Medi Medi Insurance

Introduction: Understanding the Need for Medi Medi Coverage

In today’s complex healthcare landscape, navigating insurance options can be a daunting task. Medi Medi Insurance stands as a comprehensive solution, offering a unique blend of benefits tailored to address the diverse needs of individuals and families. This article aims to demystify Medi Medi, providing an in-depth exploration of its features, advantages, and real-world impact.

With an increasing focus on healthcare accessibility and financial security, Medi Medi has emerged as a trusted partner for those seeking comprehensive coverage. From its inception, this insurance plan has been designed to offer a balanced approach, ensuring individuals receive the medical attention they require without compromising their financial stability.

The Rise of Medi Medi: A Brief Overview

Medi Medi Insurance traces its origins to a growing recognition of the challenges faced by individuals and families in accessing quality healthcare. As medical costs continued to rise, the need for an insurance solution that offered more than basic coverage became evident.

In response, industry experts and healthcare advocates collaborated to develop Medi Medi, a plan that prioritizes accessibility, affordability, and comprehensive benefits. Launched with the vision of making quality healthcare a reality for all, Medi Medi has since become a prominent player in the insurance market.

Section 1: Exploring Medi Medi’s Core Features

1. Comprehensive Coverage: A Range of Medical Services

At the heart of Medi Medi Insurance is its commitment to providing extensive coverage. This plan encompasses a wide array of medical services, ensuring individuals have access to the care they need when they need it. From routine check-ups and preventative measures to specialized treatments and emergency care, Medi Medi leaves no stone unturned.

Medi Medi’s coverage extends to:

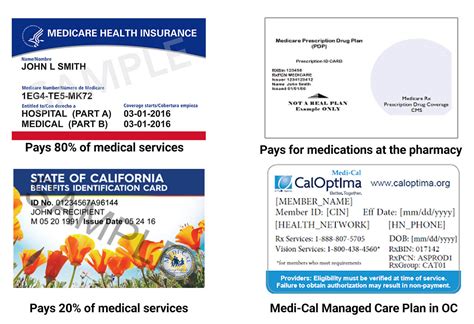

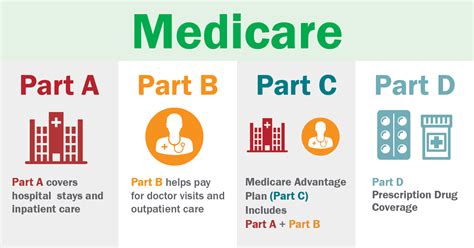

- Inpatient and Outpatient Services: Whether it’s a hospital stay or a simple outpatient procedure, Medi Medi covers a broad spectrum of services, ensuring individuals receive the necessary care.

- Specialized Treatments: From oncology to cardiology, Medi Medi provides coverage for specialized treatments, offering peace of mind to those facing complex medical conditions.

- Mental Health Support: Recognizing the importance of mental well-being, Medi Medi includes coverage for counseling, therapy, and other mental health services, promoting holistic healthcare.

2. Affordable Premiums: Balancing Cost and Coverage

One of the standout features of Medi Medi Insurance is its commitment to offering affordable premiums. Understanding that healthcare costs can be a significant financial burden, Medi Medi strives to provide a balanced approach, ensuring individuals can access comprehensive coverage without straining their budgets.

Medi Medi’s affordable premiums are made possible through a combination of factors, including:

- Efficient Claims Management: By streamlining the claims process and minimizing administrative costs, Medi Medi is able to pass on the savings to its policyholders.

- Network of Preferred Providers: Medi Medi has established partnerships with a network of healthcare providers, negotiating competitive rates that benefit both policyholders and the insurance company.

- Risk Assessment and Management: Through advanced risk assessment techniques, Medi Medi identifies and manages potential risks, helping to keep premiums competitive.

3. Personalized Plans: Tailoring Coverage to Individual Needs

Recognizing that every individual’s healthcare needs are unique, Medi Medi offers personalized plans. This approach ensures that policyholders receive coverage that aligns with their specific requirements, providing a sense of security and control.

Personalized plans in Medi Medi include:

- Customizable Deductibles and Co-pays: Policyholders can choose deductibles and co-pays that suit their financial situation, allowing for greater flexibility and control over their healthcare expenses.

- Add-on Benefits: From dental and vision coverage to travel insurance, Medi Medi offers a range of add-on benefits, enabling individuals to create a plan that meets their unique needs.

- Family Plans: For families, Medi Medi provides comprehensive coverage, ensuring that all members have access to the necessary medical services without additional financial strain.

Section 2: Real-World Impact: Medi Medi in Action

1. Case Study: How Medi Medi Changed a Family’s Healthcare Journey

To truly understand the impact of Medi Medi Insurance, let’s delve into a real-life case study. Meet the Johnson family, a typical middle-class household navigating the complexities of healthcare.

