Health Insurance

In today's fast-paced and unpredictable world, ensuring access to quality healthcare is paramount. Health insurance serves as a vital safeguard, providing individuals and families with the peace of mind that comes from knowing they are protected against the financial burdens of unexpected illnesses or accidents. This comprehensive guide will delve into the world of health insurance, exploring its significance, how it works, and the key factors to consider when choosing a plan that best suits your needs.

The Importance of Health Insurance

Health insurance is a cornerstone of modern healthcare systems, offering numerous benefits that extend beyond financial protection. Let’s delve into some of the key advantages it provides:

Financial Security

The primary purpose of health insurance is to mitigate the financial risks associated with medical care. Medical treatments, especially in emergency situations or for chronic conditions, can incur substantial costs. Health insurance helps individuals avoid the potential financial strain of paying for these expenses out of pocket. By covering a portion or the entirety of the medical bills, insurance providers ensure that individuals can access necessary healthcare without worrying about unaffordable medical debts.

Access to Quality Healthcare

Health insurance plays a pivotal role in ensuring that individuals have access to a wide range of healthcare services. Insurance plans typically include coverage for primary care, specialist visits, hospital stays, prescription medications, and preventive care. This comprehensive coverage enables individuals to seek timely medical attention without facing financial barriers, leading to better health outcomes and overall well-being.

Preventive Care and Wellness

Many health insurance plans emphasize preventive care and wellness initiatives. These programs encourage individuals to prioritize their health through regular check-ups, screenings, and immunizations. By focusing on early detection and prevention, health insurance providers aim to reduce the occurrence of serious illnesses and promote healthier lifestyles. This proactive approach not only improves the overall health of the population but also reduces long-term healthcare costs.

Peace of Mind

One of the most significant advantages of health insurance is the peace of mind it offers. Knowing that you have coverage in place can alleviate the stress and anxiety associated with unexpected medical events. With health insurance, individuals can focus on their recovery and well-being without worrying about the financial implications of their healthcare needs.

Understanding How Health Insurance Works

Health insurance operates through a complex system of premiums, deductibles, copayments, and networks. Let’s break down these key components to gain a better understanding of how health insurance plans function:

Premiums

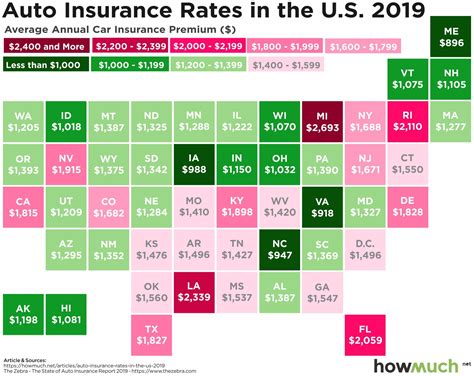

Premiums are the regular payments made by individuals or groups to maintain their health insurance coverage. These payments are typically made monthly, quarterly, or annually. The premium amount can vary based on factors such as age, location, coverage type, and the insurance provider. It is essential to consider premiums as a crucial aspect when evaluating the affordability and suitability of a health insurance plan.

Deductibles and Copayments

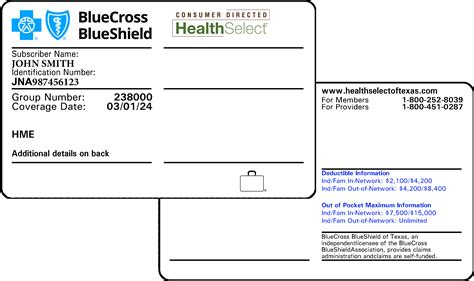

Deductibles and copayments are two key terms related to out-of-pocket expenses in health insurance. A deductible is the amount an individual must pay out of pocket before the insurance coverage kicks in. Copayments, on the other hand, are fixed amounts individuals pay for specific healthcare services, such as doctor visits or prescription medications. Understanding these expenses is vital when assessing the overall cost of a health insurance plan.

Networks and Providers

Health insurance plans often work within networks of healthcare providers, including hospitals, clinics, and doctors. These networks are established by insurance companies to negotiate preferred rates and ensure quality care. When choosing a health insurance plan, it is essential to consider the network of providers and whether your preferred healthcare professionals are included. Out-of-network care may result in higher out-of-pocket costs, so it is crucial to understand the network coverage before making a decision.

Coverage Options

Health insurance plans offer a variety of coverage options to cater to different needs and preferences. These options can include:

- Individual Plans: Designed for single individuals or families, these plans provide coverage tailored to personal healthcare needs.

- Employer-Sponsored Plans: Many employers offer group health insurance plans as part of their benefits package, providing coverage for employees and their dependents.

- Government-Sponsored Plans: Government programs like Medicare and Medicaid provide health insurance coverage for specific populations, such as the elderly, disabled individuals, and low-income families.

- Short-Term Plans: These plans offer temporary coverage for individuals between jobs or during periods of transition, providing a cost-effective solution for short-term healthcare needs.

