Compare Pet Insurance Plans

Pet ownership brings immense joy and companionship, but it also comes with responsibilities and potential financial burdens. One of the key decisions pet owners face is whether to invest in pet insurance, a proactive measure to ensure the well-being of their beloved animals. In this comprehensive guide, we delve into the world of pet insurance, exploring the various plans, coverage options, and real-world examples to help pet owners make informed choices.

Understanding Pet Insurance: A Necessary Investment

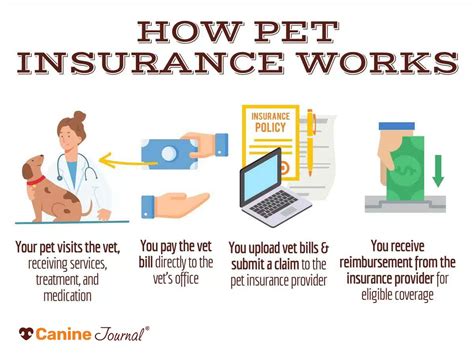

Pet insurance serves as a safety net for unexpected veterinary expenses, offering financial protection and peace of mind to pet owners. While routine check-ups and preventive care are essential, accidents and illnesses can strike unexpectedly, leading to substantial costs. Here, we unravel the intricacies of pet insurance plans, shedding light on the benefits they provide.

Key Coverage Aspects

Pet insurance plans typically cover a range of medical conditions and treatments, including but not limited to:

- Emergency Care: Sudden injuries or accidents requiring immediate veterinary attention.

- Illnesses: From common ailments to chronic conditions, pet insurance can help manage ongoing treatment costs.

- Prescription Medications: Coverage for medications prescribed by veterinarians, ensuring affordable access to essential drugs.

- Surgery and Hospitalization: Major procedures and extended hospital stays can be costly, and insurance provides financial relief.

- Specialist Care: Referrals to veterinary specialists for advanced treatments, such as oncology or orthopedics.

Understanding Plan Types

Pet insurance plans come in various forms, each with its own unique features and coverage options. Here’s a breakdown of the primary plan types:

- Accident-Only Plans: As the name suggests, these plans cover injuries resulting from accidents. They are more affordable but provide limited coverage, making them suitable for pet owners on a budget.

- Accident and Illness Plans: These plans offer a more comprehensive approach, covering both accidental injuries and illnesses. They are the most popular choice, providing broader protection for pet health.

- Wellness Plans: Designed to cover routine care and preventive measures, wellness plans include vaccinations, check-ups, and sometimes even dental procedures. They are an excellent addition to accident and illness plans, ensuring holistic pet health.

Real-World Examples: Case Studies of Pet Insurance Benefits

To illustrate the impact of pet insurance, let’s explore a few real-life scenarios where insurance plans made a significant difference in the lives of pets and their owners.

Emergency Surgery for Max, the Adventurous Dog

Max, a young Labrador Retriever, is known for his boundless energy and love for exploring. During one of his adventures, he sustained a serious injury, requiring emergency surgery to repair a torn ligament. The procedure and hospital stay amounted to a substantial $5,000. With his accident and illness insurance plan, Max’s owners were relieved to discover that the insurance covered 80% of the costs, leaving them with a manageable out-of-pocket expense.

Chronic Illness Management for Bella, the Senior Cat

Bella, a beloved senior cat, was diagnosed with chronic kidney disease. Her owners, who had opted for an accident and illness plan with lifetime coverage, found the insurance invaluable. The plan covered regular blood work, medications, and specialized veterinary care, ensuring Bella received the best treatment without straining their finances. Over the course of her illness, the insurance provided over $10,000 in coverage, allowing Bella to live a comfortable and healthy life.

Preventive Care for Luna, the Active Pup

Luna, an energetic puppy, joined her family with a wellness plan in place. The plan covered her annual vaccinations, routine check-ups, and even her spay procedure. With the insurance, her owners could ensure Luna received all the necessary preventive care without worrying about the financial burden. The plan saved them an average of $500 annually, making it a wise investment for Luna’s long-term health.

Analyzing Plan Details: What to Look For

When comparing pet insurance plans, several factors come into play. Here’s a comprehensive guide to help pet owners make an informed decision:

