Glasses Online With Insurance

In today's digital age, purchasing prescription glasses online has become an increasingly popular option for consumers seeking convenience and affordability. When it comes to making the most of your vision insurance coverage, navigating the online marketplace can be a bit daunting. This article aims to provide an in-depth guide on how to maximize your vision insurance benefits when buying glasses online, ensuring you get the best value for your money.

Understanding Vision Insurance Benefits

Vision insurance plans offer a range of benefits to policyholders, including discounts on eye exams, lens upgrades, and frames. The specific perks vary depending on your insurance provider and the plan you’ve chosen. It’s crucial to familiarize yourself with your coverage to make the most of your benefits.

Review Your Policy

Start by thoroughly reviewing your vision insurance policy. Look for details on the following:

- Annual allowance or reimbursement limits for eye exams and eyewear.

- In-network providers or retailers offering discounts.

- Coverage for specific lens types or frame materials.

- Discounts on lens coatings or special treatments.

- Any exclusions or limitations on benefits.

Understanding these details will help you make informed choices when purchasing glasses online.

Check Eligibility and Validity

Ensure your insurance policy is active and up-to-date. Some policies have specific eligibility criteria, such as a minimum period of coverage or age restrictions. Make sure you meet these requirements to avoid any surprises during the purchasing process.

Finding the Right Online Retailer

Not all online eyewear retailers accept vision insurance. It’s essential to find a reputable retailer that integrates with your insurance provider to ensure a seamless transaction.

In-Network Retailers

Your vision insurance provider may have a list of in-network retailers or partners. These retailers have negotiated rates with the insurance company, often resulting in better discounts or coverage for policyholders. Check your insurance website or contact their customer support to obtain a list of preferred retailers.

For example, VisionSource has a network of independent optometrists and optical retailers that accept most major vision insurance plans. Their online platform allows you to easily find an in-network provider in your area.

Out-of-Network Options

If you can’t find an in-network retailer that suits your needs, you can still purchase glasses online using your vision insurance benefits. However, the process may involve a few extra steps.

Look for online retailers that offer insurance processing services. They'll help you submit your claim and receive reimbursement for your purchase. Some popular out-of-network retailers include:

- Zenni Optical: Offers a wide range of affordable frames and lenses. They provide an insurance claim form to help you process your reimbursement.

- Warby Parker: Known for its stylish frames and home try-on program. While they don't directly accept insurance, they can guide you through the reimbursement process.

- EyeBuyDirect: Provides an easy-to-use insurance verification tool and helps with claim submissions.

Selecting the Right Frames and Lenses

Once you've found a suitable online retailer, it's time to choose your frames and lenses. This decision should be guided by your prescription, lifestyle, and personal preferences.

Prescription Considerations

Ensure you have an up-to-date prescription. Most online retailers require you to upload a valid prescription during the checkout process. This prescription should include the following details:

- Sphere (SPH)

- Cylinder (CYL)

- Axis

- Pupillary Distance (PD)

If your prescription is missing any of these components, consult your eye doctor or optometrist to obtain the necessary information.

Lens Options

Lens selection can significantly impact the overall cost of your glasses. Consider the following when choosing lenses:

- Lens Material: Common options include plastic, polycarbonate, and high-index lenses. High-index lenses are thinner and lighter but typically cost more.

- Lens Coatings: Anti-reflective (AR) coatings, scratch-resistant coatings, and UV protection coatings can enhance your lenses. Check if your insurance covers any of these coatings.

- Lens Type: Single-vision lenses, bifocals, or progressive lenses, depending on your prescription needs.

Frame Selection

Frames come in various materials, styles, and brands. Consider the following when choosing frames:

- Frame Material: Plastic, metal, or a combination of both. Each has its advantages; plastic frames are often more affordable, while metal frames may be more durable.

- Frame Style: Choose a style that complements your face shape and personal taste. Online retailers often provide virtual try-on tools to help you visualize how frames will look on you.

- Brand: Some brands may be more expensive due to their reputation or exclusive designs. Check if your insurance covers a specific brand or provides discounts on certain brands.

Placing Your Order and Processing Insurance

Now that you’ve selected your frames and lenses, it’s time to place your order and utilize your insurance benefits.

