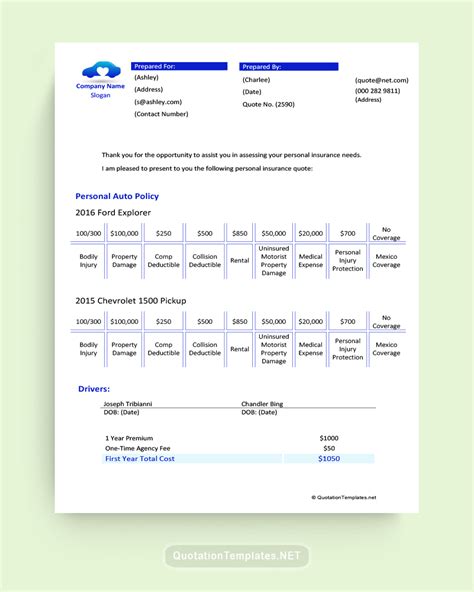

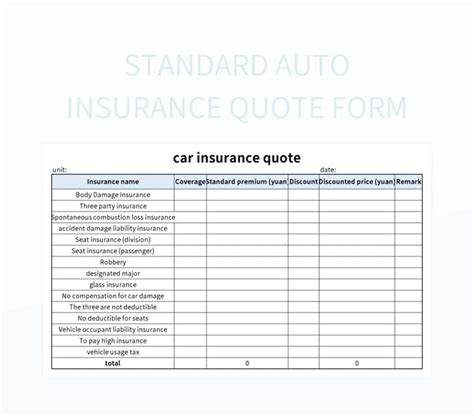

Car Insurance Quote Quote

When it comes to insuring your vehicle, obtaining a car insurance quote is a crucial step. It provides you with an estimated cost of coverage and allows you to compare different policies to find the best fit for your needs. A car insurance quote is essentially an assessment of the risk you pose as a driver and the potential costs associated with insuring your vehicle. In this comprehensive guide, we will delve into the world of car insurance quotes, exploring the factors that influence them, the steps involved in obtaining an accurate quote, and the strategies to secure the most favorable rates.

Understanding Car Insurance Quotes

A car insurance quote is a personalized estimate of the cost of insuring your vehicle. It is based on a variety of factors that insurance companies use to assess the risk associated with providing coverage for your specific circumstances. These factors can include your driving history, the make and model of your vehicle, your age and gender, the location where you primarily drive, and even your credit score. By evaluating these variables, insurance providers can determine the likelihood of claims and tailor their quotes accordingly.

Key Factors Influencing Car Insurance Quotes

Several critical factors play a significant role in shaping your car insurance quote. Let’s explore some of the most influential elements:

- Driving History: Your driving record is a crucial factor. Insurance companies closely examine your history of accidents, traffic violations, and claims. A clean driving record with no recent accidents or serious violations can lead to more favorable quotes. On the other hand, multiple accidents or frequent tickets may result in higher premiums.

- Vehicle Type and Usage: The make, model, and age of your vehicle impact your quote. Sports cars and luxury vehicles often have higher insurance costs due to their increased repair expenses and higher risk of theft. Additionally, the primary usage of your vehicle matters. If you primarily drive for personal use, your quote may differ from someone who uses their vehicle for business or commercial purposes.

- Age and Gender: Insurance companies consider age and gender when assessing risk. Younger drivers, especially those under 25, often face higher premiums due to their lack of driving experience and higher likelihood of accidents. Gender can also be a factor, with some insurance providers offering slightly different rates based on historical data and statistical trends.

- Location: Where you live and drive significantly influences your quote. Urban areas with higher traffic congestion and crime rates often result in higher insurance costs. Additionally, the specific neighborhood or zip code you reside in can impact your rates, as certain areas may have a higher incidence of accidents or theft.

- Credit Score: Surprisingly, your credit score can affect your car insurance quote. Many insurance companies use credit-based insurance scores to assess your financial responsibility. A higher credit score may result in lower premiums, as it indicates a lower risk of non-payment or missed payments.

The Process of Obtaining a Car Insurance Quote

Obtaining a car insurance quote is a straightforward process, but it’s essential to provide accurate and honest information to ensure an accurate assessment of your insurance needs. Here’s a step-by-step guide to help you navigate the quote process:

Step 1: Gather Essential Information

Before requesting a quote, gather the necessary details about your vehicle, driving history, and personal information. This includes:

- Make, model, and year of your vehicle

- Vehicle identification number (VIN)

- Driving license number and state of issue

- Date of birth and gender

- Current insurance policy details (if applicable)

- Details of any accidents, violations, or claims in the past few years

Step 2: Compare Multiple Quotes

It’s advisable to obtain quotes from multiple insurance providers to compare coverage options and prices. You can use online quote comparison tools or contact insurance companies directly. Ensure that you’re comparing quotes for similar coverage levels to make an accurate assessment.

