Best Health Insurance Plans For Family

When it comes to choosing the best health insurance plan for your family, it can be a daunting task with numerous options available in the market. Each family has unique needs and preferences, and understanding these factors is crucial for making an informed decision. This comprehensive guide will delve into the world of family health insurance, providing you with the knowledge and tools to select the most suitable plan for your loved ones.

Understanding Your Family’s Health Needs

Before diving into the sea of insurance plans, it’s imperative to evaluate your family’s specific health requirements. Consider the age and gender distribution within your family, as well as any pre-existing medical conditions or chronic illnesses. Are there young children who require regular check-ups and vaccinations? Do any family members have ongoing treatments or require specialized medical attention? Understanding these needs will help you narrow down the options and find a plan that provides comprehensive coverage.

Coverage Options for Pre-Existing Conditions

If any family member has a pre-existing condition, ensuring adequate coverage for it is essential. Many health insurance plans have specific policies regarding pre-existing conditions, including waiting periods or exclusions. Research and compare plans that offer coverage for such conditions without excessive limitations. Look for plans with shorter waiting periods or those that cover pre-existing conditions immediately upon enrollment.

For instance, let's say a family has a member with a history of diabetes. A suitable plan would provide coverage for regular check-ups, glucose monitoring, and any necessary medications without imposing excessive out-of-pocket costs. Understanding the plan's benefits and limitations regarding pre-existing conditions is crucial to avoid financial surprises down the line.

| Plan | Waiting Period for Pre-existing Conditions |

|---|---|

| Family Health Plus | 3 months |

| Medicare Advantage | 6 months |

| Private Health Insurance | 12 months |

Assessing Your Budget and Coverage Requirements

Health insurance plans come with varying premium costs and coverage levels. It’s essential to strike a balance between affordability and the scope of coverage. Assess your family’s financial situation and determine the maximum premium you can comfortably afford. Remember, a higher premium doesn’t always guarantee better coverage; it’s about finding the right fit for your family’s needs.

Comparing Premium Costs and Coverage Levels

Research and compare different health insurance plans based on their premium costs and the extent of coverage they offer. Some plans may have lower premiums but come with higher deductibles or limited coverage for specific services. On the other hand, more comprehensive plans with lower deductibles and extensive coverage might have higher premiums.

Consider a family with varying healthcare needs, including regular doctor visits, occasional specialist consultations, and potential emergency room visits. In such a case, a plan with a moderate premium, reasonable deductibles, and comprehensive coverage for a wide range of services would be an ideal fit. It ensures that the family is adequately covered without incurring excessive out-of-pocket expenses.

| Plan | Premium Cost | Coverage Level |

|---|---|---|

| Basic Family Plan | $350/month | Essential coverage, high deductibles |

| Comprehensive Family Plan | $500/month | Extensive coverage, moderate deductibles |

| Premium Family Plan | $700/month | Comprehensive coverage, low deductibles |

Evaluating Network Providers and Hospital Options

Health insurance plans often have networks of healthcare providers and hospitals with which they have negotiated rates. It’s crucial to assess whether your preferred doctors, specialists, and hospitals are included in the plan’s network. If not, you may face higher out-of-pocket costs or limited coverage.

Ensuring Access to Preferred Healthcare Providers

Before selecting a plan, make a list of your family’s preferred healthcare providers and verify if they are in-network. If you have specific doctors or specialists you wish to continue seeing, ensure they are covered by the plan. Additionally, consider the plan’s network of hospitals, especially if you anticipate potential emergency room visits or specialized treatments.

Imagine a family with a child who requires regular visits to a pediatric cardiologist. In such a case, choosing a plan that includes this specialist in its network is crucial to avoid additional costs or the hassle of finding an alternative provider.

Network Size and Accessibility

The size and geographic spread of a plan’s network can also impact your convenience and accessibility. A larger network may offer more options, especially if you frequently travel or live in a rural area. Consider the number of healthcare providers and facilities within the network and their proximity to your residence.

| Plan | Network Size | Geographic Spread |

|---|---|---|

| National Health Plan | 10,000+ providers | Nationwide coverage |

| Regional Health Plan | 5,000 providers | Regional coverage, focused on a specific state |

| Local Health Plan | 2,000 providers | Limited to a specific city or metropolitan area |

Understanding Plan Types and Benefits

Health insurance plans come in various types, each with its own set of benefits and features. Understanding the different plan types and their unique advantages will help you make an informed decision.

Traditional Fee-for-Service Plans

Fee-for-service plans, also known as indemnity plans, offer the most flexibility in terms of choosing healthcare providers. With these plans, you can visit any doctor or hospital without prior authorization. However, you may need to pay a higher premium and bear a larger portion of the costs out-of-pocket.

These plans are ideal for families who prefer the freedom to choose their healthcare providers without restrictions. They provide peace of mind, especially for those with specific healthcare needs or a history of unexpected medical emergencies.

Health Maintenance Organizations (HMOs)

HMOs are known for their cost-effectiveness and structured approach to healthcare. With an HMO plan, you typically select a primary care physician (PCP) who coordinates your healthcare needs. The PCP acts as a gatekeeper, referring you to specialists within the HMO’s network. HMOs often have lower premiums and out-of-pocket costs compared to other plan types.