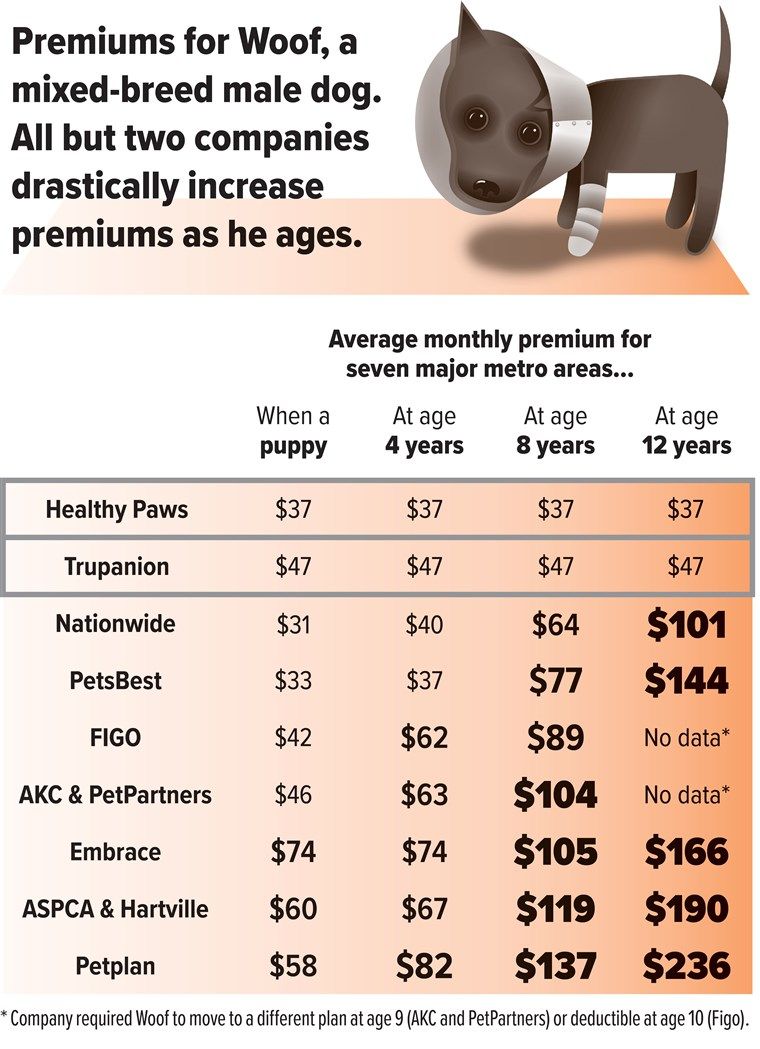

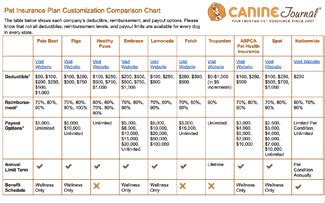

Coverage Limits and Deductibles

Coverage limits refer to the maximum amount an insurance plan will pay out for a specific condition or annually. Deductibles, on the other hand, are the out-of-pocket expenses pet owners must pay before insurance coverage kicks in. Understanding these limits and deductibles is crucial, as they directly impact the financial protection provided.

For example, let’s consider two plans: Plan A has an annual limit of 10,000 and a 200 deductible, while Plan B offers unlimited coverage with a $500 deductible. Plan A provides a solid balance between coverage and affordability, while Plan B offers extensive protection for those seeking comprehensive coverage.

Reimbursement Methods

Pet insurance plans often vary in their reimbursement methods. Some plans reimburse based on a percentage of the total bill, while others reimburse based on a set schedule of fees. Understanding these methods is essential, as they can impact the overall cost of insurance and the ease of reimbursement.

For instance, Plan C reimburses 80% of the actual veterinary bill, whereas Plan D reimburses based on a fee schedule, with predetermined amounts for common procedures. Plan C offers flexibility but may result in higher out-of-pocket costs, while Plan D provides more predictability.

Exclusions and Waiting Periods

Insurance plans may exclude certain conditions or treatments, and it’s crucial to review these exclusions carefully. Additionally, waiting periods apply to specific conditions, meaning the insurance coverage may not kick in immediately. Being aware of these exclusions and waiting periods ensures pet owners are prepared for potential gaps in coverage.

| Plan | Exclusions | Waiting Periods |

|---|---|---|

| Plan E | Pre-existing conditions, cosmetic procedures | 14 days for accidents, 6 months for illnesses |

| Plan F | Breeding-related issues, elective procedures | 30 days for all conditions |

Network of Providers

Some pet insurance plans have networks of preferred veterinary providers, offering discounts or additional benefits when using these veterinarians. While not a requirement, being aware of the network can provide cost-saving opportunities.

The Future of Pet Insurance: Expanding Horizons

The pet insurance industry is evolving, with an increasing focus on innovative coverage options and tailored plans. As veterinary medicine advances, so too does the need for comprehensive insurance solutions. Here’s a glimpse into the future of pet insurance:

Telehealth and Virtual Care

With the rise of telehealth, pet insurance providers are exploring ways to incorporate virtual veterinary care into their plans. This could include coverage for remote consultations, video appointments, and even telemedicine prescriptions, offering pet owners convenient and cost-effective options.

Specialized Coverage for Unique Needs

Recognizing the diverse needs of pets, insurance providers are developing specialized plans. From plans tailored to specific breeds and their common health issues to coverage for alternative therapies like acupuncture and hydrotherapy, the industry is adapting to provide personalized protection.

Preventive Care Incentives

Promoting proactive pet health, insurance companies are incentivizing preventive care. This could involve discounts on annual vaccinations, rewards for regular check-ups, or even coverage for preventive procedures like dental cleanings. By encouraging preventive measures, insurance providers aim to reduce the likelihood of costly illnesses.

Conclusion: Empowering Pet Owners

Pet insurance is a powerful tool in the hands of responsible pet owners, offering a safety net for unexpected veterinary costs. By understanding the various plan types, coverage options, and real-world benefits, pet owners can make informed choices to protect their furry companions. As the industry continues to evolve, pet insurance remains a crucial aspect of responsible pet ownership, ensuring pets receive the care they deserve without financial strain.

How do I choose the right pet insurance plan for my pet’s needs?

+Consider your pet’s age, breed, and health history. Assess the likelihood of future health issues and choose a plan that provides adequate coverage. Additionally, factor in your financial capabilities and opt for a plan that balances coverage and affordability.

Are there any pet insurance plans that cover pre-existing conditions?

+While some plans offer coverage for pre-existing conditions, these are typically limited and may come with higher premiums. It’s essential to carefully review the terms and conditions to understand the extent of coverage.

Can I switch pet insurance providers if I’m not satisfied with my current plan?

+Yes, you can switch providers, but it’s important to note that pre-existing conditions may not be covered by the new plan. Review the waiting periods and exclusions to ensure a smooth transition.

What is the typical age limit for pet insurance policies?

+Age limits vary among providers, but many offer coverage for pets up to 14 years old. It’s recommended to enroll your pet as early as possible to ensure comprehensive coverage throughout their life.