Cancel Insurance

In today's world, insurance policies play a crucial role in providing financial protection and peace of mind. However, there may be instances where individuals or businesses need to cancel insurance policies, and understanding the process and potential implications is essential. This comprehensive guide aims to delve into the intricate world of insurance cancellation, offering valuable insights and practical advice.

Understanding Insurance Cancellation

Canceling an insurance policy is a significant decision that requires careful consideration. Whether it’s due to a change in circumstances, a better alternative, or a desire to manage finances, the process involves several key steps and potential repercussions.

Reasons for Cancellation

There are various reasons why individuals or entities might seek to cancel their insurance coverage. Some common motives include:

- Change in Circumstances: Life events such as marriage, divorce, retirement, or a move to a new location can alter insurance needs.

- Better Alternatives: Finding a more suitable or cost-effective insurance plan that better aligns with one’s requirements.

- Financial Constraints: Economic hardships may prompt individuals to reassess their insurance coverage and opt for cancellation.

- Policy Discontinuance: Insurance companies sometimes decide to discontinue specific policies, prompting customers to seek alternatives or cancel.

The Cancellation Process

The process of canceling an insurance policy varies depending on the type of insurance and the provider. Generally, it involves the following steps:

- Reviewing the Policy: Understanding the terms and conditions of the insurance policy is crucial. Pay attention to cancellation provisions, refund policies, and any potential penalties.

- Contacting the Insurer: Reach out to the insurance company or agent to initiate the cancellation process. They will guide you through the necessary steps and provide the required documentation.

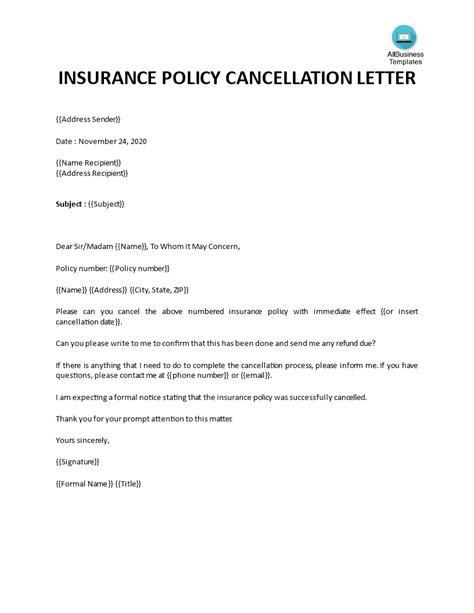

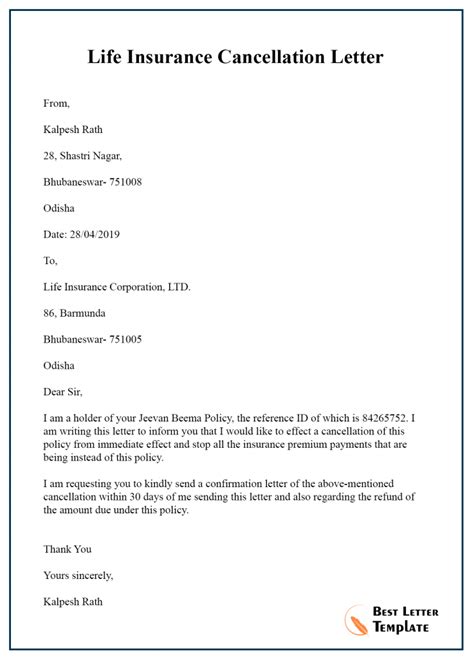

- Providing Notice: Most insurance policies require a formal notice of cancellation. This can be done through a written letter, email, or online form, depending on the insurer’s preferences.

- Returning Documents: If you have physical copies of the policy or related documents, ensure you return them to the insurer as requested.

- Waiting for Confirmation: Once you’ve initiated the cancellation, wait for official confirmation from the insurer. This typically includes a cancellation letter or email, detailing the effective date of termination.

Implications and Considerations

Canceling an insurance policy comes with several implications and considerations. It’s crucial to weigh these factors before making a decision.

Financial Implications

One of the primary concerns when canceling insurance is the financial impact. Depending on the type of insurance and the timing of cancellation, you may be entitled to a refund of your premium payments. However, there are situations where you might not receive a full refund:

- Pro-Rated Refunds: Some insurers offer pro-rated refunds, meaning you’ll receive a portion of your premium based on the remaining coverage period.

