Insurance For Car Cheap

In today's fast-paced world, finding affordable car insurance is a top priority for many vehicle owners. With the rising costs of living and the ever-increasing expenses associated with owning a car, it's essential to explore ways to secure comprehensive coverage at a reasonable price. This article aims to provide an in-depth guide to securing cheap car insurance without compromising on quality, helping you navigate the complex world of automotive insurance with ease and confidence.

Understanding Car Insurance Basics

Before diving into the strategies for obtaining cheap car insurance, it’s crucial to grasp the fundamental concepts and factors that influence insurance rates. Car insurance is a contract between you and the insurance provider, offering financial protection against potential risks and liabilities associated with owning and operating a vehicle. This protection comes in various forms, including liability coverage, collision coverage, comprehensive coverage, and additional optional coverages tailored to your specific needs.

Key Components of Car Insurance

- Liability Coverage: This is the most basic and often mandatory form of insurance, covering bodily injury and property damage you cause to others in an accident.

- Collision Coverage: This optional coverage pays for damages to your vehicle after a collision, regardless of fault.

- Comprehensive Coverage: It provides protection against non-collision incidents like theft, vandalism, fire, and natural disasters.

- Additional Coverages: Depending on your needs, you might consider adding rental car coverage, roadside assistance, or medical payments coverage to your policy.

The cost of your car insurance policy is determined by a variety of factors, including your driving history, the type of car you own, the area you live in, and your chosen coverage limits. Understanding these variables is the first step towards securing the best insurance deal for your needs.

Tips for Securing Cheap Car Insurance

Now that we have a solid grasp of the basics, let’s delve into practical strategies to obtain cheap car insurance. These tips are designed to help you make informed decisions and potentially save a significant amount on your insurance premiums.

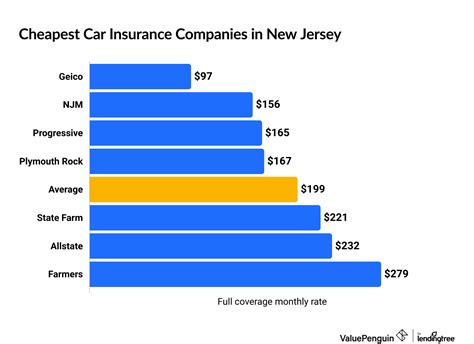

Compare Multiple Insurance Providers

One of the most effective ways to find cheap car insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary widely between companies, even for the same level of coverage. Use online quote comparison tools or reach out to different insurance agents to gather quotes and assess the best options for your needs.

When comparing quotes, pay attention to the coverage limits and deductibles offered. While a lower premium might be appealing, ensure that the coverage provided meets your specific requirements. It's crucial to strike a balance between affordability and adequate protection.

| Insurance Provider | Average Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,500 |

| Provider C | $950 |

In the above example, Provider C offers the most affordable average annual premium. However, it's essential to review the coverage details and ensure that the policy meets your specific needs before making a decision.

Improve Your Driving Record

Insurance companies heavily consider your driving history when calculating your insurance rates. Maintaining a clean driving record, free from accidents and violations, can significantly reduce your insurance premiums. If you have a less-than-perfect driving record, consider taking defensive driving courses to improve your skills and potentially earn discounts on your insurance.

Additionally, some insurance providers offer accident forgiveness programs. These programs prevent your rates from increasing after your first at-fault accident, provided you meet certain conditions. Inquire with your insurance provider about such programs and the requirements to qualify.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you essentially agree to pay more in the event of a claim, which can result in lower monthly premiums.

However, it's essential to choose a deductible amount that you can afford. If you frequently file small claims, a higher deductible might not be the best option. Evaluate your financial situation and choose a deductible that strikes the right balance between affordability and risk.

Explore Discounts and Bundle Options

Insurance providers often offer a variety of discounts to attract and retain customers. Some common discounts include:

- Safe Driver Discount: For drivers with a clean record.

- Good Student Discount: For young drivers with good academic performance.

- Multi-Policy Discount: When you bundle your car insurance with other policies like home or renters insurance.

