Cheap Commercial Auto Insurance

For business owners and fleet operators, finding affordable commercial auto insurance is a top priority. It's an essential component of running a successful business, ensuring that your vehicles and drivers are protected in the event of an accident or other unforeseen circumstances. However, navigating the world of commercial auto insurance can be challenging, with a myriad of options and factors to consider. This article aims to provide a comprehensive guide to securing cheap commercial auto insurance while maintaining the necessary coverage and peace of mind.

Understanding Commercial Auto Insurance

Commercial auto insurance is a specialized type of coverage designed for businesses that utilize vehicles in their operations. It is distinct from personal auto insurance and offers protection for a wide range of vehicles, including cars, trucks, vans, and even specialized equipment like trailers and tow trucks. This type of insurance is crucial for businesses that rely on vehicles to transport goods, provide services, or support their day-to-day operations.

The primary goal of commercial auto insurance is to protect businesses from financial losses arising from vehicle-related incidents. This includes coverage for damage to the vehicle, liability for injuries or property damage caused by the business's vehicle, and protection for employees who use company vehicles. By having adequate commercial auto insurance, businesses can mitigate the financial risks associated with vehicle ownership and operation.

Key Components of Commercial Auto Insurance

- Liability Coverage: This is the cornerstone of any commercial auto insurance policy. It provides protection against claims arising from bodily injury or property damage caused by the insured vehicle. Liability coverage helps businesses cover medical expenses, repair costs, and legal fees associated with accidents.

- Physical Damage Coverage: This component covers the cost of repairing or replacing vehicles that are damaged or totaled in an accident. It includes comprehensive coverage for non-collision incidents like theft, vandalism, or natural disasters, and collision coverage for accidents involving other vehicles or objects.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage helps pay for medical expenses incurred by the driver and passengers of the insured vehicle, regardless of fault. It provides a vital safety net for businesses to ensure their employees’ medical needs are met after an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the business and its employees in the event of an accident with a driver who does not have adequate insurance. It ensures that the business is not left financially vulnerable if the other driver is unable to cover the costs of the accident.

Factors Affecting Commercial Auto Insurance Rates

The cost of commercial auto insurance is influenced by a variety of factors. Understanding these factors can help businesses make informed decisions to secure the best rates while maintaining adequate coverage.

Vehicle Type and Usage

The type of vehicles insured and their intended use are significant factors in determining insurance rates. Generally, commercial vehicles that are used for more intensive purposes, such as hauling heavy loads or transporting passengers, will have higher insurance premiums. The more risk associated with the vehicle’s usage, the higher the insurance cost.

For example, a business that operates a fleet of delivery trucks may face higher insurance premiums compared to a business that uses sedans for sales calls. Similarly, vehicles used for specialized tasks like towing or emergency response may have unique insurance requirements and higher costs.

| Vehicle Type | Usage | Average Premium |

|---|---|---|

| Delivery Trucks | Freight Transportation | $2,500 - $3,000 |

| Passenger Vans | Airport Shuttle Services | $1,800 - $2,200 |

| Sedans | Sales Team Vehicles | $1,200 - $1,500 |

Driver Profile

The driving record and experience of the individuals operating the commercial vehicles are crucial factors in insurance rates. Insurance companies assess the risk associated with each driver and adjust premiums accordingly. Drivers with a history of accidents or traffic violations are considered higher risk and may face higher insurance costs.

Additionally, the age and experience of drivers play a role. Younger, less experienced drivers may result in higher premiums due to their increased likelihood of being involved in accidents. Conversely, mature, experienced drivers with clean driving records can help lower insurance costs for the business.

Insurance Provider and Coverage Options

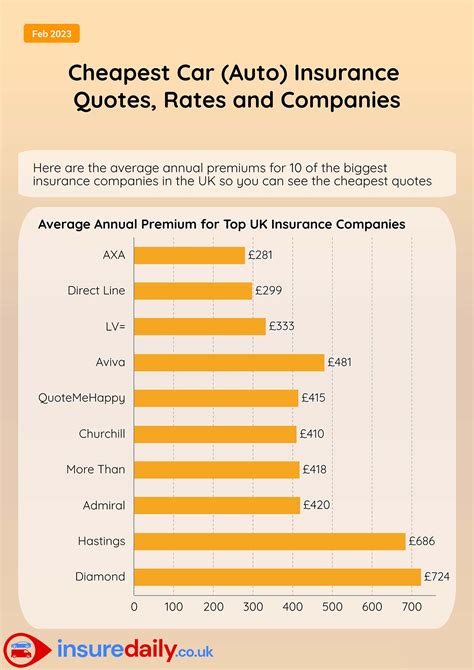

Choosing the right insurance provider and selecting the appropriate coverage options can significantly impact the cost of commercial auto insurance. Different providers offer varying levels of coverage and pricing structures. It’s essential to shop around and compare quotes from multiple insurers to find the best combination of coverage and cost.

Furthermore, businesses should carefully review the coverage options available. While it may be tempting to opt for the cheapest policy, it's crucial to ensure that the policy provides adequate protection for the business's unique needs. Insufficient coverage can leave the business vulnerable to financial losses in the event of an accident.

