Geico Auto Insurance California

In the realm of auto insurance, finding the right coverage at an affordable price is essential for every driver. GEICO, one of the leading insurance providers in the United States, has been a trusted name for many years, offering a wide range of insurance products, including auto insurance. This article will delve into the specifics of GEICO auto insurance policies in California, exploring the coverage options, policy features, and benefits tailored to meet the unique needs of drivers in the Golden State.

Understanding GEICO Auto Insurance in California

GEICO, an acronym for Government Employees Insurance Company, has been providing auto insurance to millions of Americans since its establishment in 1936. With a strong reputation for customer satisfaction and competitive pricing, GEICO has expanded its reach across the nation, offering comprehensive coverage options to cater to the diverse needs of its customers.

In California, GEICO auto insurance policies are designed to comply with the state's stringent insurance regulations, ensuring that drivers have the necessary protection while navigating the diverse road conditions and potential risks unique to the state.

Key Coverage Options in GEICO Auto Insurance Policies

GEICO’s auto insurance policies in California offer a comprehensive range of coverage options, allowing drivers to customize their policies based on their individual needs and preferences. Here’s a breakdown of some of the key coverage options available:

- Liability Coverage: This fundamental coverage is mandatory in California and protects policyholders against bodily injury and property damage claims made by others involved in an accident for which the insured driver is at fault. GEICO offers various liability limits, allowing drivers to choose the level of protection that suits their budget and peace of mind.

- Collision Coverage: This optional coverage pays for repairs or replacement of the insured vehicle if it is damaged in a collision, regardless of fault. GEICO's collision coverage provides added protection, ensuring that drivers can get their vehicles back on the road quickly after an accident.

- Comprehensive Coverage: GEICO's comprehensive coverage protects against damage caused by non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals. This coverage is particularly beneficial for drivers in California, where natural disasters like wildfires and earthquakes are not uncommon.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of the insured driver and passengers after an accident, regardless of fault. GEICO's medical payments coverage provides added financial security, ensuring that medical bills are covered even if the insured driver is not at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. In California, where uninsured drivers are a concern, this coverage is essential to ensure adequate protection.

Policy Features and Benefits Tailored for California Drivers

GEICO’s auto insurance policies in California come with a host of features and benefits designed to enhance the overall insurance experience for drivers in the state. Some of the notable policy features include:

- Accident Forgiveness: GEICO offers accident forgiveness, a feature that allows policyholders to maintain their good driver discount even after their first at-fault accident. This benefit is particularly valuable for drivers in California, where accidents can happen unexpectedly due to the state's busy roads and diverse driving conditions.

- Emergency Roadside Assistance: GEICO provides 24/7 emergency roadside assistance, offering services such as towing, flat tire changes, jump-starts, and fuel delivery. This feature is especially beneficial for drivers in California, where unexpected road emergencies can occur due to the state's vast network of highways and rural areas.

- Discounts and Savings: GEICO offers a wide range of discounts to help policyholders save on their auto insurance premiums. These discounts include multi-policy discounts, good student discounts, military discounts, and more. By bundling policies or maintaining a clean driving record, California drivers can take advantage of these savings opportunities.

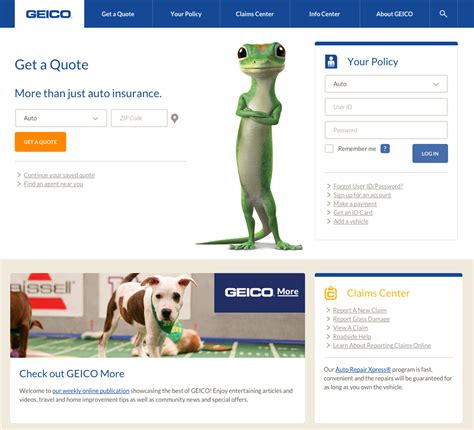

- Digital Tools and Resources: GEICO provides a user-friendly digital platform, allowing policyholders to manage their policies, make payments, and file claims online or through the GEICO mobile app. This convenience is especially beneficial for busy California drivers who value accessibility and ease of use.

| Policy Feature | Description |

|---|---|

| Accident Forgiveness | Maintain your good driver discount after an at-fault accident. |

| Emergency Roadside Assistance | 24/7 assistance for towing, tire changes, and more. |

| Discounts and Savings | Various discounts for multi-policy, good students, and military members. |

| Digital Tools | Manage policies, make payments, and file claims online or via the app. |

The Benefits of Choosing GEICO Auto Insurance in California

GEICO’s auto insurance policies in California offer numerous benefits that cater to the unique needs of drivers in the state. Here are some key advantages of choosing GEICO as your auto insurance provider:

Comprehensive Coverage Options

GEICO’s auto insurance policies in California provide a wide range of coverage options, ensuring that drivers can tailor their policies to their specific needs. Whether it’s liability coverage, collision coverage, comprehensive coverage, or medical payments coverage, GEICO offers flexible limits and customizable features to provide the right level of protection.

