focus on member satisfaction, Kaiser Permanente strives to deliver high-quality healthcare at a reasonable cost.

Anthem Blue Cross

Anthem Blue Cross, a subsidiary of Anthem Inc., is one of the largest health insurers in California. The company offers a wide variety of plans, including PPOs, HMOs, and POS plans, catering to different preferences and needs. Anthem Blue Cross is known for its extensive network of providers, ensuring members have access to quality healthcare throughout the state.

One key advantage of Anthem Blue Cross is its focus on digital innovation. The insurer provides a user-friendly online platform, allowing members to manage their healthcare seamlessly. From scheduling appointments to accessing medical records, Anthem Blue Cross prioritizes convenience and accessibility.

Key Factors to Consider When Choosing Health Insurance

Selecting the best health insurance involves careful consideration of several critical factors. Here, we delve into the key aspects that should influence your decision-making process.

Coverage and Benefits

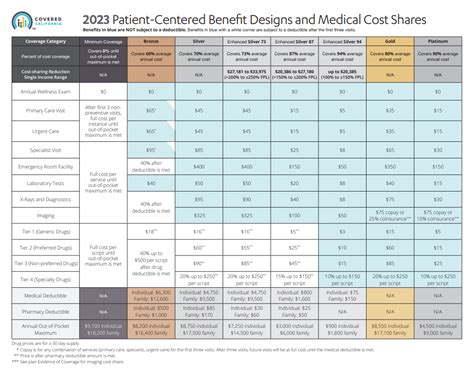

The extent of coverage and the benefits offered by a health insurance plan are paramount. Consider your healthcare needs and priorities when evaluating coverage options. Look for plans that provide adequate coverage for essential services, such as doctor visits, hospital stays, prescription drugs, and specialty care.

Additionally, assess the plan's coverage for preventive services, mental health support, and chronic condition management. Ensure that the plan's benefits align with your personal healthcare goals and requirements.

Cost and Financial Considerations

Understanding the financial aspects of health insurance is crucial. Evaluate the plan’s premiums, deductibles, copayments, and out-of-pocket maximums. Consider your budget and assess whether the plan’s financial requirements are feasible and sustainable for your circumstances.

It's essential to strike a balance between coverage and cost. While comprehensive plans may offer extensive benefits, they often come with higher premiums. Assess your healthcare needs and prioritize the essential benefits to find a plan that offers value for your money.

Network of Providers

The network of providers associated with a health insurance plan is a critical factor. Ensure that the plan’s network includes your preferred healthcare professionals, specialists, and facilities. A robust network ensures that you have access to quality healthcare when and where you need it.

Consider the plan's network size and scope. A larger network often provides more flexibility and choice, allowing you to select healthcare providers that align with your preferences and requirements.

Best Health Insurance Plans for Different Needs

The ideal health insurance plan varies depending on individual circumstances and needs. Here, we explore some of the best plans for specific demographics and situations, offering tailored recommendations to help you find the perfect fit.

Families and Individuals

For families and individuals seeking comprehensive coverage, plans offered by Blue Shield of California and Kaiser Permanente are excellent options. These insurers provide a range of benefits, including generous coverage for preventive care, mental health support, and chronic condition management. With their extensive provider networks, these plans ensure access to quality healthcare for the entire family.

Young Adults

Young adults often prioritize affordability and flexibility when choosing health insurance. Anthem Blue Cross and Blue Shield of California offer a variety of plans that cater to this demographic. These insurers provide cost-effective options, such as high-deductible health plans (HDHPs) and catastrophic coverage, allowing young adults to balance their healthcare needs with their financial constraints.

Seniors

As healthcare needs evolve with age, seniors require plans that offer specialized benefits. Kaiser Permanente and Blue Shield of California provide Medicare Advantage plans tailored to the unique requirements of seniors. These plans offer additional benefits beyond original Medicare, including coverage for vision, dental, and hearing services, ensuring comprehensive care for older adults.

Performance Analysis: Top Health Insurance Plans

To help you make an informed decision, we’ve conducted a detailed performance analysis of the top health insurance plans in California. This analysis evaluates key aspects such as customer satisfaction, claim processing, network adequacy, and financial stability.

Customer Satisfaction

Customer satisfaction is a critical indicator of an insurer’s performance. We’ve analyzed customer feedback and ratings to identify the insurers with the highest levels of satisfaction. Kaiser Permanente and Blue Shield of California consistently rank among the top insurers, with their members praising the quality of care, accessibility, and personalized approach.