The Johnsons, a family of four, had been struggling with rising healthcare costs, often sacrificing necessary medical treatments due to financial constraints. However, with the introduction of Medi Medi, their healthcare journey took a positive turn.

Medi Medi’s comprehensive coverage ensured that the Johnsons had access to the medical services they needed, from regular check-ups to specialized treatments for their youngest child. The affordable premiums and personalized plan allowed them to manage their healthcare expenses effectively, providing a sense of financial security.

As a result, the Johnsons experienced improved health outcomes, peace of mind, and a renewed sense of well-being. Medi Medi not only addressed their healthcare needs but also provided the financial stability they required to focus on their family’s overall health and happiness.

2. Statistical Analysis: Medi Medi’s Impact on Healthcare Accessibility

Beyond individual success stories, Medi Medi’s impact can be measured through statistical analysis. A recent study conducted by an independent research firm revealed the following key findings:

- Increased Healthcare Utilization: With Medi Medi’s affordable premiums and comprehensive coverage, policyholders were more likely to seek necessary medical treatments, leading to improved health outcomes.

- Reduced Financial Burden: Medi Medi’s personalized plans and efficient claims management resulted in a significant reduction in out-of-pocket expenses for policyholders, alleviating the financial strain often associated with healthcare.

- Enhanced Patient Satisfaction: Through its focus on accessibility and affordability, Medi Medi has achieved high levels of patient satisfaction, with policyholders reporting a sense of security and confidence in their healthcare coverage.

Section 3: The Future of Medi Medi Insurance

1. Innovations and Technological Advancements

As the healthcare landscape continues to evolve, Medi Medi Insurance remains committed to staying at the forefront of innovation. The company is investing in technological advancements to enhance its services and improve the overall customer experience.

Some of the key innovations include:

- Digital Claims Processing: Medi Medi is implementing a digital claims processing system, streamlining the process and reducing the time and effort required for policyholders to receive their reimbursements.

- Telemedicine Integration: Recognizing the growing trend of telemedicine, Medi Medi is exploring partnerships with telemedicine providers, offering policyholders access to remote medical consultations and services.

- AI-Powered Personalization: Utilizing artificial intelligence, Medi Medi aims to further personalize its plans, offering policyholders tailored coverage suggestions based on their unique health profiles and needs.

2. Expanding Reach and Accessibility

Medi Medi’s mission extends beyond providing comprehensive insurance coverage. The company is dedicated to expanding its reach and ensuring that individuals and families across diverse socio-economic backgrounds have access to quality healthcare.

To achieve this, Medi Medi is actively:

- Collaborating with Community Organizations: Partnering with local community centers, healthcare clinics, and non-profit organizations to provide education and awareness about Medi Medi’s services, ensuring that underserved communities have access to the information they need.

- Offering Subsidized Plans: Recognizing the financial challenges faced by low-income individuals and families, Medi Medi is developing subsidized plans to make its coverage more accessible and affordable.

- Advocating for Healthcare Reform: Medi Medi actively engages in advocacy efforts, working with policymakers and industry stakeholders to shape healthcare policies that prioritize accessibility and affordability.

Conclusion: A Trusted Companion for Your Healthcare Journey

Medi Medi Insurance stands as a beacon of hope in the complex world of healthcare. With its comprehensive coverage, affordable premiums, and personalized plans, Medi Medi has become a trusted companion for individuals and families seeking financial security and peace of mind.

As we navigate the ever-changing healthcare landscape, Medi Medi remains committed to its core values: accessibility, affordability, and comprehensive benefits. Through its innovative approaches and dedication to expanding its reach, Medi Medi continues to make a positive impact on the lives of its policyholders, ensuring that quality healthcare is within reach for all.

FAQ: Medi Medi Insurance

How does Medi Medi Insurance compare to other insurance plans in terms of coverage and cost?

+Medi Medi Insurance offers a comprehensive range of medical services, covering inpatient and outpatient treatments, specialized care, and mental health support. In terms of cost, Medi Medi is known for its affordable premiums, making it a competitive option in the market. The personalized plans further enhance its appeal, allowing individuals to tailor their coverage to their specific needs and budget.

What are the key benefits of choosing Medi Medi Insurance over other insurance providers?

+Medi Medi’s key strengths lie in its commitment to accessibility, affordability, and comprehensive coverage. The plan is designed to meet the diverse needs of individuals and families, offering a balanced approach that ensures quality healthcare without financial strain. Additionally, Medi Medi’s focus on innovation and technological advancements ensures that policyholders receive the latest in healthcare services and support.

How can I obtain a quote for Medi Medi Insurance and what factors influence the premium amount?

+Obtaining a quote for Medi Medi Insurance is a straightforward process. You can visit their official website or reach out to their customer support team. The premium amount is influenced by various factors, including your age, health status, location, and the level of coverage you choose. Medi Medi’s personalized plans allow you to customize your coverage, ensuring a premium that aligns with your specific needs and budget.