Homeowners Maintenance Insurance

Welcome to an in-depth exploration of the often-overlooked yet crucial aspect of homeownership: maintenance insurance. In a world where unexpected home repairs can lead to significant financial burdens, understanding the role of maintenance insurance is essential. This comprehensive guide aims to shed light on the importance, benefits, and intricacies of this insurance type, empowering homeowners to make informed decisions and secure their investments.

Understanding Homeowners Maintenance Insurance

Homeowners maintenance insurance, a specialized form of property coverage, goes beyond the traditional scope of home insurance. While standard home insurance policies typically address structural damage, theft, and liability, maintenance insurance focuses on the upkeep and routine repairs of a property. It is designed to offer financial protection for the myriad of maintenance tasks that are an inevitable part of homeownership.

The concept behind maintenance insurance is straightforward: it provides homeowners with a safety net to cover the costs of regular maintenance and unexpected repairs. This can range from fixing a leaky roof to replacing worn-out appliances or addressing issues with plumbing and electrical systems. By having maintenance insurance in place, homeowners can avoid the financial strain and unexpected expenses that often accompany homeownership.

The Scope of Coverage

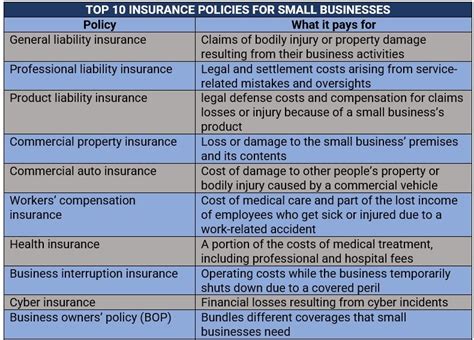

Maintenance insurance policies can vary widely in terms of coverage. Some policies offer comprehensive protection, covering a broad range of maintenance and repair tasks, while others may be more specific, targeting certain areas such as HVAC systems or roofing. It is essential for homeowners to thoroughly review their policy to understand the extent of coverage and any potential exclusions.

One of the key benefits of maintenance insurance is the peace of mind it provides. Homeowners can rest assured knowing that they are prepared for the unexpected, and that routine maintenance won't become a financial burden. This insurance type can be particularly valuable for older homes or properties with unique architectural features, as these often require more frequent and specialized maintenance.

| Coverage Type | Description |

|---|---|

| Standard Maintenance | Covers routine tasks like roof repairs, plumbing issues, and minor electrical work. |

| Appliance Coverage | Provides protection for the replacement or repair of essential appliances such as refrigerators and washing machines. |

| Specialty Maintenance | Offers coverage for unique home features, including historical preservation or specific architectural elements. |

The Benefits of Maintenance Insurance

Maintenance insurance brings a multitude of advantages to homeowners, each contributing to a more secure and financially stable homeownership experience. From mitigating unexpected costs to promoting proactive home care, the benefits of this insurance type are far-reaching.

Financial Protection and Peace of Mind

Perhaps the most significant advantage of maintenance insurance is the financial protection it provides. Home maintenance and repairs can be costly, and without insurance coverage, these expenses can quickly deplete savings or lead to financial strain. With maintenance insurance, homeowners can rest assured that they are prepared for the unexpected, whether it's a burst pipe or a faulty air conditioning unit.

Moreover, the peace of mind that comes with maintenance insurance is invaluable. Homeowners no longer have to worry about how they will afford necessary repairs or worry about the financial impact of an unforeseen home issue. This insurance type allows homeowners to focus on enjoying their homes rather than worrying about potential maintenance headaches.

Promoting Proactive Home Care

Maintenance insurance also encourages homeowners to be proactive in their home care. By having coverage in place, homeowners are more likely to address minor issues before they become major problems. This proactive approach can lead to longer-lasting home systems and potentially extend the lifespan of various components.

For example, regular maintenance of a roof, as covered by maintenance insurance, can identify small leaks or worn-out shingles early on. Addressing these issues promptly can prevent water damage to the interior of the home and potentially save homeowners from more extensive and costly repairs in the future.

