Family Life Insurance Quotes

Securing the financial well-being of your loved ones is a top priority for any family. Life insurance is an essential tool to provide peace of mind and ensure a stable future, especially during uncertain times. As a family, understanding the various life insurance options and their quotes is crucial to making informed decisions. In this comprehensive guide, we will delve into the world of family life insurance, exploring the factors that influence quotes, the types of policies available, and the steps to finding the best coverage for your unique circumstances.

Understanding the Impact of Family on Life Insurance Quotes

When it comes to life insurance, the composition and needs of your family play a significant role in determining the quotes you receive. The insurance provider considers several factors to assess the risk and tailor the policy accordingly.

Family Size and Composition

The size of your family is a primary consideration. Insurance companies assess the number of dependents and their ages to evaluate the potential financial impact of a breadwinner’s absence. For instance, a family with young children may require a larger death benefit to cover their education and future expenses, while an empty nester’s needs may be more focused on retirement planning.

| Family Composition | Average Quote Impact |

|---|---|

| Couple with 2 Children | +15% to +20% compared to a single individual |

| Single Parent with 1 Child | +10% to +15% increase |

| Elderly Couple with No Dependents | ±0% to +5% depending on health and retirement plans |

Health and Lifestyle Factors

The overall health and lifestyle of family members are taken into account. This includes assessing medical histories, smoking habits, and participation in risky activities. For example, a family with members who engage in extreme sports or have pre-existing medical conditions may face higher premiums due to the increased risk of claims.

Financial Stability and Needs

Insurance providers also consider the family’s financial stability and future goals. This includes evaluating income levels, debt, and savings. A family with substantial savings and a stable income may have different insurance needs compared to one with significant financial obligations.

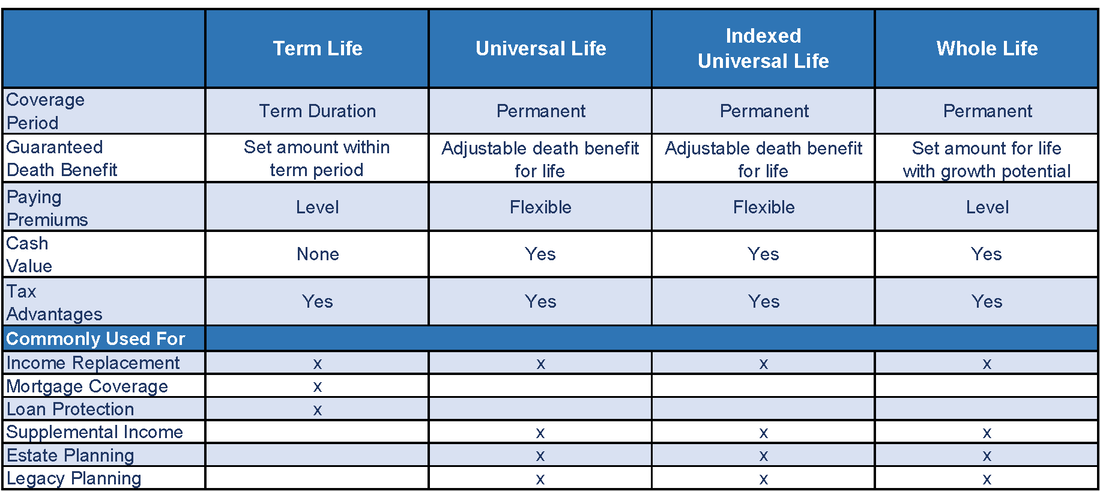

Types of Life Insurance for Families

There are several types of life insurance policies available, each designed to meet different family needs. Understanding these options is crucial to selecting the right coverage.

