Insurance Hdhp

High Deductible Health Plans (HDHPs) have become an increasingly popular choice for individuals and families seeking comprehensive healthcare coverage while also aiming to save on insurance premiums. These plans offer a unique balance between cost-effectiveness and extensive medical benefits, making them an attractive option in today's healthcare landscape. However, understanding the intricacies of HDHPs and their potential impact on your financial and healthcare decisions is crucial. This comprehensive guide will delve into the world of Insurance HDHPs, providing an in-depth analysis and expert insights to help you make informed choices.

Unraveling the Concept of High Deductible Health Plans (HDHPs)

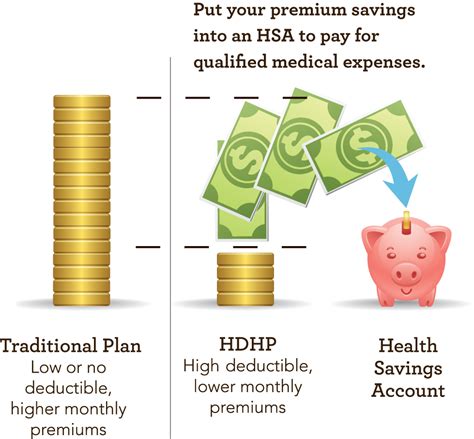

High Deductible Health Plans, as the name suggests, are health insurance plans that come with higher deductibles compared to traditional health plans. A deductible is the amount you, as the policyholder, must pay out of pocket before your insurance coverage kicks in. HDHPs are often coupled with Health Savings Accounts (HSAs), which provide a tax-advantaged way to save for medical expenses.

The appeal of HDHPs lies in their potential to offer lower premiums, making them an affordable option for those who prioritize cost savings. However, it's essential to understand the trade-offs and how these plans can impact your overall healthcare experience.

Understanding the Mechanics of HDHPs

HDHPs operate on a straightforward principle: you pay a higher deductible, which means you’re responsible for a larger portion of your healthcare costs upfront. In return, you benefit from lower monthly premiums. This model is particularly attractive to individuals who anticipate minimal healthcare needs or who are comfortable with the idea of paying more out of pocket when medical expenses arise.

For instance, let's consider a traditional health plan with a $500 deductible and a monthly premium of $300. In contrast, an HDHP might have a deductible of $2,000 but offer a reduced monthly premium of $200. The choice between these plans depends on your individual healthcare needs and financial situation.

| Plan Type | Deductible | Monthly Premium |

|---|---|---|

| Traditional Health Plan | $500 | $300 |

| High Deductible Health Plan (HDHP) | $2,000 | $200 |

It's worth noting that HDHPs are not a one-size-fits-all solution. The suitability of these plans depends on various factors, including your age, health status, and expected healthcare utilization.

The Pros and Cons of Choosing an HDHP

Like any insurance plan, HDHPs come with their advantages and disadvantages. Understanding these can help you decide if this type of insurance aligns with your healthcare and financial goals.

Pros of HDHPs

- Lower Premiums: One of the most significant advantages of HDHPs is the potential for reduced monthly premiums. This can be especially beneficial for those on a tight budget or for families looking to save on insurance costs.

- Tax Benefits: HDHPs are often paired with Health Savings Accounts (HSAs). Contributions to HSAs are tax-deductible, and the funds can grow tax-free. Additionally, any withdrawals used for qualified medical expenses are also tax-free.

- Encourages Cost Consciousness: With a higher deductible, individuals are more likely to be mindful of their healthcare choices. This can lead to a reduction in unnecessary medical visits and procedures, fostering a more cost-effective approach to healthcare.

- Flexibility: HDHPs offer flexibility in managing healthcare expenses. Policyholders have control over their HSA funds and can decide when and how to use them.

Cons of HDHPs

- High Out-of-Pocket Costs: The primary drawback of HDHPs is the potential for significant out-of-pocket expenses. If you require extensive medical care, you could end up paying a substantial amount before your insurance coverage takes effect.

- Unpredictable Healthcare Needs: For individuals with unpredictable or complex healthcare needs, HDHPs might not provide the necessary financial protection. Unexpected illnesses or injuries could result in substantial financial burdens.

- Limited Coverage for Certain Services: While HDHPs cover a wide range of medical services, some plans may have restrictions or higher cost-sharing for specific procedures or treatments. It’s crucial to review the plan’s benefits carefully.

