Aetna Insurance Plans Health Coverage

Aetna is a well-known name in the health insurance industry, offering a range of plans to cater to diverse healthcare needs. With a rich history spanning over a century, Aetna has established itself as a trusted provider, continuously evolving to meet the changing demands of healthcare coverage. This article aims to delve into the world of Aetna insurance plans, exploring the various health coverage options they offer, the benefits they provide, and the factors to consider when choosing an Aetna plan.

Understanding Aetna’s Health Insurance Plans

Aetna’s health insurance plans are designed to offer comprehensive coverage, ensuring individuals and families have access to the medical care they need. These plans cover a wide range of services, from routine check-ups and preventive care to specialized treatments and prescription medications. By partnering with a vast network of healthcare providers, Aetna aims to provide its members with convenient and cost-effective healthcare solutions.

Aetna’s Plan Options

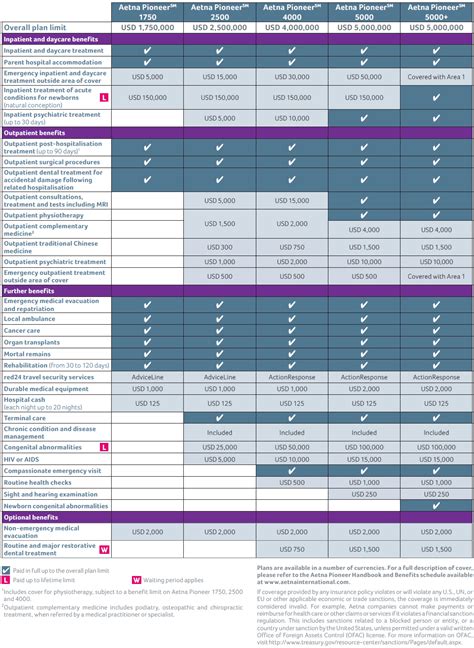

Aetna offers a variety of health insurance plans, each tailored to suit different lifestyles and healthcare requirements. Here’s an overview of the key plan types:

- Individual Plans: These plans are designed for single individuals seeking personalized coverage. Aetna’s individual plans offer flexibility and the ability to customize coverage to match specific health needs.

- Family Plans: Tailored for families, these plans provide comprehensive coverage for multiple members under one policy. Aetna’s family plans often include pediatric dental and vision coverage, ensuring the well-being of children.

- Senior Plans: As individuals age, their healthcare needs evolve. Aetna’s senior plans, often referred to as Medicare Advantage plans, are tailored to meet the unique requirements of older adults. These plans offer additional benefits beyond traditional Medicare coverage.

- Group Plans: Many employers offer Aetna health insurance plans as part of their employee benefits package. Group plans provide coverage for a company’s workforce and often come with additional perks and discounts.

Each of these plan types comes with a range of options, allowing individuals to choose the level of coverage and benefits that best suit their needs and budget.

Benefits of Aetna Health Insurance Plans

Aetna’s health insurance plans offer a multitude of benefits, making them a popular choice for individuals and families seeking comprehensive healthcare coverage. Here are some key advantages:

- Comprehensive Coverage: Aetna plans cover a wide range of healthcare services, including doctor visits, hospital stays, prescription medications, and specialty care. This ensures individuals have access to the necessary medical treatments without financial strain.

- Preventive Care: Many Aetna plans prioritize preventive care, offering coverage for annual check-ups, screenings, and immunizations. By focusing on prevention, these plans aim to catch health issues early, potentially reducing the need for costly treatments down the line.

- Dental and Vision Coverage: Some Aetna plans include dental and vision benefits, providing coverage for routine dental check-ups, eye exams, and corrective lenses. This comprehensive approach ensures overall health and well-being.

- Prescription Drug Coverage: With a vast network of pharmacies, Aetna plans offer coverage for prescription medications, making it easier for individuals to manage chronic conditions or acute illnesses.

- Wellness Programs: Aetna encourages a healthy lifestyle through various wellness programs. These programs often include discounts on gym memberships, weight loss programs, and smoking cessation resources, promoting overall health and well-being.

Factors to Consider When Choosing an Aetna Plan

When evaluating Aetna’s health insurance plans, there are several key factors to consider to ensure you choose the plan that best suits your needs:

- Coverage Options: Review the specific coverage offered by each plan. Consider your current and potential future healthcare needs, including any ongoing medical conditions or anticipated treatments.

- Network of Providers: Aetna partners with a vast network of healthcare providers. Ensure that your preferred doctors, specialists, and hospitals are included in the plan’s network to avoid out-of-network costs.

- Cost and Deductibles: Evaluate the monthly premiums, deductibles, and out-of-pocket expenses associated with each plan. Consider your budget and whether you prefer a lower monthly premium with higher out-of-pocket costs or vice versa.

- Benefit Limitations: Carefully read the plan’s summary of benefits and coverage to understand any limitations or exclusions. Ensure that the plan covers the specific services you may require.

- Additional Benefits: Look beyond basic coverage and consider any additional benefits offered by the plan, such as wellness programs, telemedicine services, or coverage for alternative therapies.

Personalized Plan Comparison

To assist in your decision-making process, Aetna provides online tools and resources to compare different plan options. These tools allow you to input your specific healthcare needs and preferences, generating a personalized plan comparison. By utilizing these resources, you can make an informed choice that aligns with your health and financial goals.

The Impact of Aetna’s Health Insurance Plans

Aetna’s health insurance plans have a significant impact on the lives of individuals and families, providing peace of mind and access to quality healthcare. By offering comprehensive coverage and prioritizing preventive care, Aetna aims to improve overall health outcomes and reduce the financial burden associated with medical treatments.

Furthermore, Aetna's commitment to innovation and technological advancements has enhanced the overall healthcare experience. Their digital platforms and mobile apps provide members with convenient access to their health records, claim status, and healthcare providers, making managing healthcare more efficient and streamlined.

Aetna’s Commitment to Community Health

Beyond individual health coverage, Aetna actively contributes to community health initiatives. Through partnerships with non-profit organizations and community-based programs, Aetna aims to improve access to healthcare and promote health education in underserved areas. This commitment to community well-being aligns with Aetna’s mission to make healthcare more accessible and affordable for all.

Conclusion

Aetna’s health insurance plans offer a comprehensive approach to healthcare coverage, catering to a diverse range of individuals and families. With a focus on preventive care, a vast network of providers, and innovative digital tools, Aetna strives to make healthcare more manageable and affordable. By carefully evaluating your healthcare needs and utilizing Aetna’s resources, you can find a plan that provides the coverage and benefits you require, ensuring your health and well-being are prioritized.

What is the difference between Aetna’s individual and family plans?

+Aetna’s individual plans are tailored for single individuals, offering personalized coverage options. In contrast, family plans are designed to cover multiple members, often including pediatric dental and vision benefits.

How can I determine if my preferred healthcare providers are in Aetna’s network?

+You can easily check the network of providers for each plan by using Aetna’s online tools or contacting their customer support. This ensures you have access to your preferred doctors and specialists without incurring out-of-network costs.

Are there any discounts or perks associated with Aetna’s group plans through my employer?

+Group plans often come with additional benefits and discounts, including reduced premiums and access to exclusive wellness programs. These perks vary depending on the employer’s partnership with Aetna.