Reduce Auto Insurance

Auto insurance is an essential financial safeguard for drivers, providing coverage for a range of risks and potential damages. However, for many individuals, the cost of insurance can be a significant burden on their budgets. Fortunately, there are strategies and considerations that can help reduce auto insurance costs without compromising necessary coverage. This article explores the intricacies of auto insurance, offering expert insights and practical tips to help drivers navigate the insurance landscape and find the best deals tailored to their needs.

Understanding Auto Insurance Coverage

Auto insurance is a contract between an individual and an insurance provider, offering financial protection in the event of an accident, theft, or other vehicle-related incidents. It consists of various coverage types, each addressing specific risks and potential damages. Understanding these coverage types is crucial for drivers to make informed decisions and tailor their insurance policies to their needs.

Liability Coverage

Liability coverage is a fundamental component of auto insurance. It covers the costs associated with bodily injury or property damage caused to others in an accident for which the insured driver is at fault. This coverage is typically divided into two categories: bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses, lost wages, and pain and suffering claims of individuals injured in an accident caused by the insured driver. Property damage liability, on the other hand, covers the cost of repairing or replacing property damaged in an accident, such as the other driver’s vehicle or any other damaged property.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended components of auto insurance. Collision coverage pays for the repair or replacement of the insured vehicle after an accident, regardless of fault. It covers damage resulting from collisions with other vehicles or objects, such as trees or fences.

Comprehensive coverage, on the other hand, protects against damage caused by events other than collisions. This can include theft, vandalism, natural disasters, or damage caused by animals. It provides a broader level of protection, ensuring that the insured driver is covered for a wider range of potential incidents.

Personal Injury Protection (PIP) and Medical Payments (MedPay)

Personal Injury Protection (PIP) and Medical Payments (MedPay) coverage provide financial assistance for medical expenses and related costs incurred by the insured driver and passengers in an accident, regardless of fault. PIP typically covers a wider range of expenses, including medical bills, lost wages, and funeral costs, while MedPay is more focused on covering medical expenses.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is an essential component of auto insurance, especially in states where it is mandatory. It provides protection in the event of an accident involving an uninsured or underinsured driver. UM coverage covers bodily injury and property damage caused by an uninsured driver, while UIM coverage steps in when the at-fault driver’s liability coverage is insufficient to cover the insured driver’s damages.

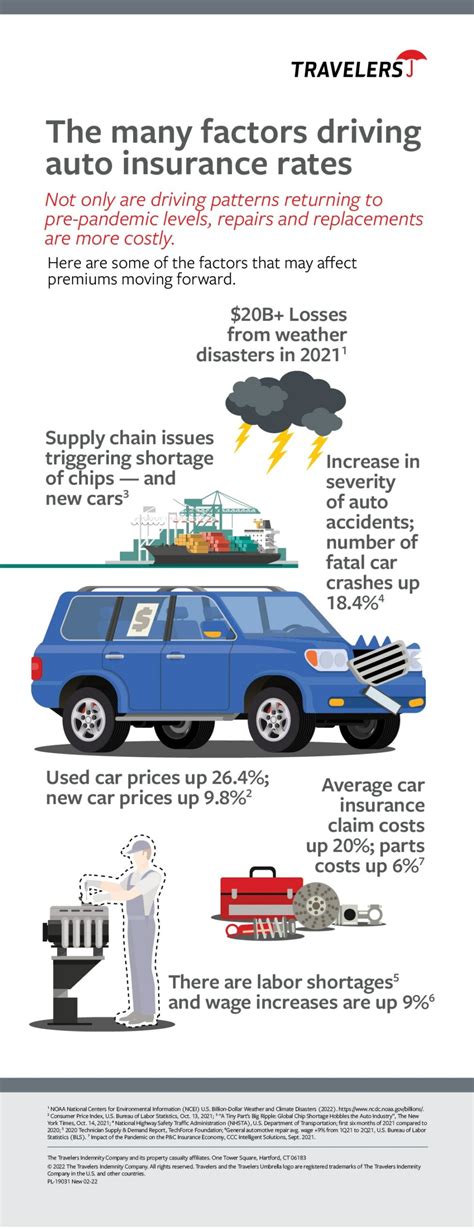

Factors Influencing Auto Insurance Rates

Auto insurance rates are influenced by a multitude of factors, each playing a unique role in determining the cost of coverage. Understanding these factors is key to making informed decisions and potentially reducing insurance costs.

