Home Insurance Best Rates

Finding the best home insurance rates is a crucial step in protecting your most valuable asset—your home. With a vast array of insurance providers offering different coverage options and rates, it can be overwhelming to navigate the market and secure the most advantageous policy. In this comprehensive guide, we'll delve into the intricacies of home insurance, offering expert insights and practical tips to help you identify the best rates available.

Understanding Home Insurance

Home insurance, also known as homeowners insurance, is a vital financial safety net that provides coverage for your home, its contents, and potential liabilities. It’s designed to offer protection against various risks, including damage caused by natural disasters, theft, vandalism, and even accidents that might occur on your property.

The importance of home insurance cannot be overstated. It safeguards your financial investment in your home and ensures that you're prepared for unexpected events. By understanding the components of home insurance and the factors that influence rates, you can make informed decisions and secure the best coverage for your needs.

Components of Home Insurance Coverage

Home insurance policies typically consist of several key components, each designed to address specific risks and liabilities:

- Dwelling Coverage: This provides protection for the physical structure of your home, covering repairs or rebuilding costs in the event of damage or destruction.

- Personal Property Coverage: This covers the contents of your home, including furniture, electronics, and personal belongings. It ensures that you're compensated for lost or damaged items.

- Liability Coverage: This safeguards you against potential lawsuits if someone is injured on your property or if your actions result in property damage to others.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered incident, this coverage helps cover the costs of temporary housing and other necessary expenses.

- Medical Payments Coverage: This provides coverage for medical expenses if someone is injured on your property, regardless of fault.

It's important to note that different insurance providers may offer variations of these coverage types, and some may include additional endorsements or riders to customize your policy further.

Factors Influencing Home Insurance Rates

When it comes to home insurance rates, a multitude of factors come into play. Understanding these factors can help you anticipate and manage your insurance costs effectively. Here’s an overview of the key influences on home insurance rates:

Location

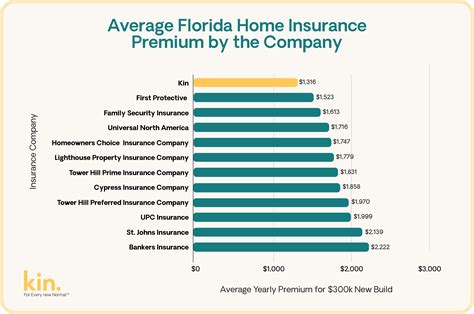

The location of your home is a significant determinant of your insurance rates. Insurance providers assess the risk associated with your geographical area, considering factors such as crime rates, natural disaster frequency, and local building codes. Areas prone to natural disasters like hurricanes, earthquakes, or floods will generally have higher insurance rates.

For instance, if your home is located in a coastal region frequently impacted by hurricanes, you can expect higher insurance premiums. Similarly, areas with high crime rates may also see increased insurance costs due to the elevated risk of theft or vandalism.

Home Value and Construction

The value and construction of your home play a crucial role in determining insurance rates. Insurance providers assess the cost of rebuilding your home, taking into account factors like its size, materials used, and any unique architectural features. Homes with high-value construction or specialized features may require more extensive coverage, resulting in higher insurance premiums.

For example, a home with a unique architectural design or custom features may demand a more specialized and costly insurance policy.

Claim History

Your claim history is a critical factor in determining insurance rates. Insurance providers closely examine your past claims to assess the risk associated with insuring your home. A history of frequent or costly claims may result in higher insurance premiums, as it indicates a higher likelihood of future claims.

If you've had multiple claims within a short period, insurance providers may view you as a higher-risk policyholder, leading to increased rates.

Deductibles and Coverage Limits

The deductibles and coverage limits you choose for your policy can significantly impact your insurance rates. Higher deductibles (the amount you pay out of pocket before insurance coverage kicks in) often result in lower premiums, while lower deductibles can increase your rates.

Similarly, higher coverage limits (the maximum amount your insurance policy will pay for a covered loss) can lead to increased insurance costs. It's important to strike a balance between your desired coverage and the associated premiums.

Discounts and Bundling

Insurance providers often offer discounts and incentives to encourage policyholders to bundle multiple insurance policies or take advantage of specific safety features. For instance, bundling your home insurance with your auto insurance can lead to significant savings. Additionally, having safety features like smoke detectors, security systems, or fire-resistant roofing can qualify you for discounts.

Exploring these discount opportunities can help reduce your overall insurance costs.

Credit Score

Your credit score is an unexpected factor that can influence your home insurance rates. Insurance providers often use credit-based insurance scores to assess the risk associated with insuring your home. A higher credit score may result in lower insurance premiums, as it indicates a lower likelihood of filing claims.

Improving your credit score can potentially lead to savings on your home insurance policy.

Shopping for the Best Home Insurance Rates

Now that we’ve explored the factors influencing home insurance rates, let’s delve into the process of shopping for the best rates. Here’s a step-by-step guide to help you navigate the market effectively:

Research and Compare Providers

Start by researching and comparing multiple insurance providers. Look for reputable companies with a solid track record of claims handling and customer satisfaction. Consider factors like financial stability, customer service ratings, and the range of coverage options offered.

