Mortgage Insurance Cost Per Month

When buying a home, one crucial aspect to consider is the cost of mortgage insurance. Mortgage insurance, also known as private mortgage insurance (PMI), is an essential component of homeownership for many prospective buyers, especially those with a down payment of less than 20% of the property's value. In this comprehensive guide, we will delve into the intricacies of mortgage insurance costs, providing you with the knowledge to make informed decisions during the home-buying process.

Understanding Mortgage Insurance

Mortgage insurance is a safeguard for lenders, protecting them against potential losses if a borrower defaults on their loan. It is typically required for conventional loans when the borrower’s down payment is less than 20% of the home’s purchase price. This insurance provides a layer of security, allowing lenders to offer financing to a wider range of borrowers.

The cost of mortgage insurance is an additional expense on top of your monthly mortgage payments. It is calculated as a percentage of the loan amount and can vary depending on several factors, including the loan-to-value ratio, credit score, and the type of loan.

Factors Influencing Mortgage Insurance Costs

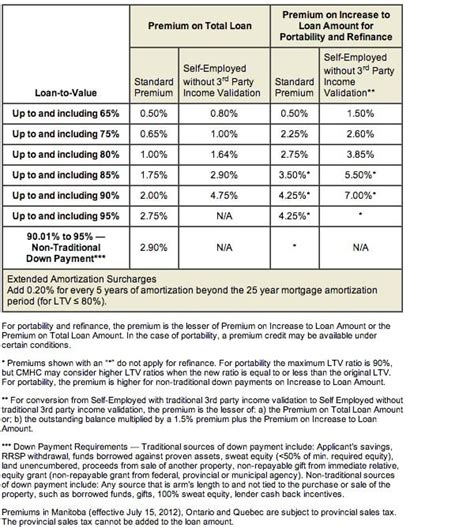

Loan-to-Value Ratio (LTV)

The loan-to-value ratio is a critical factor in determining your mortgage insurance costs. LTV represents the ratio of the loan amount to the appraised value of the property. Lenders typically require mortgage insurance when the LTV exceeds a certain threshold, usually 80%.

For example, if you purchase a home valued at $300,000 and make a down payment of 10% ($30,000), your loan amount would be $270,000. This results in an LTV of 90%, which is above the standard threshold, and thus, mortgage insurance would be required.

Credit Score

Your credit score plays a significant role in determining the cost of mortgage insurance. Lenders consider a borrower’s creditworthiness, and a higher credit score often leads to lower insurance premiums. Borrowers with excellent credit may qualify for reduced rates or even be exempt from mortgage insurance requirements.

For instance, a borrower with a credit score of 760 or higher may receive a better deal on mortgage insurance compared to someone with a score below 620.

