Best Rates For Home Insurance

Finding the best rates for home insurance is an important task for homeowners, as it not only protects one of their most valuable assets but also ensures financial security in the event of unexpected incidents. With a wide range of insurance providers and policies available, it can be challenging to navigate the market and secure the most advantageous coverage at the most competitive price. This comprehensive guide aims to provide an in-depth analysis of the factors influencing home insurance rates and offer practical tips to help homeowners secure the best deals.

Understanding Home Insurance Rates

Home insurance rates are determined by a complex interplay of factors, each contributing to the overall cost of coverage. Understanding these factors is crucial for homeowners seeking the best rates. Here’s a breakdown of the key elements that influence home insurance premiums:

Location and Risk Factors

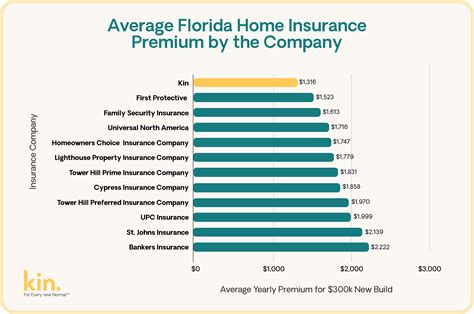

The geographical location of your home plays a significant role in determining insurance rates. Areas prone to natural disasters like hurricanes, floods, or wildfires typically command higher premiums due to the increased risk of claims. Additionally, crime rates and the proximity to fire stations or hydrants can also impact insurance costs. For instance, a home located in a high-risk flood zone or a neighborhood with a high crime rate may face steeper insurance premiums.

| Risk Factor | Impact on Rates |

|---|---|

| Natural Disaster Risk | High-risk areas demand higher premiums. |

| Crime Rate | Areas with higher crime rates often result in elevated insurance costs. |

| Proximity to Fire Stations/Hydrants | Better access to fire services can lead to lower rates. |

Home Characteristics

The physical attributes of your home are another critical factor in insurance rate calculations. Older homes, especially those built with outdated materials or lacking modern safety features, may be considered higher risk and attract higher premiums. Similarly, homes with unique architectural designs or those located in historic districts may face unique challenges in securing insurance or obtaining competitive rates.

Coverage and Deductibles

The level of coverage you choose and the associated deductibles significantly impact your insurance rates. Opting for higher coverage limits or lower deductibles will generally result in higher premiums. It’s essential to strike a balance between adequate coverage and affordable premiums, ensuring you’re not overinsured or underinsured.

Claim History

Insurance companies carefully review your claim history when determining rates. A history of frequent claims or large-scale incidents can lead to higher premiums or even non-renewal of your policy. Maintaining a clean claim record is, therefore, crucial for securing the best insurance rates.

Discounts and Bundling

Insurance providers often offer discounts to incentivize certain behaviors or choices. Common discounts include those for safety features like burglar alarms or smoke detectors, loyalty discounts for long-term customers, or multi-policy discounts when you bundle home and auto insurance with the same provider. Exploring these discounts can help reduce your overall insurance costs.

Securing the Best Home Insurance Rates

Now that we’ve examined the key factors influencing home insurance rates, let’s delve into practical strategies to help you secure the best deals in the market.

Shop Around and Compare

One of the most effective ways to find the best home insurance rates is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, even for similar coverage, so obtaining multiple quotes is essential. Online comparison tools can streamline this process, allowing you to quickly gather and compare quotes from various insurers.

Assess Your Coverage Needs

Before obtaining quotes, it’s crucial to assess your specific coverage needs. Consider the value of your home, the cost of rebuilding, and the possessions you wish to insure. Overinsuring or underinsuring can lead to unnecessary expenses or inadequate coverage, respectively. By accurately assessing your needs, you can ensure you’re obtaining quotes for the right level of coverage.

Understand Policy Terms

When comparing policies, it’s not just about the premium. It’s essential to understand the terms and conditions of each policy, including the coverage limits, deductibles, and any exclusions. Policies may vary in their coverage of specific perils, such as water damage or theft, so ensure you’re comparing apples to apples when evaluating different quotes.