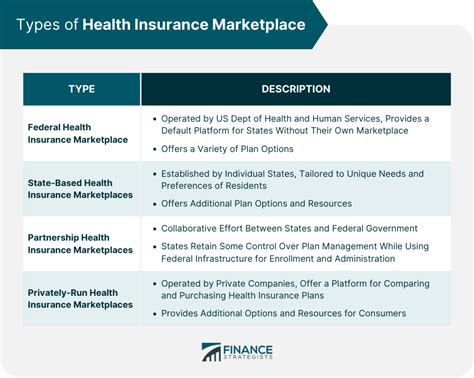

Utilize online comparison tools and insurance marketplaces to quickly assess the offerings of different providers. This initial research will help you narrow down your options and identify potential candidates for further investigation.

Assess Your Coverage Needs

Before requesting quotes, take the time to assess your specific coverage needs. Consider the value of your home, the cost of rebuilding it, and the value of your personal belongings. Determine the level of liability coverage you require and any additional coverage options you may need, such as flood or earthquake insurance.

By understanding your coverage needs, you can ensure that you're not overpaying for unnecessary coverage or leaving yourself vulnerable with inadequate protection.

Obtain Multiple Quotes

Request quotes from several insurance providers to compare rates and coverage options. Provide accurate and detailed information about your home, including its location, construction, and any unique features. Be transparent about your claim history and any safety features or discounts you may be eligible for.

Compare the quotes based on both price and coverage. Look for policies that offer the level of protection you need at a competitive rate. Don't hesitate to ask questions and seek clarification on any aspects of the policies that are unclear.

Explore Discounts and Bundling Opportunities

As mentioned earlier, insurance providers often offer discounts and incentives to encourage policyholders to bundle policies or take advantage of safety features. Explore these opportunities and inquire about any discounts that may apply to your situation.

Bundling your home insurance with other policies, such as auto or life insurance, can lead to significant savings. Additionally, consider implementing safety features in your home to qualify for additional discounts.

Read the Fine Print

When comparing quotes, it’s crucial to read the fine print and understand the specific terms and conditions of each policy. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations that may apply. Ensure that the policy aligns with your expectations and provides the protection you need.

Don't hesitate to seek clarification or additional information from the insurance provider if you have any doubts or questions.

Consider Customer Service and Claims Handling

In addition to price and coverage, consider the reputation and reliability of the insurance provider. Look for companies with a strong track record of customer satisfaction and efficient claims handling. Read reviews and seek recommendations from trusted sources to assess the provider’s performance in these areas.

A reputable insurance provider with a solid customer service reputation can provide peace of mind, especially in the event of a claim.

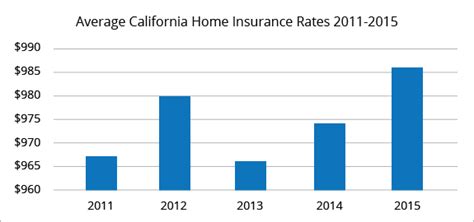

Shop Around Regularly

Home insurance rates can fluctuate over time, so it’s important to shop around regularly to ensure you’re still getting the best deal. Review your policy annually and compare it to the market to identify any potential savings. Insurance providers may offer competitive rates to new customers, so don’t be afraid to explore your options and negotiate with your current provider.

Regularly shopping around can help you stay informed about market changes and ensure that you're not overpaying for your home insurance.

Tips for Optimizing Your Home Insurance Rates

Beyond the standard shopping process, there are several strategies you can employ to optimize your home insurance rates and potentially save money. Here are some expert tips to consider:

Improve Your Credit Score

As mentioned earlier, your credit score can impact your home insurance rates. Take steps to improve your credit score by paying bills on time, reducing credit card balances, and disputing any errors on your credit report. A higher credit score can lead to lower insurance premiums, so it’s worth investing effort into improving your creditworthiness.

Raise Your Deductibles

Increasing your deductibles can result in lower insurance premiums. However, it’s important to strike a balance between saving on premiums and being able to afford the higher out-of-pocket costs in the event of a claim. Consider your financial situation and comfort level with higher deductibles before making any changes.

Bundle Policies

Bundling your home insurance with other policies, such as auto or life insurance, can lead to significant savings. Insurance providers often offer multi-policy discounts to encourage policyholders to bundle their coverage. By combining policies, you can streamline your insurance needs and potentially reduce your overall costs.

Implement Safety Features

Installing safety features in your home, such as smoke detectors, fire sprinklers, security systems, or fire-resistant roofing, can qualify you for insurance discounts. These features not only enhance your home’s safety but also reduce the risk of claims, making you a more attractive insurance candidate.

Maintain a Good Claim History

A history of frequent or costly claims can lead to higher insurance rates. Strive to maintain a good claim history by taking preventive measures to avoid potential risks. Regularly inspect your home for potential hazards, address any maintenance issues promptly, and consider implementing loss prevention measures to reduce the likelihood of claims.

