Household Insurance Quotes

In today's world, safeguarding our homes and possessions is an essential aspect of responsible living. Household insurance, often referred to as home insurance, is a vital financial tool that provides protection against various unforeseen events, ensuring peace of mind for homeowners and renters alike. Obtaining household insurance quotes is the first step towards securing this vital coverage, but it's not as simple as comparing prices. This guide aims to delve into the intricacies of household insurance, offering a comprehensive understanding of the factors that influence quotes and providing valuable insights to empower you to make informed decisions.

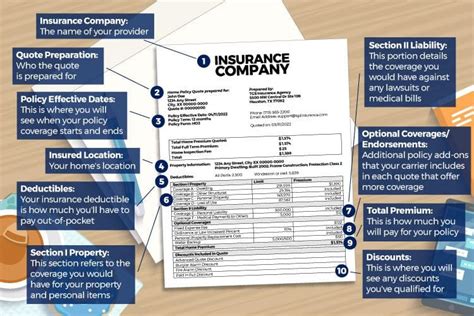

Understanding Household Insurance Quotes

Household insurance quotes are tailored estimates provided by insurance companies, outlining the cost of insuring your home and its contents. These quotes are influenced by a multitude of factors, each playing a unique role in determining the final price. By exploring these factors and understanding their impact, you can navigate the insurance landscape with confidence, securing the best coverage at the most competitive rates.

The Impact of Location

One of the most significant factors in household insurance quotes is your location. Insurance companies carefully assess the unique risks associated with different geographical areas, considering factors like crime rates, natural disaster prevalence, and even local construction costs. For instance, areas prone to earthquakes or hurricanes may attract higher premiums due to the increased likelihood of insurance claims.

Additionally, the specific neighborhood and its characteristics play a role. Homes in affluent areas with high property values may face higher premiums due to the potential for more expensive claims. Conversely, neighborhoods with a lower risk profile, such as those with low crime rates and minimal natural disaster risks, may enjoy more competitive rates.

To illustrate, consider the example of two identical homes: one located in a coastal area prone to hurricanes and the other in an inland region with minimal natural disaster risks. The coastal home is likely to attract a higher insurance quote due to the increased likelihood of storm-related claims.

| Location | Insurance Quote |

|---|---|

| Coastal Region (Hurricane-Prone) | $1,500 per year |

| Inland Region (Minimal Risks) | $1,200 per year |

The Influence of Home Value and Size

The value and size of your home are crucial factors in determining insurance quotes. Insurance companies assess the replacement cost of your home, which includes the expense of rebuilding it in the event of a total loss. Homes with higher replacement costs will naturally attract higher insurance premiums.

Additionally, the size of your home plays a role. Larger homes, with more square footage and potentially more valuable contents, may face higher premiums. This is because the potential cost of replacing or repairing these homes and their contents is greater.

Let’s consider an example. Imagine two homes with identical features and locations, but one is a cozy cottage while the other is a spacious mansion. The mansion, with its larger footprint and potentially more luxurious finishes and fixtures, will likely require a higher insurance premium to adequately cover its replacement cost.

| Home Type | Square Footage | Insurance Quote |

|---|---|---|

| Cozy Cottage | 1,200 sq. ft. | $800 per year |

| Spacious Mansion | 5,000 sq. ft. | $1,800 per year |

The Role of Deductibles and Coverage Limits

Deductibles and coverage limits are two key aspects of your household insurance policy that directly influence your insurance quote. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, as you’re taking on more financial responsibility in the event of a claim.

Coverage limits, on the other hand, refer to the maximum amount your insurance policy will pay out for a covered loss. Policies with higher coverage limits generally attract higher premiums, as they provide more extensive protection.

To illustrate, let’s consider two insurance policies with different deductibles and coverage limits:

| Policy | Deductible | Coverage Limit | Premium |

|---|---|---|---|

| Policy A | $500 | $200,000 | $1,000 per year |

| Policy B | $1,000 | $300,000 | $1,200 per year |

In this example, Policy B offers a higher coverage limit and a lower deductible, resulting in a slightly higher premium. When choosing your policy, consider your financial situation and the level of protection you desire. Higher deductibles can lead to lower premiums, but they also mean you'll be responsible for a larger portion of any claims.

The Effect of Your Insurance History

Your insurance history, including any prior claims, is a significant factor in determining your insurance quote. Insurance companies carefully assess your claim history, taking into account the frequency and severity of past claims. A history of frequent or costly claims may result in higher premiums, as it indicates a higher risk profile.

Conversely, a clean claim history can work in your favor, often leading to more competitive insurance quotes. Insurance companies view homeowners with a low risk profile as desirable clients, potentially offering them more favorable rates.

For instance, consider two homeowners with identical homes and locations. One homeowner has a history of frequent water damage claims, while the other has never filed a claim. The insurance company is likely to offer the latter homeowner a more attractive quote, as their low-risk profile indicates a reduced likelihood of future claims.

| Homeowner | Claim History | Insurance Quote |

|---|---|---|

| Homeowner A | Multiple water damage claims | $1,400 per year |

| Homeowner B | No claims | $1,100 per year |

The Power of Bundling and Discounts

Bundling your insurance policies and taking advantage of available discounts can significantly impact your household insurance quote. Many insurance companies offer multi-policy discounts, providing reduced premiums when you bundle your home and other insurance policies, such as auto or life insurance.

Additionally, insurance companies often provide discounts for various factors, including loyalty, safety features in your home, or even your profession. For example, homeowners who install security systems or fire prevention measures may be eligible for discounts, as these features reduce the risk of claims.

Let’s consider an example. Imagine a homeowner who bundles their home insurance with their auto insurance policy and also installs a security system in their home. This homeowner may be eligible for significant discounts, potentially reducing their overall insurance premiums.

| Discount Type | Discount Percentage |

|---|---|

| Multi-Policy Discount | 10% |

| Security System Discount | 5% |

In this example, the homeowner enjoys a total discount of 15% on their insurance premiums, a significant savings that underscores the value of bundling and taking advantage of available discounts.

Navigating the Household Insurance Landscape

As we’ve explored, numerous factors influence household insurance quotes, from your location and home characteristics to your insurance history and the discounts you’re eligible for. Understanding these factors empowers you to make informed decisions when choosing your insurance policy.

When comparing quotes, it’s essential to consider not just the premium but also the coverage provided. Ensure that the policy aligns with your needs, offering adequate protection for your home and its contents. Remember, the cheapest quote may not always be the best value, especially if it sacrifices essential coverage.

Additionally, don’t hesitate to reach out to insurance professionals for guidance. They can provide valuable insights, answer your questions, and help you tailor your insurance coverage to your unique circumstances. Their expertise can be a crucial asset in navigating the complex world of household insurance.

How often should I review my household insurance policy and quotes?

+It’s recommended to review your household insurance policy and quotes annually, or whenever you experience significant life changes such as home renovations, moving to a new location, or adding valuable possessions. Regular reviews ensure your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

What factors can I control to influence my insurance quote?

+While certain factors like location and home value are beyond your control, you can influence your insurance quote by maintaining a clean claim history, installing safety features, and exploring bundling options with your insurance provider. These actions can lead to significant discounts and more competitive quotes.

Are there any common mistakes to avoid when obtaining household insurance quotes?

+One common mistake is solely focusing on the premium without considering the coverage provided. Another mistake is failing to review and update your policy regularly, which can lead to inadequate coverage or overpayment. Additionally, not disclosing all relevant information to your insurance provider can result in policy cancellations or claim denials.