Avoiding Deferred Maintenance

Deferred maintenance, the practice of delaying necessary repairs or maintenance, can lead to significant problems down the line. When homeowners lack the financial means or choose to delay maintenance due to cost concerns, small issues can quickly escalate into major repairs. Maintenance insurance helps homeowners avoid this pitfall by providing the necessary financial resources to address issues promptly.

By having maintenance insurance, homeowners can ensure that their properties are well-maintained and that any necessary repairs are completed in a timely manner. This not only protects the value of the home but also ensures the safety and comfort of the residents.

Real-World Applications and Success Stories

Maintenance insurance has proven its worth time and again in the real-world experiences of homeowners across the globe. From unexpected plumbing disasters to the timely replacement of aging appliances, maintenance insurance has provided a financial safety net for homeowners in a variety of scenarios.

Case Study: Plumbing Disaster Averted

Consider the story of John, a homeowner in a suburban area. One morning, he woke up to find water flooding his basement due to a burst pipe. The situation was dire, and the cost of repairs was estimated to be several thousand dollars. Fortunately, John had maintenance insurance in place, which covered the cost of the repairs, saving him from a significant financial burden.

John's insurance policy not only covered the plumbing repairs but also provided additional support for the water damage restoration, ensuring that his home was fully restored to its pre-disaster condition.

Success Story: Timely Appliance Replacement

In another scenario, Sarah, a busy professional, relied on her maintenance insurance when her refrigerator suddenly stopped working. With a busy schedule and a young family, the last thing Sarah wanted to worry about was the cost of a new appliance. Fortunately, her maintenance insurance policy included coverage for appliance replacement, allowing her to quickly and easily replace her refrigerator without breaking the bank.

Sarah's experience highlights the convenience and peace of mind that maintenance insurance provides. By having coverage in place, homeowners can avoid the stress and financial strain of unexpected appliance failures.

Choosing the Right Maintenance Insurance Policy

Selecting the appropriate maintenance insurance policy is a crucial step in ensuring comprehensive coverage and financial protection. With a myriad of options available, homeowners must carefully consider their specific needs and the unique characteristics of their property to make an informed decision.

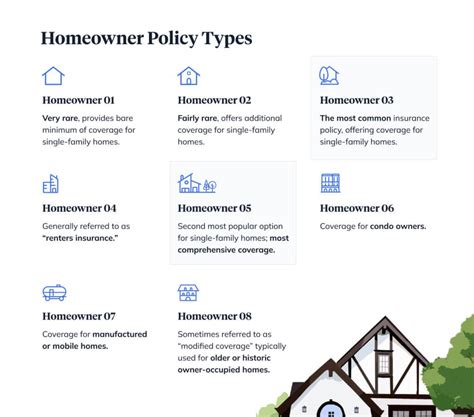

Assessing Your Home's Needs

The first step in choosing a maintenance insurance policy is to conduct a thorough assessment of your home's needs. Consider the age of your home, its construction, and any unique features or systems it may have. Older homes, for instance, often require more frequent maintenance and may benefit from a policy that offers broader coverage.

Additionally, take into account the climate and environmental factors that may impact your home. If you live in an area prone to severe weather, such as hurricanes or tornadoes, you may want to prioritize coverage for roof repairs or water damage. Understanding the specific needs of your home will guide you in selecting the right policy.

Comparing Policy Options

Once you have a clear understanding of your home's needs, it's time to compare different policy options. Look for insurance providers that offer a range of coverage options, from standard maintenance to more specialized coverage for unique home features. Ensure that the policies you are considering provide clear and detailed explanations of what is covered and any potential exclusions.

It's also essential to compare the premiums and deductibles associated with each policy. While a lower premium may be tempting, it's crucial to strike a balance between affordability and comprehensive coverage. Consider your budget and the potential costs of home maintenance and repairs to determine the best fit for your financial situation.