Step 3: Evaluate Coverage Options

When reviewing quotes, pay close attention to the coverage limits and deductibles offered. Ensure that the policy provides adequate protection for your vehicle and financial situation. Consider the following coverage types:

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: Pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-accident-related incidents like theft, vandalism, or natural disasters.

- Medical Payments Coverage: Covers medical expenses for you and your passengers after an accident.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who has insufficient or no insurance.

Step 4: Choose the Right Policy

Once you’ve compared quotes and evaluated coverage options, select the policy that best meets your needs and budget. Consider the reputation and financial stability of the insurance company, as well as any additional perks or discounts they offer.

Strategies for Securing the Best Car Insurance Quote

To obtain the most favorable car insurance quote, consider implementing the following strategies:

Improve Your Driving Record

A clean driving record is one of the most effective ways to lower your insurance costs. Avoid traffic violations and maintain a safe driving habit. If you’ve had accidents or violations in the past, focus on improving your driving behavior and avoiding further incidents to see your insurance premiums decrease over time.

Shop Around and Compare

Don’t settle for the first quote you receive. Take the time to compare quotes from multiple insurance providers. Online quote comparison tools can be a valuable resource, but also consider reaching out to local insurance agents or brokers who can offer personalized advice and additional options.

Bundle Your Policies

If you have multiple insurance needs, such as home or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, resulting in significant savings.

Explore Discounts and Savings

Insurance companies often provide various discounts to attract and retain customers. Common discounts include:

- Safe Driver Discount: Recognizes drivers with a clean driving record and no recent accidents or violations.

- Multi-Policy Discount: As mentioned, bundling multiple policies with the same insurer can result in substantial savings.

- Loyalty Discount: Rewards customers who have been with the same insurer for an extended period.

- Good Student Discount: Offered to students with good academic performance, typically for those under 25.

- Defensive Driving Discount: Available to drivers who complete approved defensive driving courses.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a larger deductible, you essentially share more of the financial responsibility, which can result in reduced monthly premiums.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, and several factors are shaping the future of insurance quotes and coverage. Here are some key trends and implications to consider:

Telematics and Usage-Based Insurance

Telematics technology, which includes devices and apps that track driving behavior, is gaining popularity. Usage-based insurance (UBI) programs offer customized premiums based on real-time driving data. These programs reward safe drivers with lower premiums, as they can accurately assess individual risk.

Autonomous Vehicles and Safety Features

The rise of autonomous and semi-autonomous vehicles is expected to revolutionize car insurance. As these vehicles become more prevalent, insurance premiums may decrease due to the potential for reduced accidents and claims. Additionally, advanced safety features like lane departure warnings and automatic emergency braking could lead to lower insurance costs for drivers with such vehicles.

Environmental Impact and Electric Vehicles

The shift towards electric and hybrid vehicles is another trend that could impact car insurance quotes. Electric vehicles have lower maintenance costs and are generally safer on the road, which may result in reduced insurance premiums. Furthermore, the environmental impact of traditional vehicles could lead to regulatory changes and incentives that influence insurance rates.

Digital Transformation and Online Insurance

The digital transformation of the insurance industry has made it easier for consumers to obtain quotes and manage their policies online. This shift towards digital insurance has increased competition and transparency, benefiting consumers with more choices and better rates. Online insurance platforms and comparison tools are expected to play an even more significant role in the future, making it convenient for drivers to shop for and purchase insurance.

Conclusion

Obtaining a car insurance quote is a critical step in ensuring you have adequate coverage for your vehicle. By understanding the factors that influence quotes, following the proper steps to obtain accurate assessments, and implementing strategies to secure the best rates, you can make informed decisions about your insurance needs. Remember, the car insurance landscape is constantly evolving, and staying informed about industry trends and advancements can help you navigate the market effectively.

How often should I review my car insurance policy and quotes?

+It’s recommended to review your car insurance policy and quotes annually or whenever your circumstances change significantly. Life events like getting married, buying a new car, or moving to a different location can impact your insurance needs and rates. Regularly comparing quotes ensures you’re getting the best value for your money.

Can I negotiate car insurance quotes with providers?

+While insurance quotes are typically based on standardized rates, you can negotiate certain aspects of your policy. For example, you can discuss coverage limits, deductibles, and additional perks or discounts. Building a relationship with your insurance agent or broker can help you secure the best deal possible.

What are some common mistakes to avoid when obtaining car insurance quotes?

+Some common mistakes to avoid include providing inaccurate or incomplete information, failing to compare quotes from multiple providers, and not taking advantage of available discounts. Additionally, rushing the decision-making process and not thoroughly understanding the coverage limits and exclusions can lead to unexpected costs or inadequate protection.