Tax Credit For Health Insurance

In the United States, healthcare is a complex and often costly aspect of life. Many individuals and families rely on health insurance to access medical services, but the financial burden can be significant. To alleviate some of this financial strain, the government offers various tax incentives, including the Health Insurance Tax Credit, also known as the Premium Tax Credit. This credit aims to make healthcare more affordable and accessible for eligible individuals and families.

Understanding the Health Insurance Tax Credit

The Health Insurance Tax Credit is a provision under the Affordable Care Act (ACA) that provides a refundable tax credit to help individuals and families with low to moderate incomes afford their health insurance premiums. It is designed to assist those who may otherwise struggle to obtain or maintain coverage.

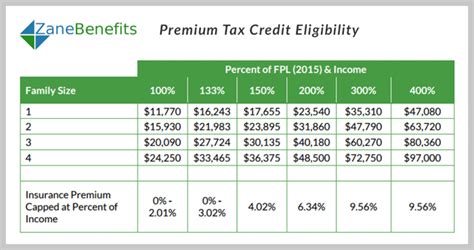

The credit is calculated based on a percentage of the applicable percentage of the premium for a Bronze plan available through the Health Insurance Marketplace (also known as the Health Insurance Exchange) in your state. This means that the credit amount can vary depending on your income, family size, and the cost of health insurance plans in your area.

Eligibility Criteria

To be eligible for the Health Insurance Tax Credit, individuals must meet certain criteria:

- You must be a U.S. citizen or a lawfully present resident.

- Your household income must fall within a specific range, typically between 100% and 400% of the federal poverty level. This range can vary slightly depending on your state and family size.

- You cannot be claimed as a dependent on someone else’s tax return.

- You must enroll in a qualified health plan through the Health Insurance Marketplace during the open enrollment period or a special enrollment period if you qualify.

How the Credit Works

The Health Insurance Tax Credit can be claimed in two ways:

- Advance Premium Tax Credit: This option allows you to receive the credit in advance, directly reducing your monthly premium payments. You can estimate your eligibility and the credit amount when you enroll in a health plan through the Marketplace. The advance credit is then paid directly to your insurance provider, lowering your monthly costs.

- Reconciliation at Tax Time: Alternatively, you can wait until you file your federal tax return to claim the credit. This is particularly useful if your income or household circumstances change during the year, affecting your eligibility. You will receive the full credit amount as a refund or reduction in your tax liability.

| Year | Applicable Percentage of Bronze Plan Premium |

|---|---|

| 2023 | 6.55% |

| 2022 | 3.00% |

| 2021 | 2.00% |

Maximizing Your Tax Credit

To ensure you receive the maximum benefit from the Health Insurance Tax Credit, consider the following strategies:

Estimate Your Eligibility

Before enrolling in a health plan, use the Health Insurance Marketplace’s tools to estimate your eligibility for the credit. This will help you choose a plan that aligns with your budget and coverage needs. The Marketplace’s calculator considers factors like your income, family size, and the cost of plans in your area to provide an accurate estimate.

Consider Your Income Fluctuations

If your income is likely to change significantly during the year, it may be more advantageous to claim the credit at tax time rather than in advance. This way, you can ensure you receive the full credit amount based on your final income for the year.

Review Your Coverage Annually

Health insurance plans and their costs can vary from year to year. Make sure to review your coverage options during the open enrollment period to find the plan that best suits your needs and maximizes your tax credit. Additionally, keep an eye on any special enrollment periods that may arise due to life events such as losing other health coverage or experiencing a change in household size.

Real-Life Example: Sarah’s Story

Let’s consider the case of Sarah, a single mother with two children living in a moderate-income household. Sarah enrolls in a Bronze health plan through the Health Insurance Marketplace, which typically costs 500 per month. With an annual income of 35,000, she is eligible for the Health Insurance Tax Credit.

By opting for the Advance Premium Tax Credit, Sarah's monthly premium is reduced to $150 (based on the applicable percentage of 6.55% for 2023). This means she saves $350 per month, making healthcare more affordable for her family. The credit amount is automatically applied to her insurance bill each month, providing immediate relief.

Performance Analysis and Impact

The Health Insurance Tax Credit has had a significant impact on improving access to healthcare for millions of Americans. According to the Centers for Medicare & Medicaid Services (CMS), in 2022, approximately 12.8 million people received financial assistance through the Marketplace, with an average tax credit of $557 per month. This assistance has helped individuals and families obtain coverage, leading to improved health outcomes and reduced financial strain.

Furthermore, the credit has encouraged enrollment in the Marketplace, contributing to a more diverse and robust insurance pool. This, in turn, has helped stabilize premiums and enhance the overall affordability of healthcare plans.

Future Implications and Considerations

The future of the Health Insurance Tax Credit remains tied to the continued implementation of the Affordable Care Act. As the ACA is subject to ongoing political and legal debates, the long-term stability of the credit may be uncertain. However, the credit’s success in expanding healthcare access and improving financial security for millions of Americans underscores its importance and potential for further development.

As healthcare costs continue to rise, ensuring the availability and accessibility of tax credits like the Health Insurance Tax Credit will be crucial in helping individuals and families navigate the complexities of healthcare financing.

Frequently Asked Questions

Can I receive the Health Insurance Tax Credit if I have other health coverage, such as employer-provided insurance?

+No, the Health Insurance Tax Credit is intended for individuals and families who do not have access to other affordable health coverage options. If you have employer-provided insurance or are covered by another plan, you may not be eligible for the credit.

How often do the eligibility criteria and applicable percentages change for the Health Insurance Tax Credit?

+The eligibility criteria and applicable percentages for the Health Insurance Tax Credit can change annually. These changes are typically based on adjustments to the federal poverty level and policy decisions. It’s important to stay updated with the latest guidelines to ensure accurate eligibility assessment.

Can I use the Health Insurance Tax Credit to purchase any type of health insurance plan, or are there restrictions?

+The Health Insurance Tax Credit can be used to purchase qualified health plans offered through the Health Insurance Marketplace. These plans must meet certain standards, including providing essential health benefits. The credit cannot be applied to other types of insurance, such as short-term plans or catastrophic coverage.