Need A Quote For Car Insurance

Finding a suitable car insurance quote is a crucial step for any vehicle owner. With a multitude of insurance providers offering diverse coverage options, the process can be complex. However, with the right approach and understanding of key factors, you can secure an optimal insurance plan tailored to your needs. This guide aims to provide an in-depth analysis of the car insurance quotation process, offering insights and strategies to navigate it effectively.

Understanding Car Insurance Quotations

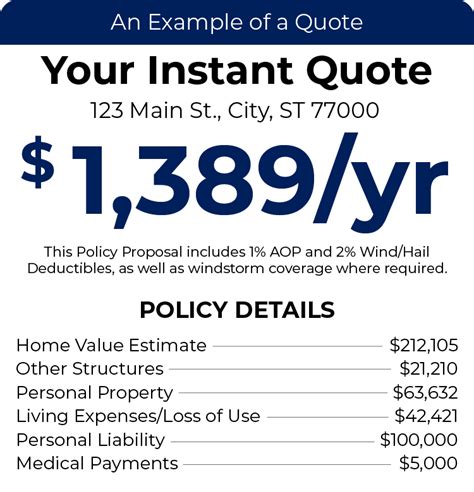

A car insurance quote is an estimate of the cost of insurance coverage for a specific vehicle. It takes into account various factors to determine the premium, including the make and model of the car, the driver's age and driving history, the geographic location, and the desired level of coverage. Quotations are an essential part of the insurance process, allowing individuals to compare different policies and find the best fit.

The quotation process typically involves an assessment of risk. Insurance providers evaluate the likelihood of a claim being made based on the provided information. This risk assessment influences the premium, with higher-risk drivers or vehicles often incurring higher costs.

Factors Influencing Car Insurance Quotes

Several key factors play a role in determining car insurance quotes. These include:

- Vehicle Type and Age: Newer, high-end vehicles generally attract higher insurance premiums due to their cost of repair or replacement. Conversely, older, less valuable cars may have lower premiums.

- Driver's Profile: The driver's age, gender, and driving record significantly impact the quote. Young, inexperienced drivers often face higher premiums due to their perceived risk, while mature drivers with clean records may benefit from lower rates.

- Location: The geographic location of the vehicle's primary use affects the quote. Areas with higher crime rates or frequent accidents may result in increased premiums.

- Coverage Level: The level of coverage desired, such as comprehensive, collision, or liability-only, influences the quote. Higher levels of coverage typically mean higher premiums.

- Additional Factors: Other considerations include the driver's credit score, the insurance provider's own risk assessment models, and any discounts or promotions offered.

Strategies for Securing Competitive Quotes

To obtain the best car insurance quotes, it's essential to employ effective strategies. Here are some key approaches:

Research and Compare

Take the time to research and compare quotes from multiple insurance providers. Utilize online tools and insurance comparison websites to quickly assess a range of options. Consider not just the premium but also the coverage offered and the reputation of the provider.

Bundle Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with one provider. Many insurers offer discounts for multiple policy holders, potentially reducing your overall insurance costs.

Utilize Discounts

Insurance providers often offer a variety of discounts, such as safe driver discounts, loyalty discounts, or discounts for specific professions or affiliations. Be sure to inquire about any applicable discounts when obtaining quotes.

Adjust Coverage Levels

Review your desired coverage levels and consider whether you can afford to reduce certain aspects. For instance, opting for a higher deductible can lower your premium. However, be mindful that this may result in higher out-of-pocket expenses if you need to make a claim.

The Quotation Process

The car insurance quotation process typically involves the following steps:

- Provide Information: You'll need to supply details about your vehicle, your driving history, and your desired coverage level.

- Risk Assessment: The insurance provider will assess the risk associated with insuring your vehicle based on the provided information.

- Receive Quote: You'll be provided with an estimate of the cost of insurance coverage, including any applicable discounts.

- Compare and Decide: Compare the quote with others to ensure you're getting the best value. If satisfied, you can proceed to purchase the insurance policy.

Performance and Analysis

Performance and analysis of car insurance quotes are essential to making an informed decision. Here's a closer look at these aspects:

Performance Metrics

When analyzing car insurance quotes, consider the following performance metrics:

| Metric | Description |

|---|---|

| Premium Cost | The total cost of the insurance policy, including any additional fees. |

| Coverage Level | The extent of coverage provided by the policy, including any exclusions or limitations. |

| Deductible | The amount you'll need to pay out-of-pocket before the insurance coverage kicks in. |

| Customer Service | The reputation and responsiveness of the insurance provider's customer service. |

| Claims Process | The ease and efficiency of the claims process, including any potential delays or complications. |

Comparative Analysis

To make an informed decision, compare quotes from multiple providers based on these performance metrics. Consider not just the premium cost but also the overall value and reliability of the insurance provider. Look for providers with a strong track record of customer satisfaction and efficient claims processing.

Future Implications and Expert Insights

The car insurance landscape is continually evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences. Here are some future implications and expert insights to consider:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in the insurance industry. Usage-based insurance policies, which adjust premiums based on real-time driving data, are expected to become more prevalent. This shift could incentivize safer driving practices and lead to more personalized insurance rates.

💡 As an industry expert, I foresee a future where telematics plays a pivotal role in car insurance. While it offers the potential for more accurate risk assessment and tailored coverage, it also raises privacy concerns. Balancing these aspects will be crucial for the industry's growth and consumer acceptance.

Digital Transformation

The insurance industry is undergoing a digital transformation, with online quotation and policy management becoming increasingly common. This shift towards digital services offers convenience and efficiency for consumers, allowing for quicker and more transparent interactions with insurance providers.

Regulatory Changes

Regulatory bodies play a significant role in shaping the insurance industry. Changes in regulations, such as those related to autonomous vehicles or ride-sharing services, can have a substantial impact on insurance requirements and premiums. Staying informed about these changes is essential for both insurance providers and consumers.

Frequently Asked Questions

How often should I review my car insurance quotes?

+It’s recommended to review your car insurance quotes annually or whenever you experience significant life changes, such as moving to a new location, purchasing a new vehicle, or getting married. Regular reviews ensure you’re getting the best value and coverage for your needs.

Can I negotiate car insurance quotes?

+While car insurance quotes are primarily based on risk assessment, some providers may offer flexibility on certain aspects, such as coverage levels or deductibles. It’s worth inquiring about potential adjustments to tailor the policy to your needs and budget.

What are some common discounts available for car insurance?

+Common car insurance discounts include safe driver discounts, loyalty discounts, multi-policy discounts (for bundling multiple insurance policies), and discounts for specific professions or affiliations. It’s always worth asking about potential discounts when obtaining quotes.