- Cancellation Fees: Certain policies impose cancellation fees, which are deducted from your refund. These fees vary across insurers and policy types.

- Minimum Premium: In some cases, insurers may require you to pay a minimum premium, even if you cancel the policy early.

It's essential to carefully review your policy documents and understand the financial implications before proceeding with cancellation.

Legal and Regulatory Considerations

Insurance policies are governed by legal and regulatory frameworks, and canceling them may have implications beyond the financial aspect. Here are some key considerations:

- Compliance with Laws: Ensure that your cancellation process complies with local insurance regulations and laws. Failure to adhere to these rules can result in legal consequences.

- Waiting Periods: Some types of insurance, especially health insurance, may have waiting periods after cancellation. This means you might need to wait before obtaining new coverage, potentially leaving you uninsured for a period.

- Claim Settlements: If you’ve made a claim under the policy and it’s still pending, canceling the insurance could impact the settlement process. It’s advisable to wait until all claims are resolved before proceeding with cancellation.

Impact on Future Coverage

Canceling an insurance policy can affect your future coverage options. Here’s what you need to consider:

- Reinstatement: If you change your mind and decide to reinstate the policy, the insurer may charge a reinstatement fee or require additional documentation.

- Pre-Existing Conditions: In the case of health insurance, canceling your policy may result in the insurer treating your health conditions as pre-existing. This could impact your ability to obtain new coverage or result in higher premiums.

- Credit Score Impact: Canceling certain types of insurance, such as auto insurance, may affect your credit score, especially if you’ve had a history of claims or violations.

Alternatives to Cancellation

Before canceling your insurance policy, it’s worth exploring alternatives that might better suit your needs and circumstances.

Adjusting Coverage

If your insurance needs have changed, you might consider adjusting your coverage instead of canceling the policy altogether. This could involve:

- Changing Deductibles: Adjusting your deductible can impact your premium payments. A higher deductible may result in lower premiums, making insurance more affordable.

- Modifying Coverage Limits: Reviewing and modifying the coverage limits of your policy can help align it with your current requirements. For instance, you might reduce coverage for certain risks or increase it for others.

- Adding or Removing Riders: Insurance policies often offer optional riders or endorsements that can be added or removed. These can customize your coverage to better suit your needs.

Switching Insurers

Shopping around for a new insurance provider can sometimes lead to better coverage and more competitive rates. Consider the following when switching insurers:

- Compare Quotes: Obtain quotes from multiple insurers to compare coverage and premiums. Online tools and insurance brokers can simplify this process.

- Check Reputation: Research the reputation and financial stability of potential insurers. This ensures you’re choosing a reliable and trustworthy company.

- Transfer of Coverage: Inquire about the process of transferring your coverage to the new insurer. Some insurers offer seamless transitions, ensuring your protection remains uninterrupted.

Conclusion

Canceling an insurance policy is a significant decision that requires careful consideration of various factors. From financial implications to legal considerations and the impact on future coverage, it’s crucial to approach this process with knowledge and expertise. By understanding the cancellation process, exploring alternatives, and seeking professional advice, you can make informed choices that align with your insurance needs and financial goals.

Frequently Asked Questions

Can I cancel my insurance policy at any time?

+

The answer depends on the type of insurance and the terms of your policy. Some policies allow cancellation at any time, while others have specific cancellation periods or require notice. It’s essential to review your policy documents or consult with your insurer to understand the cancellation provisions.

Will I receive a refund if I cancel my insurance policy?

+

Whether you receive a refund and the amount you receive can vary. Some insurers offer pro-rated refunds, while others may have cancellation fees or minimum premium requirements. It’s crucial to review your policy or contact your insurer to understand the refund policy.

What happens if I cancel my health insurance policy mid-treatment?

+

Canceling a health insurance policy mid-treatment can have significant implications. It’s advisable to wait until your treatment is complete or consult with your insurer about the best course of action. In some cases, you may need to pay out-of-pocket for ongoing treatments.

Can I cancel my insurance policy online?

+

Many insurers now offer online cancellation options, making the process more convenient. However, it’s essential to confirm with your insurer whether this is an available option for your policy. Some policies may still require a formal written notice or other specific procedures.

Are there any penalties for canceling my insurance policy early?

+

Yes, some insurance policies impose penalties or fees for early cancellation. These fees can vary and are typically outlined in the policy documents. It’s crucial to review these terms before initiating the cancellation process to understand the potential financial implications.