Seeking Expert Advice

If you're unsure about which maintenance insurance policy is right for you, seeking expert advice can be invaluable. Insurance brokers and agents can provide personalized recommendations based on your home's characteristics and your specific needs. They can also guide you through the often-complex world of insurance policies, ensuring that you understand the fine print and make an informed decision.

The Future of Homeowners Maintenance Insurance

As the landscape of homeownership continues to evolve, so too does the role of maintenance insurance. With advancements in technology and a growing emphasis on sustainable and energy-efficient homes, maintenance insurance policies are adapting to meet these changing needs.

Technological Advancements and Smart Homes

The integration of technology into homes, often referred to as smart homes, is a growing trend. From automated lighting and temperature control to advanced security systems, these technological advancements offer increased convenience and energy efficiency. As a result, maintenance insurance policies are beginning to incorporate coverage for these smart home systems.

Maintenance insurance providers are recognizing the importance of protecting these advanced systems, offering coverage for repairs and replacements. This ensures that homeowners can continue to enjoy the benefits of their smart homes without worrying about the financial implications of potential malfunctions or failures.

Sustainable and Energy-Efficient Homes

With a global focus on sustainability and environmental responsibility, many homeowners are embracing energy-efficient and sustainable practices. This includes the use of renewable energy sources, such as solar panels, and the adoption of energy-efficient appliances and systems. Maintenance insurance policies are adapting to support these initiatives, offering coverage for the maintenance and repair of these sustainable features.

By providing coverage for the upkeep of solar panels, wind turbines, or other renewable energy systems, maintenance insurance encourages homeowners to make environmentally conscious choices. This not only benefits the planet but also helps homeowners maintain the efficiency and longevity of their sustainable investments.

The Evolution of Policy Options

The future of homeowners maintenance insurance is also characterized by an expanding range of policy options. Insurance providers are recognizing the diverse needs of homeowners and are developing policies that cater to specific demographics and home types. This includes policies tailored for older homes, historic properties, or homes with unique architectural features.

Additionally, maintenance insurance providers are exploring the potential of personalized policies. By leveraging data and analytics, insurance companies can offer customized coverage plans that take into account the specific needs and risks associated with each individual home. This level of customization ensures that homeowners receive the most comprehensive and relevant coverage for their properties.

FAQ

What is the average cost of homeowners maintenance insurance?

+

The cost of homeowners maintenance insurance can vary widely depending on factors such as the location, age, and size of your home, as well as the specific coverage options you choose. On average, maintenance insurance premiums range from 200 to 1,000 annually. However, it’s essential to obtain multiple quotes to find the best coverage at the most competitive price.

Does homeowners maintenance insurance cover all types of maintenance and repairs?

+

Maintenance insurance policies typically cover a wide range of maintenance and repair needs, but it’s important to review the policy details carefully. Some policies may have specific exclusions or limitations, such as not covering certain types of appliances or only providing coverage for emergency repairs. Always read the fine print to understand the scope of your coverage.

How does homeowners maintenance insurance differ from standard home insurance policies?

+

Standard home insurance policies primarily focus on protecting against structural damage, theft, and liability claims. While they may offer some coverage for maintenance and repairs, it is often limited and not as comprehensive as dedicated maintenance insurance policies. Maintenance insurance is designed specifically to cover the costs of routine and unexpected maintenance, providing more extensive protection for homeowners.

Can I customize my homeowners maintenance insurance policy to suit my specific needs?

+

Yes, many insurance providers offer customizable maintenance insurance policies. This allows you to tailor the coverage to your specific needs and budget. You can choose the level of coverage, the types of maintenance and repairs covered, and even add optional coverage for specific items or systems in your home. Customization ensures that you get the protection that aligns with your unique home and circumstances.

How do I file a claim with my homeowners maintenance insurance policy?

+

The process of filing a claim with your homeowners maintenance insurance policy may vary depending on your insurance provider. Typically, you’ll need to contact your insurance company and provide details about the maintenance issue or repair needed. They may require documentation, such as estimates or invoices, to process your claim. It’s essential to review your policy and understand the specific claim process to ensure a smooth and timely resolution.