Term Life Insurance Price

Term life insurance is a fundamental component of financial planning, offering protection and peace of mind to individuals and families during their working years. The cost of term life insurance is a crucial consideration for those seeking coverage, as it directly impacts their financial strategies and budget allocation. This comprehensive analysis delves into the factors influencing the price of term life insurance, providing valuable insights for individuals aiming to secure the best coverage at an affordable rate.

Understanding Term Life Insurance Pricing

The cost of term life insurance is determined by a meticulous evaluation of various factors, each playing a significant role in the overall premium. These factors are meticulously analyzed by insurance providers to assess the risk associated with insuring an individual and, consequently, set the premium amount.

Key Factors Influencing Term Life Insurance Costs

The price of term life insurance is not a static figure; it varies based on an array of individual circumstances and personal attributes. Here’s an in-depth look at the primary factors that influence the cost of term life insurance coverage.

-

Age and Gender: Age is a fundamental determinant of term life insurance premiums. In general, younger individuals pay lower premiums, as they are statistically less likely to pass away during the term of the policy. Gender also plays a role, with men often facing higher premiums due to their historically shorter life expectancies.

-

Health Status: Insurance providers meticulously evaluate an individual's health status to assess their risk level. Factors such as height and weight, blood pressure, cholesterol levels, and medical history are considered. Individuals with pre-existing health conditions or unhealthy lifestyle habits may face higher premiums or even be declined coverage.

-

Smoking and Alcohol Consumption: Smoking and excessive alcohol consumption are major risk factors that can significantly impact life insurance premiums. Smokers are generally charged higher premiums due to the increased health risks associated with tobacco use. Similarly, excessive alcohol consumption can lead to higher premiums or even coverage denials.

-

Occupation and Lifestyle: The nature of one's occupation and lifestyle can influence the cost of term life insurance. High-risk occupations, such as those in the military or emergency services, often result in higher premiums. Additionally, hobbies and activities like skydiving or motor racing can also increase the cost of coverage.

-

Family History: Insurance providers also consider an individual's family medical history. Conditions like heart disease, diabetes, or certain types of cancer that run in the family can impact the cost of coverage.

-

Term Length: The duration of the term life insurance policy also affects the premium. Longer term lengths generally result in higher premiums, as the risk of the insured passing away increases over time.

-

Amount of Coverage: The level of coverage an individual chooses directly impacts the premium. Higher coverage amounts require higher premiums to ensure adequate financial protection for beneficiaries.

-

Rider Options: Riders are optional additions to a life insurance policy that provide additional benefits or coverage. These can include waivers for premium payments in case of disability, accelerated death benefits for terminal illnesses, or child riders that provide coverage for the insured's children. While these riders enhance the policy's value, they also increase the premium.

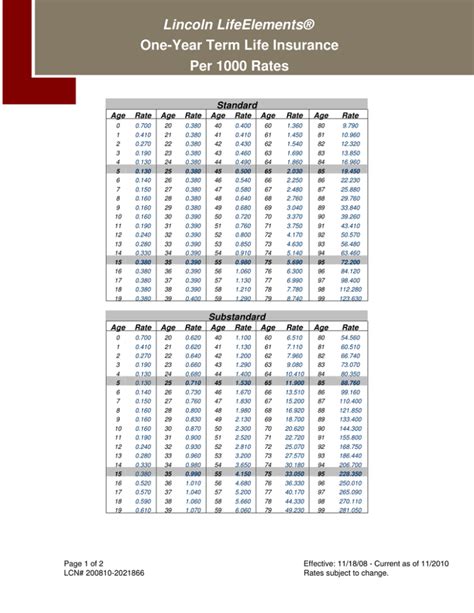

Comparative Analysis of Term Life Insurance Premiums

To provide a tangible understanding of how these factors influence term life insurance costs, let’s examine some real-world examples. The following table showcases the average annual premiums for a $500,000, 20-year term life insurance policy for individuals with varying characteristics.

| Age | Gender | Health Status | Annual Premium |

|---|---|---|---|

| 30 | Male | Excellent Health | $250 |

| 35 | Female | Average Health | $280 |

| 40 | Male | Pre-existing Health Conditions | $350 |

| 45 | Female | Excellent Health, Smoker | $480 |

| 50 | Male | High-Risk Occupation | $550 |

This table illustrates how factors like age, gender, health status, and occupation can significantly impact the cost of term life insurance. It's important to note that these are average estimates, and actual premiums can vary based on individual circumstances and the insurance provider.