Term Life Insurance

Term life insurance is a popular choice for families due to its affordability and flexibility. This policy provides coverage for a specified term, typically ranging from 10 to 30 years. During the term, the policy pays out a death benefit to the beneficiaries if the insured passes away. Term life insurance is ideal for covering temporary needs, such as child-rearing expenses or mortgage payments.

| Term Length | Average Premium |

|---|---|

| 10-year Term | $20 - $30 per month for a healthy individual |

| 20-year Term | $30 - $50 per month |

| 30-year Term | $50 - $80 per month |

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the insured’s entire life. This policy includes a cash value component that grows over time, providing a savings element in addition to the death benefit. Whole life insurance is a more expensive option but offers guaranteed coverage and the potential for long-term financial growth.

| Whole Life Insurance | Average Premium |

|---|---|

| Standard Policy | $150 - $300 per month |

| High-Value Policy | $300+ per month |

Universal Life Insurance

Universal life insurance is a flexible permanent policy that allows policyholders to adjust their coverage and premiums over time. This policy combines a death benefit with a savings element, providing a customizable option for families with changing needs. Universal life insurance offers more flexibility than whole life but may have higher premiums due to the added flexibility.

Factors Influencing Life Insurance Quotes for Families

When obtaining life insurance quotes for your family, several factors will influence the premiums you receive. Understanding these factors can help you navigate the process and secure the best coverage.

Age and Health of Insured

The age and health of the insured individual are primary considerations. Younger, healthier individuals typically receive lower premiums, as they pose a lower risk to the insurance provider. As individuals age or develop health conditions, premiums may increase to reflect the higher likelihood of claims.

Policy Duration and Coverage Amount

The length of the policy term and the chosen coverage amount will impact quotes. Longer terms and higher coverage amounts generally result in higher premiums. It’s essential to strike a balance between your family’s needs and your budget when selecting these factors.

Tobacco and Substance Use

Insurance companies consider tobacco and substance use when assessing risk. Smokers and individuals with a history of substance abuse may face higher premiums or be denied coverage altogether due to the increased health risks associated with these habits.

Occupation and Hobbies

The insured’s occupation and hobbies can also affect quotes. High-risk occupations, such as those in construction or emergency services, may result in higher premiums due to the increased likelihood of accidents or health issues. Similarly, hobbies like skydiving or motorcycling can impact quotes, as they involve higher risks.

Securing the Best Life Insurance Quotes for Your Family

Obtaining the best life insurance quotes for your family involves a careful assessment of your needs and a strategic approach to the application process. Here are some steps to help you secure the most favorable quotes.

Evaluate Your Family’s Needs

Start by assessing your family’s financial needs and goals. Consider factors such as child-rearing expenses, mortgage payments, and retirement planning. Determine the coverage amount and policy term that align with your family’s unique circumstances.

Compare Multiple Quotes

Don’t settle for the first quote you receive. Compare quotes from multiple insurance providers to ensure you’re getting the best rate. Online quote comparison tools can be a valuable resource for this step.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when you combine multiple types of insurance, such as life, auto, and home insurance. Explore these options to potentially save on your life insurance premiums.

Maintain a Healthy Lifestyle

Leading a healthy lifestyle can have a positive impact on your life insurance quotes. Regular exercise, a balanced diet, and avoiding tobacco and excessive alcohol consumption can improve your health and reduce premiums.

Shop Around Regularly

Life insurance quotes can fluctuate over time, so it’s essential to shop around regularly, especially when your policy is up for renewal. This ensures you’re always getting the best rate available.

Conclusion: A Secure Future for Your Family

Securing life insurance for your family is a responsible and caring decision that provides a safety net for your loved ones. By understanding the factors that influence quotes and exploring the various policy options, you can make informed choices to protect your family’s financial well-being. Remember, the right life insurance policy is a crucial component of your family’s overall financial plan, ensuring a stable future even in the face of uncertainty.

How much life insurance coverage does my family need?

+The amount of life insurance coverage your family needs depends on various factors, including your income, debt, and future financial goals. As a general guideline, experts recommend having enough coverage to replace 7-10 times your annual income. This ensures your family can maintain their current lifestyle and cover essential expenses in your absence.

Can I get life insurance if I have a pre-existing medical condition?

+Yes, it is possible to obtain life insurance with a pre-existing medical condition. However, the availability and cost of coverage may vary depending on the condition. Some insurance providers specialize in covering individuals with specific health issues. It’s essential to be honest about your health when applying for life insurance to avoid potential issues with your policy.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will expire, and you will no longer have protection. However, many term life policies offer the option to convert to a permanent policy, such as whole life insurance, without undergoing a new medical exam. This provides an opportunity to continue your coverage and build a long-term financial safety net.