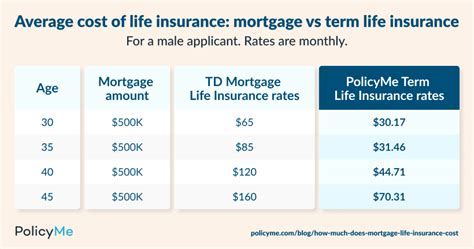

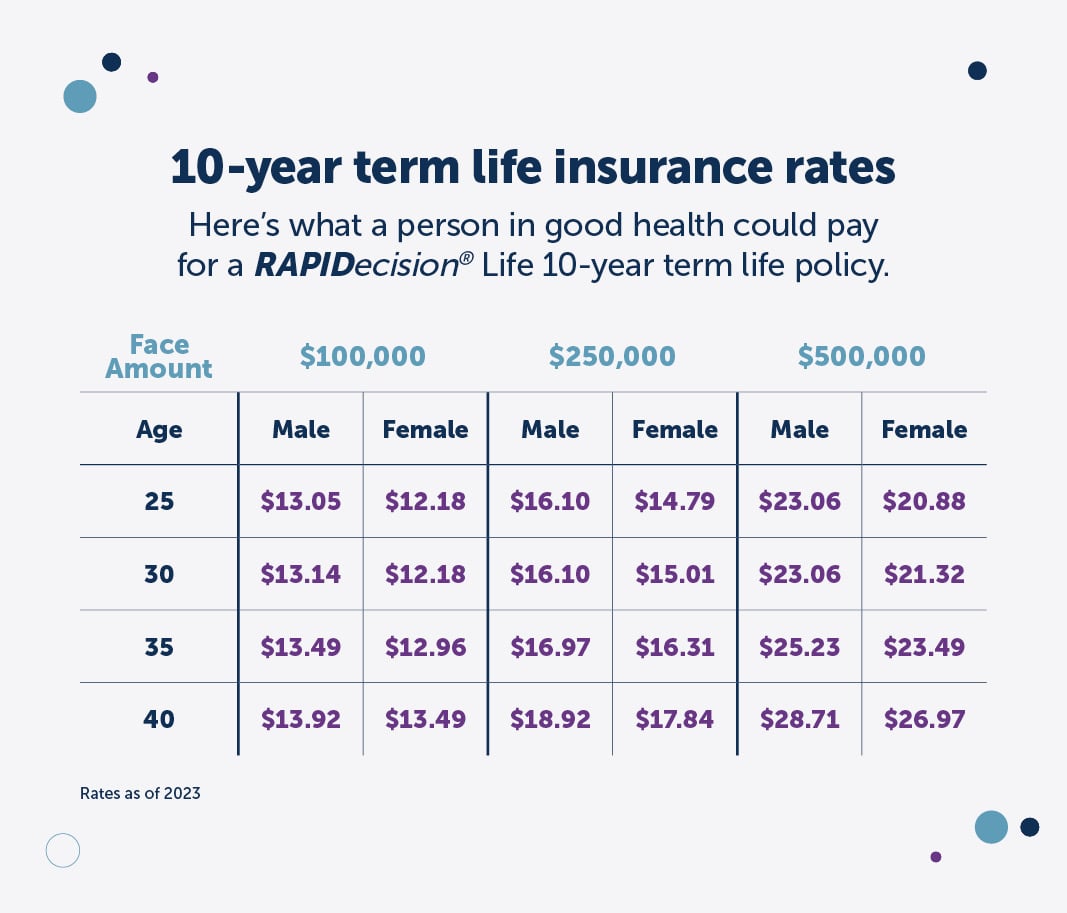

Loan Type and Term

The type of loan you choose can also impact your mortgage insurance costs. Conventional loans typically require mortgage insurance, while government-backed loans like FHA loans have their own insurance programs with different pricing structures.

Additionally, the term of your loan can influence insurance costs. Shorter-term loans, such as 15-year fixed-rate mortgages, often have lower insurance premiums compared to longer-term loans like 30-year mortgages.

Calculating Mortgage Insurance Costs

The cost of mortgage insurance is typically expressed as a monthly premium, calculated as a percentage of the loan amount. This premium is added to your monthly mortgage payment.

For instance, let's consider a borrower with a $200,000 loan and an LTV of 90%. The monthly mortgage insurance premium for this scenario could range from approximately $70 to $100, depending on the borrower's credit score and other factors.

| Loan Amount | LTV | Monthly PMI Premium Range |

|---|---|---|

| $200,000 | 90% | $70 - $100 |

| $300,000 | 85% | $105 - $150 |

| $400,000 | 80% | $140 - $200 |

It's important to note that these ranges are estimates and can vary based on individual circumstances and lender policies. To get an accurate estimate of your mortgage insurance costs, it's recommended to consult with a mortgage professional or use online mortgage calculators that take into account your specific loan details.

Strategies to Reduce Mortgage Insurance Costs

Increase Your Down Payment

One of the most effective ways to reduce or eliminate mortgage insurance is by increasing your down payment. By putting down at least 20% of the home’s purchase price, you can typically avoid mortgage insurance altogether. This not only lowers your monthly payments but also saves you from paying insurance premiums over the life of the loan.

Improve Your Credit Score

A higher credit score can significantly impact the cost of mortgage insurance. Lenders view borrowers with excellent credit as lower-risk, which often results in reduced insurance premiums. Taking steps to improve your credit score, such as paying bills on time, reducing credit card balances, and disputing any errors on your credit report, can lead to substantial savings on mortgage insurance.

Consider Different Loan Options

Exploring alternative loan options can also help reduce mortgage insurance costs. Government-backed loans, such as FHA loans, have their own insurance programs with lower premiums. However, these loans may have other requirements and costs associated with them, so it’s essential to weigh the pros and cons before making a decision.

Pay Down Your Loan Balance

As you make regular mortgage payments, your loan balance decreases, and your LTV improves. Once your LTV reaches a certain threshold, usually 80% or lower, you may be eligible to cancel your mortgage insurance. This process is known as mortgage insurance cancellation or PMI removal. It’s important to note that cancellation requirements vary depending on the type of loan and lender policies.

The Future of Mortgage Insurance

The mortgage insurance landscape is continually evolving, and recent trends suggest a shift towards more flexibility and borrower-friendly policies. Some lenders are offering lower insurance premiums for borrowers with excellent credit and low LTVs. Additionally, there is a growing emphasis on providing educational resources to help borrowers understand their mortgage insurance options and make informed decisions.

As the housing market adapts to changing economic conditions and consumer needs, mortgage insurance programs are likely to become more tailored and accessible. This evolution aims to make homeownership more attainable while maintaining the necessary safeguards for lenders.

Conclusion

Understanding the cost of mortgage insurance is crucial when planning your home purchase. By considering factors like loan-to-value ratio, credit score, and loan type, you can make informed decisions to minimize insurance expenses. Remember, mortgage insurance is a necessary step towards homeownership for many, and with the right strategies, you can navigate this process successfully.

Can I avoid mortgage insurance completely?

+Yes, you can avoid mortgage insurance by making a down payment of at least 20% of the home’s purchase price. This reduces the loan-to-value ratio to a level where insurance is typically not required.

How long do I have to pay mortgage insurance?

+The duration of mortgage insurance payments depends on your loan type and lender policies. For conventional loans, you may have to pay mortgage insurance for the entire loan term unless you reach an LTV of 80% or lower, at which point you may be eligible for cancellation.

Can I refinance to remove mortgage insurance?

+Yes, refinancing your mortgage can be a way to remove mortgage insurance. By refinancing to a new loan with a lower interest rate or a shorter term, you may be able to reduce your LTV to a level where insurance is no longer required. However, it’s important to consider the costs and benefits of refinancing before making a decision.

Are there any government programs to assist with mortgage insurance costs?

+Yes, there are government programs like the FHA loan program that offer more flexible mortgage insurance options. These programs may have lower insurance premiums and provide assistance to first-time homebuyers or those with lower incomes. It’s worth exploring these options to see if you qualify.