Dave Ramsey Medical Insurance

In today's healthcare landscape, having comprehensive medical insurance is more than just a necessity; it's a critical component of financial planning and overall well-being. Personal finance expert Dave Ramsey, renowned for his financial advice and guidance, has often emphasized the importance of insurance as a cornerstone of financial stability. In this article, we delve into the world of medical insurance, exploring its significance, understanding the various aspects, and highlighting how it aligns with Dave Ramsey's principles.

The Importance of Medical Insurance

Medical emergencies and unexpected health issues can arise at any time, regardless of age or lifestyle. Without adequate insurance coverage, these events can lead to significant financial burdens, often derailing an individual’s or family’s financial plans and goals. This is where medical insurance steps in as a vital safeguard.

Medical insurance provides a safety net, offering financial protection against the high costs associated with healthcare. It ensures that individuals can access the medical care they need without facing bankruptcy or severe financial strain. By spreading the risk across a large pool of policyholders, insurance companies can offer coverage that makes healthcare more affordable and accessible.

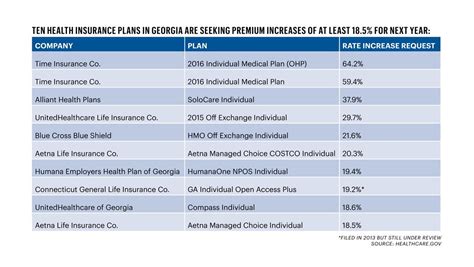

The importance of medical insurance is further highlighted by the rising costs of healthcare. According to a report by the Kaiser Family Foundation, healthcare expenses have been increasing steadily, with the average annual premium for employer-sponsored health insurance reaching $22,221 for family coverage in 2022. This figure underscores the critical need for robust medical insurance plans to manage these escalating costs.

Understanding Medical Insurance Plans

Medical insurance plans come in various forms, each with its own set of features and benefits. Understanding the different types of plans is essential to making an informed decision about your healthcare coverage.

Health Maintenance Organization (HMO)

HMOs are a popular choice for those seeking comprehensive healthcare coverage. These plans typically offer a wide range of benefits, including preventative care, specialist visits, and prescription drug coverage. With an HMO, you choose a primary care physician (PCP) who coordinates your healthcare needs. The PCP acts as a gatekeeper, referring you to specialists within the HMO’s network when necessary. HMOs often have lower out-of-pocket costs but may have more limited provider choices.

Preferred Provider Organization (PPO)

PPOs offer more flexibility compared to HMOs. With a PPO plan, you can visit any healthcare provider, whether in-network or out-of-network, without needing a referral. While out-of-network visits may result in higher out-of-pocket costs, PPOs provide the convenience of choosing your own doctors and specialists. PPOs often have a larger network of providers, giving you more options for your healthcare needs.

Exclusive Provider Organization (EPO)

EPOs represent a middle ground between HMOs and PPOs. Like HMOs, EPOs require you to choose an in-network primary care physician. However, unlike HMOs, EPOs allow you to visit specialists without a referral. While EPOs typically have lower premiums than PPOs, they may have more limited provider networks, which can impact your choice of healthcare professionals.

Point-of-Service (POS) Plans

POS plans combine elements of both HMOs and PPOs. With a POS plan, you have the option to choose between an HMO-like structure, where you select a primary care physician and receive referrals, or a PPO-like structure, where you can visit specialists without a referral. POS plans offer flexibility and can be a good choice for those who want a balance between cost-effectiveness and provider choice.

Key Considerations for Choosing Medical Insurance

When selecting a medical insurance plan, several factors come into play. It’s essential to consider your specific healthcare needs, budget, and personal preferences to make the right choice.

Assessing Your Healthcare Needs

Evaluate your current and potential future healthcare needs. Consider factors such as your age, existing health conditions, and family medical history. If you have a known health condition or require regular specialist visits, an HMO or EPO plan with a robust network of providers might be ideal. On the other hand, if you prefer the flexibility to choose your own doctors, a PPO or POS plan could be a better fit.

Understanding Out-of-Pocket Costs

Out-of-pocket costs, including deductibles, copayments, and coinsurance, can vary significantly between insurance plans. It’s crucial to understand these costs and how they might impact your budget. While plans with lower premiums may seem attractive, they often come with higher out-of-pocket expenses. Assess your ability to manage these costs and choose a plan that aligns with your financial situation.