Choosing the Right HDHP for Your Needs

Selecting an HDHP that aligns with your unique circumstances is crucial. Here are some key considerations to guide your decision-making process:

Evaluate Your Healthcare Needs

Assess your past and anticipated future healthcare needs. Consider factors such as chronic conditions, regular medications, and the likelihood of major medical procedures. If you anticipate significant healthcare expenses, an HDHP might not be the most cost-effective option.

Compare Plan Options

Different HDHPs offer varying deductibles, out-of-pocket maximums, and premium costs. Compare these aspects across multiple plans to find the best fit for your budget and healthcare requirements. Remember, the lowest premium might not always be the best choice if it comes with a significantly higher deductible.

Consider Your Financial Situation

Your financial stability and ability to manage potential out-of-pocket expenses are crucial factors. If you have a steady income and can afford to save in an HSA, an HDHP can be a smart financial decision. However, if your income is unpredictable or you have limited savings, a traditional health plan might provide more immediate financial protection.

Review the Plan’s Network

Check if your preferred healthcare providers are in-network with the HDHP. Out-of-network care can result in higher costs, potentially defeating the purpose of choosing an HDHP for cost savings.

Maximizing the Benefits of Your HDHP

If you’ve decided that an HDHP is the right choice for you, here are some strategies to make the most of your insurance coverage and manage your healthcare expenses effectively:

Utilize Your HSA Wisely

Health Savings Accounts (HSAs) are a powerful tool when paired with HDHPs. Contribute as much as you can afford to your HSA, as the funds can grow tax-free and be used for qualified medical expenses. Remember, HSAs have contribution limits, so plan your contributions strategically.

Stay Informed About Your Plan’s Benefits

Understand your plan’s coverage limits, deductibles, and out-of-pocket maximums. Know which services are covered and at what percentage. This knowledge will help you make informed decisions about your healthcare and manage your expenses effectively.

Negotiate Medical Bills

If you receive a medical bill that seems excessive, don’t hesitate to contact the provider and negotiate the amount. Many healthcare providers are open to negotiating, especially if you can demonstrate financial hardship.

Explore Cost-Saving Options

Research and utilize cost-saving measures such as generic medications, price comparisons for procedures, and discounts for paying in cash. These strategies can help you manage your healthcare expenses more effectively.

The Future of HDHPs: Trends and Implications

The landscape of HDHPs is evolving, and understanding the potential future trends can provide valuable insights for policyholders and healthcare professionals alike.

Increasing Popularity

HDHPs are gaining traction, particularly among younger individuals and those with lower healthcare needs. The flexibility and potential for cost savings make these plans an attractive option for a growing segment of the population.

Enhanced Consumer Awareness

As HDHPs become more prevalent, consumers are becoming more aware of their healthcare choices. This increased awareness is leading to better-informed decisions and a more engaged approach to healthcare management.

Technological Advances

Advancements in healthcare technology are enabling more efficient and cost-effective healthcare delivery. From telemedicine to digital health records, these innovations are making healthcare more accessible and affordable, further enhancing the appeal of HDHPs.

Potential Regulatory Changes

The healthcare industry is subject to regulatory changes, and HDHPs are no exception. While it’s challenging to predict specific changes, staying informed about potential shifts in policy can help you prepare for any future adjustments to your HDHP.

Can I use my HSA funds for any medical expense?

+Yes, you can use your HSA funds for a wide range of qualified medical expenses, including copayments, deductibles, and prescription medications. However, it's essential to keep receipts and records to substantiate your expenses in case of an audit.

Are HDHPs suitable for families with young children?

+HDHPs can be a cost-effective option for families with healthy children who don't anticipate significant medical expenses. However, it's crucial to carefully consider the potential for unexpected illnesses or injuries, as the higher deductibles could pose a financial burden.

What happens if I don't use all the funds in my HSA in a year?

+Unlike flexible spending accounts (FSAs), HSA funds roll over from year to year. This means you can continue to save and grow your HSA balance without losing any contributions. The funds remain available for future qualified medical expenses.

Can I have both an HDHP and a traditional health plan simultaneously?

+No, you cannot have both an HDHP and a traditional health plan at the same time. The two plan types are mutually exclusive, and you must choose one or the other based on your healthcare and financial needs.

In conclusion, High Deductible Health Plans offer a unique blend of affordability and comprehensive healthcare coverage. By understanding the nuances of HDHPs and making informed decisions, you can navigate the healthcare system effectively while managing your financial well-being. Remember, choosing the right insurance plan is a crucial step towards ensuring your health and financial security.