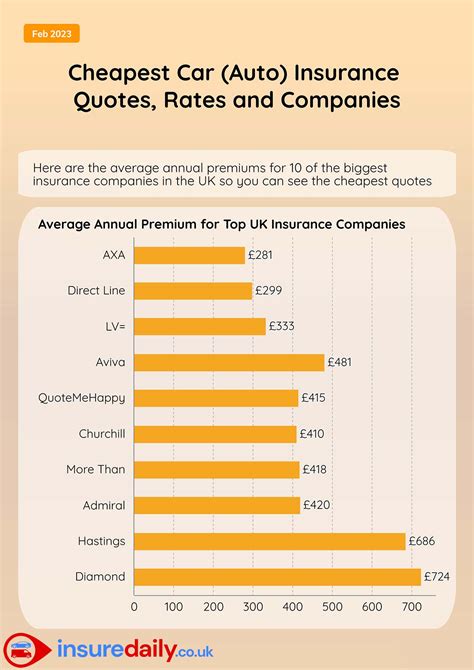

Competitive Pricing and Discounts

GEICO is known for its competitive pricing, making it an attractive option for budget-conscious drivers in California. The company’s extensive range of discounts further enhances its affordability. By taking advantage of discounts for safe driving, multi-policy bundles, military service, and more, California drivers can save significantly on their auto insurance premiums.

Excellent Customer Service and Claims Handling

GEICO prides itself on its exceptional customer service, ensuring that policyholders receive the support they need throughout their insurance journey. The company’s claims handling process is efficient and streamlined, with dedicated claims adjusters and a 24⁄7 claims hotline. This means that California drivers can have peace of mind knowing that their claims will be handled promptly and professionally.

Innovative Digital Tools and Resources

In today’s digital age, GEICO understands the importance of providing accessible and user-friendly digital tools. The company’s online platform and mobile app offer a seamless experience, allowing California drivers to manage their policies, make payments, and file claims with just a few clicks. This level of convenience and accessibility is highly valued by tech-savvy drivers.

A Trusted Name in the Insurance Industry

With a long history of providing reliable insurance coverage, GEICO has established itself as a trusted name in the industry. The company’s commitment to customer satisfaction and its reputation for financial stability provide California drivers with the confidence they need when choosing an auto insurance provider. GEICO’s strong financial ratings and positive customer reviews further reinforce its reliability.

GEICO’s Auto Insurance Experience: A California Perspective

To understand the real-world impact of GEICO’s auto insurance policies in California, let’s hear from a few satisfied customers who have experienced the benefits firsthand:

"As a California resident, I appreciate the comprehensive coverage options offered by GEICO. Their auto insurance policies provide me with the peace of mind I need while navigating the busy roads of the Golden State. The accident forgiveness feature is especially valuable, as it ensures that one mistake doesn't impact my insurance rates significantly."

- John D., Los Angeles, CA

"GEICO's emergency roadside assistance has been a lifesaver for me on multiple occasions. Whether it's a flat tire on the freeway or a dead battery in a remote area, their 24/7 support has gotten me back on the road quickly. I feel secure knowing that help is just a phone call away."

- Sarah M., San Francisco, CA

"I've been a loyal GEICO customer for many years, and their auto insurance policies have always met my expectations. The discounts they offer, such as the multi-policy discount and the good student discount, have helped me save a considerable amount on my insurance premiums. It's great to know that I'm getting quality coverage at an affordable price."

- Michael T., Sacramento, CA

FAQs

Can I customize my GEICO auto insurance policy to meet my specific needs in California?

+

Absolutely! GEICO offers a wide range of coverage options, allowing you to tailor your policy to your unique circumstances. You can choose from various liability limits, add optional coverages like collision and comprehensive, and take advantage of additional features like accident forgiveness and emergency roadside assistance.

How can I save on my GEICO auto insurance premiums in California?

+

GEICO provides numerous discounts to help you save on your auto insurance premiums. These include multi-policy discounts, good student discounts, military discounts, and more. By bundling your policies or maintaining a clean driving record, you can take advantage of these savings opportunities.

What should I do if I need to file a claim with GEICO in California?

+

If you need to file a claim with GEICO, you can do so through their online platform, mobile app, or by calling their 24⁄7 claims hotline. GEICO’s dedicated claims adjusters will guide you through the process, ensuring a smooth and efficient claims experience.

Does GEICO offer any digital tools or resources to manage my auto insurance policy in California?

+

Yes, GEICO provides a user-friendly digital platform and mobile app, allowing you to manage your policy, make payments, and file claims with ease. These digital tools offer convenience and accessibility, ensuring you can access your policy information anytime, anywhere.

How does GEICO’s auto insurance pricing compare to other providers in California?

+

GEICO is known for its competitive pricing, often offering lower premiums compared to other insurance providers in California. However, it’s essential to obtain multiple quotes to ensure you’re getting the best value for your specific circumstances.