Geico Motorcycle Insurance Quote

Motorcycle enthusiasts are always on the lookout for reliable insurance coverage that not only offers comprehensive protection but also provides an efficient and seamless experience. In the United States, one of the leading insurance providers, GEICO (Government Employees Insurance Company), offers a range of insurance products tailored to the needs of motorcycle riders. Obtaining a GEICO motorcycle insurance quote is a straightforward process, and in this article, we will delve into the specifics, exploring the factors that influence the quote, the coverage options available, and the steps to secure the best possible policy for your biking adventures.

Understanding the GEICO Motorcycle Insurance Quote Process

The GEICO motorcycle insurance quote process is designed to be user-friendly and efficient. Riders can quickly obtain a quote either through GEICO’s official website or by contacting their customer service representatives. The quote is personalized based on various factors, ensuring that each policy is tailored to the rider’s specific needs.

Factors Influencing Your GEICO Motorcycle Insurance Quote

Several factors come into play when determining your GEICO motorcycle insurance quote. These include:

- Rider Information: Your age, gender, and riding experience play a significant role in determining the quote. Younger riders with less experience may receive higher quotes due to the perceived higher risk involved.

- Location: The state and city you reside in can impact your quote. Different states have varying laws and regulations regarding motorcycle insurance, which can affect the cost.

- Make and Model of Your Motorcycle: The type of bike you ride can influence the quote. Sports bikes, for instance, may attract higher premiums due to their association with higher speeds and potential risks.

- Coverage Preferences: The level of coverage you opt for will directly impact your quote. Comprehensive coverage options often come at a higher cost compared to basic liability coverage.

- Claims History: Your previous claims history is taken into account. A clean record with no previous claims can result in more favorable quotes.

- Discounts and Bundles: GEICO offers various discounts and bundle options that can reduce the overall cost of your insurance. These may include multi-policy discounts, good student discounts, and more.

Coverage Options Available with GEICO Motorcycle Insurance

GEICO provides a range of coverage options to ensure riders can tailor their insurance to their specific needs. Here are some of the key coverages available:

- Liability Coverage: This coverage protects you against financial loss if you are found at fault in an accident. It covers the cost of injuries or property damage caused to others.

- Collision Coverage: In the event of an accident, collision coverage pays for the repairs or replacement of your motorcycle, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your bike against damage or loss caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: If you are involved in an accident with a driver who has no insurance or insufficient coverage, this coverage steps in to protect you.

- Roadside Assistance: GEICO’s roadside assistance program provides help in case of emergencies, including towing, flat tire changes, and more.

- Custom Parts and Equipment Coverage: If you have made modifications or added custom parts to your bike, this coverage ensures they are protected in case of an accident or theft.

How to Get the Best GEICO Motorcycle Insurance Quote

To ensure you get the most favorable GEICO motorcycle insurance quote, consider the following tips:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare and contrast the coverage and costs. This will help you make an informed decision.

- Bundle Policies: If you have other insurance policies with GEICO, such as auto or homeowners insurance, bundling them can often result in significant discounts.

- Understand Your Coverage Needs: Evaluate your specific needs and the risks associated with your riding habits. Choose the coverage options that best fit your requirements without overinsuring yourself.

- Maintain a Good Riding Record: A clean riding record with no accidents or violations can lead to lower insurance quotes. Safe riding practices not only keep you and others safe but also keep your insurance costs down.

- Explore Discounts: GEICO offers various discounts, so be sure to inquire about them. These discounts can include good student discounts, military discounts, and safe rider discounts.

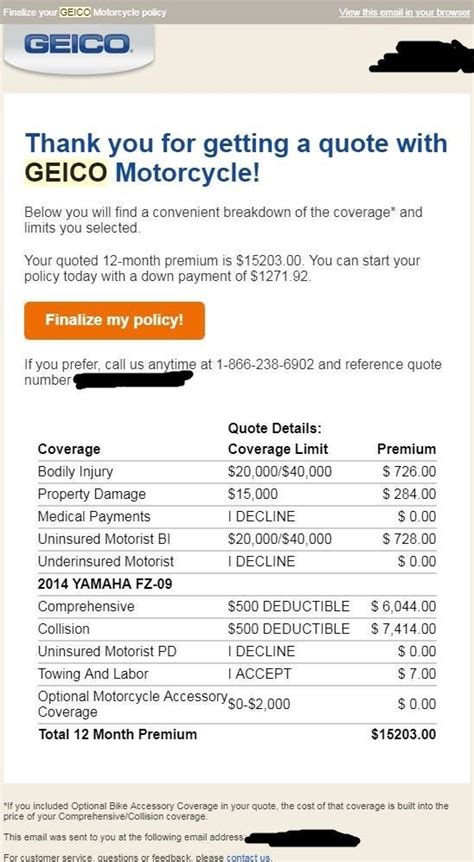

GEICO Motorcycle Insurance Quote: Real-World Example

To provide a real-world perspective, let’s look at an example of a GEICO motorcycle insurance quote for a hypothetical rider, John. John is a 35-year-old male residing in Los Angeles, California. He rides a 2018 Harley-Davidson Sportster and has over 10 years of riding experience. John is looking for comprehensive coverage that includes liability, collision, and uninsured motorist coverage.

| Coverage | Premium |

|---|---|

| Liability Coverage | $300 annually |

| Collision Coverage | $450 annually |

| Comprehensive Coverage | $250 annually |

| Uninsured Motorist Coverage | $150 annually |

| Total Annual Premium | $1,150 |

In this example, John's total annual premium for the desired coverage is $1,150. However, by exploring discounts and considering his clean riding record, John may be eligible for further reductions in his insurance costs.

Conclusion

GEICO’s motorcycle insurance offers a comprehensive range of coverage options, providing peace of mind for riders like John. By understanding the factors that influence your quote and exploring the various coverage choices, you can secure an insurance policy that suits your needs and budget. Remember, safe riding practices and a good riding record can significantly impact your insurance costs, so always prioritize safety on the road.

Frequently Asked Questions

Can I get a GEICO motorcycle insurance quote online?

+

Yes, you can obtain a GEICO motorcycle insurance quote online through their official website. The online quote process is quick and user-friendly, allowing you to compare coverage options and premiums instantly.

Are there any discounts available for GEICO motorcycle insurance?

+

Yes, GEICO offers a range of discounts for motorcycle insurance, including multi-policy discounts, good student discounts, military discounts, and safe rider discounts. These discounts can significantly reduce your insurance premiums.

What factors determine the cost of GEICO motorcycle insurance quotes?

+

Several factors influence the cost of GEICO motorcycle insurance quotes, such as rider information (age, gender, and riding experience), location, make and model of the motorcycle, coverage preferences, and claims history. These factors are considered to personalize the quote for each rider.

How can I reduce my GEICO motorcycle insurance costs?

+

To reduce your GEICO motorcycle insurance costs, you can explore various options such as bundling policies with other GEICO insurance products, maintaining a clean riding record, understanding your coverage needs to avoid overinsurance, and taking advantage of the discounts offered by GEICO.

Does GEICO offer any specialized coverage for custom motorcycles or vintage bikes?

+

Yes, GEICO understands the unique needs of custom motorcycle and vintage bike owners. They offer specialized coverage options, such as custom parts and equipment coverage, to ensure that these valuable bikes are protected in case of an accident or theft.