Allstate Insurance Companies Near Me

Allstate Insurance, a prominent name in the insurance industry, offers a wide range of services to individuals and businesses. With its network of local agents, Allstate provides personalized insurance solutions tailored to meet specific needs. In this article, we delve into the world of Allstate Insurance Companies, exploring their services, coverage options, and the benefits of choosing a local agent.

Allstate Insurance: A Comprehensive Overview

Allstate Insurance is a leading provider of property and casualty insurance, serving millions of customers across the United States. Founded in 1931, the company has grown into a trusted brand, offering a comprehensive suite of insurance products and financial services. Allstate’s mission is to help people protect what matters most to them, providing peace of mind and financial security.

The company's core values revolve around innovation, customer-centricity, and community involvement. Allstate continuously adapts to the evolving needs of its customers, leveraging technology to enhance the insurance experience. With a strong focus on customer satisfaction, Allstate strives to deliver exceptional service and personalized coverage options.

Allstate’s Product Portfolio

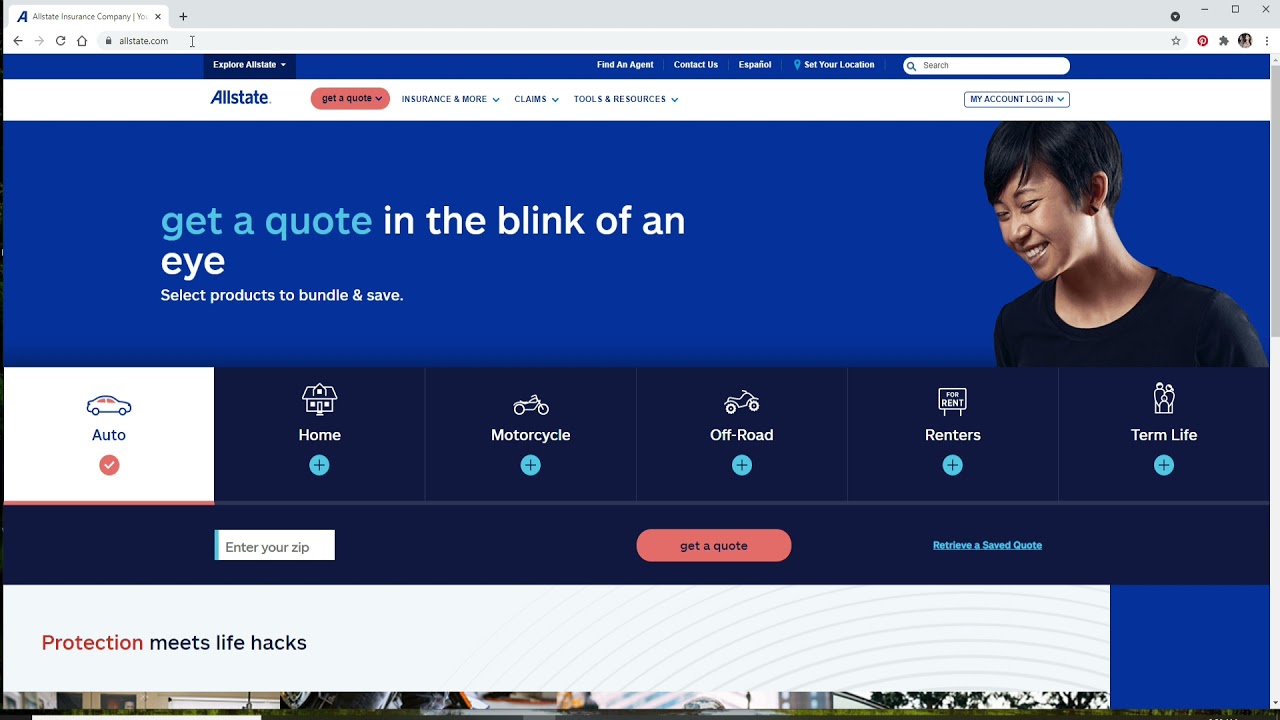

Allstate Insurance offers a diverse range of insurance products to cater to various segments of society. Here’s an overview of their key offerings:

- Auto Insurance: Allstate provides comprehensive auto insurance plans, covering a wide range of vehicles. From cars and motorcycles to RVs and boats, they offer customized coverage options to protect your vehicles against accidents, theft, and other risks.

- Home Insurance: Whether you own a house, condominium, or rental property, Allstate has tailored home insurance solutions. Their policies cover structural damage, personal belongings, and liability, ensuring your home and assets are protected.

- Life Insurance: Allstate understands the importance of life insurance in providing financial security for your loved ones. They offer term life, whole life, and universal life insurance policies, allowing you to choose the coverage that aligns with your goals and budget.

- Business Insurance: Small businesses and entrepreneurs can rely on Allstate for comprehensive business insurance solutions. From general liability to commercial auto and property insurance, they provide coverage tailored to the unique needs of different industries.

