Health Insurance For Students Over 26

Health insurance is a crucial aspect of our lives, ensuring we have access to quality healthcare services when needed. For students, having comprehensive health coverage becomes even more important as they navigate through their academic journey and beyond. However, the question arises: what happens when students turn 26 and are no longer eligible for their parents' health insurance plans? This article aims to provide an in-depth analysis of the options and considerations for students over 26 regarding their health insurance coverage.

Understanding the Age-Related Changes in Health Insurance

In many countries, including the United States, health insurance plans often cover dependents, such as children, up to a certain age. Traditionally, this age limit has been 26 years, allowing students to remain on their parents’ insurance plans until they complete their education and establish financial independence.

However, as students approach this milestone, they must start planning for their transition into independent health insurance coverage. This transition can be daunting, especially for those who are unfamiliar with the intricacies of the healthcare system and insurance options available to them.

Exploring Student-Friendly Health Insurance Options

For students over 26, several health insurance options are worth considering. Understanding these options and their unique features is essential to making an informed decision.

1. Individual Market Plans

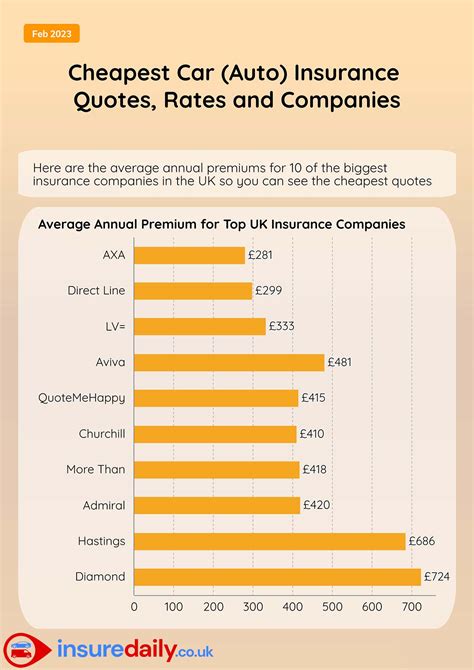

One of the most common paths for students is to explore individual market health insurance plans. These plans are offered by private insurance companies and can be purchased directly by the student. The Affordable Care Act (ACA) has made it easier for individuals to obtain coverage, with subsidies and tax credits available for those who qualify based on their income.

When shopping for individual plans, students should consider their healthcare needs, such as chronic conditions or the need for specialized treatments. Plans can vary significantly in terms of coverage, deductibles, and out-of-pocket costs. It is advisable to compare different providers and plans to find the best fit for their specific requirements.

2. Employer-Sponsored Plans

If a student is employed, they may have the option to enroll in their employer’s health insurance plan. Many companies offer comprehensive benefits packages that include healthcare coverage. These plans often provide a good balance between cost and coverage, making them an attractive option for students who are working part-time or full-time.

However, it's important to note that not all employers offer health insurance, and some may have eligibility requirements or waiting periods before employees can enroll. Students should carefully review the details of their employment contracts and discuss their options with their employers.

3. Short-Term Plans

For students who are between jobs, transitioning to a new plan, or simply need temporary coverage, short-term health insurance plans can be a viable option. These plans offer more limited coverage and typically have shorter durations, ranging from a few months to a year. While they may not provide the same level of comprehensive benefits as other plans, they can be a cost-effective solution for students in need of immediate coverage.

It is crucial to read the fine print of short-term plans, as they often have exclusions and limitations. Students should ensure they understand the coverage details and any potential gaps before enrolling.

4. Government-Sponsored Programs

Depending on their income and eligibility criteria, students over 26 may qualify for government-sponsored health insurance programs. These programs aim to provide coverage for individuals who cannot afford private insurance or do not have access to employer-sponsored plans.

In the United States, for example, the Medicaid program offers health coverage for low-income individuals and families. Additionally, the Children's Health Insurance Program (CHIP) provides coverage for children and, in some states, young adults up to the age of 26. Students should research their state's specific programs and eligibility requirements to determine if they qualify.

