Home And Auto Insurance Florida

The Sunshine State, Florida, is known for its vibrant culture, stunning beaches, and unique natural landscapes. However, living in this paradise comes with its own set of challenges, primarily due to the state's susceptibility to various weather-related events and natural disasters. This makes insurance an essential aspect of life for Floridians, with home and auto insurance policies playing a crucial role in protecting residents' financial well-being.

In this comprehensive guide, we will delve into the world of home and auto insurance in Florida, exploring the specific considerations, unique challenges, and best practices to ensure that you, as a Florida resident, are adequately protected. From understanding the state's insurance landscape to navigating the complexities of policy coverage, we will provide you with the knowledge and insights needed to make informed decisions.

Understanding the Florida Insurance Landscape

Florida's insurance market is unique and complex, shaped by the state's geographical location and its vulnerability to hurricanes, floods, and other natural calamities. This distinct environment influences the types of insurance policies available, the coverage options, and the overall cost of insurance.

The Role of Natural Disasters

Florida's susceptibility to natural disasters is a significant factor in its insurance landscape. Hurricanes, in particular, pose a constant threat to the state, often resulting in extensive property damage. This vulnerability has led to a higher demand for comprehensive insurance coverage, especially for homeowners.

According to the Insurance Information Institute, Florida consistently ranks among the top states for insurance claims related to natural disasters. In 2022 alone, the state witnessed several significant weather events, including Hurricane Ian, which caused an estimated $50-$60 billion in damages.

| Year | Significant Weather Events in Florida |

|---|---|

| 2022 | Hurricane Ian, Hurricane Nicole |

| 2021 | Hurricane Elsa, Tropical Storm Eta |

| 2020 | Hurricane Eta, Hurricane Zeta |

The Cost of Insurance in Florida

The high risk associated with natural disasters in Florida often translates to higher insurance premiums. According to the National Association of Insurance Commissioners, Florida ranks among the top states for average homeowners' insurance premiums, with an annual cost of approximately $1,975 (2021 data). This is significantly higher than the national average of $1,312.

Similarly, auto insurance premiums in Florida are among the highest in the nation. The average cost of car insurance in the state is approximately $2,197 per year (2021 data), more than double the national average of $1,000.

Home Insurance in Florida: A Comprehensive Guide

Home insurance is a critical aspect of protecting your investment and financial stability in Florida. Given the state's unique challenges, it's essential to understand the key components of home insurance policies and how they can safeguard you and your property.

Understanding Home Insurance Policies

Home insurance policies in Florida typically cover a range of perils, including fire, lightning, windstorms, and theft. However, it's important to note that not all policies are created equal, and the coverage can vary significantly depending on the provider and the specific policy.

Key components of a standard home insurance policy in Florida often include:

- Dwelling Coverage: Protects the structure of your home, including the walls, roof, and foundation, against covered perils.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, such as furniture, electronics, and clothing, in the event of damage or loss.

- Liability Coverage: Provides financial protection if you are held legally responsible for another person's injury or property damage that occurs on your property.

- Additional Living Expenses: Covers the cost of temporary housing and other necessary expenses if your home becomes uninhabitable due to a covered loss.

Unique Considerations for Florida Homeowners

Florida homeowners face unique challenges that require specialized coverage. Here are some key considerations:

Hurricane Coverage

Given Florida's vulnerability to hurricanes, it's crucial to have adequate hurricane coverage. This typically involves two parts: hurricane deductibles and windstorm coverage.

- Hurricane Deductibles: These are separate deductibles that apply specifically to hurricane-related damage. They can be a set dollar amount or a percentage of the home's insured value.

- Windstorm Coverage: This coverage protects against damage caused by high winds, including hurricanes and tropical storms. It is often a mandatory component of home insurance policies in Florida.

Flood Insurance

Standard home insurance policies in Florida typically do not cover flood damage. This is especially important to note as Florida is susceptible to flooding due to its low-lying coastal areas and frequent heavy rainfall. Flood insurance is available through the National Flood Insurance Program (NFIP) and private insurers.

Sinkhole Coverage

Florida is one of the states most susceptible to sinkholes due to its unique geology. Sinkhole coverage can be added to your home insurance policy to provide protection against damage caused by sinkholes.