Improve Your Home’s Safety

Insurance companies often offer discounts for homes equipped with safety features that reduce the risk of claims. Investing in home security systems, fire prevention equipment, or storm-proofing measures can not only enhance your home’s safety but also lead to significant insurance discounts. For instance, installing a monitored burglar alarm or a sprinkler system can qualify you for substantial savings on your insurance premiums.

Consider Bundling Policies

Bundling your insurance policies, such as combining home and auto insurance with the same provider, can often lead to significant savings. Insurance companies frequently offer multi-policy discounts to incentivize customers to bundle their coverage. By consolidating your insurance needs with a single provider, you can simplify your insurance management and potentially reduce your overall insurance costs.

Maintain a Good Credit Score

Your credit score can play a role in determining your insurance rates. Many insurance companies use credit-based insurance scores to assess the risk of insuring a particular individual. Maintaining a good credit score can, therefore, positively impact your insurance rates. Regularly review your credit report, ensure accurate information, and take steps to improve your credit score if needed.

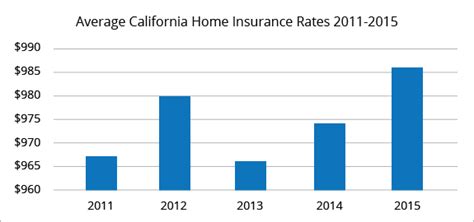

Review and Renegotiate

Insurance rates can change over time, so it’s essential to regularly review your policy and compare it to the market. If you’ve noticed a significant increase in your premiums or believe you can secure a better deal elsewhere, don’t hesitate to renegotiate with your current provider or explore alternative options. Loyalty shouldn’t be a barrier to securing the best rates.

The Future of Home Insurance Rates

The home insurance market is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of home insurance rates and what homeowners can expect:

Digitalization and Personalized Pricing

The insurance industry is embracing digitalization, with many providers now offering online quote comparisons and policy management. This shift towards digital platforms allows for more personalized pricing, as insurers can gather and analyze vast amounts of data to offer tailored coverage and rates. Homeowners can expect more accurate and competitive pricing as insurers leverage data analytics to refine their risk assessment models.

Use of Telematics and Smart Home Technology

Telematics, the use of technology to monitor and analyze data, is increasingly being applied in home insurance. Insurers may offer discounts to homeowners who install smart home devices, such as smart locks or water leak detectors, as these technologies can provide real-time data on home conditions and alert insurers to potential risks. The adoption of smart home technology is expected to grow, offering homeowners opportunities to reduce their insurance premiums through improved home safety and risk management.

Climate Change and Risk Mitigation

The increasing frequency and severity of natural disasters due to climate change are prompting insurers to reevaluate their risk models and pricing strategies. Insurers are investing in climate change research and developing new risk mitigation strategies to better protect homeowners. While this may lead to higher premiums in high-risk areas, it also presents an opportunity for homeowners to take proactive measures to reduce their risk and potentially qualify for lower rates.

Insurtech Innovations

The emergence of insurtech startups is disrupting the traditional insurance industry, offering innovative solutions and new approaches to insurance. These startups often leverage technology to provide more efficient and personalized insurance experiences. Homeowners can expect to see more insurtech players entering the market, offering competitive rates and unique coverage options. Keeping an eye on these developments can help homeowners stay ahead of the curve and access the best insurance deals.

FAQ

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever there are significant changes to your home, such as renovations or additions. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any new discounts or policy enhancements.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time, but it’s important to ensure there’s no gap in coverage. When switching mid-term, your new provider may offer you a pro-rated premium, and you’ll likely receive a refund from your previous insurer for the unused portion of your policy.

What are some common home insurance discounts I should look for?

+Common home insurance discounts include safety device discounts (for burglar alarms, smoke detectors, etc.), multi-policy discounts (when you bundle home and auto insurance), loyalty discounts (for long-term customers), and discounts for good credit scores. It’s worth exploring these discounts when shopping for insurance to reduce your overall costs.

How can I reduce my home insurance deductible?

+Reducing your home insurance deductible can lower your premium, but it’s important to ensure you can afford the deductible in the event of a claim. Consider your financial situation and the potential cost of a claim before opting for a lower deductible. It’s a balance between affordability and risk tolerance.