Insurance Quotes House

Obtaining an insurance quote for your home is a crucial step in protecting one of your most valuable assets. Home insurance provides financial coverage and peace of mind, ensuring that you and your property are safeguarded against various risks. In this comprehensive guide, we will delve into the world of home insurance quotes, exploring the factors that influence them, the process of obtaining accurate estimates, and the strategies to secure the best coverage for your needs.

Understanding the Complexity of Insurance Quotes for Your Home

The process of determining insurance quotes for a house is intricate, as it takes into account a multitude of factors. Insurance companies assess various aspects to determine the level of risk associated with insuring a particular property. These factors include the location of the home, its age, the materials used in its construction, and the presence of any amenities or features that may impact the risk level.

For instance, a home located in an area prone to natural disasters such as hurricanes or earthquakes will likely face higher insurance premiums. Similarly, older homes may require more extensive coverage due to the potential for outdated electrical or plumbing systems, while modern homes built with advanced materials and designs may benefit from more affordable insurance rates.

Key Factors Influencing Insurance Quotes

- Location: The geographical location of your home plays a significant role. Areas with a higher risk of natural disasters, crimes, or other hazards will generally result in higher insurance premiums.

- Home Value and Replacement Cost: The value of your home, as well as the cost to rebuild or repair it in the event of damage, are crucial factors. Insurance companies will assess these values to determine the appropriate coverage and premiums.

- Construction Materials and Design: The materials used in the construction of your home, such as brick, wood, or concrete, can impact the risk level and subsequently, the insurance quote. Additionally, the design and layout of your home, including the presence of fire-resistant features or security systems, may influence the quote.

- Age of the Property: Older homes may require more specialized coverage due to potential wear and tear or outdated systems. On the other hand, newer homes may benefit from more standard coverage options.

- Personalized Coverage Preferences: Homeowners have the option to customize their insurance policies to suit their specific needs. This could include adding coverage for valuables, personal liability, or additional living expenses in case of a disaster.

Strategies for Securing the Best Insurance Quote

Obtaining a competitive insurance quote for your home requires a strategic approach. Here are some tips to help you navigate the process:

- Research Multiple Insurance Providers: Compare quotes from different insurance companies to ensure you're getting the best rate. Each provider may have different risk assessment criteria, so shopping around can yield significant savings.

- Bundle Policies: Consider bundling your home insurance with other policies, such as auto insurance, to potentially qualify for discounts and simplified billing.

- Review Coverage Options: Understand the different types of coverage available, including comprehensive, liability, and personal property coverage. Tailor your policy to your specific needs to avoid overpaying for unnecessary coverage.

- Enhance Home Security: Investing in home security systems, such as alarm systems or fire-resistant materials, can lower your insurance premiums by reducing the risk associated with your property.

- Regularly Review and Update Your Policy: As your home and circumstances change, it's essential to review your insurance policy to ensure it still meets your needs. This includes updating the value of your home and any significant renovations or additions.

The Insurance Quote Process: A Step-by-Step Guide

Obtaining an insurance quote for your home is a straightforward process, but it requires providing accurate and detailed information. Here’s a step-by-step guide to help you navigate the quote process:

- Choose a Reputable Insurance Provider: Start by selecting a reputable insurance company that offers home insurance policies. Consider factors such as their financial stability, customer reviews, and the range of coverage options they provide.

- Gather Essential Information: Before requesting a quote, ensure you have the necessary details about your home. This includes the address, square footage, age, construction materials, and any recent renovations or additions. Additionally, have information about your personal financial situation, such as income and existing insurance policies.

- Request a Quote: Contact the insurance provider and request a quote. You can do this online, over the phone, or in person. Provide the required information accurately to receive an initial estimate.

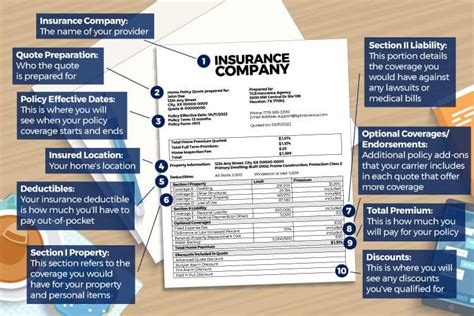

- Review the Quote: Once you receive the quote, carefully review it to understand the coverage limits, deductibles, and any additional fees or exclusions. Ensure that the policy aligns with your specific needs and circumstances.