Factors to Consider When Choosing Health Insurance

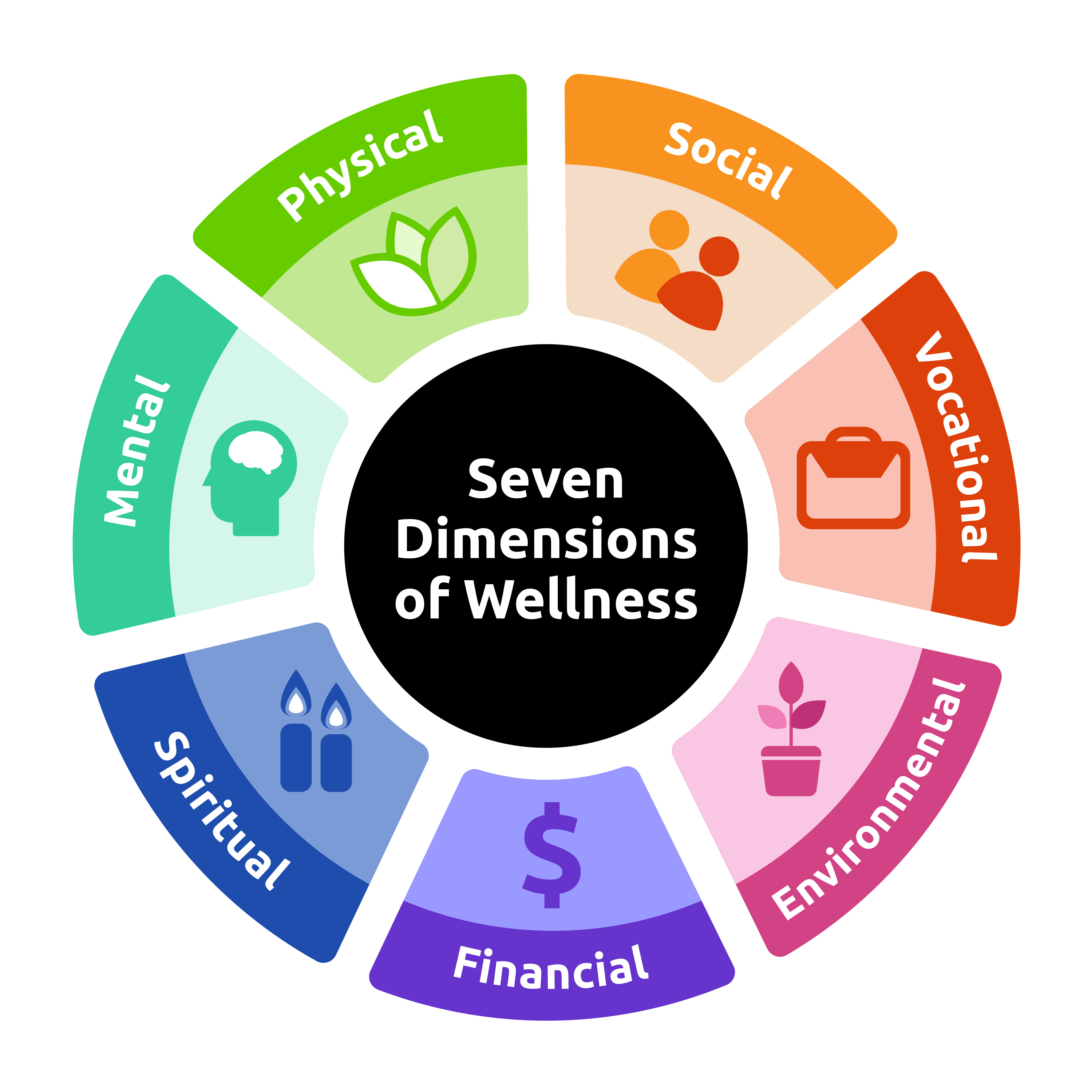

When selecting a health insurance plan, students should carefully evaluate several factors to make an informed decision. These considerations can significantly impact their overall healthcare experience and financial well-being.

1. Cost and Coverage

One of the primary concerns for students is the cost of health insurance. Plans can vary greatly in terms of premiums, deductibles, copayments, and out-of-pocket maximums. Students should assess their budget and determine the level of coverage they require. While it may be tempting to opt for a cheaper plan, it’s crucial to ensure that it aligns with their healthcare needs and doesn’t leave them vulnerable to unexpected expenses.

2. Network and Provider Options

Health insurance plans often have networks of preferred providers, including doctors, hospitals, and specialists. Students should review the network to ensure that their preferred healthcare professionals are included. If they have specific healthcare needs or require ongoing treatment, accessing their usual providers can be crucial.

Additionally, students should consider the availability of providers in their area. Some plans may have a limited network, which could require them to travel further for medical services.

3. Prescription Drug Coverage

For students who rely on prescription medications, prescription drug coverage is an essential aspect of their health insurance plan. Students should carefully review the formulary (list of covered drugs) to ensure that their medications are included. If they require specialized or costly medications, they may need to choose a plan that offers comprehensive drug coverage.