Auto Insurance in Florida: Navigating the Essentials

Auto insurance is a legal requirement for all drivers in Florida, and it plays a crucial role in protecting you and your vehicle in the event of an accident or other road-related incidents. Understanding the key aspects of auto insurance in Florida is essential to ensure you have the right coverage.

Florida's Auto Insurance Requirements

Florida is a no-fault state, which means that, in the event of an accident, each driver's insurance company pays for their respective damages and injuries up to the policy limits, regardless of who caused the accident.

The minimum auto insurance requirements in Florida are:

- Personal Injury Protection (PIP): Covers medical expenses and a portion of lost wages for the policyholder and their passengers, regardless of fault.

- Property Damage Liability: Covers damage to others' property caused by the policyholder.

While these are the minimum requirements, it's generally recommended to have higher coverage limits to ensure adequate protection.

Additional Auto Insurance Coverage Options

Beyond the minimum requirements, there are several additional coverage options available to Florida drivers. These include:

- Collision Coverage: Covers damage to your vehicle in the event of an accident, regardless of fault.

- Comprehensive Coverage: Provides protection against damage caused by non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Rental Car Reimbursement: Covers the cost of renting a vehicle if your car is being repaired due to a covered loss.

Tips for Finding the Right Home and Auto Insurance in Florida

Given the unique challenges of the Florida insurance landscape, finding the right home and auto insurance policies can be a complex task. Here are some tips to guide you in making informed decisions:

Shop Around and Compare Policies

Insurance rates can vary significantly between providers, so it's essential to shop around and compare policies. Get quotes from multiple insurers to find the best combination of coverage and cost.

Understand Your Coverage Needs

Take the time to understand your specific coverage needs. Consider factors such as the value of your home and personal belongings, the age and condition of your vehicle, and your personal risk tolerance. Tailor your insurance coverage to your unique circumstances.