Key Factors to Consider When Choosing a Health Insurance Plan

Selecting the right health insurance plan is a crucial decision that requires careful consideration. Here are some key factors to keep in mind when evaluating your options:

Coverage and Benefits

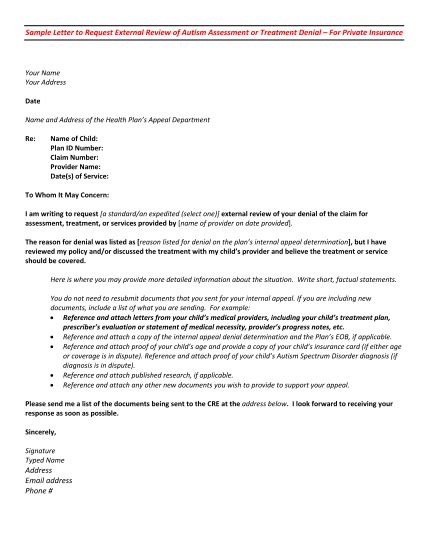

Examine the coverage and benefits offered by different plans. Assess whether the plan covers the specific healthcare services you require, such as prescription medications, mental health services, or specialized treatments. Look for plans that provide comprehensive coverage tailored to your individual needs.

Network of Providers

Review the network of healthcare providers associated with each plan. Ensure that your preferred doctors, specialists, and hospitals are included in the network to avoid potential out-of-network costs. Consider the convenience of accessing care and the availability of providers near your residence or workplace.

Cost and Affordability

Evaluate the overall cost of the health insurance plan, including premiums, deductibles, and copayments. Consider your budget and assess whether the plan is financially feasible for you and your family. Look for plans that offer a balance between coverage and affordability, ensuring you can maintain the necessary level of healthcare protection.

Plan Types and Flexibility

Explore the different plan types available, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type offers unique features and flexibility in terms of provider choice and coverage. Assess your healthcare needs and preferences to determine which plan type aligns best with your requirements.

Customer Service and Reputation

Research the reputation and customer service record of the insurance provider. Look for reviews and feedback from existing policyholders to gauge their satisfaction with the company’s services. A reputable insurance provider with a strong track record of customer satisfaction can provide added peace of mind and ensure a seamless experience when navigating the complexities of health insurance.

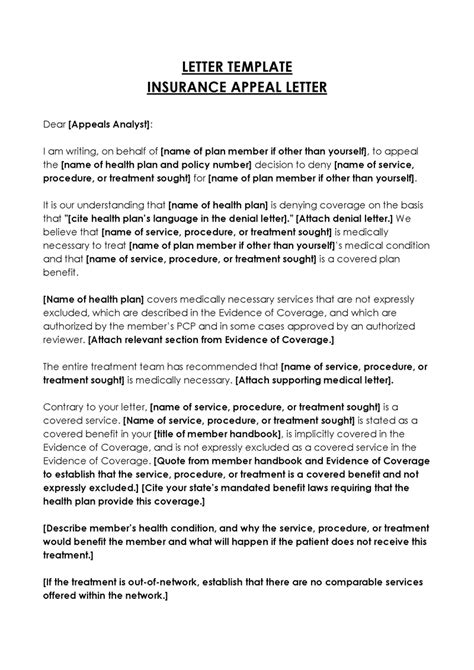

Making an Informed Decision

Choosing the right health insurance plan involves a careful assessment of your individual needs, preferences, and financial situation. It is essential to take the time to understand the intricacies of health insurance, compare different plans, and seek professional advice when needed. By making an informed decision, you can ensure that you have the necessary coverage to protect your health and well-being, giving you the confidence to navigate the complexities of modern healthcare.

Conclusion

Health insurance is a vital component of a comprehensive healthcare system, offering financial protection, access to quality care, and peace of mind. By understanding the importance of health insurance, how it works, and the key factors to consider when choosing a plan, individuals can make informed decisions to safeguard their health and well-being. With the right health insurance coverage, you can focus on living a healthy and fulfilling life, knowing that you have the support you need when facing unexpected medical challenges.

What is the difference between a PPO and an HMO plan?

+PPO (Preferred Provider Organization) plans offer more flexibility in terms of provider choice, allowing you to see doctors and specialists both in and out of the network. HMO (Health Maintenance Organization) plans, on the other hand, typically require you to choose a primary care physician within the network and obtain referrals for specialist visits. PPOs often have higher premiums but provide greater freedom in healthcare decisions.

Can I switch health insurance plans during the year?

+In most cases, you can only switch health insurance plans during specific enrollment periods, such as the annual open enrollment period or special enrollment periods triggered by life events like marriage, birth of a child, or loss of existing coverage. Check with your insurance provider or a healthcare advisor to understand your options for switching plans.

What are some common exclusions or limitations in health insurance plans?

+Common exclusions or limitations in health insurance plans may include pre-existing conditions, cosmetic procedures, experimental treatments, and certain types of mental health services. It’s crucial to carefully review the policy’s terms and conditions to understand any exclusions or limitations that may apply to your specific plan.