Evaluating Provider Networks

The provider network is a critical aspect of any medical insurance plan. Ensure that your preferred doctors, specialists, and hospitals are included in the plan’s network. If you have a trusted healthcare provider, verify their inclusion to avoid any surprises later on. Some plans offer broader networks, providing more flexibility in choosing healthcare professionals.

Considering Additional Benefits

Beyond basic healthcare coverage, some insurance plans offer additional benefits such as vision and dental care, mental health services, and wellness programs. Evaluate whether these added benefits are valuable to you and align with your overall healthcare needs. Plans with comprehensive coverage might be more expensive, but they can provide peace of mind and access to a wide range of healthcare services.

| Insurance Type | Key Features | Pros | Cons |

|---|---|---|---|

| HMO | Comprehensive coverage, lower out-of-pocket costs | Affordable, good for preventative care | Limited provider choice, may require referrals |

| PPO | Flexibility, broad provider network | Convenience, no referrals needed | Higher premiums, potentially higher out-of-pocket costs |

| EPO | Balance between HMO and PPO | Lower premiums, specialist access | Limited provider network |

| POS | Flexibility, HMO and PPO options | Customizable, balance of costs and benefits | May have higher out-of-pocket costs |

Dave Ramsey’s Perspective on Medical Insurance

Dave Ramsey, a renowned personal finance expert, has often emphasized the importance of insurance as a fundamental aspect of financial planning. While he hasn’t specifically addressed medical insurance in great detail, his principles of financial freedom and stability can be applied to this critical area of personal finance.

According to Dave Ramsey, insurance is a necessary expense to protect against financial risks. In the context of medical insurance, this means safeguarding your finances against the potentially devastating costs of healthcare. By investing in adequate medical insurance, you can ensure that you're prepared for unexpected health issues without derailing your financial goals.

Dave Ramsey advocates for a proactive approach to financial planning, which includes being prepared for emergencies. Medical emergencies are an inevitable part of life, and having insurance in place ensures that you're not caught off guard financially. It allows you to focus on your health and well-being without the added stress of financial strain.

Tips for Managing Medical Insurance Costs

Medical insurance can be a significant expense, but there are strategies to manage these costs effectively. Here are some tips to help you navigate the world of medical insurance while staying within your budget.

Compare Plans and Shop Around

Don’t settle for the first insurance plan you come across. Take the time to compare different plans, including those offered by various providers. Shopping around can reveal significant differences in premiums, deductibles, and coverage. Online comparison tools and insurance brokers can be valuable resources to find the best plan for your needs.

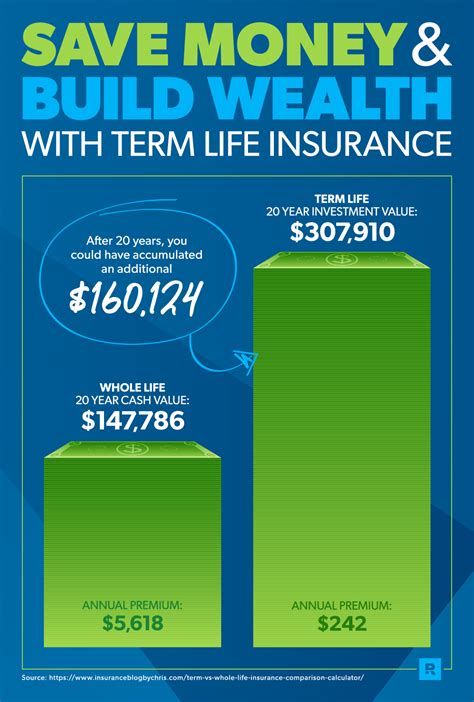

Consider High-Deductible Health Plans (HDHPs)

HDHPs are a cost-effective option for those who prioritize lower premiums. These plans have higher deductibles, meaning you’ll pay more out-of-pocket before your insurance coverage kicks in. However, HDHPs are often paired with Health Savings Accounts (HSAs), which allow you to save pre-tax dollars for healthcare expenses. HSAs can provide a tax-efficient way to manage your healthcare costs.

Review Your Coverage Annually

Insurance plans and healthcare needs can change over time. It’s essential to review your coverage annually to ensure it still aligns with your requirements. Factors like changing health conditions, family growth, or job transitions can impact your insurance needs. Regularly assessing your coverage ensures that you’re not paying for unnecessary benefits or lacking critical coverage.