Driver Profile

The driver’s profile is a significant determinant of insurance rates. Factors such as age, gender, driving record, and credit score all play a role in how insurance providers assess risk. Younger drivers, particularly those under 25, often face higher premiums due to their relative inexperience on the road. Similarly, drivers with a history of accidents or traffic violations may be considered high-risk, leading to increased insurance costs.

Credit score is another critical factor, with many insurance providers using credit-based insurance scores to assess risk. A higher credit score often correlates with lower insurance rates, as it indicates a level of financial responsibility that can extend to driving habits.

Vehicle Factors

The type of vehicle insured also influences insurance rates. More expensive vehicles, luxury cars, and sports cars often come with higher insurance costs due to their higher repair and replacement costs. Similarly, vehicles with advanced safety features or anti-theft devices may be eligible for discounts, as they reduce the risk of accidents and theft.

The age and condition of the vehicle are also considered. Older vehicles may be less expensive to insure, as their value has depreciated, while newer vehicles may command higher premiums due to their higher replacement cost.

Location and Usage

The location where the vehicle is garaged and the primary area of usage can significantly impact insurance rates. Urban areas often have higher rates due to increased traffic, congestion, and the higher likelihood of accidents and theft. Similarly, drivers who use their vehicles for business purposes or commute long distances may face higher premiums due to the increased exposure to risk.

Coverage and Deductibles

The level of coverage chosen and the associated deductibles also play a role in determining insurance rates. Higher coverage limits and lower deductibles typically result in higher premiums, as they provide a greater level of protection and financial responsibility for the insured driver. Conversely, opting for lower coverage limits and higher deductibles can lead to reduced premiums, but it’s important to strike a balance that ensures adequate protection.

Strategies to Reduce Auto Insurance Costs

Reducing auto insurance costs is a balance between finding the right coverage and exploring strategies to negotiate better rates. Here are some expert tips and strategies to help drivers reduce their insurance premiums without compromising necessary coverage.

Shop Around and Compare Rates

One of the most effective ways to reduce insurance costs is to shop around and compare rates from multiple providers. Insurance rates can vary significantly between companies, and by comparing quotes, drivers can often find more competitive rates that better suit their needs and budget.

Utilizing online insurance comparison tools can streamline this process, allowing drivers to quickly and easily obtain quotes from multiple providers. These tools provide a convenient way to assess different policies and their features, helping drivers make informed decisions about their insurance coverage.

Bundle Policies for Discounts

Many insurance providers offer discounts when multiple policies are bundled together. For instance, if a driver has both auto and home insurance with the same provider, they may be eligible for a multi-policy discount. Similarly, bundling auto insurance with other types of insurance, such as life or health insurance, can also result in savings.

Bundling policies not only provides financial savings but also simplifies the insurance process, as all policies are managed through a single provider. This can be especially beneficial for those who prefer a streamlined insurance experience and want to minimize the hassle of dealing with multiple providers.

Opt for Higher Deductibles

Increasing the deductible on an auto insurance policy can lead to significant savings on premiums. A deductible is the amount the insured pays out of pocket before the insurance coverage kicks in. By opting for a higher deductible, drivers can reduce their monthly or annual premiums, as the insurance provider assumes less financial risk.

However, it’s important to choose a deductible that is manageable in the event of an accident or claim. While a higher deductible can result in lower premiums, it also means the insured will need to pay more out of pocket if they need to make a claim. Balancing the potential savings with the financial responsibility of a higher deductible is crucial when making this decision.

Take Advantage of Discounts

Insurance providers offer a variety of discounts that can significantly reduce insurance costs. These discounts can be based on factors such as the driver’s age, occupation, educational background, or even the type of vehicle insured. Some providers also offer discounts for safe driving habits, such as avoiding accidents or traffic violations.

Additionally, many insurance companies provide discounts for vehicles equipped with advanced safety features or anti-theft devices. These features not only enhance the safety of the vehicle but also reduce the risk of accidents and theft, making them attractive to insurance providers and resulting in potential savings for the insured.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep insurance costs low. Insurance providers use driving records to assess the risk associated with insuring a particular driver. A history of accidents, traffic violations, or even frequent claims can result in higher insurance premiums, as these incidents indicate a higher likelihood of future claims.

