Dental Health Insurance Plans

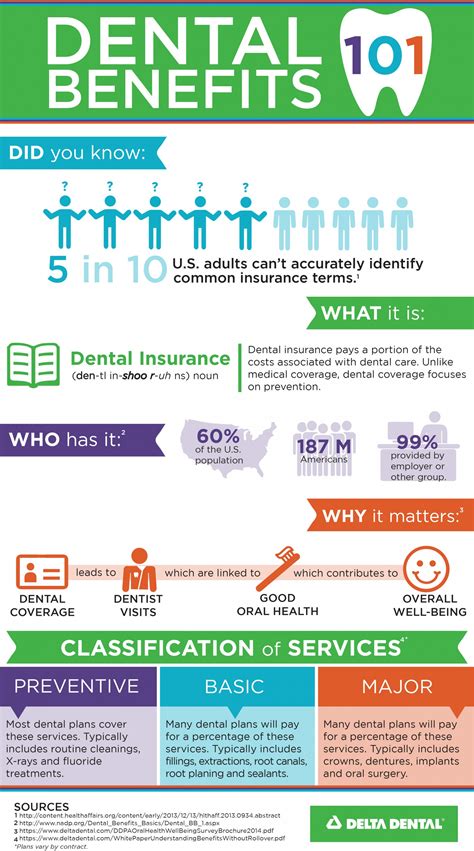

Dental health is an often-overlooked aspect of overall well-being, yet it plays a crucial role in maintaining good physical health and self-esteem. A healthy smile not only boosts confidence but also contributes to the prevention of various systemic health issues. This is where dental health insurance plans step in, offering comprehensive coverage to ensure individuals and families can access necessary dental care without financial strain.

Understanding Dental Health Insurance Plans

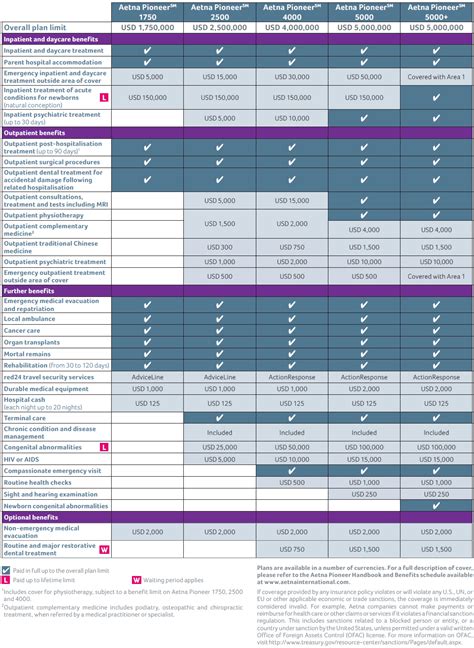

Dental health insurance plans are designed to provide coverage for a range of dental services, from routine check-ups and cleanings to more complex procedures like root canals and orthodontic treatments. These plans vary widely, with different levels of coverage, premiums, and deductibles. Understanding the intricacies of dental insurance is key to making informed choices and maximizing the benefits of these plans.

Coverage and Benefits

Dental insurance plans typically cover preventive care, such as dental exams, X-rays, and professional cleanings, at 100%. This encourages regular check-ups, which are essential for early detection and treatment of dental issues. Additionally, many plans offer partial coverage for basic services like fillings, extractions, and root canals, and some even extend to more advanced treatments like crowns, bridges, and implants.

One unique aspect of dental insurance is the inclusion of orthodontic benefits. These benefits can provide significant financial relief for those requiring braces or other orthodontic treatments. The level of coverage for orthodontics varies between plans, but it is a valuable addition for families with children or adults seeking orthodontic care.

Dental plans often feature a preferred provider network, which is a group of dentists and specialists who have agreed to provide services at a discounted rate. Choosing an in-network provider can result in lower out-of-pocket costs, making dental care more accessible and affordable.

| Dental Service | Average Coverage Percentage |

|---|---|

| Preventive Care (Cleanings, Exams) | 100% |

| Basic Restorative Care (Fillings, Extractions) | 50-80% |

| Major Restorative Care (Crowns, Bridges) | 50% |

| Orthodontic Treatments | 40-50% |

Choosing the Right Plan

Selecting the appropriate dental health insurance plan involves considering several factors, including individual dental needs, family requirements, and budget. Here are some key considerations:

- Coverage Needs: Assess your current and potential future dental needs. If you or your family members require extensive dental work, a plan with higher coverage limits and lower deductibles might be preferable. On the other hand, for those with primarily preventive care needs, a plan with lower premiums and higher coverage for basic services could be a better fit.

- Provider Network: Check the network of dentists and specialists included in the plan. Ensure that your preferred dental professionals are in-network to minimize out-of-pocket expenses. If you or your family members have specific needs, such as pediatric dentistry or specialized treatments, verify that the plan covers these services.

- Additional Benefits: Some dental plans offer added perks like vision or hearing care benefits, or even discounts on dental products. While these additional benefits might not be a deciding factor, they can provide extra value and savings.

- Cost: Compare the premiums, deductibles, and out-of-pocket maximums to find a plan that fits your budget. Remember, a higher premium might indicate more comprehensive coverage, but it's essential to balance cost with your actual dental needs.

The Impact of Dental Insurance

Dental health insurance plans have a significant impact on the accessibility and affordability of dental care. By covering a range of services, these plans encourage regular dental check-ups, which are vital for maintaining good oral health. Early detection and treatment of dental issues can prevent more serious and costly problems down the line.

Moreover, dental insurance plays a crucial role in promoting oral health equity. It ensures that individuals from all socioeconomic backgrounds can access necessary dental care, thereby reducing the disparities in oral health outcomes. This is especially important for children and vulnerable populations, as good oral health in childhood sets the foundation for a lifetime of healthy habits and overall well-being.

Conclusion: The Bright Smile Advantage

Dental health insurance plans offer a spectrum of benefits, from preventive care to specialized treatments, ensuring that individuals and families can maintain optimal oral health. By understanding the coverage options and choosing the right plan, you can take control of your dental health and enjoy the confidence that comes with a bright, healthy smile.

Frequently Asked Questions

How often should I see a dentist, even with dental insurance?

+It is generally recommended to visit a dentist every six months for a check-up and cleaning, regardless of having dental insurance. This allows for early detection of any potential issues and helps maintain optimal oral health. Dental insurance plans typically cover these preventive visits at 100%, making regular check-ups an affordable and beneficial practice.

Can I use my dental insurance for emergency dental treatments?

+Yes, dental insurance plans often cover emergency dental treatments. However, the coverage may vary depending on the plan and the specific emergency. It’s advisable to review your policy details to understand the extent of coverage for emergency care. Additionally, some plans might require pre-authorization for certain emergency procedures, so it’s beneficial to contact your insurance provider in case of an emergency.

Are there any limitations or exclusions in dental insurance plans?

+Yes, dental insurance plans typically have certain limitations and exclusions. These can include specific procedures, such as cosmetic dentistry, or certain conditions, like pre-existing dental issues. It’s crucial to review the plan’s details and exclusions carefully to understand what is and isn’t covered. Being aware of these limitations can help manage expectations and financial planning for dental care.