- Health Insurance: Allstate collaborates with trusted health insurance providers to offer a range of health plans. Whether you need individual or family coverage, they can help you find the right plan that meets your healthcare needs and budget.

In addition to these core insurance products, Allstate also offers specialized coverage options such as umbrella insurance, identity protection, and pet insurance. They aim to provide a holistic approach to insurance, ensuring their customers have access to a wide range of protection options.

The Benefits of Choosing an Allstate Local Agent

One of the key advantages of Allstate Insurance is their network of local agents. These agents are not just insurance professionals; they are members of the community, dedicated to understanding the unique needs and concerns of their clients. Here’s why choosing an Allstate local agent can be beneficial:

Personalized Service

Local agents take the time to understand your individual circumstances, providing personalized insurance recommendations. They consider factors such as your lifestyle, budget, and specific risks to tailor a coverage plan that suits your needs perfectly.

Expertise and Guidance

Allstate agents are highly trained and knowledgeable about the insurance industry. They can explain complex insurance terms and concepts in a clear and concise manner, ensuring you fully understand the coverage you’re purchasing. Their expertise helps you make informed decisions and choose the right policies.

Community Knowledge

Local agents have an in-depth understanding of the community they serve. They are aware of the unique risks and challenges faced by residents in their area. This knowledge allows them to provide tailored coverage options that address specific local concerns, ensuring comprehensive protection.

Convenience and Accessibility

Having a local agent nearby offers unparalleled convenience. You can schedule face-to-face meetings, discuss your insurance needs, and receive immediate assistance whenever required. Local agents make the insurance process more accessible and less intimidating.

Claims Support

In the event of a claim, your local agent becomes your advocate. They guide you through the claims process, ensuring a smooth and efficient experience. With their knowledge and expertise, they can help expedite claims and ensure you receive the compensation you deserve.

Community Involvement

Allstate local agents are often actively involved in their communities. They sponsor local events, support charitable initiatives, and engage with community organizations. By choosing a local agent, you not only receive exceptional insurance service but also contribute to the growth and well-being of your community.

Performance and Customer Satisfaction

Allstate Insurance prides itself on its commitment to customer satisfaction. They consistently strive to deliver exceptional service and build long-lasting relationships with their clients. Here’s a glimpse into their performance and customer satisfaction metrics:

| Metric | Rating |

|---|---|

| Customer Satisfaction (J.D. Power) | 4.5/5 |

| Financial Strength (AM Best) | A+ (Superior) |

| Claims Satisfaction (J.D. Power) | 4/5 |

| Customer Service Rating | 4.8/5 (based on customer reviews) |

These ratings showcase Allstate's dedication to providing high-quality service and meeting customer expectations. Their financial strength and claims satisfaction ratings reflect their ability to handle claims efficiently and provide fair compensation.

The Future of Allstate Insurance

As the insurance landscape continues to evolve, Allstate Insurance remains committed to innovation and technological advancements. They are continuously investing in digital tools and platforms to enhance the customer experience and streamline processes.

Allstate recognizes the importance of embracing new technologies to meet the changing needs of their customers. They are focused on developing innovative solutions that simplify insurance and make it more accessible. From digital claim processing to personalized risk assessment tools, Allstate is dedicated to staying at the forefront of the industry.

Frequently Asked Questions

What types of discounts does Allstate offer on insurance policies?

+

Allstate provides a range of discounts on their insurance policies, including multi-policy discounts for bundling your auto, home, and life insurance with them. They also offer discounts for safe driving, loyalty, and certain vehicle safety features. Additionally, Allstate may provide discounts for military personnel, students, and senior citizens.

How does Allstate determine insurance rates for customers?

+

Allstate considers various factors when determining insurance rates, such as the type of coverage, the location of the insured property or vehicle, the insured’s age and driving record, and the level of risk associated with the policy. They also take into account discounts and any applicable discounts the insured may qualify for.

Can I purchase insurance policies directly from Allstate’s website or do I need to go through an agent?

+

While Allstate offers the convenience of purchasing insurance policies online through their website, they highly recommend working with a local agent. Local agents can provide personalized advice, answer specific questions, and ensure you receive the most suitable coverage for your needs. They can also assist with any policy changes or claims.

What is Allstate’s claims process like, and how long does it typically take to resolve a claim?

+

Allstate’s claims process is designed to be efficient and customer-centric. When you file a claim, your local agent will guide you through the process, providing support and advocacy. The timeline for resolving a claim can vary depending on the complexity and nature of the incident. Allstate aims to process claims promptly, ensuring fair and timely compensation.

Does Allstate offer any specialized insurance products or services for unique situations or industries?

+

Absolutely! Allstate understands that different situations and industries require specialized insurance coverage. They offer a range of specialized products, including coverage for rideshare drivers, contractors, pet businesses, and more. Their local agents can help you navigate these specialized options and find the right coverage for your unique needs.