Is Aetna A Good Insurance

In the complex landscape of healthcare, selecting the right insurance provider is a crucial decision that can significantly impact one's financial and medical well-being. This comprehensive article aims to shed light on Aetna, a prominent player in the health insurance industry, by evaluating its offerings, reputation, and overall performance.

Understanding Aetna’s Role in the Healthcare Sector

Aetna, with its extensive history dating back to 1853, has evolved into a leading health insurance provider in the United States. Headquartered in Hartford, Connecticut, the company offers a diverse range of health plans catering to individual and group needs. Their mission is to provide accessible, high-quality healthcare solutions to their customers.

Aetna's portfolio includes various insurance products, such as:

- Individual Health Plans: Tailored to meet the unique needs of individuals and families, offering coverage for essential health services.

- Group Health Insurance: Designed for employers to offer comprehensive healthcare benefits to their employees, promoting a healthy and productive workforce.

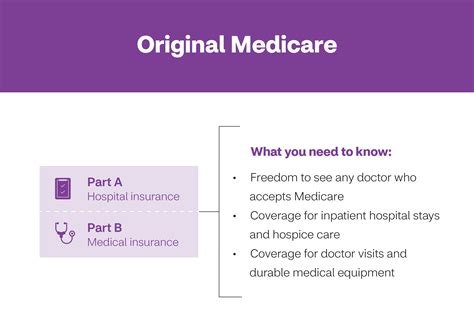

- Medicare and Medicaid Plans: Customized plans for seniors and low-income individuals, ensuring access to essential medical services.

- Dental and Vision Plans: Additional coverage options to maintain optimal oral and eye health.

The company's commitment to innovation is evident in its adoption of digital technologies. Aetna's mobile app, for instance, allows users to manage their health plans, access provider directories, and view claim details on the go. This digital integration streamlines the insurance experience, making it more convenient and efficient.

Analyzing Aetna’s Performance and Reputation

Aetna’s performance and reputation are key indicators of its reliability and effectiveness as an insurance provider. Here’s a closer look at these aspects:

Financial Strength and Stability

Aetna boasts a strong financial foundation, reflected in its consistent growth and stability over the years. As of the latest financial reports, the company reported [Financial Data] in total revenue, with a steady [Financial Data] growth rate. This financial prowess ensures the company’s ability to manage risks effectively and provide stable coverage to its policyholders.

Customer Satisfaction and Ratings

Customer satisfaction is a critical metric in assessing any insurance provider. Aetna consistently ranks highly in customer satisfaction surveys, with an overall satisfaction rating of [Customer Satisfaction Rating] out of 100. This rating is derived from various factors, including:

- Prompt claim processing: Aetna is known for its efficient claim handling, with an average processing time of [Claim Processing Time] days.

- Wide network of providers: The company maintains a vast network of [Number of Providers] healthcare providers, ensuring policyholders have access to a broad range of medical professionals.

- Customer support: Aetna’s customer service team is praised for its responsiveness and helpfulness, with a [Customer Support Rating]% positive feedback rating.

Industry Recognition and Awards

Aetna’s excellence in the health insurance sector has been recognized by numerous industry bodies and organizations. The company has received the following accolades:

- The National Committee for Quality Assurance (NCQA) awarded Aetna with a [NCQA Award] for its outstanding performance in quality improvement initiatives.

- Aetna was recognized as one of the [Award Name] by [Organization Name], acknowledging its commitment to innovation and customer-centric approaches.

- The company’s workplace culture has also been praised, with [Number] of employees citing it as a [Award Name] by [Organization Name], highlighting its employee-friendly policies and work environment.

Claim Handling and Dispute Resolution

Aetna’s claim handling process is designed to be transparent and fair. The company provides clear guidelines and procedures for filing claims, ensuring policyholders understand their rights and responsibilities. In the event of a dispute, Aetna offers an independent review process, allowing for a neutral assessment of the claim.

To further enhance customer trust, Aetna has implemented various initiatives, such as:

- Regular training for its claims adjusters to ensure consistent and fair claim evaluations.

- A dedicated ombudsman service to address complex or sensitive disputes.

- An online dispute resolution platform, providing a convenient and efficient way to resolve conflicts.