- Loyalty Discount: For long-term customers.

- Safety Features Discount: For vehicles equipped with advanced safety technologies.

Inquire with your insurance provider about the discounts they offer and the criteria for eligibility. Additionally, consider bundling your car insurance with other policies to potentially save more.

Maintain a Good Credit Score

Your credit score can have a significant impact on your insurance rates. Many insurance companies use credit-based insurance scores to assess risk and set premiums. Improving your credit score can lead to lower insurance rates, so it’s essential to manage your finances responsibly and maintain a good credit history.

Review Your Coverage Regularly

Insurance needs can change over time, so it’s crucial to review your coverage regularly. As your life circumstances change, such as getting married, buying a new car, or moving to a new area, your insurance requirements might also change. Stay updated with your policy and make adjustments as needed to ensure you’re not overpaying for coverage you don’t need or underinsured for your current situation.

The Future of Affordable Car Insurance

The car insurance industry is evolving rapidly, driven by advancements in technology and changing consumer expectations. Here’s a glimpse into the future of affordable car insurance and the trends that may impact your insurance journey.

Telematics and Usage-Based Insurance

Telematics is the use of technology to monitor and analyze driving behavior. Usage-based insurance (UBI) programs leverage telematics to offer personalized insurance rates based on how, when, and where you drive. These programs use devices or smartphone apps to track driving habits, rewarding safe drivers with lower premiums.

While UBI programs are gaining popularity, they might not be suitable for everyone. If you have a less-than-perfect driving record or tend to drive during high-risk hours, traditional insurance plans might still be more affordable.

Digital Transformation and Convenience

The digital transformation of the insurance industry is revolutionizing the way customers interact with their providers. Online and mobile platforms now offer convenient ways to manage policies, file claims, and access insurance-related services. These digital advancements can lead to more efficient processes and potentially lower insurance costs.

Additionally, the rise of insurtech startups is bringing innovation to the insurance space. These companies are leveraging technology to offer innovative coverage options and more personalized insurance experiences, often at competitive rates.

The Rise of Electric Vehicles (EVs)

The growing popularity of electric vehicles is set to impact the car insurance industry. EVs often have different safety features and maintenance requirements compared to traditional vehicles, which can influence insurance rates. Some insurance providers are already offering specialized coverage for EVs, and this trend is expected to continue as the adoption of electric vehicles increases.

Predictive Analytics and Risk Assessment

Insurance companies are increasingly using advanced analytics and artificial intelligence to assess risk and set premiums. These technologies enable insurers to make more accurate predictions about the likelihood of accidents and claims, leading to more precise pricing models. As predictive analytics continues to evolve, it may lead to more fair and personalized insurance rates.

Conclusion: Navigating the Road to Affordable Insurance

Securing cheap car insurance is a journey that requires research, comparison, and a good understanding of your specific needs. By following the tips outlined in this article and staying informed about the evolving trends in the insurance industry, you can make informed decisions and potentially save a significant amount on your insurance premiums.

Remember, finding affordable car insurance is not just about the price. It's about striking the right balance between cost and coverage to ensure you're adequately protected on the road. With the right approach and a bit of diligence, you can navigate the complex world of automotive insurance with confidence and peace of mind.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and appropriate for your needs.

Can I switch insurance providers to save money?

+Absolutely! Shopping around for insurance quotes is a great way to find better rates. Don’t be afraid to switch providers if you find a more affordable and suitable option.

What are some common mistakes to avoid when choosing car insurance?

+Some common mistakes include selecting the cheapest policy without considering coverage limits, neglecting to compare quotes from multiple providers, and assuming your current provider offers the best rates.

How can I improve my chances of getting cheap car insurance as a young driver?

+As a young driver, maintaining a clean driving record, taking defensive driving courses, and exploring student discounts can help lower your insurance premiums. Additionally, consider adding a more experienced driver to your policy as a named driver.

What are some red flags to watch out for when choosing an insurance provider?

+Red flags may include a lack of transparency in their pricing or coverage details, negative customer reviews, and a history of poor claims handling. Always research the provider thoroughly before making a decision.