Car Insurance Pricing

Car insurance pricing is a complex and often confusing topic for many vehicle owners. The cost of insurance can vary significantly, and understanding the factors that influence these prices is crucial for both consumers and industry professionals alike. In this comprehensive guide, we will delve into the intricacies of car insurance pricing, exploring the key variables, industry trends, and strategies to navigate this vital aspect of vehicle ownership.

Unraveling the Factors Behind Car Insurance Pricing

The price of car insurance is influenced by a multitude of factors, each playing a unique role in determining the final cost. From the type of vehicle you drive to your personal driving history, these elements are carefully assessed by insurance providers to calculate risk and, consequently, the premium you pay.

Vehicle-Specific Factors

The make, model, and age of your vehicle are among the primary considerations in insurance pricing. High-performance sports cars and luxury vehicles, for instance, often come with higher insurance costs due to their higher repair costs and increased likelihood of theft. Additionally, the safety features and overall safety record of a vehicle can also impact insurance rates. Cars equipped with advanced safety technologies may enjoy lower premiums, as they are statistically less likely to be involved in accidents.

Here's a table illustrating the impact of vehicle type on insurance costs:

| Vehicle Type | Average Annual Insurance Cost |

|---|---|

| Sports Cars | $2,500 - $3,000 |

| Luxury Sedans | $1,800 - $2,200 |

| Compact Cars | $1,200 - $1,500 |

| SUVs | $1,500 - $2,000 |

Driver Profile and History

Your personal driving history and demographic details are crucial in insurance pricing. Young drivers, particularly those under 25, often face higher premiums due to their statistically higher risk of accidents. Similarly, drivers with a history of accidents or traffic violations may also see increased insurance costs. On the other hand, safe drivers with a clean record and a long tenure of driving experience often enjoy lower insurance rates.

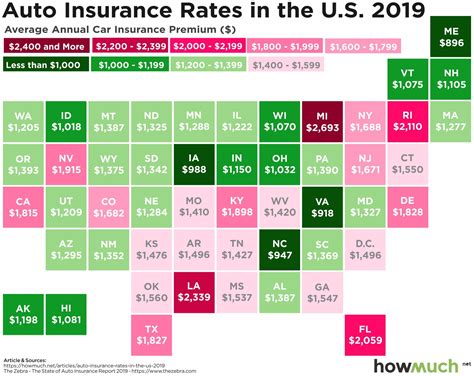

Geographic and Usage Factors

The location where you reside and the nature of your vehicle usage also play a significant role in insurance pricing. Urban areas with higher population densities and a greater frequency of accidents often result in higher insurance costs. Additionally, the purpose for which you use your vehicle (e.g., personal, business, or pleasure) can impact your insurance rates. Commercial usage or frequent long-distance travel may lead to increased premiums.

Coverage and Deductibles

The level of coverage you choose and the associated deductibles are key components in insurance pricing. Comprehensive and collision coverage, while providing more extensive protection, often result in higher premiums. Conversely, higher deductibles (the amount you pay out-of-pocket before insurance coverage kicks in) can lead to lower premiums. It’s essential to find the right balance between coverage and cost to suit your specific needs.

Industry Trends and Innovations in Car Insurance Pricing

The car insurance industry is continuously evolving, with technological advancements and data-driven approaches reshaping the way premiums are calculated. These innovations aim to provide more accurate assessments of risk, offering both benefits and challenges to consumers.

Telematics and Usage-Based Insurance

Telematics devices, which track driving behavior and vehicle usage, are revolutionizing insurance pricing. Usage-based insurance (UBI) programs use these devices to monitor factors such as driving speed, acceleration, and braking patterns. By collecting real-time data, insurance providers can offer premiums tailored to individual driving habits. Safe drivers who adhere to recommended practices may enjoy significant discounts, while those with riskier driving habits may face higher premiums.

Big Data Analytics and Risk Assessment

The insurance industry is harnessing the power of big data analytics to refine risk assessment models. By analyzing vast datasets, insurers can identify patterns and correlations that influence insurance costs. This includes factors like traffic congestion, weather patterns, and even social media data, which can provide insights into driver behavior and potential risks.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the way insurance claims are processed and prices are determined. These technologies can automate complex tasks, such as assessing the severity of accidents and predicting repair costs, leading to faster and more accurate claim settlements. Additionally, AI-powered risk assessment models can continuously learn and adapt, improving the accuracy of insurance pricing over time.