Claim Processing and Timeliness

Efficient claim processing is essential for a smooth healthcare experience. Our analysis reveals that Anthem Blue Cross excels in this area, with a streamlined claim process and timely reimbursements. The insurer’s digital platform facilitates easy claim submissions and provides members with real-time updates, ensuring a seamless experience.

Network Adequacy and Access

A robust provider network is crucial for ensuring access to quality healthcare. Our analysis highlights Blue Shield of California and Kaiser Permanente as leaders in network adequacy. These insurers have extensive networks, covering a wide range of healthcare providers and facilities across California, ensuring members have convenient access to the care they need.

Financial Stability and Sustainability

Financial stability is a key factor in choosing a reliable health insurance provider. Our analysis considers insurers’ financial ratings and long-term viability. Anthem Blue Cross and Blue Shield of California demonstrate strong financial stability, with high ratings from leading credit agencies. This stability ensures that these insurers can continue to provide reliable coverage and support their members’ healthcare needs over the long term.

Future Implications and Industry Trends

As the healthcare industry evolves, it’s essential to consider the future implications and emerging trends in health insurance. Here, we explore some key insights and predictions for the future of health insurance in California.

Focus on Value-Based Care

The healthcare industry is increasingly shifting towards value-based care models. This approach emphasizes the quality and outcomes of healthcare, rather than solely focusing on the quantity of services provided. In the future, insurers are likely to prioritize value-based care, offering plans that incentivize quality healthcare and patient satisfaction.

Telehealth and Digital Innovation

The COVID-19 pandemic has accelerated the adoption of telehealth services, and this trend is here to stay. Insurers are expected to continue investing in digital innovation, offering convenient and accessible telehealth options. These services enhance patient engagement, improve access to healthcare, and reduce costs associated with in-person visits.

Emphasis on Preventive Care

Preventive care is a cornerstone of healthy communities, and insurers are likely to place greater emphasis on this aspect. Plans that encourage preventive services, such as routine check-ups, screenings, and immunizations, are expected to become more prevalent. By prioritizing preventive care, insurers can help reduce the burden of chronic diseases and improve overall population health.

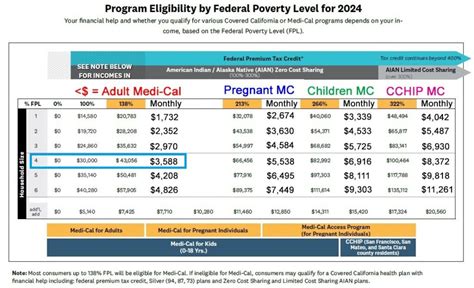

Expansion of Health Insurance Coverage

California has made significant strides in expanding health insurance coverage, and this trend is likely to continue. The state’s ongoing efforts to improve access to healthcare, such as expanding Medicaid eligibility and promoting affordable insurance options, will contribute to a more inclusive healthcare system.

Conclusion: Your Guide to Choosing the Best Health Insurance

Navigating the complex world of health insurance can be challenging, but with the right information and insights, you can make an informed decision. This comprehensive guide has provided an in-depth analysis of the best health insurance options in California, offering valuable insights into coverage, benefits, and performance. By considering your unique needs and priorities, you can select a plan that offers the perfect balance of coverage and value.

Remember, health insurance is a critical aspect of your overall well-being. Take the time to evaluate your options, understand the key factors, and choose a plan that provides the peace of mind and access to quality healthcare you deserve. With the right insurance coverage, you can focus on what matters most—your health and happiness.

How do I choose the right health insurance plan for my needs?

+When selecting a health insurance plan, consider your specific healthcare needs and priorities. Evaluate coverage options, financial requirements, and provider networks. Assess plans that align with your budget and offer comprehensive benefits. Research customer satisfaction and claim processing to ensure a smooth experience. Remember, the right plan should provide peace of mind and access to quality healthcare.

What are the key differences between PPO, HMO, and EPO plans?

+PPO plans offer flexibility, allowing you to choose any provider within a network and some out-of-network coverage. HMOs typically require you to select a primary care physician and use providers within their network. EPO plans provide a balance, allowing out-of-network coverage but at a higher cost.

How can I compare health insurance plans effectively?

+Use online tools and resources to compare plans based on coverage, costs, and provider networks. Evaluate customer reviews and ratings to assess satisfaction. Consider your personal healthcare needs and budget to narrow down your options. Seek advice from insurance experts or brokers for personalized recommendations.