Low Cost Liability Insurance California

In the state of California, liability insurance is a vital aspect of personal and business protection. It offers a safety net against potential financial risks and legal liabilities, ensuring that individuals and businesses can operate with peace of mind. However, finding affordable liability insurance coverage can be a challenge. This comprehensive guide aims to explore the intricacies of low-cost liability insurance in California, providing valuable insights for those seeking the best value for their insurance needs.

Understanding Liability Insurance in California

Liability insurance is a crucial component of any risk management strategy, especially in a state as diverse and dynamic as California. This type of insurance provides coverage for legal liabilities that may arise from accidents, injuries, or property damage caused by the policyholder or their business operations. In California, liability insurance is particularly important due to the state’s unique landscape, varied industries, and the potential for a wide range of liability risks.

The California Department of Insurance regulates the insurance industry within the state, ensuring that insurance providers offer fair and adequate coverage. This regulation is vital in maintaining a competitive market and protecting consumers from inadequate or fraudulent insurance practices. It is important for policyholders to understand their rights and the obligations of insurance companies under California law.

Key Types of Liability Insurance

Within the realm of liability insurance, there are several key types that cater to different needs and scenarios. These include:

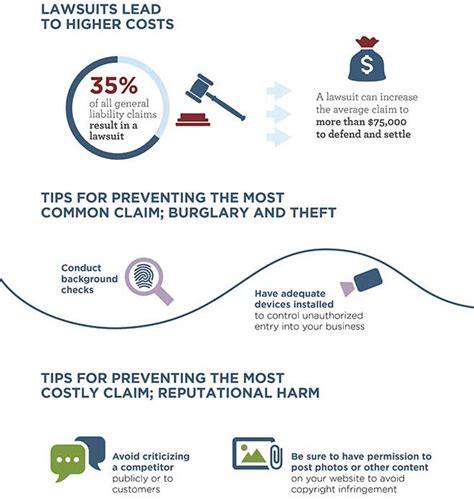

- General Liability Insurance: This broad type of insurance covers a wide range of common risks, such as slip-and-fall accidents, property damage, and advertising injuries. It is a fundamental protection for many businesses, providing a safety net against unexpected events.

- Professional Liability Insurance (Errors and Omissions): Tailored for professionals, this insurance covers legal liabilities arising from mistakes or failures in service. It is particularly important for industries like consulting, healthcare, and legal services, where errors can have significant financial and legal consequences.

- Product Liability Insurance: Manufacturers and distributors can benefit from this type of insurance, which covers liabilities arising from defective products. It protects businesses from potential lawsuits and financial losses resulting from product-related accidents or injuries.

- Cyber Liability Insurance: With the increasing reliance on technology, this insurance has become crucial. It covers legal liabilities and costs associated with data breaches, cyber attacks, and other online risks. As cyber threats evolve, this insurance is becoming an essential part of any comprehensive risk management strategy.

The Importance of Affordable Liability Insurance

While liability insurance is vital for personal and business protection, finding affordable coverage is often a top priority. The cost of liability insurance can vary significantly based on factors such as the type of business, the level of risk involved, and the insurance provider. For many individuals and small businesses, the cost of insurance can be a significant financial burden, making it essential to explore cost-effective options.

Affordable liability insurance not only ensures that individuals and businesses are adequately protected, but it also promotes financial stability and peace of mind. It allows businesses to allocate their resources more efficiently, focusing on growth and development rather than being weighed down by high insurance costs. For individuals, affordable insurance means being able to manage their finances effectively without compromising on essential protection.

Factors Influencing Insurance Costs

The cost of liability insurance is influenced by several key factors, including:

- Type of Business: Different industries carry varying levels of risk. For instance, construction businesses may face higher insurance costs due to the physical nature of their work, while professional services may have lower costs due to the reduced physical risk.

- Size of Business: Larger businesses generally require more extensive coverage, leading to higher insurance premiums. Small businesses, on the other hand, may benefit from more affordable options tailored to their specific needs and scale of operations.

- Location: The geographical location of a business can significantly impact insurance costs. Areas with a higher risk of natural disasters, crime, or traffic accidents may have higher insurance premiums. Understanding the unique risks of your location is crucial in finding the right insurance coverage.

