Medigap Insurance Plans

Medigap insurance plans, also known as Medicare Supplement Insurance, play a crucial role in helping seniors and individuals with disabilities navigate the complexities of healthcare coverage. These plans are specifically designed to fill the gaps left by original Medicare, providing additional financial protection and peace of mind. With a wide range of options available, understanding the nuances of Medigap plans is essential for making informed decisions about your healthcare.

Understanding Medigap Insurance Plans

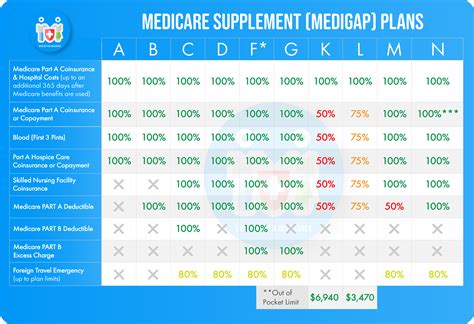

Medigap plans are standardized by the Centers for Medicare & Medicaid Services (CMS), ensuring consistency and clarity across different insurance providers. These plans are identified by letters A through N, with each plan offering a unique set of benefits. The standardization means that Plan F from one insurance company will offer the same coverage as Plan F from another, allowing individuals to compare plans based on their specific needs and preferences.

One of the key advantages of Medigap plans is their ability to cover expenses that original Medicare might not fully cover. This includes copayments, coinsurance, and deductibles, which can accumulate quickly, especially for individuals with chronic conditions or frequent medical needs. By having a Medigap plan, individuals can significantly reduce their out-of-pocket costs, making healthcare more affordable and accessible.

Benefits and Coverage of Medigap Plans

The specific benefits of Medigap plans vary depending on the plan chosen. However, all Medigap plans cover the Medicare Part A deductible for hospital stays, which is a significant expense for many individuals. Additionally, most plans cover Medicare Part B coinsurance or copayments, further reducing the financial burden of medical services. Some plans also offer coverage for additional benefits, such as foreign travel emergency care, blood transfusions, and even hospice care.

| Medigap Plan | Coverage Highlights |

|---|---|

| Plan A | Basic coverage, including Medicare Part A hospital deductible and Part B coinsurance |

| Plan F | Comprehensive coverage, including all Medicare deductibles, coinsurance, and copayments |

| Plan G | Similar to Plan F, but covers Part B deductible separately |

| Plan N | Covers Part A and Part B deductibles, but with lower coverage for office visits and some other services |

It's important to note that while Medigap plans provide valuable coverage, they are designed to work alongside original Medicare and do not cover all healthcare costs. For example, Medigap plans typically do not cover long-term care, dental care, vision care, or hearing aids. Individuals may need to explore additional insurance options to cover these specific needs.

Choosing the Right Medigap Plan

Selecting the appropriate Medigap plan involves careful consideration of your healthcare needs and financial situation. Factors such as your anticipated healthcare utilization, existing health conditions, and budget play a significant role in this decision.

For individuals with frequent medical needs and a higher likelihood of incurring substantial expenses, plans like Plan F or Plan G might be more suitable. These plans offer comprehensive coverage, ensuring that most out-of-pocket costs are minimized. On the other hand, individuals with fewer healthcare needs or those on a tighter budget might opt for a more basic plan, such as Plan A or Plan N, which provide essential coverage at a lower cost.

It's crucial to review the details of each plan and assess your personal circumstances to make an informed choice. Consulting with a licensed insurance agent or a Medicare expert can provide valuable guidance tailored to your specific situation.

Medigap Enrollment and Eligibility

Eligibility for Medigap plans is closely tied to your enrollment in original Medicare. To be eligible for a Medigap plan, you must have Medicare Part A and Part B, and you must also be enrolled in a Medicare prescription drug plan (Part D) if you want prescription drug coverage.

The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period, which begins the month you turn 65 and are enrolled in Medicare Part B. During this initial enrollment period, insurance companies cannot deny you coverage or charge you more due to pre-existing conditions. This makes it an ideal time to secure the Medigap plan that best suits your needs.

If you miss your initial enrollment period, you may still be able to enroll in a Medigap plan, but it might be more challenging. Insurance companies can charge you more or deny you coverage based on your health status. It's advisable to consult with an insurance expert to explore your options during these situations.