Shop Around for Endorsements and Riders

Some insurance providers offer endorsements or riders to customize your policy further. These add-ons can provide additional coverage for specific risks or valuable possessions. Shop around for these options and compare the costs and benefits to ensure you’re getting the best value for your needs.

Review Your Policy Annually

Regularly reviewing your home insurance policy is essential to ensure it remains up-to-date and aligned with your needs. Assess any changes in your circumstances, such as home improvements, increased home value, or changes in personal belongings. Update your policy accordingly to ensure you have adequate coverage.

Additionally, review your policy for any unnecessary coverage or duplicate protections that may be driving up your premiums. Eliminating unnecessary coverage can help reduce your insurance costs.

Understanding Home Insurance Claims

Knowing how to navigate the claims process is crucial when it comes to home insurance. Here’s an overview of what you need to know:

Reporting a Claim

When a covered incident occurs, it’s important to report the claim to your insurance provider promptly. Most providers have dedicated claims departments that can guide you through the process. Provide detailed information about the incident, including any damage sustained and any potential causes.

It's beneficial to document the claim by taking photographs or videos of the damage and keeping records of any repairs or replacement costs incurred. This documentation can help support your claim and ensure a smoother resolution process.

The Claims Adjustment Process

Once you’ve reported your claim, the insurance provider will assign a claims adjuster to investigate and evaluate the extent of the damage. The adjuster will inspect the property, review your policy, and assess the validity and extent of the claim. They may request additional information or documentation to support your claim.

It's important to cooperate fully with the adjuster and provide any necessary documentation in a timely manner. This will help expedite the claims adjustment process and ensure a fair resolution.

Settlement and Payment

After the claims adjuster has completed their evaluation, they will determine the settlement amount based on the policy terms and the extent of the damage. The settlement amount will cover the costs of repairs or replacements, taking into account your policy’s coverage limits and deductibles.

Once the settlement is agreed upon, the insurance provider will issue payment to you or directly to the repair or replacement service providers, depending on the circumstances and your policy terms.

Understanding Policy Limitations and Exclusions

It’s crucial to understand the limitations and exclusions outlined in your policy. While home insurance provides comprehensive coverage, there may be specific risks or damages that are not covered. For example, standard home insurance policies typically do not cover flood damage, earthquake damage, or damage caused by pests.

Review your policy carefully to understand the scope of coverage and any potential limitations or exclusions. If you have concerns about specific risks, consider purchasing additional coverage or endorsements to address those gaps.

Future Trends and Innovations in Home Insurance

The home insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of home insurance:

Digitalization and Automation

The digital transformation of the insurance industry is accelerating, with insurers embracing technology to enhance the customer experience and streamline processes. Digital tools and platforms are being utilized for policy management, claims reporting, and even risk assessment.

Automation is expected to play a significant role in the future of home insurance, with the potential for automated claims processing, intelligent risk assessment algorithms, and real-time policy adjustments based on changing circumstances.

Telematics and Smart Home Integration

The integration of telematics and smart home technology is set to revolutionize home insurance. Telematics devices, which collect and analyze data about your home’s usage and performance, can provide valuable insights into risk factors and help personalize insurance policies.

Smart home devices, such as smart thermostats, security systems, and water leak detectors, can also enhance risk assessment and potentially lead to insurance discounts. Insurers are increasingly leveraging these technologies to offer more accurate and tailored coverage options.

Data-Driven Risk Assessment

The insurance industry is increasingly utilizing advanced data analytics and machine learning to assess risks more accurately. By analyzing vast amounts of data, insurers can identify patterns and trends, allowing for more precise risk profiling and pricing.

Data-driven risk assessment can lead to more efficient underwriting processes and the development of innovative insurance products that better meet the needs of policyholders.

Sustainable and Green Insurance

With growing environmental awareness, the insurance industry is exploring ways to promote sustainability and reward policyholders for eco-friendly practices. Sustainable insurance policies may offer incentives or discounts for homeowners who implement energy-efficient measures or adopt environmentally friendly home designs.

The future of home insurance is likely to see a greater focus on sustainability, with insurers playing a role in encouraging and supporting environmentally conscious choices.

Conclusion

Navigating the world of home insurance can be complex, but with the right knowledge and strategies, you can secure the best rates and comprehensive coverage for your home. By understanding the factors that influence insurance rates and exploring the various options available, you can make informed decisions and protect your most valuable asset effectively.

Remember to shop around, compare quotes, and optimize your policy to suit your needs. Stay informed about the latest trends and innovations in home insurance, as they can offer new opportunities for savings and improved coverage. With the right approach, you can find the best home insurance rates and rest easy knowing your home is protected.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually to ensure it remains up-to-date and aligned with your needs. Life circumstances can change, and it’s important to assess any home improvements, increased home value, or changes in personal belongings that may impact your coverage requirements.

Can I switch insurance providers to get better rates?

+Absolutely! Shopping around for home insurance