- Claims History: Insurance providers consider a business’s or individual’s claims history when determining premiums. A history of frequent claims may lead to higher insurance costs, as it indicates a higher risk of future claims. Maintaining a positive claims history can help keep insurance costs down.

- Insurance Provider: Different insurance companies offer varying rates and coverage options. Shopping around and comparing quotes from multiple providers can help identify the most cost-effective options. It’s important to consider not just the price, but also the quality of coverage and the reputation of the insurance provider.

Strategies for Finding Low-Cost Liability Insurance

Navigating the insurance market to find low-cost liability insurance requires a strategic approach. Here are some key strategies to consider:

Shop Around and Compare Quotes

The insurance market is highly competitive, and insurance providers offer a wide range of rates and coverage options. Shopping around and comparing quotes from multiple providers is essential to finding the best value. Online insurance marketplaces and comparison websites can be valuable tools in this process, providing a quick and efficient way to compare options.

When comparing quotes, it's important to look beyond just the price. Consider the coverage limits, deductibles, and any additional benefits or exclusions. Understanding the fine print is crucial to ensuring you're getting the right coverage at the right price.

Bundle Policies

Bundling multiple insurance policies with the same provider can often lead to significant cost savings. Many insurance companies offer discounts when you purchase multiple policies, such as combining liability insurance with property insurance or other types of coverage. This strategy not only saves money but also simplifies the insurance process, providing a single point of contact for all your insurance needs.

Understand Your Risks and Coverage Needs

Assessing your unique risks and coverage needs is vital in finding the right liability insurance at the right price. Different businesses and individuals face different risks, and understanding these risks can help tailor your insurance coverage accordingly. This ensures that you’re not overpaying for coverage you don’t need or underinsured for risks that are relevant to your situation.

Consider working with an insurance broker or agent who can provide expert advice on the specific risks and coverage options relevant to your industry or personal circumstances. Their knowledge and experience can be invaluable in navigating the complex world of insurance.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premiums. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially sharing more of the financial risk with your insurance provider, which can result in lower premiums. However, it’s important to ensure that you can afford the higher deductible in the event of a claim.

Explore Small Business Insurance Options

Small businesses often have unique insurance needs and may benefit from specialized insurance programs. Many insurance providers offer tailored insurance packages for small businesses, which can provide comprehensive coverage at a more affordable price. These packages are designed to address the specific risks and challenges faced by small businesses, making them a cost-effective option.

Utilize Technology and Online Tools

In today’s digital age, technology and online tools can be powerful allies in finding low-cost liability insurance. Online insurance marketplaces, comparison websites, and insurance provider apps can provide quick and convenient access to insurance quotes and policy details. These tools often offer real-time comparisons and allow you to customize your coverage, making it easier to find the best value for your insurance needs.

Case Study: Low-Cost Liability Insurance for a Small Business

Let’s explore a hypothetical case study to illustrate the strategies for finding low-cost liability insurance in California. Imagine a small business owner, Sarah, who operates a local café in San Francisco. She’s looking to renew her liability insurance policy and wants to find a more cost-effective option without compromising on coverage.

Assessing Risks and Coverage Needs

Sarah begins by assessing the unique risks her café faces. These include slip-and-fall accidents, food-related illnesses, and property damage. She also considers the potential for cyber attacks, given the increasing reliance on technology for ordering systems and customer data management.

Based on this assessment, Sarah decides she needs a comprehensive general liability insurance policy, along with cyber liability insurance to protect against online risks. She also considers professional liability insurance to cover any potential mistakes or failures in service.

Shopping Around and Comparing Quotes

Sarah uses an online insurance marketplace to compare quotes from multiple providers. She inputs her coverage needs and receives real-time quotes, allowing her to quickly identify the most cost-effective options. She also reaches out to local insurance brokers for personalized advice and recommendations.

By comparing quotes and seeking expert advice, Sarah finds a specialized small business insurance package that includes all the coverage she needs at a significantly lower price than her previous policy. This package, tailored for small businesses, provides comprehensive coverage while taking into account the unique risks of the food service industry.