Negotiate Your Healthcare Bills

Believe it or not, healthcare bills are often negotiable. If you receive a medical bill that seems excessive or unreasonable, don’t hesitate to contact the provider’s billing department. Many healthcare facilities are open to negotiating prices, especially if you’re willing to pay upfront or set up a payment plan. Negotiating can help reduce your out-of-pocket costs and make healthcare more affordable.

The Future of Medical Insurance

The landscape of medical insurance is evolving, driven by technological advancements, changing healthcare regulations, and shifting consumer preferences. Here’s a glimpse into the future of medical insurance and how it might impact your coverage.

Digital Health and Telemedicine

Digital health technologies and telemedicine are transforming the way healthcare is delivered. Insurance companies are increasingly incorporating these innovations into their plans. Telemedicine allows you to consult with healthcare professionals remotely, often at a lower cost than in-person visits. Digital health platforms can provide convenient access to healthcare services, making it easier to manage your health and well-being.

Value-Based Care and Bundled Payments

The healthcare industry is moving towards value-based care, where providers are paid based on the quality and outcomes of care, rather than the quantity of services provided. This shift can lead to more efficient and cost-effective healthcare. Bundled payments, where a single payment covers all aspects of a patient’s care for a specific condition or episode, are becoming more common. This approach can simplify billing and reduce administrative burdens for both patients and providers.

Personalized Medicine and Precision Health

Advancements in genetics and precision medicine are enabling a more personalized approach to healthcare. Insurance companies are beginning to incorporate genetic testing and personalized treatment plans into their coverage. This shift towards precision health can lead to more effective and targeted treatments, potentially reducing overall healthcare costs and improving patient outcomes.

Consumer-Driven Health Plans

Consumer-driven health plans, such as HDHPs paired with HSAs, are gaining popularity. These plans empower individuals to take control of their healthcare decisions and costs. With consumer-driven plans, you have more flexibility in choosing healthcare providers and managing your healthcare expenses. This shift towards consumer-driven healthcare can encourage more informed decision-making and cost-conscious behavior.

Conclusion

Medical insurance is an indispensable component of financial planning and overall well-being. It provides a vital safety net against the uncertainties of healthcare costs. By understanding the different types of insurance plans, assessing your needs, and managing costs effectively, you can ensure that you have the coverage you need without straining your finances.

While Dave Ramsey hasn't delved deeply into medical insurance, his principles of financial preparedness and risk management align perfectly with the importance of this aspect of personal finance. By incorporating his philosophy into your approach to medical insurance, you can take control of your healthcare costs and work towards achieving your financial goals.

As the world of medical insurance continues to evolve, staying informed and adapting to changes is crucial. By embracing technological advancements, value-based care, and personalized medicine, you can navigate the future of healthcare with confidence and peace of mind.

How much does medical insurance typically cost?

+The cost of medical insurance varies widely depending on factors such as the type of plan, your location, age, and the level of coverage. According to the Kaiser Family Foundation, the average annual premium for employer-sponsored health insurance was around 7,739 for single coverage</strong> and <strong>22,221 for family coverage in 2022. However, these figures can be significantly lower or higher based on your specific circumstances.

What happens if I don’t have medical insurance?

+Going without medical insurance can be risky. In the event of a medical emergency or unexpected health issue, you would be responsible for paying all associated costs out of pocket. These expenses can quickly become unaffordable, leading to financial hardship or even bankruptcy. It’s essential to have medical insurance to protect yourself and your finances.

Can I get medical insurance if I have a pre-existing condition?

+Yes, you can still obtain medical insurance even with a pre-existing condition. Under the Affordable Care Act (ACA), insurance companies are prohibited from denying coverage or charging higher premiums based on pre-existing conditions. However, it’s important to note that short-term health insurance plans and certain types of coverage may not adhere to these regulations.

How do I choose the right medical insurance plan for my family?

+Choosing the right medical insurance plan for your family involves careful consideration of several factors. Assess your family’s healthcare needs, including any existing conditions and the likelihood of future medical issues. Evaluate the provider networks to ensure your preferred doctors and hospitals are included. Consider the balance between premiums and out-of-pocket costs, and don’t forget to look into additional benefits like vision and dental coverage.