4. Mental Health and Substance Abuse Coverage

Mental health and substance abuse coverage are becoming increasingly important considerations in health insurance plans. Students, especially those facing academic and personal challenges, may benefit from having access to mental health services and addiction treatment. Plans vary in their coverage for these services, so students should review the details to ensure they have adequate support.

Navigating the Enrollment Process

Once students have identified their preferred health insurance option, they must navigate the enrollment process. This process can vary depending on the type of plan and the provider.

For individual market plans, students can typically enroll directly through the insurance company's website or by contacting their customer service. They may need to provide personal information, such as their social security number, date of birth, and income details. It's important to gather all the necessary documents and information before starting the enrollment process to ensure a smooth experience.

If a student is enrolling in an employer-sponsored plan, the process may be simpler, as the employer often facilitates the enrollment. Students should familiarize themselves with the open enrollment period and any required paperwork.

For government-sponsored programs, the enrollment process may involve completing an application and providing supporting documentation to prove eligibility. Students should refer to the specific program's guidelines and deadlines to ensure they meet all the requirements.

Understanding Your Rights and Responsibilities

As a student navigating the world of health insurance, it’s essential to understand your rights and responsibilities. Familiarizing yourself with the healthcare system and your insurance plan can help you make the most of your coverage and avoid potential pitfalls.

1. Pre-Existing Conditions

Under the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. This means that students with chronic illnesses or previous medical conditions should not face discrimination when applying for health insurance. However, it’s crucial to review the plan’s specifics to understand how pre-existing conditions are managed and whether there are any waiting periods for coverage.

2. Preventive Care

Most health insurance plans are required to cover preventive care services without any cost-sharing. This includes vaccinations, screenings, and regular check-ups. Students should take advantage of these services to maintain their health and catch any potential issues early on. By staying up-to-date with preventive care, students can avoid more significant health problems down the line.

3. Understanding Your Plan’s Benefits

To make the most of your health insurance coverage, it’s vital to understand the benefits and limitations of your plan. This includes knowing your coverage limits, deductibles, and any exclusions. Reading the plan’s summary of benefits and coverage document can provide valuable insights. Additionally, reaching out to the insurance company’s customer service can help clarify any doubts or concerns you may have.

4. Claiming and Appeal Processes

In the event of a medical emergency or significant healthcare expense, students should be aware of the claiming and appeal processes. Understanding how to submit claims and navigate the billing process can ensure that you receive the coverage you are entitled to. If there are any disputes or denials, knowing your rights and the appeal process can be crucial in resolving the issue.

Staying Informed and Adapting to Changes

The healthcare landscape is dynamic, and health insurance options can evolve over time. Staying informed about changes in policies, plans, and coverage options is essential for students to make informed decisions. Regularly reviewing and comparing plans can help students identify new opportunities or better-suited options as their needs change.

Additionally, students should stay updated on any legislative changes or healthcare reforms that may impact their insurance coverage. Keeping an eye on industry news and following reputable healthcare sources can provide valuable insights.

Conclusion: Taking Control of Your Health Insurance Journey

Transitioning from dependent to independent health insurance coverage can be a significant milestone for students over 26. By exploring the various options available, considering their specific needs, and understanding their rights and responsibilities, students can take control of their health insurance journey. It may seem overwhelming at first, but with careful research and planning, students can secure comprehensive and affordable health insurance coverage to support their well-being during their academic pursuits and beyond.

Can I stay on my parents’ insurance plan if I’m a full-time student over 26?

+Unfortunately, most insurance plans only cover dependents up to the age of 26, regardless of their student status. However, some plans may offer extensions for full-time students, so it’s worth checking with your specific provider.

What if I can’t afford the premiums for individual market plans?

+If you have a low income, you may qualify for subsidies or tax credits under the Affordable Care Act. These financial aids can help reduce the cost of your premiums, making health insurance more affordable. It’s worth exploring these options to find a plan that fits your budget.

Are there any special considerations for international students over 26?

+International students may face unique challenges when it comes to health insurance. Some countries require international students to have adequate coverage, so it’s essential to research the specific requirements for your destination. Additionally, some student visa programs may offer insurance options tailored to international students.

Can I switch health insurance plans during the year if I find a better option?

+Generally, health insurance plans have specific enrollment periods, and switching outside of these periods can be challenging. However, certain life events, such as losing your job or getting married, may qualify you for a special enrollment period. It’s best to review your plan’s guidelines and consult with the insurance company to understand your options.