Minnesota Insurance

Understanding insurance coverage is crucial, especially when navigating the unique landscape of each state. Minnesota, the "Land of 10,000 Lakes," has its own set of regulations and requirements when it comes to insurance, offering a range of options and policies to protect its residents. This comprehensive guide aims to shed light on the world of Minnesota Insurance, covering everything from mandatory coverage to optional policies, industry insights, and future trends.

Mandatory Insurance Requirements in Minnesota

Like many other states, Minnesota has specific laws regarding insurance coverage to ensure the safety and financial protection of its residents. Let’s delve into the mandatory insurance requirements that every Minnesotan should be aware of.

Automotive Insurance

For all vehicle owners in Minnesota, automotive insurance is a legal requirement. The state’s minimum liability coverage includes:

- Bodily Injury Liability: 30,000 per person and 60,000 per accident.

- Property Damage Liability: 10,000 per accident.</li> <li><strong>Uninsured Motorist Coverage:</strong> 25,000 per person and $50,000 per accident.

It’s important to note that while these are the minimum requirements, many drivers opt for higher coverage limits to ensure adequate protection in the event of an accident.

Homeowners Insurance

While homeowners insurance is not mandated by law in Minnesota, it is highly recommended for all homeowners. This type of insurance provides coverage for the structure of the home, personal belongings, and liability protection. The average cost of homeowners insurance in Minnesota is around $1,300 per year, making it an affordable option for many.

Health Insurance

Minnesota has taken significant steps to ensure its residents have access to quality healthcare. The state has implemented the Minnesota Comprehensive Health Association (MCHA), which provides health insurance coverage to individuals with pre-existing conditions who may have difficulty obtaining coverage through traditional means. The MCHA also offers a high-risk pool for those with expensive medical conditions.

Optional Insurance Policies in Minnesota

Beyond the mandatory requirements, Minnesota residents have a range of optional insurance policies they can consider to further protect themselves and their assets.

Umbrella Insurance

Umbrella insurance is an additional layer of liability coverage that goes beyond the limits of standard policies. It can be particularly beneficial for individuals with significant assets or those facing unique liability risks. In Minnesota, umbrella policies typically provide coverage starting at $1 million and can be customized to fit individual needs.

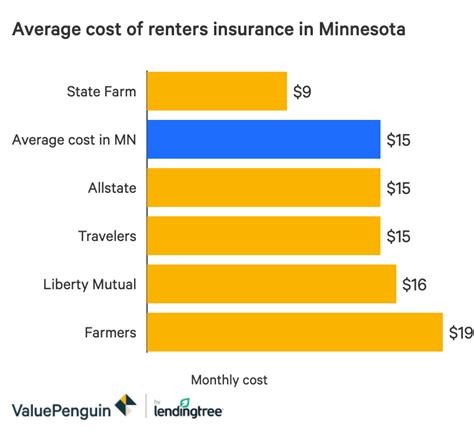

Renter’s Insurance

Renter’s insurance is a smart investment for Minnesotans living in rented properties. This policy covers personal belongings, provides liability protection, and can even include additional living expenses if the insured is displaced due to a covered event. The average cost of renter’s insurance in Minnesota is approximately $150 per year, making it an affordable way to protect one’s possessions.

Pet Insurance

With a growing pet population, pet insurance is becoming increasingly popular in Minnesota. This type of insurance can help cover the costs of veterinary care, including accidents, illnesses, and even routine check-ups. The average cost of pet insurance varies depending on the age and breed of the pet, but it typically ranges from 30 to 50 per month.

Industry Insights and Trends

The insurance industry in Minnesota is dynamic, with constant changes and developments. Staying informed about these trends can help individuals make more informed decisions about their coverage.

Digital Transformation

Like many industries, insurance in Minnesota is undergoing a digital transformation. Insurers are investing in technology to enhance the customer experience, streamline processes, and improve overall efficiency. From online quoting tools to mobile apps for policy management, the digital shift is making insurance more accessible and convenient for Minnesotans.

Climate Change and Natural Disasters

Minnesota, known for its unpredictable weather, faces increasing risks associated with climate change. This includes more frequent and severe storms, tornadoes, and even flooding. As a result, insurers are adapting their policies and rates to account for these changing conditions. Residents can expect to see a greater focus on disaster preparedness and insurance products designed to cover climate-related risks.

Telemedicine and Healthcare Innovations

The healthcare landscape in Minnesota is evolving, with telemedicine and other digital health solutions gaining traction. This trend is influencing the health insurance market, as insurers adapt to cover these new forms of care. Minnesotans can benefit from expanded access to healthcare services and more comprehensive coverage for virtual consultations and remote monitoring.

Performance Analysis and Future Implications

Examining the performance of the insurance industry in Minnesota provides valuable insights into its stability and future prospects.

Market Growth and Stability

The insurance market in Minnesota has shown steady growth over the past decade. According to the Minnesota Department of Commerce, the total written premium for property and casualty insurance in the state increased by 3.7% in 2022. This growth is a positive indicator of the industry’s stability and its ability to adapt to changing market conditions.

Regulatory Changes and Consumer Protection

Minnesota’s insurance regulators play a crucial role in ensuring a fair and competitive market. The state has implemented various consumer protection measures, including the Minnesota Fair Access to Insurance Requirements (FAIR) law, which ensures access to insurance coverage for high-risk individuals and businesses. Future regulatory changes are likely to focus on continuing to protect consumers while promoting innovation in the industry.

Insurance Technology and Insurtech

The rise of insurtech, or insurance technology, is a global trend that is significantly impacting the Minnesota insurance market. Insurtech startups are disrupting traditional insurance models, offering innovative products and services. Minnesotans can expect to see more personalized insurance offerings, improved risk assessment, and enhanced customer experiences as insurtech continues to evolve.

Table: Insurance Costs in Minnesota

| Insurance Type | Average Annual Cost |

|---|---|

| Homeowners Insurance | 1,300</td> </tr> <tr> <td>Renter's Insurance</td> <td>150 |

| Auto Insurance (Minimum Liability) | Varies by provider and driving record |

| Pet Insurance | 360 - 600 (annual range) |

| Umbrella Insurance (starting coverage) | $1 million in additional liability coverage |

What are the penalties for not having automotive insurance in Minnesota?

+Failing to maintain automotive insurance in Minnesota can result in significant penalties. Drivers caught without insurance may face fines of up to $200, have their registration suspended, and even receive a misdemeanor charge for a second offense. It’s crucial to maintain continuous coverage to avoid these consequences.

Are there discounts available for insurance in Minnesota?

+Yes, there are various discounts available for insurance policies in Minnesota. These may include safe driver discounts, multi-policy discounts (combining auto and home insurance), loyalty discounts, and even discounts for specific occupations or membership in certain organizations. It’s worth exploring these options with your insurance provider to reduce costs.

How does Minnesota’s insurance market compare to other states?

+Minnesota’s insurance market is generally considered competitive and stable. The state’s insurance regulations provide a balance between consumer protection and market freedom, resulting in a robust and innovative insurance environment. Compared to other states, Minnesota often ranks favorably in terms of affordability and availability of coverage.