Managed Care Organization Insurance

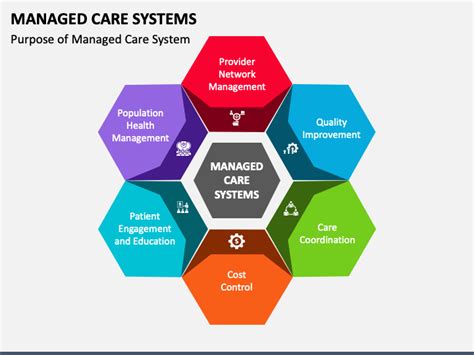

Managed care organizations (MCOs) have become an integral part of the healthcare system, offering a unique approach to insurance coverage and patient care. In an era where healthcare costs are a growing concern, MCOs aim to provide efficient and cost-effective solutions while ensuring quality medical services. This article delves into the intricacies of Managed Care Organization Insurance, exploring its benefits, operational mechanisms, and its evolving role in the healthcare landscape.

Understanding Managed Care Organization Insurance

Managed Care Organization Insurance, often simply referred to as MCO insurance, is a health insurance model that integrates the financing and delivery of healthcare services. MCOs aim to provide comprehensive health coverage while managing costs through various strategies. This model differs from traditional fee-for-service insurance, where patients and providers have more autonomy, but costs can be unpredictable.

MCOs contract with healthcare providers, such as doctors, hospitals, and clinics, to create a network of preferred providers. Insured individuals, or members, are encouraged to utilize these providers to receive the best benefits and coverage. This network-based approach allows MCOs to negotiate rates and manage the quality of care delivered.

The core principle of MCO insurance is to improve the efficiency and effectiveness of healthcare delivery, ensuring that members receive the necessary care while minimizing unnecessary or redundant services. This approach has the potential to reduce overall healthcare costs, making quality healthcare more accessible.

Key Components of MCO Insurance

- Capitation: MCOs often employ a capitation model, where providers receive a fixed payment per member, regardless of the actual services rendered. This encourages providers to manage their resources efficiently and focus on preventive care, as it can be more cost-effective than treating advanced illnesses.

- Utilization Management: MCOs utilize various strategies to manage the utilization of healthcare services. This includes pre-authorization for certain procedures, case management for complex conditions, and disease management programs to help members better manage chronic illnesses.

- Preferred Provider Networks: As mentioned, MCOs contract with a network of providers, offering incentives and discounted rates. Members typically have incentives to use these providers, as out-of-network services may incur higher costs or reduced coverage.

- Evidence-Based Guidelines: MCOs often implement evidence-based guidelines for treatment protocols, ensuring that the most effective and cost-efficient practices are followed. This can include clinical pathways, diagnostic protocols, and treatment algorithms.

By combining these components, MCOs strive to provide a comprehensive and coordinated healthcare experience for their members, focusing on both cost control and quality improvement.

Benefits of Managed Care Organization Insurance

MCO insurance offers a range of advantages for both members and the healthcare system as a whole. These benefits have contributed to the growing popularity of MCOs as a viable insurance option.

Cost Control and Affordability

One of the primary benefits of MCO insurance is its potential to control healthcare costs. By negotiating rates with providers and implementing utilization management strategies, MCOs can offer more affordable insurance plans. This is particularly beneficial for individuals and families who may not have access to employer-sponsored health insurance or who are seeking more cost-effective options.

| Traditional Insurance | MCO Insurance |

|---|---|

| Higher Premiums | More Affordable Premiums |

| Variable Out-of-Pocket Costs | Predictable Out-of-Pocket Costs |

| Limited Provider Networks | Wider Network Options |

The cost-control measures implemented by MCOs can lead to more predictable and manageable healthcare expenses for members.

Enhanced Access to Healthcare

MCO insurance often provides broader access to healthcare services. The network-based approach ensures that members have a range of providers to choose from, including specialists and facilities that may not be available through traditional insurance plans. This can be particularly beneficial for individuals with complex or chronic health conditions.

Additionally, MCOs often offer preventive care services at little to no cost, encouraging members to take a proactive approach to their health. This can lead to earlier detection of health issues and more effective management of chronic conditions, ultimately improving overall health outcomes.

Coordinated Care and Continuity

MCOs emphasize coordinated care, ensuring that members receive consistent and integrated healthcare. This means that different providers within the network can share information and work together to manage a member’s health. This coordination can improve the overall quality of care and reduce the likelihood of medical errors or gaps in treatment.

Furthermore, MCOs often assign case managers to members with complex or chronic conditions. These professionals help navigate the healthcare system, ensuring that members receive the necessary services and providing ongoing support and guidance. This level of coordination and continuity can be invaluable for managing complex health issues.

The Future of Managed Care Organization Insurance

As the healthcare landscape continues to evolve, MCO insurance is adapting to meet the changing needs of patients and providers. The future of MCO insurance is likely to be shaped by several key factors and trends.

Focus on Value-Based Care

There is a growing shift towards value-based care in the healthcare industry, and MCOs are at the forefront of this movement. Value-based care focuses on delivering high-quality healthcare outcomes while controlling costs. MCOs are well-positioned to drive this transition due to their integrated approach to healthcare delivery and cost management.

Under a value-based care model, MCOs can further incentivize providers to deliver efficient and effective care. This can lead to improved health outcomes and a more sustainable healthcare system.

Integration of Technology

The integration of technology is another significant trend shaping the future of MCO insurance. MCOs are increasingly leveraging digital tools and platforms to enhance the member experience and improve operational efficiency.

- Telehealth Services: MCOs are expanding their telehealth offerings, allowing members to access healthcare services remotely. This can improve access to care, particularly for individuals in rural or underserved areas.

- Digital Health Records: MCOs are adopting digital health records to improve the sharing of medical information among providers. This can enhance the coordination of care and improve the accuracy of medical diagnoses and treatments.

- Mobile Apps and Portals: MCOs are developing user-friendly mobile apps and member portals, providing members with easy access to their health information, appointment scheduling, and other self-service options.

Addressing Social Determinants of Health

MCOs are also recognizing the importance of addressing social determinants of health (SDOH) to improve overall health outcomes. SDOH refers to the economic and social conditions that influence individual and community health, such as access to healthy food, safe housing, and educational opportunities.

MCOs are exploring ways to integrate SDOH into their care management strategies, recognizing that these factors can significantly impact a member's health. This may involve partnerships with community organizations or the development of programs that address these social determinants directly.

How do MCOs ensure quality healthcare while managing costs?

+MCOs employ a range of strategies, including evidence-based guidelines, utilization management, and preferred provider networks. These approaches ensure that members receive necessary care while minimizing unnecessary services, thereby controlling costs.

What is the role of case managers in MCO insurance?

+Case managers play a crucial role in coordinating care for members with complex or chronic conditions. They help navigate the healthcare system, ensure members receive necessary services, and provide ongoing support and guidance.

How does MCO insurance impact the patient experience?

+MCO insurance aims to enhance the patient experience by providing broader access to healthcare services, encouraging preventive care, and ensuring coordinated and continuous care. This can lead to improved health outcomes and a more satisfying healthcare journey.

In conclusion, Managed Care Organization Insurance offers a unique and innovative approach to healthcare coverage, focusing on cost control, quality improvement, and member experience. As the healthcare industry continues to evolve, MCOs are poised to play a pivotal role in shaping a more efficient and accessible healthcare system.