What Is The Best Health Insurance For Seniors On Medicare

As a senior, finding the right health insurance coverage is crucial to ensure your medical needs are met without breaking the bank. With the complex world of Medicare and its various parts, supplements, and plans, it can be daunting to navigate. This article aims to guide you through the process of choosing the best health insurance option, specifically tailored to seniors on Medicare.

Understanding Medicare: The Basics

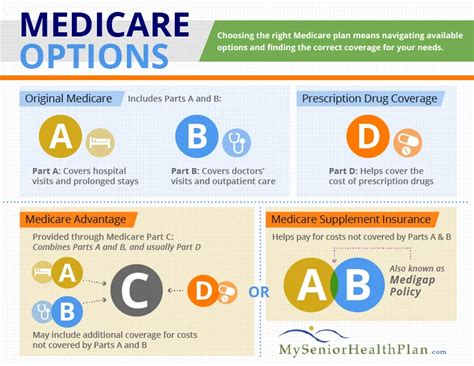

Medicare, a federal health insurance program, is designed to provide coverage for people aged 65 and older, as well as certain younger individuals with disabilities or specific medical conditions. It consists of several parts, each covering different aspects of healthcare.

Parts of Medicare

- Part A (Hospital Insurance): This part covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. Most people don’t pay a premium for Part A as they or their spouse have paid Medicare taxes while working.

- Part B (Medical Insurance): Part B covers outpatient medical services, including doctor visits, lab tests, durable medical equipment, and some preventive services. A monthly premium is typically required for Part B coverage.

- Part C (Medicare Advantage): Also known as Medicare Part C plans, these are offered by private insurance companies and approved by Medicare. They provide all the benefits of Parts A and B, and often include additional benefits like prescription drug coverage and vision/dental care.

- Part D (Prescription Drug Coverage): Part D plans, offered by private insurance companies, help cover the cost of prescription medications. Seniors must pay a monthly premium for this coverage, and the cost can vary depending on the plan and the individual’s prescription needs.

Supplementing Your Medicare Coverage

While Original Medicare (Parts A and B) provides a solid foundation for healthcare coverage, many seniors choose to supplement their coverage to fill in potential gaps. Here are some common options:

Medigap (Medicare Supplement Insurance)

Medigap plans, sold by private insurance companies, are designed to cover the gaps in Original Medicare coverage, including deductibles, copayments, and coinsurance. These plans are identified by letters (such as Plan A, Plan B, Plan G, etc.), and each plan offers a different set of benefits.

For instance, Plan F, which is no longer available for new enrollees, covers all the gaps in Medicare Part A and Part B. On the other hand, Plan G covers everything except the Medicare Part B deductible. The specific benefits and costs of Medigap plans can vary depending on the insurance company and the state.

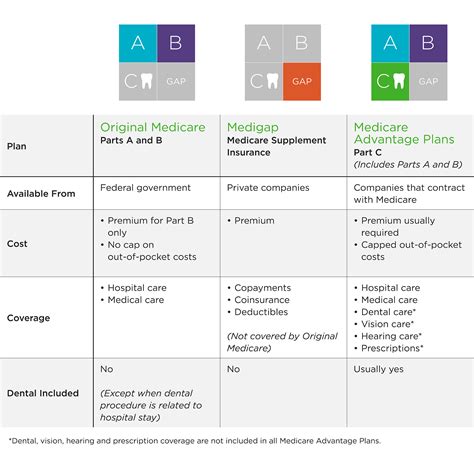

Comparing Medigap and Medicare Advantage

While Medigap plans supplement Original Medicare, Medicare Advantage plans (Part C) replace Original Medicare. Here’s a quick comparison:

| Aspect | Medigap | Medicare Advantage |

|---|---|---|

| Provider Network | Generally, any provider who accepts Medicare will accept your Medigap plan. This gives you more freedom to choose your healthcare providers. | You must use providers within the plan's network, which may limit your options. |

| Out-of-Pocket Costs | Medigap plans typically have higher monthly premiums but lower out-of-pocket costs during medical events. | Premiums can be lower, but out-of-pocket costs during a medical event can be higher. |

| Additional Benefits | Medigap plans only cover the gaps in Original Medicare. They don't usually include prescription drug coverage or vision/dental care. | Medicare Advantage plans often include additional benefits like prescription drug coverage, vision/dental care, and sometimes even fitness memberships. |