Tips for Securing Cheap Commercial Auto Insurance

Finding affordable commercial auto insurance requires a strategic approach. Here are some tips to help businesses secure the best rates while maintaining essential coverage:

Shop Around and Compare Quotes

Obtaining quotes from multiple insurance providers is essential. Each insurer has its own underwriting guidelines and pricing structures, so it’s likely that quotes will vary significantly. By comparing quotes, businesses can identify the most competitive rates and choose the insurer that best fits their needs.

Online quote comparison tools can be a valuable resource, providing a quick and convenient way to gather multiple quotes. However, it's also important to speak directly with insurance agents to understand the fine print and ensure that the policy meets the business's specific requirements.

Improve Driver Safety and Training

Investing in driver safety and training programs can have a positive impact on insurance rates. By reducing the likelihood of accidents and violations, businesses can demonstrate to insurers that their drivers are responsible and well-prepared. This can lead to lower premiums and improved coverage options.

Implementing regular driver training sessions, providing clear safety guidelines, and monitoring driver behavior can all contribute to a safer driving culture within the business. As a result, insurers may view the business as a lower risk, leading to more favorable insurance rates.

Bundle Policies and Explore Discounts

Bundling multiple insurance policies with the same provider can often result in significant savings. Many insurers offer discounts when businesses combine commercial auto insurance with other types of coverage, such as general liability, property insurance, or workers’ compensation. By consolidating policies, businesses can simplify their insurance management and potentially reduce costs.

Additionally, businesses should explore other potential discounts. For example, some insurers offer discounts for businesses that maintain a low mileage usage, utilize safety equipment like GPS tracking or airbags, or implement telematics systems to monitor driver behavior. These discounts can help further reduce insurance premiums.

Review Coverage Regularly

Insurance needs can change over time as a business evolves. It’s essential to regularly review the commercial auto insurance policy to ensure that it continues to meet the business’s requirements. This includes assessing whether the coverage limits are adequate, verifying that all necessary vehicles are insured, and confirming that the policy aligns with any legal or contractual obligations.

By staying on top of their insurance needs, businesses can avoid gaps in coverage and ensure that they are not overpaying for unnecessary coverage. Regular reviews can also help identify opportunities to optimize the policy and potentially reduce costs.

The Future of Commercial Auto Insurance

The commercial auto insurance landscape is continually evolving, driven by technological advancements and changing business needs. As businesses embrace new technologies and operating models, the insurance industry is adapting to provide relevant coverage options.

The Rise of Telematics and Usage-Based Insurance

Telematics technology, which uses GPS and other sensors to monitor vehicle usage and driver behavior, is gaining traction in the commercial auto insurance space. By providing real-time data on driving habits, telematics systems can help insurers assess risk more accurately and offer more tailored insurance policies.

Usage-based insurance, also known as pay-as-you-drive insurance, is an emerging model that allows businesses to pay insurance premiums based on actual vehicle usage rather than estimated mileage. This can be particularly beneficial for businesses with seasonal or variable vehicle usage, as it ensures that insurance costs align more closely with their operational needs.

The Impact of Autonomous Vehicles

The advent of autonomous vehicles is set to revolutionize the transportation industry, and the insurance sector is preparing for this paradigm shift. As self-driving vehicles become more prevalent, the liability landscape will change, and new insurance products will be required to cover the unique risks associated with autonomous technologies.

Insurance providers are already developing innovative coverage options for autonomous vehicles, including liability coverage for manufacturers and operators, as well as policies that address the unique risks associated with cyber attacks and data breaches in autonomous systems. The insurance industry is poised to play a crucial role in facilitating the safe and responsible adoption of autonomous technologies.

Conclusion

Securing cheap commercial auto insurance is a critical aspect of managing a successful business. By understanding the factors that influence insurance rates and implementing strategic approaches, businesses can find the right balance between cost and coverage. As the commercial auto insurance landscape continues to evolve, staying informed and adaptable will be key to navigating the industry’s changes and ensuring the continued protection of business assets and employees.

How much does commercial auto insurance typically cost for a small business with 5 vehicles?

+The cost of commercial auto insurance for a small business with 5 vehicles can vary widely based on factors such as vehicle type, usage, driver profile, and coverage options. On average, small businesses can expect to pay between 5,000 and 10,000 annually for commercial auto insurance. However, it’s crucial to obtain quotes from multiple insurers to find the best rates for your specific business needs.

Are there any ways to reduce my commercial auto insurance premiums without compromising coverage?

+Yes, there are several strategies to reduce commercial auto insurance premiums while maintaining adequate coverage. These include improving driver safety and training, bundling policies with the same insurer, exploring discounts for safety equipment or low mileage usage, and regularly reviewing your coverage to ensure it aligns with your business’s evolving needs.

What are some common mistakes businesses make when purchasing commercial auto insurance?

+Common mistakes include choosing the cheapest policy without considering coverage adequacy, failing to compare quotes from multiple insurers, neglecting to review coverage regularly, and overlooking the potential benefits of bundling policies or exploring discounts. It’s essential to thoroughly assess your business’s unique needs and shop around for the best combination of coverage and cost.