Home And Contents Insurance

In the complex landscape of financial protection, home and contents insurance stands as a cornerstone for countless individuals and families, offering a safety net against the unforeseen perils that life may bring. This comprehensive insurance policy safeguards not just the physical structure of one's home but also the cherished belongings within it, providing a sense of security and peace of mind. As we delve into the intricacies of home and contents insurance, we'll explore the vital components, the nuanced coverage options, and the real-world implications that make this a crucial consideration for homeowners.

Understanding the Fundamentals: What is Home and Contents Insurance?

Home and contents insurance is a specialized form of property insurance that provides financial protection for homeowners against a wide range of risks and potential losses. It’s designed to cover not only the physical structure of a house or dwelling but also the personal belongings, known as “contents,” that are typically found within it. This insurance policy acts as a safety net, offering coverage for a variety of perils, from natural disasters and accidents to theft and vandalism.

The primary objective of home and contents insurance is to offer homeowners a means to financially recover from unexpected events that could result in substantial damage or loss. This could include events like fires, floods, storms, or even break-ins. By having this insurance in place, homeowners can ensure that they have the financial support needed to repair or replace their home and its contents, helping them get back on their feet after a disaster.

However, it's important to note that home and contents insurance is a highly customizable form of coverage. The specific risks and perils covered can vary greatly depending on the policyholder's needs and the insurance provider. Some policies may offer comprehensive coverage, including protection against a wide range of potential disasters, while others may be more tailored to specific risks, such as flood or earthquake insurance.

The Essential Components of Home and Contents Insurance

A typical home and contents insurance policy is comprised of several key components, each designed to address a specific aspect of homeownership and the associated risks. These components often include:

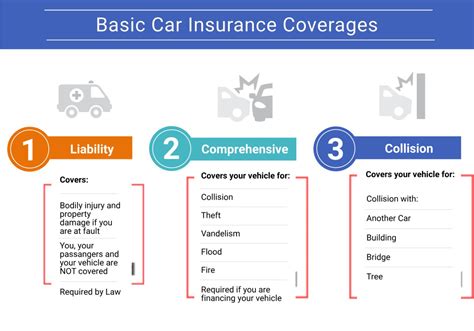

- Building Cover: This component provides financial protection for the physical structure of the home, including walls, roofs, floors, and any permanent fixtures. It covers the cost of repairing or rebuilding the home in the event of damage or destruction caused by an insured event.

- Contents Cover: Contents cover is a vital aspect of home insurance, as it protects the policyholder's personal belongings, such as furniture, electronics, clothing, and other items typically found in a home. This coverage ensures that the insured can replace or repair their possessions if they are damaged or stolen.

- Liability Cover: Liability insurance is an important feature of home and contents insurance, providing protection against claims made by third parties for injuries or property damage that occur on the insured property. This coverage can help cover legal costs and any compensation that may be awarded.

- Additional Coverages: Many home insurance policies offer optional additional coverages that can be tailored to the policyholder's specific needs. These might include cover for specific high-value items, cover for temporary accommodation if the home becomes uninhabitable, or even cover for events like theft of cash or identity theft.

Each of these components plays a crucial role in providing a comprehensive safety net for homeowners, ensuring that they are protected against a wide range of potential risks and losses. By understanding these components and how they work together, policyholders can make informed decisions about their home and contents insurance coverage, ensuring that they have the right level of protection for their specific needs.

Tailoring Coverage: Customizing Your Home and Contents Insurance

One of the most significant advantages of home and contents insurance is its adaptability, allowing policyholders to tailor their coverage to fit their unique needs and circumstances. This customization ensures that homeowners are not paying for coverage they don’t need, while also ensuring that they have adequate protection for the risks that are most relevant to their situation.

Assessing Your Risks and Needs

The first step in customizing your home and contents insurance is to assess the risks and needs specific to your home and your personal circumstances. This involves a careful evaluation of your home’s location, its construction, and any unique features or factors that could impact the potential risks you face. For instance, if your home is located in an area prone to natural disasters like floods or earthquakes, you’ll want to ensure that your policy includes coverage for these specific perils.

Additionally, it's important to consider your personal belongings and their value. Do you have valuable artwork, jewelry, or electronics that may require additional coverage? Are there any items that are particularly susceptible to damage or loss, such as fragile collectibles or expensive musical instruments? By identifying these specific risks and needs, you can ensure that your insurance policy is adequately tailored to provide the right level of protection.

Choosing the Right Level of Coverage

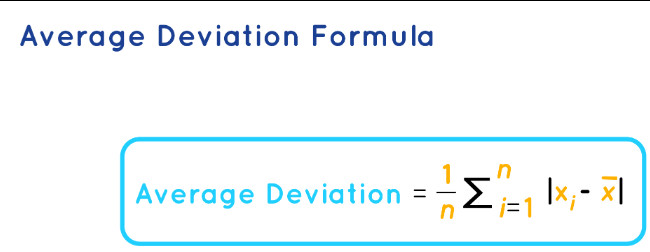

Once you’ve assessed your risks and needs, the next step is to choose the right level of coverage for your home and contents insurance. This involves deciding on the appropriate sum insured, which is the maximum amount your insurer will pay out in the event of a claim. The sum insured should be enough to cover the cost of rebuilding your home and replacing your contents if they were all lost in a single event.

