How Do I Get Homeowners Insurance

Homeownership is a significant milestone, and understanding how to secure adequate insurance coverage is essential to protect your investment and peace of mind. Homeowners insurance is a vital aspect of homeownership, providing financial protection against various risks and liabilities. This comprehensive guide will walk you through the process of obtaining homeowners insurance, covering everything from understanding the policy options to the steps involved in purchasing coverage.

Understanding Homeowners Insurance

Homeowners insurance is a contract between you, the homeowner, and an insurance company. It provides financial protection for your home and its contents, covering a range of potential losses and liabilities. These policies are designed to offer peace of mind and financial security in the face of unforeseen events such as natural disasters, theft, or accidents.

A standard homeowners insurance policy typically includes coverage for:

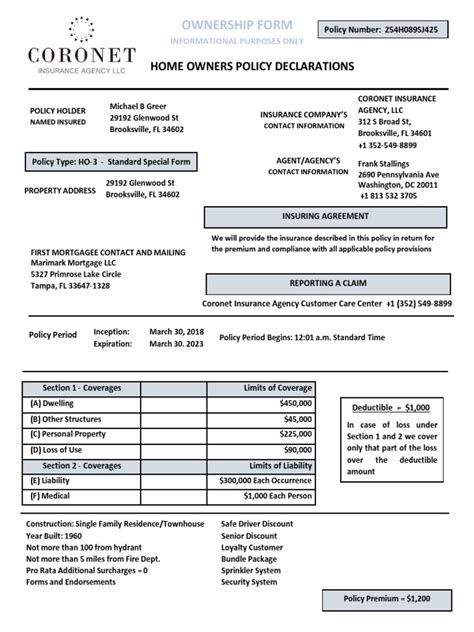

- Dwelling Coverage: This covers the physical structure of your home, including the roof, walls, and permanent fixtures.

- Personal Property Coverage: Provides protection for your personal belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Offers financial protection if you're found legally responsible for another person's injuries or property damage that occurs on your property.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered event.

- Medical Payments: Pays for medical expenses for guests who are injured on your property, regardless of liability.

It's important to note that homeowners insurance policies can vary greatly, and it's essential to understand the specific coverage options and limitations before making a decision. Let's delve into the key aspects to consider when evaluating homeowners insurance policies.

Evaluating Policy Options

When comparing homeowners insurance policies, several key factors come into play. These factors will influence the level of protection and the overall cost of your policy. Here’s what you should consider:

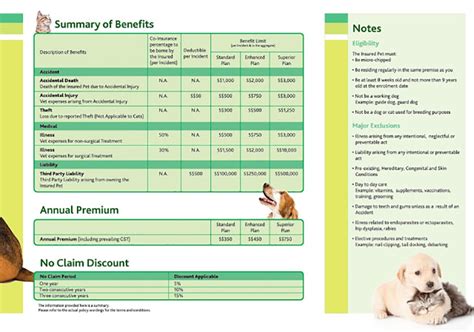

Coverage Limits

The coverage limits dictate the maximum amount your insurance provider will pay for various types of losses. It’s crucial to ensure that the limits are sufficient to cover the replacement cost of your home and its contents. Insuring your home to its full replacement value is essential to avoid being underinsured.

| Coverage Type | Recommended Coverage Limit |

|---|---|

| Dwelling Coverage | Full replacement cost of your home |

| Personal Property Coverage | Around 50% to 70% of your dwelling coverage limit |

| Liability Coverage | A minimum of $100,000, but higher limits are recommended |

Deductibles

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, but it’s important to choose a deductible that you can afford in the event of a claim. A good rule of thumb is to select a deductible that aligns with your emergency savings or a comfortable amount you can set aside.

Policy Exclusions

Every homeowners insurance policy has exclusions, which are specific risks or events that are not covered. Common exclusions include floods, earthquakes, and certain types of water damage. It’s crucial to review the exclusions carefully to ensure you understand the limitations of your coverage.

Additional Coverage Options

Standard homeowners insurance policies may not provide sufficient coverage for high-value items or unique circumstances. Consider adding the following optional coverages to enhance your protection:

- Personal Articles Floater: Provides coverage for high-value items such as jewelry, fine art, or collectibles.

- Earthquake or Flood Insurance: These are separate policies that offer protection against specific natural disasters, as they are typically excluded from standard homeowners insurance.