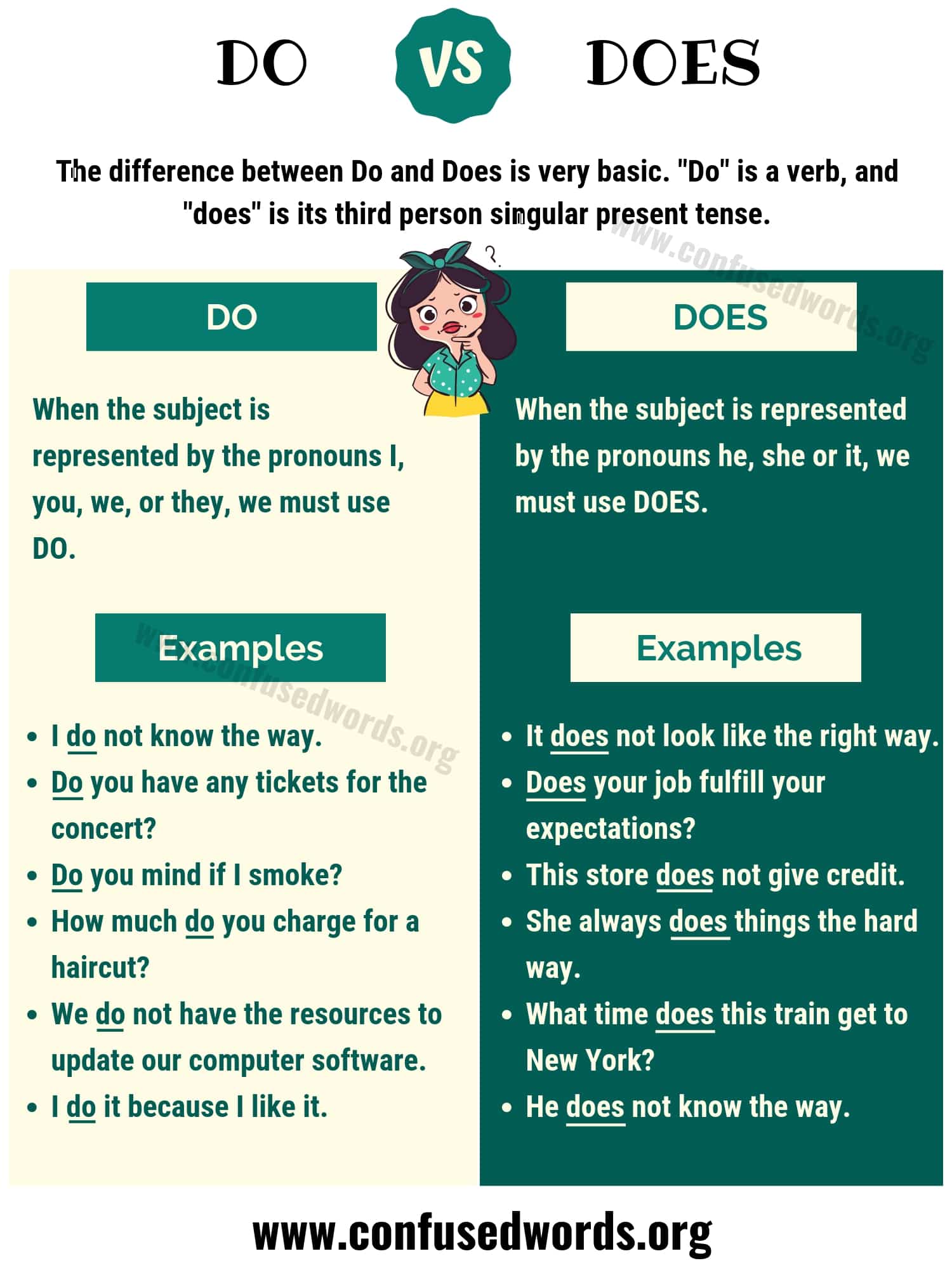

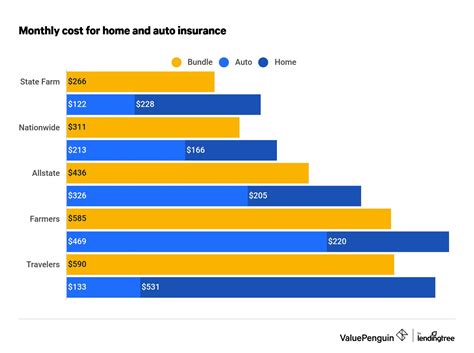

Consider Bundling Your Policies

Many insurance companies offer discounts when you bundle your home and auto insurance policies together. This can be a cost-effective way to save on your insurance premiums while ensuring you have comprehensive coverage.

Review Your Policies Regularly

Your insurance needs may change over time, so it's important to review your policies annually. Ensure that your coverage limits and deductibles are still appropriate for your current circumstances.

Work with a Trusted Insurance Agent

Consider working with a reputable insurance agent who understands the Florida market. They can provide expert guidance and help you navigate the complexities of home and auto insurance, ensuring you have the right coverage at a competitive price.

FAQ

What is the average cost of home insurance in Florida?

+The average cost of home insurance in Florida is approximately $1,975 per year. However, this can vary significantly depending on factors such as the location, size, and age of your home, as well as your chosen coverage limits and deductibles.

Are flood and hurricane coverage mandatory in Florida?

+Flood coverage is not mandatory in Florida, but it is highly recommended given the state's susceptibility to flooding. Hurricane coverage, including windstorm coverage and hurricane deductibles, is often a mandatory component of home insurance policies in Florida.

What are the minimum auto insurance requirements in Florida?

+The minimum auto insurance requirements in Florida are Personal Injury Protection (PIP) and Property Damage Liability. However, it's generally recommended to have higher coverage limits to ensure adequate protection.

Can I get a discount on my insurance by bundling home and auto policies?

+Yes, many insurance companies offer discounts when you bundle your home and auto insurance policies together. This can be a cost-effective way to save on your insurance premiums while ensuring you have comprehensive coverage.

Living in the beautiful state of Florida comes with its own set of challenges, and insurance is a crucial aspect of protecting your financial well-being. By understanding the unique insurance landscape in Florida and the key components of home and auto insurance policies, you can make informed decisions to ensure you have the right coverage.

Remember to regularly review your policies, shop around for the best deals, and work with trusted insurance professionals who can guide you through the complexities of the Florida insurance market. With the right insurance coverage, you can enjoy the Sunshine State with peace of mind.