Best Life Insurance Seniors

As we navigate the later stages of life, it's natural to consider how we can protect our loved ones and ensure their financial well-being. Life insurance for seniors is an essential aspect of financial planning, providing a safety net for families and helping to cover various expenses that may arise. In this comprehensive guide, we will delve into the world of life insurance for seniors, exploring the best options available, the key factors to consider, and the benefits it offers. Whether you're a senior looking to secure your legacy or a concerned family member seeking information, this article will equip you with the knowledge needed to make informed decisions.

Understanding Life Insurance for Seniors

Life insurance policies for seniors are specifically designed to cater to the unique needs and circumstances of individuals in their golden years. These policies aim to provide coverage for seniors, offering peace of mind and financial security to both the policyholder and their beneficiaries. Here’s a closer look at what life insurance for seniors entails:

Types of Life Insurance for Seniors

There are several types of life insurance policies tailored for seniors, each with its own set of features and benefits. The most common types include:

- Term Life Insurance: This type of policy offers coverage for a specific term, typically ranging from 10 to 30 years. It provides a death benefit to the beneficiaries if the policyholder passes away during the term. Term life insurance is often more affordable than permanent policies, making it a popular choice for seniors with budget constraints.

- Whole Life Insurance: Also known as permanent life insurance, whole life policies provide coverage for the policyholder’s entire life, as long as premiums are paid. They offer a guaranteed death benefit and often accumulate cash value over time, which can be borrowed against or withdrawn. Whole life insurance is a comprehensive option that provides long-term financial protection.

- Guaranteed Issue Life Insurance: This type of policy is specifically designed for seniors who may have health conditions or pre-existing medical issues. Guaranteed issue life insurance does not require a medical exam, making it accessible to a wider range of seniors. However, it often has a limited death benefit and may have waiting periods before the full benefit is payable.

- Final Expense Insurance: Final expense policies are designed to cover the costs associated with end-of-life care and funeral expenses. These policies typically have lower coverage amounts and are more affordable. They ensure that your loved ones are not burdened with unexpected financial burdens during an already difficult time.

Key Factors to Consider

When evaluating life insurance options for seniors, several factors come into play. Understanding these factors will help you make an informed decision:

- Health and Lifestyle: The health and lifestyle of the senior play a significant role in determining eligibility and premiums. Pre-existing medical conditions, smoking status, and overall health can impact the availability and cost of life insurance. It’s essential to be transparent about your health to secure the most suitable policy.

- Coverage Amount: Determining the appropriate coverage amount is crucial. Consider the financial needs of your beneficiaries, such as outstanding debts, funeral expenses, or any ongoing financial obligations. A comprehensive assessment of these needs will help you choose the right coverage amount.

- Budget: Life insurance policies for seniors can vary widely in cost. It’s important to assess your budget and financial capabilities to ensure you can afford the premiums. Some policies offer flexible payment options or the ability to adjust coverage amounts to accommodate budget constraints.

- Policy Features: Different life insurance policies come with various features and benefits. Look for policies that align with your specific needs. For example, some policies offer accelerated death benefits for terminal illnesses, while others provide riders for long-term care coverage.

- Reputable Insurers: Choose a reputable and financially stable insurance company. Researching insurer ratings and reviews can help you select a provider that offers reliable coverage and excellent customer service.

The Benefits of Life Insurance for Seniors

Life insurance policies for seniors offer a range of benefits that extend beyond financial protection. Here’s a closer look at the advantages they provide:

Financial Security for Loved Ones

One of the primary benefits of life insurance for seniors is the financial security it provides to their loved ones. In the event of the policyholder’s passing, the death benefit can cover a wide range of expenses, including:

- Funeral and burial costs

- Outstanding medical bills

- Mortgage or rent payments

- Daily living expenses for surviving family members

- Education expenses for grandchildren

- Debt repayment

By having life insurance, seniors can ensure that their loved ones are not left with unexpected financial burdens, allowing them to focus on healing and adjusting to life without their beloved family member.

Peace of Mind

Life insurance for seniors offers a sense of peace of mind, knowing that their financial affairs are in order. Seniors can rest assured that their legacy will be protected and their loved ones will be taken care of. This peace of mind extends beyond the financial aspect, as it also reduces the emotional burden on family members who may otherwise have to make difficult financial decisions during a time of grief.

Estate Planning and Legacy

Life insurance policies can be a crucial component of estate planning for seniors. They provide a way to pass on assets and ensure that their wishes are honored. By including life insurance as part of their estate plan, seniors can:

- Leave a financial legacy to their heirs

- Pay estate taxes and probate fees

- Provide for charitable causes or organizations they care about

- Ensure the financial stability of their beneficiaries

Life insurance can be a powerful tool to preserve and protect the senior’s legacy, allowing them to leave a lasting impact on their loved ones and the causes they support.