Evaluating Your Health Insurance Options

When it comes to choosing the best health insurance option for seniors on Medicare, several factors come into play:

Your Health Status

Your current health status and medical needs are a significant consideration. If you have multiple chronic conditions or anticipate frequent medical visits, you might benefit from a plan with lower out-of-pocket costs, such as a Medigap plan or a Medicare Advantage plan with low copays.

On the other hand, if you’re generally healthy and want more flexibility in choosing your healthcare providers, a Medigap plan paired with Original Medicare might be a better fit.

Prescription Drug Needs

The cost of prescription medications can be a significant expense for seniors. If you take multiple medications regularly, it’s essential to choose a plan that covers your specific drugs at a reasonable cost. Both Medicare Advantage plans and Part D plans can offer prescription drug coverage, but the specific drugs covered and the cost can vary greatly between plans.

Financial Considerations

Your budget and financial situation are critical factors in choosing the right health insurance. While Medigap plans often have higher monthly premiums, they can provide more financial protection during medical events due to their lower out-of-pocket costs. On the other hand, Medicare Advantage plans and Part D plans can have lower premiums but potentially higher out-of-pocket costs.

Provider Network and Flexibility

Consider whether you prefer a plan that allows you to choose any doctor or hospital that accepts Medicare (like Medigap plans) or if you’re comfortable using a specific network of providers (as with Medicare Advantage plans). Your preferred healthcare providers’ participation in different plans can also influence your decision.

Making the Right Choice

The best health insurance for seniors on Medicare will depend on individual needs and preferences. Here are some steps to guide you through the decision-making process:

- Assess Your Medical Needs: Take stock of your current health status, any ongoing medical conditions, and your anticipated medical needs. Consider the frequency of doctor visits, hospital stays, and prescription drug usage.

- Compare Plans: Research and compare different Medicare plans, including Original Medicare, Medigap, Medicare Advantage, and Part D plans. Look at the specific benefits, out-of-pocket costs, provider networks, and premiums for each plan.

- Consider Your Budget: While health insurance is essential, it's important not to strain your financial resources. Choose a plan that provides adequate coverage while also fitting within your budget.

- Evaluate Provider Networks: If you have specific healthcare providers you prefer or depend on, ensure they are in-network for the plans you're considering. This is especially important for Medicare Advantage plans, which have more restricted provider networks.

- Seek Professional Advice: Consider consulting with an independent insurance agent or a financial advisor who specializes in Medicare. They can provide personalized recommendations based on your unique situation.

FAQs

Can I have both a Medigap plan and a Medicare Advantage plan?

+No, you cannot have both a Medigap plan and a Medicare Advantage plan at the same time. These plans are designed to work with Original Medicare, and having both can lead to unnecessary costs and potential coverage issues.

What happens if I miss the enrollment period for Medicare Part B or Part D?

+If you miss the initial enrollment period for Part B or Part D, you may face late enrollment penalties. However, there are special enrollment periods for certain life events, and you may qualify for a waiver of the penalty in some cases. It’s best to consult with a Medicare expert to understand your options.

Are Medicare Advantage plans the same as HMOs or PPOs?

+Medicare Advantage plans can be structured as HMOs (Health Maintenance Organizations) or PPOs (Preferred Provider Organizations), but they are not the same. The specific plan design, benefits, and provider networks can vary between Medicare Advantage plans, even within the same type (HMO or PPO).