Medigap Premiums and Costs

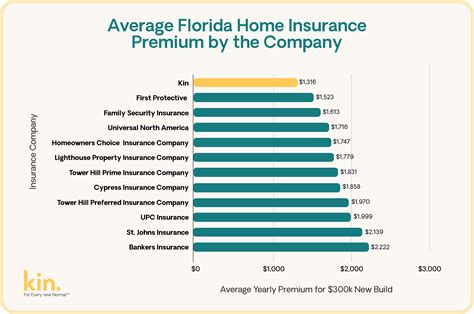

The cost of Medigap plans, known as premiums, can vary significantly based on several factors. These factors include the specific plan you choose, your location, and your age when you purchase the plan. Generally, older individuals tend to pay higher premiums, as they are more likely to utilize healthcare services.

It's important to note that Medigap plans are not part of Medicare, and they are sold by private insurance companies. As such, the premiums are set by these companies and can differ between providers. Shopping around and comparing premiums is a wise strategy to find the most cost-effective plan for your needs.

Additionally, some Medigap plans may offer different premium payment options, such as annual, semi-annual, or monthly payments. Understanding these options and their potential impact on your budget is essential when choosing a plan.

Medigap and Original Medicare: A Complementary Relationship

Medigap plans and original Medicare work hand in hand to provide comprehensive healthcare coverage. Original Medicare, consisting of Part A (hospital insurance) and Part B (medical insurance), covers a wide range of healthcare services, including hospital stays, doctor visits, and certain preventive care. However, it leaves certain gaps, such as deductibles, coinsurance, and copayments, which can be significant financial burdens.

This is where Medigap plans step in. They are designed to cover these gaps, ensuring that individuals have more comprehensive financial protection. By combining original Medicare and a Medigap plan, individuals can have greater confidence in their healthcare coverage, knowing that their out-of-pocket costs are minimized.

The Impact of Medigap on Healthcare Utilization

Research has shown that individuals with Medigap coverage are more likely to utilize healthcare services, particularly preventive care. This is because the reduced financial barriers make it more feasible for individuals to access the care they need without worrying about substantial out-of-pocket expenses. As a result, Medigap plans can play a significant role in promoting better health outcomes and early detection of potential health issues.

Furthermore, the peace of mind that comes with having comprehensive coverage can lead to improved health management. Individuals with Medigap plans may be more inclined to follow recommended treatment plans, attend regular check-ups, and manage chronic conditions effectively. This proactive approach to healthcare can lead to better overall health and a reduced risk of severe health complications.

Future Implications and Potential Changes

The landscape of healthcare and insurance is continually evolving, and Medigap plans are no exception. While the core benefits of Medigap plans are standardized, there is ongoing discussion and potential for future changes in the industry.

One potential change is the introduction of new plan options or the modification of existing plans to better meet the evolving healthcare needs of seniors. This could involve adding coverage for certain services, such as telemedicine or certain preventive screenings, which have become increasingly important in modern healthcare.

Additionally, there may be shifts in the way Medigap plans are marketed and sold. With the rise of digital platforms and online insurance marketplaces, there could be a greater emphasis on online enrollment and digital communication, making it easier for individuals to research and choose the right Medigap plan.

Staying informed about these potential changes is crucial for individuals who rely on Medigap plans. Keeping up with industry news and consulting trusted sources can ensure that you are aware of any modifications to plans or enrollment processes, allowing you to make the most informed decisions about your healthcare coverage.

What is the difference between Medigap and Medicare Advantage plans?

+

Medigap and Medicare Advantage plans are two different types of insurance designed to work with original Medicare. Medigap plans are supplemental insurance that cover the gaps in Medicare coverage, such as deductibles and coinsurance. On the other hand, Medicare Advantage plans, also known as Part C, are an alternative to original Medicare, offering a comprehensive package of benefits that may include prescription drug coverage and additional services. The choice between Medigap and Medicare Advantage depends on individual needs and preferences.

Can I have both a Medigap plan and a Medicare Advantage plan?

+

No, you cannot have both a Medigap plan and a Medicare Advantage plan simultaneously. These plans serve different purposes and are designed to work as alternatives to original Medicare. Choosing one or the other depends on your specific healthcare needs and financial considerations.

Are Medigap plans available to everyone enrolled in Medicare?

+

Medigap plans are not available to everyone enrolled in Medicare. They are primarily designed for individuals who have original Medicare (Parts A and B) and may not be suitable for those enrolled in Medicare Advantage plans or other alternative Medicare programs. Additionally, Medigap plans have specific enrollment periods and eligibility criteria that must be met.