Penn Mutual Life Insurance Co

In the world of life insurance, few companies have a legacy as rich and extensive as Penn Mutual Life Insurance Company. With a history spanning over a century, Penn Mutual has not only endured the test of time but has also evolved to become a prominent player in the industry, offering a comprehensive suite of financial products and services. This article delves into the depths of Penn Mutual's history, its core offerings, and the unique value it brings to policyholders, positioning the company as a trusted partner in the often complex world of life insurance.

A Legacy of Trust and Innovation: The Penn Mutual Story

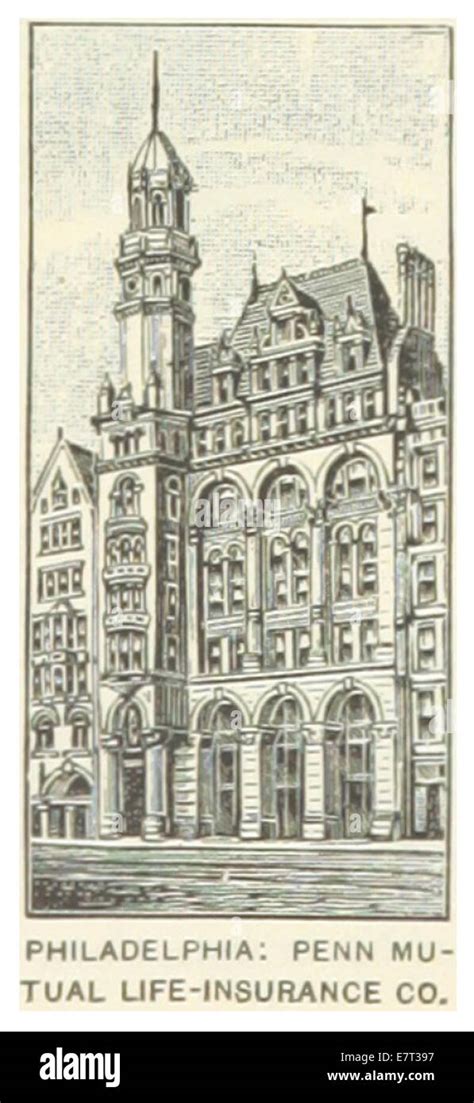

Penn Mutual Life Insurance Company was founded in 1847, in the city of Philadelphia, Pennsylvania. The company’s origins can be traced back to a group of 13 prominent citizens who recognized the need for a mutual life insurance company to serve the growing financial needs of the region. This founding principle of mutuality, where policyholders are also owners, has been a cornerstone of Penn Mutual’s success and longevity.

Over the years, Penn Mutual has navigated through various economic cycles, world wars, and significant societal changes. Its resilience is a testament to the company's adaptability and commitment to its core values. One of the key moments in its history was the introduction of the Penn 5000 plan in 1946. This innovative product offered $5,000 of life insurance coverage for only 50 cents a week, making life insurance accessible to a broader segment of the population. The success of the Penn 5000 plan solidified Penn Mutual's position as a forward-thinking, customer-centric organization.

In the modern era, Penn Mutual continues to thrive, expanding its reach and product offerings. The company's headquarters remain in Philadelphia, but its influence is felt nationwide, with a network of financial professionals and a reputation for excellence in the life insurance and financial services sectors.

Comprehensive Financial Solutions: Penn Mutual’s Product Suite

Penn Mutual’s success lies not only in its rich history but also in its ability to offer a diverse range of financial products tailored to meet the evolving needs of its clients. The company’s product portfolio is designed to provide individuals and families with the financial security and peace of mind they deserve.

Life Insurance Products

At the core of Penn Mutual’s offerings are its life insurance products, which include:

- Term Life Insurance: This basic form of life insurance provides coverage for a specified term, typically ranging from 10 to 30 years. It offers flexibility and affordability, catering to individuals and families with specific, short-term financial needs.

- Whole Life Insurance: Penn Mutual’s whole life insurance policies offer permanent coverage, with benefits that remain in force for the insured’s entire life. These policies build cash value over time, providing a savings component alongside the life insurance coverage.

- Universal Life Insurance: Universal life insurance policies offer more flexibility than traditional whole life policies. They provide lifetime coverage and allow policyholders to adjust their premium payments and death benefits to meet changing financial needs.

Annuities and Retirement Solutions

Penn Mutual also offers a range of annuities to help individuals prepare for their retirement years. Annuities are financial products that provide a stream of payments to the annuitant, either immediately or in the future. Penn Mutual’s annuities include:

- Fixed Annuities: These annuities offer a guaranteed interest rate and a fixed payment schedule, providing a stable source of income during retirement.

- Variable Annuities: Variable annuities allow the annuitant to allocate their funds among various investment options, offering the potential for higher returns but also carrying more risk.

- Indexed Annuities: Indexed annuities combine the stability of fixed annuities with the growth potential of variable annuities, providing a balance between guaranteed returns and market-linked performance.

Additional Financial Services

Beyond life insurance and annuities, Penn Mutual provides a host of other financial services to help individuals and businesses manage their wealth effectively. These include:

- Wealth Management: Penn Mutual offers comprehensive wealth management services, helping clients grow and protect their assets through strategic financial planning and investment management.

