How Much Is Long Term Care Insurance

Long-term care insurance is a crucial financial planning tool that provides individuals with coverage for the costs associated with extended care needs later in life. The importance of this insurance cannot be overstated, as it offers peace of mind and financial security during a vulnerable period. Understanding the costs involved is essential for anyone considering this type of coverage. In this comprehensive guide, we will delve into the factors that influence the price of long-term care insurance, provide real-world examples, and offer expert insights to help you make an informed decision.

Understanding the Cost of Long-Term Care Insurance

The premium for long-term care insurance can vary significantly based on several key factors. These factors include the policyholder’s age, health status, and the level of coverage chosen. Additionally, the geographic location, the insurer’s rates, and any optional benefits selected can also impact the overall cost.

Age and Health: The Primary Influencers

One of the most critical factors in determining the cost of long-term care insurance is the age of the applicant. In general, younger individuals can expect to pay lower premiums, as they are less likely to require immediate care and have a longer period to spread out the costs. For example, a 55-year-old may pay significantly less than a 70-year-old for the same level of coverage.

Health status is another pivotal factor. Insurers carefully evaluate an individual's health to assess their risk profile. Those with pre-existing conditions or a history of chronic illnesses may face higher premiums or even be declined coverage. On the other hand, individuals in excellent health may qualify for preferred rates.

Coverage Levels and Benefits

The level of coverage chosen is a significant determinant of the premium. Policies offer a range of daily benefit amounts, coverage durations, and elimination periods (the time before benefits begin). Opting for higher daily benefit amounts or longer coverage durations will naturally result in higher premiums.

Additionally, long-term care insurance policies often include a variety of optional benefits. These can include inflation protection, which ensures that the daily benefit amount keeps pace with rising healthcare costs, or non-forfeiture benefits, which provide some level of coverage even if the policy is canceled. Including these optional benefits can increase the premium.

Location and Insurer-Specific Rates

Long-term care insurance rates can vary considerably by geographic location. This variation is due to differences in the cost of long-term care services and the overall demand for insurance in a particular area. It’s not uncommon for premiums to be higher in regions where the cost of care is more expensive.

Furthermore, each insurance company sets its own rates, which can lead to significant differences in premiums for similar policies. Shopping around and comparing quotes from multiple insurers is essential to finding the most competitive rates.

The Impact of Inflation and Policy Features

Inflation protection is a critical feature to consider when choosing a long-term care insurance policy. Over time, the cost of healthcare services can increase significantly, and without inflation protection, the policy’s benefits may not keep up with these rising costs. Policies with built-in inflation protection tend to have higher premiums, but they provide peace of mind and ensure that the coverage remains adequate.

Other policy features, such as the option to accelerate death benefits for long-term care or the inclusion of home health care coverage, can also influence the premium. These features may be valuable to some policyholders but will typically increase the overall cost of the policy.

Real-World Examples of Long-Term Care Insurance Costs

To illustrate the range of costs associated with long-term care insurance, let’s consider a few hypothetical scenarios.

Scenario 1: Young, Healthy Applicant

John, a 45-year-old in excellent health, decides to purchase long-term care insurance. He opts for a policy with a 200 daily benefit, a 90-day elimination period, and a 3-year coverage duration. His premium, including inflation protection, is approximately 1,200 per year. This relatively low premium reflects his young age and good health, which indicate a lower likelihood of needing care in the near future.

Scenario 2: Older Applicant with Health Concerns

Sarah, a 65-year-old with a history of heart disease, wants to secure long-term care insurance. Due to her health concerns, she faces a higher premium. Her policy, with a 150 daily benefit, a 60-day elimination period, and a 2-year coverage duration, costs her around 3,500 per year. The higher premium reflects the increased risk associated with her age and health status.

Scenario 3: Comprehensive Coverage for Peace of Mind

Michael, a 58-year-old with a family history of Alzheimer’s disease, seeks extensive long-term care coverage. He chooses a policy with a 300 daily benefit, a 365-day elimination period, and an unlimited coverage duration. This comprehensive coverage, which includes inflation protection and a non-forfeiture benefit, comes at a premium of approximately 5,000 per year. Michael’s decision is driven by his desire to have the highest level of financial protection for his potential long-term care needs.

