How Can I Reduce My Car Insurance

If you're looking to lower your car insurance premiums, there are several strategies you can employ. The cost of car insurance can vary significantly based on various factors, including your driving record, the type of vehicle you own, and the insurance provider you choose. By understanding these factors and implementing some practical measures, you can potentially reduce your insurance costs without compromising on coverage.

Assess Your Current Coverage and Needs

Start by reviewing your existing car insurance policy. Ensure you understand the coverage you have, including liability, collision, comprehensive, and any additional optional coverages like rental car reimbursement or roadside assistance. Assess if your current coverage aligns with your needs and if there are any unnecessary features you can remove to lower your premium.

Consider your driving habits and the likelihood of accidents or claims. If you have a clean driving record and a low risk profile, you may be able to opt for higher deductibles, which can reduce your premium. However, ensure you choose deductibles that you can afford in case of an accident.

Tips for Policy Review:

- Examine the coverage limits and ensure they are adequate for your needs. Higher limits provide better protection but can also increase your premium.

- Evaluate the value of your vehicle. If your car is older and less valuable, you might consider dropping collision and comprehensive coverage, especially if the premium exceeds the value of the car.

- Check for discounts. Many insurance companies offer discounts for safe driving, multiple policies, good student grades, and more. Ensure you’re taking advantage of all applicable discounts.

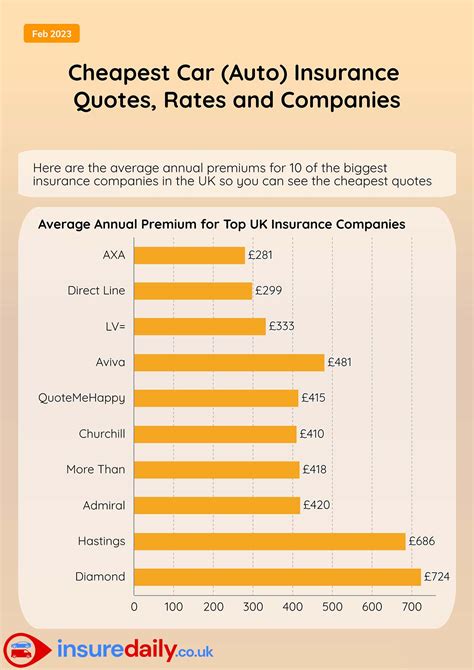

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Car insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Use online quote comparison tools or contact multiple insurance companies to get a sense of the market rates for your specific situation.

When comparing quotes, ensure you're comparing similar coverage levels and deductibles. This will give you an accurate understanding of the true cost differences between providers. Consider factors like the financial stability and customer service reputation of the insurance companies you're evaluating.

Online Quote Comparison Tips:

- Use reputable insurance comparison websites that provide accurate and up-to-date information.

- Be honest and accurate when providing information about your driving history, vehicle details, and other relevant factors. Misrepresenting information can lead to issues with your coverage.

- Consider using an independent insurance agent who can provide quotes from multiple carriers, offering a broader range of options.

Improve Your Driving Record

Your driving record is a significant factor in determining your car insurance premium. Maintaining a clean driving record by avoiding accidents, traffic violations, and claims can lead to lower insurance rates over time.

If you have a less-than-perfect driving record, consider taking a defensive driving course. Many insurance companies offer discounts for completing such courses, and it can also help improve your driving skills and reduce the likelihood of future accidents.

Benefits of a Clean Driving Record:

- Lower insurance premiums due to reduced risk.

- Eligible for good driver discounts offered by many insurance companies.

- Improved chances of receiving lower rates when shopping for new insurance.

| Violation | Average Premium Increase |

|---|---|

| Speeding Ticket | $300-$500 per year |

| DUI | $1,000-$3,000 per year |

| At-Fault Accident | $400-$1,000 per year |

Choose a Safer Vehicle

The type of vehicle you drive can impact your insurance premium. Generally, newer, more expensive, and high-performance vehicles tend to have higher insurance costs. On the other hand, safer vehicles with advanced safety features and a lower risk of accidents can result in lower insurance premiums.

When shopping for a new car, consider researching vehicles with good safety ratings and low insurance group ratings. Insurance companies often provide discounts for vehicles with advanced safety technologies like lane departure warning, automatic emergency braking, and collision avoidance systems.

Factors Affecting Vehicle Insurance Rates:

- Make and Model: Certain makes and models are more expensive to insure due to their higher repair costs and theft rates.

- Age and Condition: Older vehicles with good maintenance records and few modifications may be cheaper to insure.