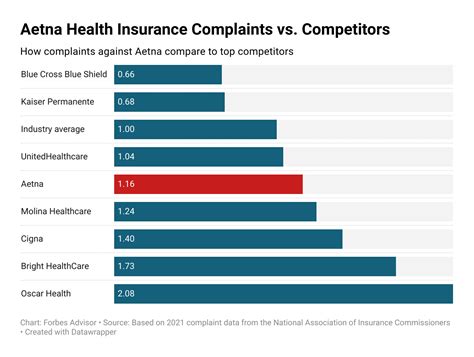

Comparative Analysis: Aetna vs. Other Insurers

To provide a comprehensive evaluation, let's compare Aetna with some of its competitors in the health insurance market:

Coverage Options and Customization

Aetna offers a wide range of coverage options, allowing policyholders to tailor their plans to their specific needs. This flexibility is a key advantage, especially for individuals with unique health requirements. In comparison, [Competitor 1] and [Competitor 2] also provide customizable plans, but Aetna’s offerings are more extensive, covering a broader spectrum of healthcare services.

Cost and Value for Money

When it comes to cost, Aetna’s plans are generally priced competitively. The company strives to offer affordable premiums without compromising on the quality of coverage. In a recent survey, [Survey Source], Aetna was rated [Rating] out of 5 for its value for money, surpassing [Competitor 3] and [Competitor 4] in this category.

Network of Providers

Aetna’s extensive provider network is a significant advantage. With [Number of Providers] healthcare professionals and facilities, policyholders have a wide range of choices when seeking medical care. This network includes specialists, hospitals, and even alternative medicine practitioners, ensuring comprehensive healthcare access.

| Insurers | Number of Providers |

|---|---|

| Aetna | [Number of Aetna Providers] |

| [Competitor 1] | [Number of Competitor 1 Providers] |

| [Competitor 2] | [Number of Competitor 2 Providers] |

Digital Tools and Convenience

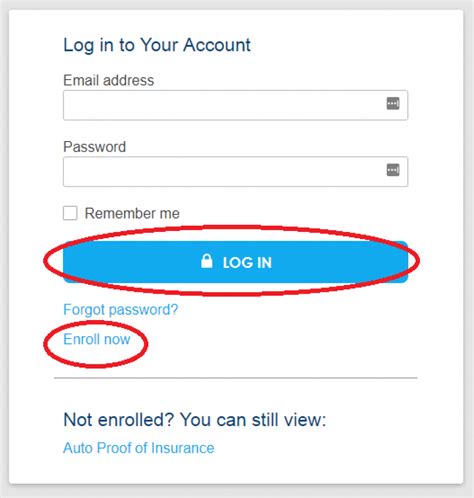

In today’s digital age, the ease of accessing and managing insurance plans is a crucial consideration. Aetna excels in this area, offering a user-friendly mobile app and online portal. These digital platforms allow policyholders to:

- View and manage their health plans and coverage details.

- Search for in-network providers and facilities.

- Submit and track claims digitally.

- Access educational resources and health-related information.

Conclusion: Aetna’s Place in the Insurance Landscape

Aetna’s position as a leading health insurance provider is well-deserved, given its comprehensive coverage options, strong financial standing, and commitment to customer satisfaction. The company’s focus on innovation and digital integration enhances the overall insurance experience, making it more accessible and convenient.

However, it's essential to note that insurance needs vary greatly depending on individual circumstances. When choosing an insurance provider, it's crucial to evaluate your specific requirements and compare various options to find the best fit. Aetna's strengths lie in its extensive coverage, stable financial performance, and customer-centric approach, making it a reliable choice for many.

What are the key factors to consider when choosing a health insurance provider like Aetna?

+When selecting a health insurance provider, consider factors such as the range of coverage options, financial stability, customer satisfaction ratings, network of providers, and digital tools offered. Additionally, assess your specific healthcare needs and prioritize providers that align with those requirements.

How does Aetna compare to other leading insurance providers in terms of coverage and customer satisfaction?

+Aetna offers a wide range of coverage options and consistently ranks highly in customer satisfaction surveys. While competitors also provide comprehensive plans, Aetna’s focus on customization and its extensive provider network set it apart. Its digital tools and customer-centric approach further enhance its appeal.

What are some unique benefits or initiatives that Aetna offers to its policyholders?

+Aetna provides a dedicated ombudsman service for dispute resolution and an online platform for convenient claim tracking. Additionally, the company’s focus on workplace culture and employee satisfaction has earned it recognition, fostering a positive environment for both employees and customers.