Strategies for Managing Car Insurance Costs

Understanding the factors that influence car insurance pricing is the first step towards managing these costs effectively. Here are some strategies to consider when navigating the complex landscape of insurance premiums.

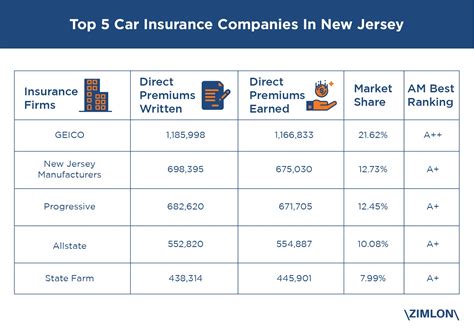

Shop Around and Compare Quotes

Insurance premiums can vary significantly between providers, so it’s essential to shop around and compare quotes. Online comparison tools can be a valuable resource, allowing you to quickly assess multiple offers and identify the most competitive rates. Remember, loyalty to a single insurer may not always result in the best deal, so be proactive in seeking out the most cost-effective options.

Optimize Your Coverage

Review your insurance coverage regularly to ensure it aligns with your current needs and circumstances. Consider the value of your vehicle and whether comprehensive and collision coverage are still necessary. If your vehicle is older or has a lower resale value, you may be able to reduce your premiums by adjusting your coverage limits or opting for liability-only coverage.

Bundle Policies and Explore Discounts

Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance. Additionally, safe drivers and those with a clean record may qualify for various discounts, including safe driver discounts, accident-free discounts, and loyalty discounts. Be sure to inquire about these options when obtaining quotes, as they can significantly reduce your overall insurance costs.

Maintain a Good Driving Record

Your driving behavior is a key factor in insurance pricing. By maintaining a clean driving record, you can qualify for lower premiums. Avoid traffic violations and accidents, and consider enrolling in safe driving courses or programs that can further enhance your driving skills and reduce your risk profile.

Consider Alternative Insurance Models

As the insurance industry evolves, new models and approaches are emerging. Usage-based insurance, as mentioned earlier, can provide significant savings for safe drivers. Additionally, peer-to-peer insurance models and collaborative insurance platforms are gaining traction, offering alternative ways to access coverage and potentially reduce costs.

Conclusion: Navigating the Complex World of Car Insurance Pricing

Car insurance pricing is a dynamic and multifaceted aspect of vehicle ownership. By understanding the key factors that influence premiums and staying abreast of industry trends and innovations, you can make informed decisions to manage your insurance costs effectively. Whether it’s optimizing your coverage, exploring alternative models, or simply shopping around for the best deals, taking a proactive approach to insurance can help ensure you’re getting the most value for your money.

Remember, the car insurance landscape is continually evolving, and staying informed is crucial to making the right choices for your specific needs. Stay tuned for further insights and updates as we navigate the ever-changing world of insurance.

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the US varies depending on numerous factors, including state regulations, the driver’s age and driving record, the type of vehicle, and the level of coverage chosen. As of recent data, the national average cost for car insurance is approximately 1,674 per year or 139 per month. However, this average can vary significantly from state to state and individual to individual.

How can I lower my car insurance premiums?

+

There are several strategies to reduce car insurance costs. These include shopping around for the best rates, maintaining a clean driving record, increasing your deductible, exploring discounts such as safe driver or multi-policy discounts, and considering usage-based insurance programs. Additionally, understanding your coverage needs and optimizing your policy to suit those needs can also help lower premiums.

Are there any factors that can increase my car insurance rates significantly?

+

Yes, certain factors can lead to significant increases in car insurance rates. These include getting into accidents, receiving traffic violations such as speeding tickets or DUIs, having a poor credit score, or being involved in fraudulent claims. Additionally, factors like your age, gender, and marital status can also influence rates, although these are becoming less common considerations due to anti-discrimination laws.

What is usage-based insurance, and how does it work?

+

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a pricing model that calculates insurance premiums based on how, when, and where you drive. Insurers use telematics devices or smartphone apps to track your driving behavior, including mileage, time of day, and driving habits such as acceleration and braking. By monitoring these factors, insurers can offer discounts to safe drivers and charge higher premiums to those with riskier driving behaviors.

How often should I review and update my car insurance policy?

+

It’s recommended to review your car insurance policy at least once a year, especially during policy renewal. This allows you to assess if your coverage still meets your needs, check for any changes in rates, and explore potential discounts. Additionally, any significant life changes, such as a move to a new state, getting married, or purchasing a new vehicle, should prompt a review of your insurance policy to ensure it remains appropriate and cost-effective.