Coverage for End-of-Life Expenses

Final expense insurance, a specialized type of life insurance for seniors, is designed to cover the costs associated with end-of-life care and funeral arrangements. This type of policy provides:

- Peace of mind knowing that funeral expenses are covered

- Flexibility in choosing funeral arrangements without financial constraints

- Assistance in covering medical expenses during the final stages of life

- Relief for family members who may not have to bear the financial burden of end-of-life costs

Case Studies: Real-Life Examples

To illustrate the impact and benefits of life insurance for seniors, let’s explore a couple of real-life case studies:

Case Study 1: Mr. Johnson’s Legacy

Mr. Johnson, a retired teacher in his late 70s, decided to purchase a whole life insurance policy to secure his legacy. With a coverage amount of $250,000, he aimed to provide financial support to his three adult children and ensure their future stability. The policy offered a guaranteed death benefit and accumulated cash value, which Mr. Johnson could access if needed during his retirement years.

Unfortunately, Mr. Johnson passed away unexpectedly due to a heart condition. His life insurance policy provided his family with the financial means to cover funeral expenses, pay off his remaining mortgage, and ensure his children’s education funds were fully funded. The policy’s death benefit also allowed his children to start their own businesses, fulfilling Mr. Johnson’s dream of supporting their entrepreneurial ventures.

Case Study 2: Mrs. Smith’s Peace of Mind

Mrs. Smith, a widow in her early 60s, was concerned about the financial burden her funeral and end-of-life expenses might place on her children. She opted for a final expense insurance policy with a coverage amount of $20,000. The policy provided her with peace of mind, knowing that her funeral arrangements were pre-paid and her children would not have to worry about the financial aspects during their grieving process.

Mrs. Smith’s policy ensured that her wishes for a simple and dignified funeral were honored. Her children appreciated the financial relief and were able to focus on celebrating their mother’s life without the added stress of arranging and paying for the funeral.

Performance Analysis and Industry Insights

The life insurance industry for seniors is experiencing significant growth and evolution. As the baby boomer generation ages, the demand for senior-specific life insurance policies is increasing. Insurers are adapting to meet the unique needs of this demographic, offering a wider range of policy options and flexible coverage amounts.

According to industry reports, the global life insurance market for seniors is projected to reach $2.5 trillion by 2025, with a CAGR of 7.8% from 2020 to 2025. This growth is driven by the rising awareness of the importance of financial planning among seniors and the increasing longevity of the population.

In addition to traditional life insurance policies, the industry is witnessing the emergence of innovative products. These include hybrid policies that combine life insurance with long-term care coverage, providing seniors with comprehensive protection for both end-of-life and long-term care needs. Insurers are also offering more customizable policies, allowing seniors to tailor coverage to their specific circumstances and budget.

| Industry Statistic | Value |

|---|---|

| Projected Market Value by 2025 | $2.5 trillion |

| Compound Annual Growth Rate (CAGR) from 2020 to 2025 | 7.8% |

FAQ

Can seniors with pre-existing medical conditions still get life insurance?

+

Yes, many life insurance companies offer policies specifically designed for seniors with pre-existing conditions. These policies may have simplified or guaranteed issue underwriting, allowing individuals with health issues to obtain coverage without a medical exam. However, the availability and cost of coverage may vary based on the severity of the condition.

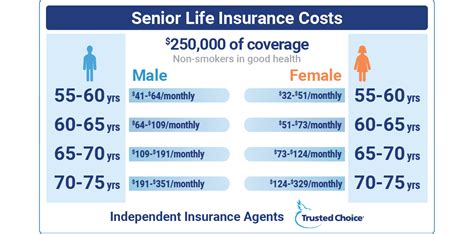

How much does life insurance for seniors typically cost?

+

The cost of life insurance for seniors can vary widely depending on factors such as age, health, lifestyle, and the type of policy chosen. Term life insurance tends to be more affordable, while permanent policies like whole life may have higher premiums. It’s recommended to obtain quotes from multiple insurers to find the most competitive rates.

Are there any tax benefits associated with life insurance for seniors?

+

Yes, life insurance policies for seniors can offer tax advantages. The death benefit received by beneficiaries is typically tax-free, providing a significant financial benefit. Additionally, certain types of policies, such as whole life insurance, may offer tax-deferred growth on the cash value component.

Life insurance for seniors is a vital component of financial planning, offering peace of mind, financial security, and the ability to leave a lasting legacy. With a wide range of policy options available, seniors can tailor their coverage to meet their unique needs and budget. By understanding the benefits and key factors involved, seniors can make informed decisions to protect their loved ones and ensure a secure future.