Dogs Insurance Cost

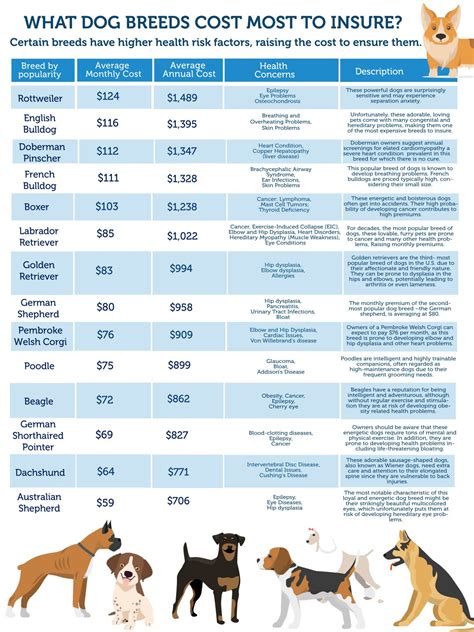

When it comes to the health and well-being of our furry companions, pet insurance has become an increasingly popular option for many dog owners. The concept of insurance for dogs offers a safety net to help cover unexpected veterinary costs, ensuring that our beloved pets receive the best possible care without breaking the bank. However, the cost of dog insurance can vary significantly based on numerous factors, making it essential for pet owners to understand the key considerations when evaluating this option.

Understanding Dog Insurance Costs

Dog insurance policies come in various forms, each offering different levels of coverage and, consequently, varying price points. The cost of insurance for dogs is influenced by a multitude of factors, including the breed of the dog, its age, the type of coverage chosen, and even the geographical location of the owner.

For instance, certain dog breeds are predisposed to specific health conditions, which can impact the insurance premium. Older dogs, too, may face higher costs due to the increased likelihood of health issues as they age. The type of coverage chosen, whether it's accident-only, illness coverage, or a comprehensive plan, will also affect the premium. Additionally, the cost of veterinary care can vary across different regions, which can influence the overall insurance cost.

Breed-Specific Considerations

Breed-specific health issues can significantly impact the cost of dog insurance. For example, breeds like the Bulldog or the Pug, known for their respiratory issues, often have higher insurance premiums due to the increased risk of related health problems. Similarly, larger breeds like the Great Dane or the Irish Wolfhound may face higher costs due to their susceptibility to joint problems.

However, it's not just the larger or smaller breeds that face breed-specific health issues. Even some of the most popular breeds, like the Golden Retriever or the Labrador Retriever, can be prone to certain conditions, which can influence insurance costs. For instance, Golden Retrievers are known to be susceptible to hip dysplasia and certain cancers, while Labradors can face issues with obesity and joint problems.

| Breed | Common Health Issues |

|---|---|

| Bulldog | Respiratory problems, skin allergies |

| Pug | Respiratory issues, eye problems |

| Great Dane | Cardiomyopathy, joint problems |

| Golden Retriever | Hip dysplasia, certain cancers |

| Labrador Retriever | Obesity, joint issues |

Age and Its Impact on Insurance Costs

The age of your dog plays a crucial role in determining insurance costs. Generally, younger dogs are seen as lower-risk, resulting in more affordable insurance premiums. This is because younger dogs are less likely to develop age-related health issues. However, as dogs age, their insurance premiums tend to increase due to the higher likelihood of health problems and the associated veterinary costs.

For instance, an insurance policy for a 2-year-old dog may be more affordable than for a 10-year-old dog, as the older dog is more susceptible to conditions like arthritis, dental problems, or even cancer. As a result, insurance providers often charge higher premiums for older dogs to cover the potential costs of these conditions.

| Age | Common Health Issues |

|---|---|

| 2-3 years | Fewer health issues; generally low-risk |

| 6-8 years | Potential for joint issues, dental problems |

| 10+ years | High risk for age-related conditions like arthritis, heart disease |

Coverage Options and Their Costs

The type of coverage you choose for your dog’s insurance plan is another critical factor influencing the cost. Insurance providers typically offer a range of coverage options, each with its own price tag.