It's important to note that choosing the right sum insured involves more than just estimating the current value of your home and contents. You also need to consider factors such as inflation and the potential cost of rebuilding or replacing items in the future. Working with an experienced insurance broker or advisor can be invaluable in this process, as they can help you navigate the complexities of choosing the right level of coverage and ensure that you have adequate protection without paying for unnecessary extras.

Adding Optional Coverages

In addition to the core components of home and contents insurance, many policies offer a range of optional coverages that can be added to provide more comprehensive protection. These optional coverages can be particularly useful for homeowners with unique circumstances or specific risks they want to mitigate.

- High-Value Item Cover: If you have valuable possessions, such as jewelry, artwork, or antiques, you may want to consider adding high-value item cover to your policy. This ensures that these items are adequately insured and can be replaced if they are lost or damaged.

- Temporary Accommodation Cover: In the event that your home becomes uninhabitable due to an insured event, temporary accommodation cover can provide financial support to cover the cost of staying elsewhere while your home is being repaired or rebuilt.

- Legal Liability Cover: This coverage provides protection against claims made by third parties for injuries or property damage that occur on your property. It can help cover legal costs and any compensation that may be awarded, providing an added layer of financial protection.

- Personal Accident Cover: Personal accident cover provides financial support in the event that you or a family member suffers an accident or injury, offering a means to cover medical expenses and other related costs.

By carefully considering your unique circumstances and the specific risks you face, you can choose the optional coverages that best meet your needs, ensuring that your home and contents insurance policy is truly tailored to provide the right level of protection.

Understanding Policy Terms and Conditions

While customizing your home and contents insurance to fit your specific needs is crucial, it’s equally important to understand the policy terms and conditions to ensure that you have a clear understanding of what is and isn’t covered. These terms and conditions outline the rights and responsibilities of both the insurer and the policyholder, providing a detailed framework for how the insurance policy operates.

Key Policy Terms to Understand

There are several key terms and conditions that are common to most home and contents insurance policies, and understanding these can be vital to ensuring that you have the right level of protection. These include:

- Sum Insured: As mentioned earlier, the sum insured is the maximum amount your insurer will pay out in the event of a claim. It's important to ensure that this amount is sufficient to cover the cost of rebuilding your home and replacing your contents, taking into account factors like inflation and future replacement costs.

- Exclusions: Exclusions are specific events or circumstances that are not covered by your insurance policy. These can vary greatly between policies, so it's crucial to carefully review the exclusions listed in your policy documentation to ensure that you're aware of any potential gaps in your coverage.

- Excess: The excess is the amount you, as the policyholder, are required to pay towards a claim. It's essentially a deductible that you must contribute before your insurer will pay out on a claim. Understanding the excess amount and how it applies to different types of claims is vital to managing your financial risk.

- Policy Period: The policy period is the duration for which your insurance policy is valid. It's important to ensure that your policy is renewed on time to avoid any gaps in coverage, as this could leave you exposed to financial risk in the event of a claim.

- Conditions Precedent: Conditions precedent are specific requirements or obligations that must be met in order for your insurance policy to be valid. These might include things like maintaining your home in a certain condition or taking reasonable steps to prevent loss or damage. Failing to meet these conditions could invalidate your policy, so it's important to understand and adhere to them.

By carefully reviewing and understanding these key policy terms and conditions, you can ensure that you have a clear picture of your coverage and the obligations that come with it. This understanding is vital to making informed decisions about your home and contents insurance and ensuring that you have the right level of protection for your specific needs.

Making a Claim: Navigating the Process

When an insured event occurs and you need to make a claim on your home and contents insurance policy, it’s important to understand the process and your responsibilities to ensure a smooth and efficient resolution. The claim process can vary slightly between insurance providers, but there are some key steps that are common to most policies.

Notifying Your Insurer

The first step in making a claim is to notify your insurance provider as soon as possible after the event. This notification should be made in writing, and it’s important to provide as much detail as possible about the event and the resulting damage or loss. Be sure to include any relevant photos or videos that can help illustrate the extent of the damage.

It's also important to take reasonable steps to prevent further damage or loss. For instance, if your home has been damaged by a storm and there is a risk of further water damage, you should take steps to mitigate this risk, such as covering any holes in the roof or boarding up broken windows. However, it's crucial to balance this with the need to preserve evidence of the original damage for your insurer.

Providing Supporting Documentation

Once you’ve notified your insurer, they will typically request supporting documentation to help assess your claim. This may include things like police reports, repair quotes, or receipts for any temporary repairs you’ve made. It’s important to provide this documentation as promptly as possible to help expedite the claim process.

If you have any high-value items that are covered by your policy, you may also be required to provide additional documentation, such as appraisals or valuations, to help establish the value of these items. This is particularly important if you're claiming for items like jewelry, artwork, or antiques, as their value can often be subjective.