Expert Insights and Strategies

Navigating the world of long-term care insurance can be complex, but experts offer valuable advice to help individuals make informed choices.

Start Early: One of the most common recommendations is to purchase long-term care insurance as early as possible. Starting young not only secures lower premiums but also ensures that you have the coverage in place when you need it most. Waiting until later in life can result in higher costs or even difficulty obtaining coverage due to health changes.

Assess Your Needs: It's crucial to carefully evaluate your specific long-term care needs. Consider factors such as your health history, family medical history, and your desired level of financial protection. Working with a financial advisor or insurance specialist can help you tailor your policy to your unique circumstances.

Shop Around: Don't settle for the first quote you receive. Long-term care insurance is a highly competitive market, and rates can vary significantly between insurers. Take the time to compare quotes from multiple providers to find the best value for your needs.

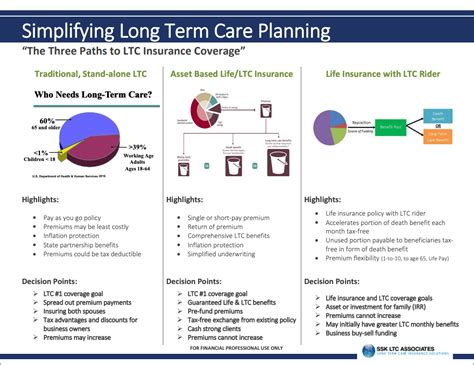

Consider Alternative Options: While long-term care insurance is a valuable tool, it's not the only option. Some individuals may find that alternative financial strategies, such as self-insuring or investing in specific assets, are more suitable for their situation. Consulting with a financial planner can help you explore these alternatives.

Keep an Eye on Inflation: Inflation protection is a critical feature to consider. While it may increase your premium, it ensures that your coverage remains adequate over time. Discuss the various inflation protection options with your insurer to find the best fit for your budget and long-term care needs.

Future Implications and Considerations

The cost of long-term care insurance is not a static factor. As you age and healthcare costs continue to rise, the premiums for this coverage may also increase. It’s essential to regularly review your policy and assess whether your coverage remains adequate and affordable.

Additionally, the landscape of long-term care insurance is evolving. Some insurers are developing innovative products that offer more flexibility and customization. Keeping up with these industry developments can help you make informed decisions about your coverage.

Lastly, it's important to note that long-term care insurance is just one piece of the financial planning puzzle. A comprehensive financial strategy should consider other forms of insurance, retirement savings, and estate planning to ensure a secure future.

Conclusion

Understanding the costs associated with long-term care insurance is a critical step in securing your financial future. By considering factors such as age, health, coverage levels, and optional benefits, you can make an informed decision about the right policy for your needs. Remember, starting early, shopping around, and seeking expert advice are key strategies to navigate this complex landscape.

Can I qualify for long-term care insurance if I have pre-existing conditions?

+Yes, many insurers offer policies specifically designed for individuals with pre-existing conditions. However, these policies may have higher premiums or more restrictive coverage. It’s essential to disclose all health conditions to ensure you receive the appropriate coverage and to avoid any future disputes.

What happens if I need long-term care but don’t have insurance?

+Without long-term care insurance, the financial burden of extended care can be significant. You may need to rely on personal savings, family support, or government assistance programs. It’s important to plan ahead and consider the potential costs to ensure you have adequate resources.

Are there tax benefits associated with long-term care insurance?

+Yes, long-term care insurance premiums may be tax-deductible, depending on your income level and other factors. Consulting with a tax professional can help you understand the potential tax benefits associated with your policy.

Can I combine long-term care insurance with other types of insurance?

+Absolutely! Long-term care insurance can be an essential part of a comprehensive insurance portfolio. You can combine it with life insurance, disability insurance, and other forms of coverage to create a robust financial safety net.