Who Typically Has The Cheapest Car Insurance

When it comes to car insurance, the cost can vary significantly depending on numerous factors. Insurance companies use various criteria to assess risk and determine premiums. While the specific cheapest options may differ based on individual circumstances and location, certain demographics and characteristics are generally associated with lower insurance rates. Let's delve into the factors that can influence who typically enjoys the most affordable car insurance rates.

Factors Affecting Car Insurance Costs

The cost of car insurance is influenced by a multitude of variables, including:

- Age and Gender: Young drivers, particularly those under 25 years old, often face higher premiums due to their lack of driving experience. Gender may also play a role, with statistics suggesting that male drivers under 25 tend to pay more than their female counterparts.

- Driving Record: A clean driving record with no accidents or violations is a significant factor in obtaining lower insurance rates. Insurers view individuals with a history of safe driving as less risky.

- Vehicle Type and Usage: The make, model, and year of your vehicle can impact insurance costs. High-performance cars and luxury vehicles generally cost more to insure. Additionally, the purpose of your vehicle (personal use, business, or pleasure) and the number of miles driven annually can affect premiums.

- Credit History: In many states, insurance companies consider an individual’s credit score when determining rates. Those with a strong credit history may qualify for better insurance deals.

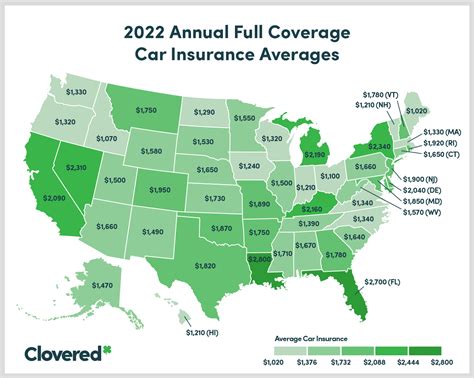

- Location: The area where you reside and park your vehicle matters. Urban areas with higher population density and a history of frequent claims may result in increased insurance costs.

- Marital Status: Some insurance providers offer discounts to married individuals, believing they tend to drive more safely.

- Education and Occupation: Certain professions and educational backgrounds may be associated with lower insurance rates, as they are seen as indicators of stability and responsibility.

Who Typically Has the Cheapest Car Insurance Rates?

Based on the factors mentioned above, the following demographics and characteristics are often associated with the most affordable car insurance rates:

- Experienced Drivers: Individuals with an extensive history of safe driving, particularly those over the age of 25, typically enjoy lower insurance premiums. As drivers gain experience and maintain a clean record, insurance companies perceive them as less risky.

- Older Adults: Senior citizens, especially those over the age of 50, often benefit from lower insurance rates. Insurers consider them to be more cautious and experienced drivers.

- Women: Statistical data suggests that women, especially those in the age bracket of 25 to 50, tend to have lower insurance premiums compared to men in the same age group. This trend may be influenced by factors such as driving habits and accident involvement.

- Married Couples: Couples who are married and share a policy often receive discounts, as insurance companies view them as a lower-risk group. Married individuals are generally associated with more stable lifestyles and responsible driving behaviors.

- Safe Drivers: Individuals who have never been involved in accidents or received traffic violations are rewarded with lower insurance rates. Insurance companies prioritize safe driving records as a key indicator of low risk.

- Rural Residents: Those who live in rural areas generally experience lower insurance costs compared to urban dwellers. Rural areas typically have fewer accidents and claims, leading to more affordable insurance rates.

- Vehicle Type and Usage: Individuals who drive standard vehicles for personal use and have a low annual mileage tend to pay less for insurance. High-performance cars and luxury vehicles, especially when used for business or pleasure, can significantly increase insurance costs.

- Good Credit History: In states where credit history is considered, individuals with excellent credit scores may qualify for better insurance rates. Insurance companies view a strong credit history as an indicator of financial responsibility and lower risk.