Bundling Policies and Utilizing Technology

In addition to her liability insurance, Sarah also needs property insurance to protect her café’s physical assets. She decides to bundle her liability and property insurance policies with the same provider, taking advantage of the cost savings associated with bundling. This simplifies her insurance process and provides a single point of contact for all her insurance needs.

Sarah also utilizes technology to her advantage. She downloads the insurance provider's app, which allows her to manage her policies, make payments, and access policy documents from her smartphone. This convenience and efficiency further enhance the cost-effectiveness of her insurance coverage.

The Future of Low-Cost Liability Insurance

The insurance industry is continually evolving, and the future of low-cost liability insurance in California holds several promising developments. Here’s a look at some of the key trends and innovations:

Insurtech Innovations

Insurtech, a combination of insurance and technology, is driving significant innovations in the insurance industry. Insurtech startups are developing new ways to assess risk, provide coverage, and manage claims, often utilizing advanced technologies like artificial intelligence and machine learning. These innovations have the potential to streamline insurance processes, reduce costs, and provide more personalized and cost-effective coverage options.

Data-Driven Risk Assessment

The increasing availability of data and advanced analytics is transforming the way insurance risks are assessed. Insurance providers are now able to use vast amounts of data to more accurately predict risks and tailor coverage accordingly. This data-driven approach can lead to more precise pricing and coverage, benefiting both insurance providers and policyholders by ensuring more accurate and cost-effective insurance options.

Telematics and Usage-Based Insurance

Telematics, the use of technology to monitor and analyze vehicle usage, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive insurance, allows insurance providers to tailor premiums based on actual driving behavior. This innovative approach can lead to significant cost savings for safe drivers, as their premiums reflect their individual risk profiles rather than being based on general assumptions.

Increased Focus on Prevention

The insurance industry is increasingly recognizing the value of prevention over reaction. Many insurance providers are now offering incentives and discounts for policyholders who take proactive steps to reduce risks. This could include installing safety features, implementing cyber security measures, or adopting healthy lifestyle habits. By encouraging prevention, insurance providers can reduce the frequency and severity of claims, leading to more stable and affordable insurance markets.

Collaboration and Partnerships

The insurance industry is seeing a rise in collaborations and partnerships between insurance providers, technology companies, and other stakeholders. These partnerships can lead to the development of innovative insurance products and services, as well as more efficient claims processes. For example, collaborations between insurance providers and healthcare organizations can result in more integrated health and liability insurance coverage, benefiting policyholders by providing more comprehensive and cost-effective protection.

Conclusion: Navigating the World of Low-Cost Liability Insurance

Finding low-cost liability insurance in California requires a strategic and informed approach. By understanding the unique risks and coverage needs, shopping around for the best quotes, and utilizing the latest tools and technologies, individuals and businesses can access affordable and comprehensive liability insurance coverage. The insurance industry is evolving rapidly, and keeping abreast of the latest trends and innovations can help ensure that you’re getting the best value for your insurance needs.

Whether you're a small business owner like Sarah, or an individual seeking personal protection, the world of low-cost liability insurance is within reach. With the right strategies and a thorough understanding of the market, you can navigate the insurance landscape with confidence, securing the protection you need at a price that fits your budget.

How do I choose the right liability insurance provider in California?

+When choosing a liability insurance provider, it’s important to consider factors such as their financial stability, reputation, and the range of coverage options they offer. Look for providers with a strong financial rating, positive customer reviews, and a track record of prompt claim handling. It’s also beneficial to choose a provider that specializes in your industry or type of business, as they will have a deeper understanding of your unique risks and coverage needs.

Can I customize my liability insurance policy to fit my specific needs?

+Absolutely! Many liability insurance providers offer customizable policies that allow you to tailor your coverage to your specific needs. This could include adjusting coverage limits, adding endorsements for specific risks, or choosing between different deductibles. Working with an insurance broker or agent can help you navigate the customization options and ensure you have the right coverage in place.

What are some common exclusions in liability insurance policies that I should be aware of?

+Liability insurance policies often have exclusions, which are specific circumstances or risks that are not covered by the policy. Common exclusions can include intentional acts, contractual liabilities, and certain types of professional negligence. It’s important to carefully review the policy’s exclusions to ensure you understand what is and isn’t covered, and to discuss any concerns with your insurance provider.