- Compare Quotes: If you're obtaining quotes from multiple providers, compare them side by side. Look for differences in coverage, premiums, and any additional benefits or discounts offered. This step is crucial in finding the best value for your money.

- Negotiate and Finalize the Policy: If you're satisfied with a particular quote, you can negotiate further to potentially lower the premium or customize the policy. Once you've agreed on the terms, finalize the policy by signing the necessary documents and making the initial payment.

| Key Consideration | Details |

|---|---|

| Location | Homes in high-risk areas face higher premiums. |

| Home Value | Higher home values may require more extensive coverage. |

| Construction Materials | Modern materials can lead to lower insurance rates. |

| Age of Property | Older homes may need specialized coverage. |

Real-Life Case Study: Analyzing Insurance Quotes for a Homeowner

Let’s consider a real-life scenario to better understand the impact of various factors on insurance quotes. Imagine a homeowner, John, who recently purchased a home in a suburban area known for its low crime rate and minimal natural disaster risks. Here’s how his insurance quote process might unfold:

Step 1: Assessing the Property

John’s home, built in the 1980s, is a two-story structure with a total square footage of 2,500 sq. ft. It features a brick exterior, a tiled roof, and modern electrical and plumbing systems updated within the last five years. John provides this information to the insurance provider.

Step 2: Personal Financial Information

John also discloses his annual income, which is well above the national average, and mentions that he already has an auto insurance policy with the same provider. This personal financial information can influence the insurance quote, as it indicates John’s ability to manage financial risks.

Step 3: Quote Comparison

John receives quotes from three different insurance providers. The quotes vary based on the provider’s assessment of risk and their specific coverage options. He compares these quotes, considering factors such as coverage limits, deductibles, and additional benefits.

Step 4: Negotiation and Finalization

Upon careful review, John identifies a provider offering a comprehensive policy with a competitive premium. He negotiates further, discussing the possibility of bundling his auto insurance with the home insurance to potentially lower the overall cost. The provider agrees to a slight reduction in the premium, and John finalizes the policy, ensuring his home is adequately protected.

Future Implications and Trends in Home Insurance

The home insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here are some key trends and future implications to consider:

- Digitalization of Insurance Services: The rise of digital technologies has made it easier for homeowners to obtain insurance quotes and manage their policies online. Insurance providers are investing in digital platforms and mobile apps to enhance customer convenience and streamline the quote process.

- Climate Change and Natural Disasters: As climate change continues to impact weather patterns, the frequency and severity of natural disasters may increase. This could lead to higher insurance premiums, especially in regions prone to such events. Insurance providers are developing risk assessment models to accurately price policies in these areas.

- Emerging Technologies and Smart Homes: The integration of smart home technologies, such as security systems and smart appliances, is expected to impact insurance quotes. Homes with advanced safety features may qualify for lower premiums, as these technologies can reduce the risk of theft, fire, and other hazards.

- Personalized Insurance Policies: Insurance providers are increasingly adopting data-driven approaches to offer personalized insurance policies. By analyzing individual risk factors and behavior, they can provide tailored coverage options and potentially lower premiums for responsible homeowners.

Conclusion: Navigating the Complex World of Home Insurance Quotes

Obtaining an insurance quote for your home is a critical step in safeguarding your investment and ensuring financial protection. By understanding the factors that influence insurance quotes and adopting a strategic approach, you can secure the best coverage at a competitive rate. Remember, regular review and updates to your policy are essential to maintain adequate protection as your home and circumstances evolve.

As the home insurance industry continues to innovate, staying informed about emerging trends and technologies can help you make informed decisions about your coverage. With the right approach and a reputable insurance provider, you can rest easy knowing your home is protected against life's unexpected events.

What are the average insurance rates for homeowners in the US?

+Average insurance rates for homeowners in the US can vary significantly based on factors such as location, home value, and coverage preferences. According to recent data, the national average for annual home insurance premiums is approximately 1,300. However, this can range from as low as 500 in some states to over $2,500 in high-risk areas.

Can I customize my home insurance policy to suit my specific needs?

+Absolutely! Home insurance policies are highly customizable to meet individual needs. You can choose the level of coverage for your home’s structure, personal belongings, and liability risks. Additionally, you can add optional coverage for specific items, such as jewelry or fine art, or for additional living expenses in case of a covered loss.

How often should I review and update my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains adequate and up-to-date. Updates may be necessary after renovations, additions, or changes in your personal assets or liabilities.