Tips for Obtaining Affordable Car Insurance

If you’re looking to reduce your car insurance costs, consider the following strategies:

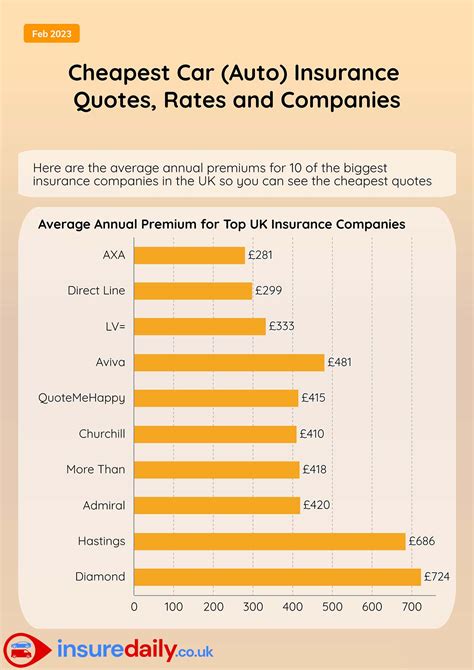

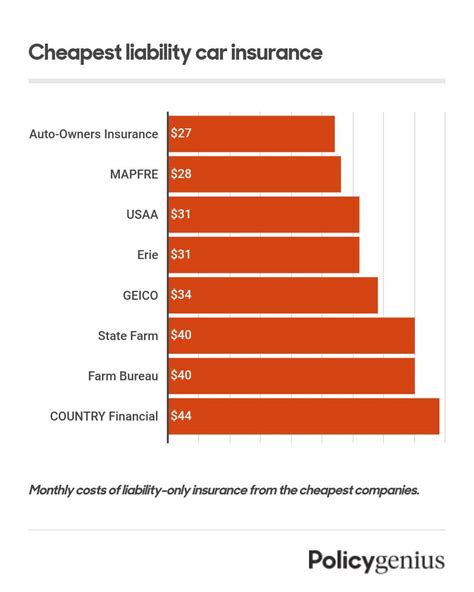

- Shop Around: Compare quotes from multiple insurance providers to find the best deal. Insurance rates can vary significantly between companies, so it’s worth investing time in researching and comparing options.

- Maintain a Clean Driving Record: Avoid accidents and violations to keep your insurance premiums low. A single traffic ticket or accident can significantly increase your insurance costs.

- Bundle Policies: Consider bundling your car insurance with other policies, such as home or renters insurance. Many insurance companies offer discounts for bundling multiple policies together.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly insurance premiums. However, ensure you have sufficient savings to cover the deductible in case of an accident.

- Consider Telematics or Usage-Based Insurance: Some insurance companies offer telematics or usage-based insurance programs. These programs track your driving behavior and reward safe driving with lower premiums. However, be aware that your driving habits will be monitored.

- Explore Discounts: Inquire about available discounts, such as safe driver discounts, loyalty discounts, or discounts for certain professions or educational achievements. Insurance companies often offer a range of discounts to attract and retain customers.

Understanding Car Insurance Premiums

Car insurance premiums are calculated based on a combination of factors, including the aforementioned demographics and characteristics. Insurance companies use actuarial science and statistical analysis to assess risk and determine appropriate premiums. The complexity of these calculations ensures that insurance rates are fair and accurate, reflecting the likelihood of an individual filing a claim.

| Demographic Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers often pay higher premiums due to their lack of experience. Rates typically decrease with age. |

| Gender | In some states, gender may influence rates, with male drivers under 25 potentially facing higher premiums. |

| Driving Record | A clean driving record with no accidents or violations leads to lower insurance costs. |

| Vehicle Type | High-performance cars and luxury vehicles generally result in higher insurance premiums. |

| Credit History | In states where credit is considered, a strong credit history can lead to better insurance rates. |

| Location | Urban areas with high population density and accident rates may have higher insurance costs. |

Frequently Asked Questions

Are there any other factors that can influence car insurance costs besides those mentioned above?

+Yes, several other factors can impact car insurance costs. These include the insurance company’s claim history, the type of coverage chosen (liability-only vs. comprehensive), and any additional coverage options selected, such as rental car reimbursement or roadside assistance.

Can I get car insurance without a credit check?

+In some states, insurance companies are not allowed to consider credit history when determining insurance rates. However, it’s important to check your state’s regulations and shop around for insurance providers who offer rates without a credit check.

Do insurance companies offer discounts for electric or hybrid vehicles?

+Some insurance companies may offer discounts for electric or hybrid vehicles, as they are generally considered safer and more environmentally friendly. However, the availability of such discounts can vary between providers, so it’s worth checking with multiple insurers.