By maintaining a clean driving record, drivers can demonstrate their responsibility and reduce the risk associated with insuring them. This not only helps keep insurance costs down but also provides peace of mind, knowing that their driving habits are contributing to a safer and more cost-effective insurance experience.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to auto insurance that tailors premiums to an individual’s actual driving habits. This type of insurance uses telematics devices or smartphone apps to track driving behavior, such as miles driven, time of day, and driving style.

By monitoring these factors, usage-based insurance providers can offer more accurate premiums that reflect an individual’s actual risk on the road. For drivers who have safe driving habits and drive less frequently, this type of insurance can result in significant savings. It provides a more personalized insurance experience, where premiums are based on actual usage rather than generalized assumptions.

Expert Tips for Negotiating Lower Rates

Negotiating lower auto insurance rates requires a strategic approach and a thorough understanding of the insurance landscape. Here are some expert tips to help drivers effectively negotiate with insurance providers and potentially secure better rates.

Understand Your Coverage Needs

Before entering negotiations, it’s crucial to have a clear understanding of your coverage needs. Assess your driving habits, the value of your vehicle, and the risks you face on the road. Consider factors such as the likelihood of accidents, theft, or damage to your vehicle, and ensure that your insurance coverage aligns with these risks.

By understanding your coverage needs, you can better evaluate insurance quotes and negotiate for the right level of coverage. This ensures that you are not paying for unnecessary coverage, while also ensuring that you have adequate protection in the event of an accident or other incident.

Leverage Competition

Insurance providers are often willing to negotiate rates, especially when faced with competitive offers from other providers. When obtaining quotes, be transparent about the offers you have received from other companies. This can put pressure on the current provider to match or beat those rates, as they may not want to lose your business.

By leveraging competition, you can often secure better rates or additional discounts. It’s a strategy that plays on the provider’s desire to retain your business, encouraging them to offer more competitive pricing or incentives to keep you as a customer.

Review Your Policy Regularly

Auto insurance policies and rates can change over time, so it’s important to review your policy regularly to ensure it remains competitive and aligned with your needs. Regular reviews can help identify potential savings or areas where your coverage could be adjusted to better suit your circumstances.

During these reviews, assess whether your driving habits or vehicle usage has changed, as these factors can impact your insurance rates. Additionally, check for any discounts or promotions that you may be eligible for, as these can further reduce your premiums. Regular policy reviews ensure that you are always getting the best value for your insurance coverage.

Build a Relationship with Your Agent

Developing a strong relationship with your insurance agent can be beneficial when negotiating rates. Agents who are familiar with your driving history, vehicle, and personal circumstances may be more willing to work with you to find the best rates or coverage options.

A good relationship with your agent can lead to personalized service and a deeper understanding of your insurance needs. They can provide valuable insights and advice, helping you make informed decisions about your coverage and potentially negotiate better rates. Building trust and rapport with your agent can go a long way in ensuring a positive and cost-effective insurance experience.

Conclusion: Empowering Drivers to Save on Auto Insurance

Reducing auto insurance costs is a complex but achievable task. By understanding the various coverage types, factors influencing rates, and strategies for negotiation, drivers can take control of their insurance costs and find policies that provide the right coverage at the best price.

This comprehensive guide has outlined expert tips and insights to help drivers navigate the auto insurance landscape. From shopping around for competitive rates to leveraging discounts and building strong relationships with insurance agents, these strategies empower drivers to make informed decisions and potentially save hundreds of dollars on their insurance premiums. With the right approach and a thorough understanding of their insurance needs, drivers can secure cost-effective coverage that protects their financial well-being without compromising on necessary protection.

How often should I review my auto insurance policy to ensure I’m getting the best rates?

+It’s recommended to review your auto insurance policy at least once a year, or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and that you’re not overpaying for unnecessary features.

What are some common discounts that auto insurance providers offer, and how can I qualify for them?

+Common discounts include multi-policy discounts (for bundling multiple insurance types with the same provider), safe driver discounts (for maintaining a clean driving record), good student discounts (for young drivers with good academic standing), and loyalty discounts (for staying with the same provider for a certain period). To qualify for these discounts, ensure you meet the criteria and provide the necessary documentation to your insurance provider.

How can I improve my chances of getting lower auto insurance rates when I have a less-than-perfect driving record?

+If you have a less-than-perfect driving record, consider opting for a usage-based insurance policy. These policies track your driving behavior and can offer lower rates if you demonstrate safe driving habits. Additionally, maintain a clean driving record going forward, as insurance providers often reward drivers for improving their driving habits over time.