- Business Planning: The company provides specialized business planning services, assisting business owners with succession planning, key person insurance, and employee benefits strategies.

- Investment Products: Penn Mutual offers a range of investment products, including mutual funds, ETFs, and managed accounts, to help clients achieve their long-term financial goals.

A Commitment to Excellence: Penn Mutual’s Value Proposition

Penn Mutual’s value proposition is rooted in its commitment to excellence and its dedication to the financial well-being of its policyholders. The company’s approach is centered on several key principles that set it apart in the industry.

Financial Strength and Stability

With over 170 years of experience, Penn Mutual has established itself as a financially strong and stable institution. The company’s financial strength is evidenced by its A+ rating from AM Best, a leading insurance rating agency. This rating signifies Penn Mutual’s ability to meet its ongoing obligations to policyholders, providing peace of mind that their financial investments are secure.

Personalized Service and Expertise

Penn Mutual understands that financial planning is a highly personal matter. The company’s approach is centered on building strong, long-lasting relationships with its clients. Its network of financial professionals offers personalized guidance, tailoring financial solutions to each client’s unique circumstances and goals. This personalized service ensures that policyholders receive the best advice and support, helping them make informed decisions about their financial future.

Innovation and Technological Advancements

In an era where technology plays a pivotal role in financial services, Penn Mutual has embraced innovation to enhance its operations and customer experience. The company has invested in state-of-the-art technology platforms, streamlining processes and making it easier for clients to manage their policies and access their financial information. From online policy management to digital account access, Penn Mutual ensures that its clients have the tools they need to stay informed and engaged with their financial plans.

Community Involvement and Social Responsibility

Penn Mutual’s commitment to its communities is a testament to its values and its role as a responsible corporate citizen. The company actively supports various charitable and community initiatives, demonstrating its dedication to making a positive impact beyond its core business operations. This commitment to social responsibility reinforces Penn Mutual’s reputation as a trusted partner, not just in the financial realm but also in the broader community.

| Product | Key Features |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term, providing financial protection during key life stages. |

| Whole Life Insurance | Permanent coverage with cash value accumulation, offering both life insurance and savings benefits. |

| Universal Life Insurance | Flexible coverage with adjustable premiums and death benefits, providing lifelong protection. |

| Fixed Annuities | Guaranteed income during retirement, offering stable and predictable payments. |

| Variable Annuities | Potential for higher returns with investment flexibility, suitable for risk-tolerant investors. |

| Indexed Annuities | Balance between guaranteed returns and market-linked performance, providing stability and growth potential. |

Conclusion: A Trusted Partner for Life

Penn Mutual Life Insurance Company stands as a beacon of financial stability and innovation in the life insurance industry. With a legacy spanning over a century and a half, the company has consistently adapted to the changing needs of its clients, offering a comprehensive suite of financial products and services. From its humble beginnings in Philadelphia to its nationwide reach today, Penn Mutual has remained true to its founding principles of mutuality and customer-centricity.

For individuals and families seeking financial security and peace of mind, Penn Mutual offers a trusted partnership. Its commitment to financial strength, personalized service, technological innovation, and social responsibility positions the company as a reliable guide through the complexities of financial planning. As policyholders navigate the various stages of life, Penn Mutual is there to provide the tools and support needed to achieve their financial goals and protect their loved ones.

In a world where financial security is paramount, Penn Mutual Life Insurance Company stands as a beacon of trust and expertise, guiding its policyholders toward a brighter and more secure future.

How does Penn Mutual’s financial strength rating compare to other insurance companies?

+Penn Mutual’s A+ rating from AM Best is an excellent indicator of its financial strength and stability. This rating is among the highest in the industry, signifying the company’s ability to meet its obligations and provide long-term security to policyholders. While other insurance companies may also have strong ratings, Penn Mutual’s consistent performance and commitment to financial excellence make it a trusted choice.

What sets Penn Mutual’s life insurance products apart from competitors?

+Penn Mutual’s life insurance products are distinguished by their flexibility and personalized approach. The company offers a range of options, including term life, whole life, and universal life insurance, allowing policyholders to choose the coverage that best suits their needs. Additionally, Penn Mutual’s focus on building strong client relationships ensures that policyholders receive tailored advice and support, making the financial planning process more accessible and effective.

How does Penn Mutual’s investment in technology benefit policyholders?

+Penn Mutual’s investment in technology has streamlined the financial planning process, making it more efficient and accessible for policyholders. The company’s digital platforms enable clients to manage their policies, access financial information, and make informed decisions with ease. This commitment to technological innovation enhances the overall customer experience and ensures that policyholders can stay engaged with their financial plans.

What is Penn Mutual’s approach to community involvement and social responsibility?

+Penn Mutual is deeply committed to making a positive impact in the communities it serves. The company actively supports a range of charitable and community initiatives, demonstrating its dedication to social responsibility. This commitment extends beyond financial contributions, with Penn Mutual employees often volunteering their time and expertise to support various causes. By engaging in community-focused activities, Penn Mutual strengthens its connections with local communities and reinforces its role as a responsible corporate citizen.