- Identity Theft Coverage: Offers assistance and reimbursement for expenses related to identity theft.

- Personal Liability Umbrella Policy: Extends your liability coverage beyond the limits of your homeowners insurance policy.

The Process of Obtaining Homeowners Insurance

Now that you have a solid understanding of homeowners insurance and the factors to consider, let’s walk through the steps to obtain coverage for your home.

Step 1: Research Insurance Providers

Start by researching reputable insurance companies that offer homeowners insurance in your area. Look for companies with a strong financial rating and positive customer reviews. Consider seeking recommendations from friends, family, or local real estate professionals.

Step 2: Obtain Quotes

Request quotes from multiple insurance providers. Provide accurate and detailed information about your home, including its location, size, construction type, and any unique features. Be sure to compare quotes based on similar coverage limits and deductibles to ensure an accurate comparison.

Step 3: Review Policy Details

Carefully review the policy documents provided by each insurance company. Pay close attention to the coverage limits, deductibles, exclusions, and any additional endorsements or riders. Ensure that the policy aligns with your specific needs and provides adequate protection.

Step 4: Assess Your Risks

Evaluate the potential risks and vulnerabilities of your home. Consider factors such as your location’s susceptibility to natural disasters, the prevalence of crime in your area, and any unique circumstances that could impact your coverage needs. Adjust your policy accordingly to address these risks effectively.

Step 5: Consider Bundling Options

Many insurance companies offer discounts when you bundle multiple policies, such as homeowners insurance with auto insurance. Explore bundling options to potentially save money and streamline your insurance management.

Step 6: Choose the Right Policy

Based on your research, quotes, and assessment of risks, select the insurance provider and policy that best meets your needs. Consider factors such as coverage limits, deductibles, reputation, customer service, and any additional benefits or perks offered by the provider.

Step 7: Purchase Your Policy

Once you’ve made your decision, proceed with purchasing your homeowners insurance policy. Provide the necessary information, including personal details, home address, and payment information. Review the policy documents thoroughly before finalizing the purchase.

Step 8: Review and Update Regularly

Homeownership is an evolving journey, and your insurance needs may change over time. Regularly review your policy to ensure it aligns with your current circumstances. Update your coverage limits, add new endorsements, or make adjustments as needed. Stay informed about any changes in your home’s value or potential risks to maintain adequate protection.

Tips for Maximizing Your Homeowners Insurance Coverage

To make the most of your homeowners insurance policy, consider the following tips:

- Maintain Your Home: Regular maintenance and upgrades can reduce the risk of accidents and damage, potentially leading to lower premiums.

- Install Safety Features : Investing in security systems, fire alarms, and smoke detectors can qualify you for discounts and enhance your coverage.

- Create an Inventory: Document and maintain a detailed inventory of your personal belongings. This will streamline the claims process in the event of a loss.

- Understand Your Policy: Familiarize yourself with the terms and conditions of your policy. Know what is covered, the steps to take in the event of a claim, and any specific exclusions or limitations.

- Stay Informed: Keep up-to-date with changes in the insurance industry and any new coverage options that may become available.

Conclusion

Obtaining homeowners insurance is a crucial step in protecting your home and ensuring financial security. By understanding the policy options, evaluating coverage limits and exclusions, and following the outlined steps, you can secure the right insurance coverage for your home. Remember, homeowners insurance is an essential investment that provides peace of mind and safeguards your most valuable asset.

How much does homeowners insurance cost on average?

+The average cost of homeowners insurance varies based on factors such as location, home value, and coverage limits. According to industry data, the national average premium for homeowners insurance is around $1,300 per year. However, rates can range from a few hundred dollars to several thousand dollars annually, depending on individual circumstances.

Can I customize my homeowners insurance policy?

+Absolutely! Homeowners insurance policies are highly customizable. You can choose coverage limits, deductibles, and optional endorsements to tailor your policy to your specific needs. It’s important to work with your insurance provider to understand your options and create a policy that provides adequate protection.

What happens if I need to file a claim?

+In the event of a covered loss, you’ll need to contact your insurance provider to initiate a claim. They will guide you through the claims process, which typically involves documenting the damage, providing proof of ownership, and submitting an estimate of the loss. It’s important to act promptly and follow the insurance company’s instructions to ensure a smooth claims process.