Maximizing Value in Term Life Insurance

While the cost of term life insurance is an important consideration, it’s equally vital to ensure that the coverage provides adequate financial protection for beneficiaries. Here are some strategies to help maximize the value of term life insurance:

-

Review Coverage Regularly: Life circumstances can change significantly over time. It's essential to periodically review your term life insurance coverage to ensure it still meets your needs. This is particularly important after major life events like marriage, having children, purchasing a home, or starting a business.

-

Compare Multiple Providers: Different insurance providers offer varying rates and coverage options. By comparing quotes from multiple providers, you can find the best combination of coverage and price that aligns with your specific needs.

-

Bundle Policies: Some insurance providers offer discounts when you bundle multiple policies together. For instance, you might consider bundling your term life insurance with other types of insurance, such as auto or home insurance, to potentially save on premiums.

-

Consider Conversion Options: Term life insurance policies often include a conversion feature, allowing you to convert your term policy into a permanent life insurance policy without a medical exam. This can be beneficial if your health status changes or if you anticipate needing life insurance coverage beyond the term of your current policy.

-

Evaluate Rider Options: Riders can enhance the value of your term life insurance policy by providing additional benefits. However, it's essential to carefully consider which riders are most relevant to your specific circumstances to avoid unnecessary costs.

The Future of Term Life Insurance

The term life insurance industry is continuously evolving, driven by advancements in technology and changes in consumer preferences. Here’s a glimpse into the potential future of term life insurance:

Technological Innovations

The advent of digital technologies has revolutionized the life insurance industry, making it more accessible and efficient. Online platforms and mobile apps now enable consumers to research, compare, and purchase term life insurance policies with just a few clicks. These digital tools also facilitate easier policy management and claims processing, enhancing the overall customer experience.

Personalized Pricing

Advancements in data analytics and machine learning are enabling insurance providers to offer more personalized pricing. By analyzing vast amounts of data, insurers can now more accurately assess individual risk levels, leading to more precise premium calculations. This shift towards personalized pricing is expected to continue, offering greater fairness and accuracy in term life insurance premiums.

Enhanced Customer Experience

Insurance providers are increasingly focused on delivering a seamless and user-friendly experience to their customers. This includes offering straightforward application processes, transparent policy terms, and efficient claims handling. The integration of digital technologies is also expected to further enhance the overall customer experience, making term life insurance more accessible and understandable for consumers.

Increasing Focus on Health and Wellness

There’s a growing trend towards integrating health and wellness into life insurance offerings. Some insurance providers are now offering incentives and rewards for policyholders who maintain healthy lifestyles or achieve specific wellness goals. This shift towards health-focused insurance products is expected to continue, encouraging policyholders to prioritize their well-being while also benefiting from potential premium discounts.

Impact of COVID-19

The COVID-19 pandemic has had a significant impact on the life insurance industry, with many insurers experiencing an increase in claims and a heightened focus on health and mortality. As a result, there’s been a surge in demand for life insurance, particularly among younger individuals and families. This increased awareness of the importance of financial protection is expected to have a lasting impact on the term life insurance market, driving further innovation and growth.

How do I know if I need term life insurance?

+

Term life insurance is particularly beneficial for individuals with financial dependents, such as a spouse, children, or aging parents. It provides a financial safety net to ensure their loved ones’ needs are met in the event of your untimely passing. Consider your current and future financial obligations, such as mortgage payments, educational expenses, or business commitments, to determine the level of coverage you require.

Can I purchase term life insurance if I have a pre-existing health condition?

+

Yes, individuals with pre-existing health conditions can still purchase term life insurance. However, it’s important to note that your health status may impact the cost of your premiums or even your eligibility for coverage. It’s advisable to consult with an insurance professional who can guide you through the process and help you find the best coverage options for your specific circumstances.

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, the coverage simply expires, and you will no longer have life insurance protection. However, many term life insurance policies include a conversion feature, allowing you to convert your term policy into a permanent life insurance policy without the need for a medical exam. This can be a valuable option if you anticipate needing life insurance coverage beyond the term of your original policy.

Are there any tax benefits associated with term life insurance?

+

The tax implications of term life insurance vary based on your jurisdiction and the specific terms of your policy. Generally, the death benefit received by your beneficiaries is not subject to income tax. However, any cash value or policy loans taken out against the policy may have tax implications. It’s advisable to consult with a tax professional to understand the specific tax benefits or obligations associated with your term life insurance policy.

Can I change my term life insurance policy once it’s in force?

+

In most cases, you can make changes to your term life insurance policy, such as increasing or decreasing the coverage amount or adding or removing riders. However, any changes to your policy may impact your premiums. It’s important to review your policy regularly and consult with your insurance provider to ensure your coverage still meets your needs and budget.