In-Network Retailers

If you’re purchasing from an in-network retailer, the process is usually straightforward. The retailer will automatically apply your insurance benefits to your order. You may be required to pay any remaining balance, including copays or additional costs for lens upgrades or premium frames.

Make sure to keep a record of your order details, including the total cost and any insurance adjustments. This information will be useful for tax purposes or if you need to dispute any charges.

Out-of-Network Retailers

When buying from an out-of-network retailer, you’ll typically need to pay the full amount upfront. However, these retailers often provide insurance claim forms or guides to help you with the reimbursement process.

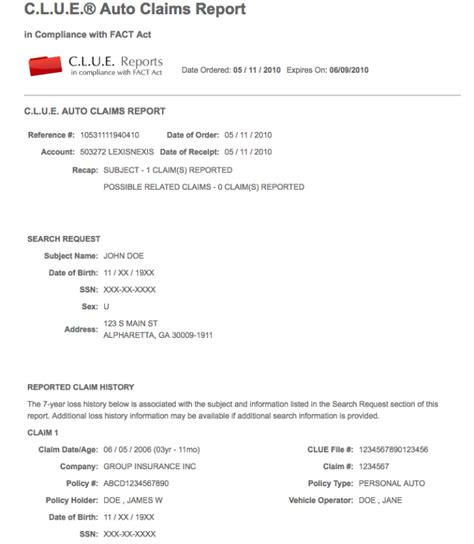

Here's a general guide on how to process your insurance claim with an out-of-network retailer:

- Gather the necessary documents:

- Your vision insurance card.

- A copy of your prescription.

- The retailer's invoice or receipt.

- Complete the insurance claim form provided by the retailer. This form typically requires detailed information about your insurance coverage, the services or products received, and the associated costs.

- Submit the claim form, along with the required documents, to your vision insurance provider. You can usually do this online, by mail, or through their mobile app.

- Wait for the insurance company to process your claim. This can take a few weeks, so be patient.

- Once your claim is processed, you'll receive a reimbursement check or have the funds deposited directly into your bank account, depending on your insurance provider's policy.

Tips for a Smooth Online Glasses Shopping Experience

To ensure a positive experience when buying glasses online with insurance, consider the following tips:

- Read reviews of the online retailer to ensure they have a good reputation and reliable customer service.

- Use virtual try-on tools or home try-on programs to get a better sense of how frames will look on you.

- Compare prices and benefits across multiple retailers to find the best deal.

- Consider adding lens treatments or coatings that enhance your vision experience, especially if they're covered by your insurance.

- Keep track of your order status and shipping details to ensure timely delivery.

Conclusion: Maximizing Your Vision Insurance Benefits

Purchasing glasses online with vision insurance can be a cost-effective and convenient option. By understanding your insurance benefits, selecting the right retailer and products, and following the proper procedures for insurance processing, you can make the most of your coverage. Remember to stay organized, keep records, and take advantage of the resources provided by your insurance provider and online retailers.

With the right approach, you can enjoy the convenience of online shopping while maximizing your vision insurance benefits.

Can I use my vision insurance for online purchases if my policy doesn’t specify online retailers?

+Yes, you can still use your vision insurance for online purchases even if your policy doesn’t explicitly mention online retailers. Most vision insurance plans cover a certain dollar amount or percentage of the cost of eyeglasses, regardless of where you purchase them. However, it’s important to check with your insurance provider to understand the specific coverage details and any limitations.

Are there any limitations on frame styles or brands when using vision insurance online?

+The limitations on frame styles or brands depend on your specific vision insurance plan and the retailer you choose. Some insurance plans may have preferred brands or styles that offer better coverage, while others may have fewer restrictions. It’s recommended to check with your insurance provider and the online retailer to understand any limitations before making your purchase.

Can I use my vision insurance benefits for contact lenses purchased online?

+Whether you can use your vision insurance benefits for contact lenses purchased online depends on your specific insurance plan. Some plans cover contact lenses, while others may only cover eyeglasses. Additionally, certain plans may require you to purchase contact lenses from authorized providers or retailers to be eligible for coverage. Always check with your insurance provider to confirm the coverage for contact lenses and any associated requirements.