Working with Your Insurer’s Assessor

Once your insurer has received your claim and supporting documentation, they will typically appoint an assessor to evaluate the damage and determine the extent of the insurer’s liability. The assessor will inspect the property and may request additional information or documentation to help inform their assessment.

It's important to cooperate fully with the assessor and provide any additional information they may request. This cooperation is vital to ensuring that your claim is assessed accurately and fairly. Be sure to keep a record of any communications with the assessor, including any recommendations or instructions they provide, to help ensure a smooth and efficient claim process.

Resolving Your Claim

Once the assessor has completed their evaluation and provided their report, your insurer will review the findings and make a decision on your claim. If your claim is approved, they will typically pay out the agreed amount, which may be subject to any applicable excess or policy limits. It’s important to understand the terms of your policy and any specific conditions that may apply to the payment of your claim.

If your claim is denied, your insurer will provide a written explanation of the reasons for the denial. In this case, it's important to carefully review the reasons provided and consider your options. You may wish to seek further advice or clarification from your insurer, or you may wish to pursue other avenues, such as mediation or legal action, depending on the circumstances.

By understanding the claim process and your responsibilities, you can help ensure that your claim is handled efficiently and effectively, providing the financial support you need to repair or replace your home and contents after an insured event.

Home and Contents Insurance in Practice: Real-World Examples

To better understand the practical applications and implications of home and contents insurance, let’s explore some real-world examples that illustrate how this insurance can provide vital financial protection for homeowners.

Case Study: Flood Damage

Imagine a homeowner, John, who lives in a low-lying area that is prone to flooding. Despite the risk, John hasn’t taken out flood insurance, assuming that his standard home and contents insurance policy will cover any flood-related damage. Unfortunately, a severe storm hits the area, causing widespread flooding that damages John’s home and many of his personal belongings.

When John makes a claim on his home and contents insurance policy, he discovers that his policy does not include coverage for flood damage. This exclusion leaves John financially exposed, as he must cover the cost of repairing his home and replacing his damaged belongings out of his own pocket. This could amount to tens of thousands of dollars, a substantial financial burden that John may struggle to manage.

This scenario highlights the importance of carefully reviewing the exclusions in your home and contents insurance policy and ensuring that you have the right level of coverage for the risks you face. In this case, John could have avoided significant financial loss by adding flood cover to his policy, ensuring that he had adequate protection against this specific risk.

Case Study: Theft and Vandalism

Now consider Sarah, a homeowner who lives in a relatively safe neighborhood and believes that her home is not at risk of theft or vandalism. As a result, she hasn’t added any additional coverages to her home and contents insurance policy to protect against these events.

Unfortunately, Sarah's home is broken into while she's on vacation, and the thieves make off with several valuable items, including her laptop, jewelry, and some antique furniture. The vandals also cause significant damage to the interior of her home, requiring extensive repairs.

When Sarah makes a claim on her home and contents insurance policy, she discovers that while her policy does cover the cost of repairing the damage caused by the vandals, it does not provide adequate coverage for the stolen items. The policy's limits for personal belongings are too low to fully replace the stolen items, leaving Sarah with a significant financial loss.

This scenario underscores the importance of assessing your unique risks and needs when customizing your home and contents insurance. By adding optional coverages, such as high-value item cover, Sarah could have ensured that she had adequate protection for her valuable possessions, even in the event of theft or vandalism.

Case Study: Storm Damage

In another example, let’s consider Mike, a homeowner who lives in an area that is prone to severe storms. Mike has carefully assessed his risks and chosen a home and contents insurance policy that includes coverage for storm damage, ensuring that he has adequate protection against this specific peril.

One day, a severe storm hits Mike's neighborhood, causing extensive damage to his home. The storm tears off part of his roof, shatters several windows, and damages his furniture and electronics. Fortunately, Mike's insurance policy covers all of these losses, providing him with the financial support he needs to repair his home and replace his damaged belongings.

This scenario illustrates the value of having a well-tailored home and contents insurance policy that provides comprehensive coverage for the risks you face. By choosing a policy that includes coverage for storm damage, Mike was able to protect himself against a significant financial loss, ensuring that he could quickly and efficiently repair his home and get back to normal life.

The Future of Home and Contents Insurance

As we look to the future, the landscape of home and contents insurance is likely to continue evolving, driven by advances in technology, changing consumer expectations, and the increasing prevalence of natural disasters and extreme weather events. These factors will shape the way home and contents insurance is offered, the risks it covers, and the ways in which it is delivered to policyholders.

Technological Advances

Technology is set to play an increasingly significant role in the future of home and contents insurance. Advances in data analytics and machine learning are already being used to improve risk assessment and pricing, helping insurers more accurately predict and manage the risks they insure. This can lead to more tailored and affordable insurance products for policyholders.

Additionally, the rise of smart home technology and the Internet of Things (IoT) is expected to have a significant impact on home and contents insurance. Smart home devices, such as connected security systems and smart sensors, can provide real-time data on the condition of a home, helping insurers to better understand and manage risks. This data can also be used to offer more personalized insurance products, providing policyholders with the right level of coverage for their specific needs.