- Safety Features: Vehicles with advanced safety technologies often qualify for insurance discounts.

Utilize Telematics and Usage-Based Insurance

Telematics and usage-based insurance programs use technology to track your driving behavior and offer personalized insurance rates based on your actual driving habits. These programs can be a great way to lower your insurance premium if you’re a safe and cautious driver.

Telematics devices monitor factors like driving speed, acceleration, braking, and mileage. Usage-based insurance programs can offer discounts for safe driving habits and low mileage. However, it's essential to understand the terms and conditions of these programs and ensure your privacy is respected.

Group Insurance Policies

If you’re a member of certain organizations or groups, you may be eligible for group insurance policies. These policies are often offered through employers, alumni associations, or professional organizations, and they can provide significant discounts on car insurance.

Group insurance policies are beneficial because they pool the risk of a large group, allowing for lower premiums for all members. It's worth checking with your employer or any organizations you're affiliated with to see if they offer group insurance options.

Examples of Group Insurance Providers:

- AAA: Offers auto insurance discounts to members.

- AARP: Provides car insurance through its partnership with The Hartford.

- Alumni Associations: Many universities and colleges offer group insurance programs for alumni.

Bundle Your Insurance Policies

If you have multiple insurance needs, such as car, home, renters, or life insurance, consider bundling your policies with the same insurance provider. Many companies offer discounts for customers who have multiple policies with them.

Bundling your insurance policies can provide significant savings, and it also simplifies your insurance management by having all your policies in one place. It's worth exploring this option, especially if you're already satisfied with your current insurance provider's service.

Potential Savings from Bundling:

- Up to 25% discount on auto insurance when bundled with home or renters insurance.

- Additional discounts for bundling other types of insurance, such as life or umbrella policies.

- Simplified insurance management and billing.

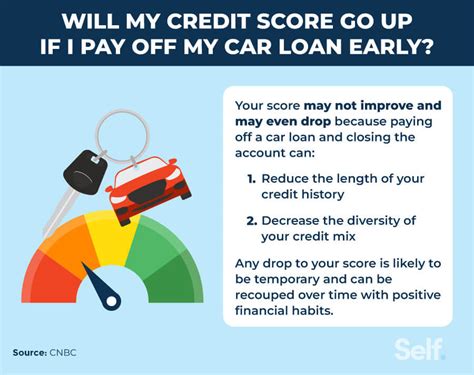

Maintain a Good Credit Score

Your credit score is another factor that can impact your car insurance premium. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. Generally, drivers with higher credit scores are seen as lower risk and may qualify for lower insurance rates.

If you have a lower credit score, consider taking steps to improve it. This includes paying your bills on time, reducing your credit card balances, and regularly reviewing your credit report for errors. A higher credit score can not only lower your insurance premium but also provide benefits in other areas of your financial life.

Impact of Credit Score on Insurance Rates:

- Drivers with excellent credit scores may save up to 20% on their insurance premiums.

- Even a small improvement in your credit score can lead to savings on your insurance.

- Maintaining a good credit score provides benefits beyond insurance, such as lower interest rates on loans and credit cards.

Conclusion

Reducing your car insurance premium is achievable through a combination of strategies. By assessing your coverage needs, shopping around for quotes, improving your driving record, choosing a safer vehicle, utilizing telematics, and exploring group and bundled insurance policies, you can potentially lower your insurance costs. Additionally, maintaining a good credit score can provide further savings. Remember to regularly review your insurance policy and make adjustments as your circumstances change to ensure you’re always getting the best value for your insurance needs.

What is the best way to compare car insurance quotes?

+

The best way to compare car insurance quotes is to use online comparison tools or contact multiple insurance companies directly. Ensure you’re comparing similar coverage levels and deductibles to get an accurate understanding of the cost differences. Consider factors like the financial stability and customer service reputation of the insurance providers.

Can I get car insurance without a good driving record?

+

Yes, you can still obtain car insurance with a less-than-perfect driving record. However, insurance companies may charge higher premiums to reflect the increased risk. You may also be eligible for discounts if you complete a defensive driving course or install telematics devices to monitor your driving behavior.

Are there any other ways to save on car insurance besides shopping around?

+

Absolutely! You can save on car insurance by improving your driving record, choosing a safer vehicle, utilizing telematics and usage-based insurance programs, exploring group insurance policies, bundling your insurance policies, and maintaining a good credit score. These strategies, combined with regular policy reviews, can help you find the best value for your insurance needs.