Accident-only coverage is often the most affordable option, as it only covers injuries resulting from accidents. Illness coverage, on the other hand, provides protection against illnesses and can be more expensive. Comprehensive plans, which offer the broadest coverage, including both accidents and illnesses, are typically the most costly.

| Coverage Type | Description | Cost |

|---|---|---|

| Accident-only | Covers injuries from accidents | Lowest cost |

| Illness coverage | Protects against illnesses | Moderate cost |

| Comprehensive | Covers accidents and illnesses | Highest cost |

Geographical Location and Its Influence

The geographical location of the dog owner can also impact insurance costs. Veterinary care costs can vary significantly across different regions, which can influence the overall insurance premium. In areas where veterinary services are more expensive, insurance premiums are likely to be higher.

Additionally, some insurance providers may offer more competitive rates in certain regions due to market competition or other factors. Therefore, it's essential to compare quotes from multiple insurance providers to find the best deal in your specific location.

Factors Influencing the Cost of Dog Insurance

Several other factors can influence the cost of dog insurance, including the policy’s deductible, reimbursement rates, and any additional benefits or exclusions.

Deductibles and Reimbursement Rates

The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, as you’re assuming more financial responsibility. Conversely, lower deductibles can lead to higher premiums, as the insurance provider assumes more financial risk.

Reimbursement rates, on the other hand, determine how much of your veterinary costs the insurance provider will cover. Typically, these rates are expressed as a percentage. For example, if you have an 80% reimbursement rate, the insurance provider will cover 80% of the approved veterinary costs, and you'll be responsible for the remaining 20%.

| Deductible | Reimbursement Rate | Impact on Premium |

|---|---|---|

| High | Lower | Lower premium |

| Low | Higher | Higher premium |

Additional Benefits and Exclusions

Insurance policies for dogs can also include additional benefits, such as coverage for routine care, including vaccinations and check-ups, or even alternative therapies like acupuncture. These additional benefits can increase the cost of the insurance policy.

Conversely, exclusions in the policy can also impact the cost. For instance, some policies may exclude pre-existing conditions or certain high-risk activities, which can lower the premium. However, it's essential to carefully review these exclusions to ensure they don't limit the policy's usefulness.

Tips for Choosing the Right Dog Insurance

Choosing the right dog insurance policy can be a complex decision. Here are some tips to help you navigate the process:

- Compare quotes from multiple insurance providers to find the best coverage at the most competitive price.

- Understand the specific needs of your dog, including any breed-specific health concerns, and choose a policy that provides adequate coverage.

- Review the policy's terms and conditions, including any deductibles, reimbursement rates, and exclusions, to ensure you're comfortable with the coverage.

- Consider your financial situation and choose a policy that offers the right balance between coverage and affordability.

- Don't be afraid to ask questions or seek clarification on any aspect of the policy.

The Future of Dog Insurance

The pet insurance market is continually evolving, with new products and services being introduced to meet the diverse needs of pet owners. As veterinary medicine advances and the cost of care increases, insurance for dogs will likely become even more popular and essential.

In the future, we can expect to see more tailored insurance products that offer flexible coverage options, allowing pet owners to customize their policies to fit their needs and budget. Additionally, advancements in technology may lead to more efficient claims processes, making it easier and faster for pet owners to receive reimbursement for veterinary expenses.

Furthermore, as the understanding of breed-specific health conditions improves, insurance providers may develop more targeted policies to address these specific needs. This could lead to more accurate pricing and better coverage for pet owners, ensuring their dogs receive the care they need without financial strain.

In conclusion, while the cost of dog insurance can vary significantly, understanding the key factors that influence these costs can help pet owners make informed decisions when choosing an insurance policy. By considering factors such as breed, age, coverage type, geographical location, deductibles, and reimbursement rates, pet owners can find a policy that offers the right balance of coverage and affordability for their furry companions.

Can I get insurance for my dog’s pre-existing condition?

+In most cases, insurance providers will not cover pre-existing conditions. However, some policies offer specific riders or add-ons that can provide limited coverage for these conditions. It’s important to review the policy’s terms carefully to understand the coverage for pre-existing conditions.

Are there any discounts available for dog insurance?

+Yes, some insurance providers offer discounts for certain circumstances. For example, you may receive a discount if you have multiple pets insured with the same provider, or if you’re a member of a specific organization or association. It’s worth inquiring about potential discounts when getting quotes.

How do I make a claim on my dog’s insurance policy?

+The claims process can vary between insurance providers. Typically, you’ll need to submit a claim form along with supporting documentation, such as veterinary bills. Some providers may also require a diagnosis from your veterinarian. Always refer to your policy’s terms and conditions for specific instructions on how to make a claim.