HMOs are suitable for families who prioritize affordability and prefer a coordinated approach to their healthcare. They are particularly beneficial for families with ongoing healthcare needs, as the PCP can oversee and manage their overall health.

Preferred Provider Organizations (PPOs)

PPOs offer a balance between flexibility and cost-effectiveness. With a PPO plan, you have the freedom to choose any healthcare provider, whether in-network or out-of-network. However, using in-network providers typically results in lower out-of-pocket costs. PPOs often have a broader network of providers compared to HMOs.

PPOs are an excellent choice for families who value flexibility but still want to benefit from lower costs when using in-network providers. They provide a good balance between freedom of choice and cost-efficiency.

Exclusive Provider Organizations (EPOs)

EPOs are similar to PPOs in that they offer a network of healthcare providers. However, EPOs do not cover out-of-network services, except in emergency situations. EPO plans typically have lower premiums compared to PPOs.

EPOs are suitable for families who are comfortable with a limited network of providers and prioritize lower premiums. They provide cost-effectiveness while still offering a certain level of flexibility within the network.

| Plan Type | Flexibility | Cost |

|---|---|---|

| Fee-for-Service | High | Higher premiums, higher out-of-pocket costs |

| HMO | Moderate (within network) | Lower premiums, lower out-of-pocket costs |

| PPO | High (in and out of network) | Moderate premiums, moderate out-of-pocket costs |

| EPO | Moderate (within network) | Lower premiums, out-of-network services not covered |

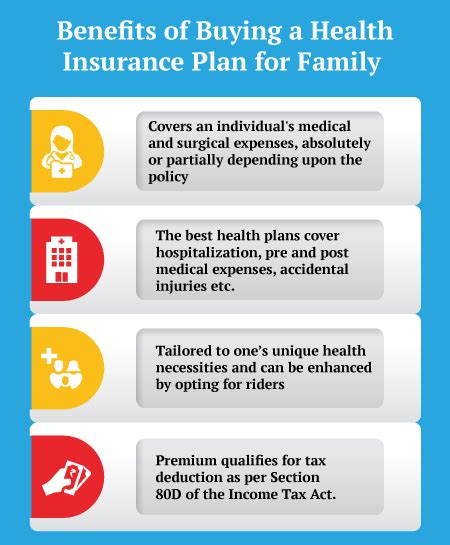

Reviewing Additional Benefits and Features

Beyond the basic coverage, many health insurance plans offer additional benefits and features that can enhance your family’s overall healthcare experience. These extras can include vision and dental coverage, wellness programs, prescription drug benefits, and more.

Vision and Dental Coverage

Vision and dental care are essential aspects of overall health. Some health insurance plans offer integrated vision and dental coverage, which can provide significant savings and convenience. Consider whether your family requires regular eye exams, eyeglasses, or dental check-ups and treatments.

For instance, a family with young children who need annual eye exams and a parent who requires regular dental cleanings and check-ups would benefit from a plan that includes vision and dental coverage. It ensures that these essential healthcare needs are covered without the need for separate insurance policies.

Wellness and Preventive Care Benefits

Many health insurance plans promote preventive care and wellness by offering incentives or reduced costs for certain services. These may include annual physicals, vaccinations, cancer screenings, and other preventive measures. Such benefits can help your family stay proactive about their health and catch potential issues early on.

Imagine a family with a history of heart disease. A plan that offers reduced costs for annual cholesterol screenings and heart health assessments would be beneficial in detecting and managing any potential issues. Wellness benefits can be a powerful tool for maintaining good health and preventing future complications.

Prescription Drug Benefits

Prescription medications can be costly, especially for families with ongoing medical conditions. Many health insurance plans offer prescription drug coverage, which can significantly reduce the out-of-pocket costs for necessary medications. Review the plan’s formulary (list of covered drugs) to ensure that your family’s medications are included.

For a family with a member who requires regular medication for a chronic condition, a plan with comprehensive prescription drug coverage would be a wise choice. It ensures that the necessary medications are accessible and affordable, without placing a financial burden on the family.

Alternative Medicine and Mental Health Coverage

Some health insurance plans recognize the importance of alternative medicine and mental health services. These plans may cover services such as acupuncture, chiropractic care, counseling, and psychotherapy. If your family values these aspects of healthcare, ensure that the plan you choose provides coverage for such services.

A family with a member struggling with anxiety or depression may find a plan that includes mental health coverage to be invaluable. It ensures that the necessary support and treatment are accessible, promoting overall well-being.

| Additional Benefit | Description |

|---|---|

| Vision and Dental Coverage | Integrated coverage for eye exams, eyeglasses, and dental care. |

| Wellness Programs | Incentives and reduced costs for preventive care and wellness initiatives. |

| Prescription Drug Benefits | Coverage for necessary medications, with reduced out-of-pocket costs. |

| Alternative Medicine and Mental Health Coverage | Inclusion of services like acupuncture, chiropractic care, and counseling. |

The Enrollment Process and Timelines

Understanding the enrollment process and timelines is crucial to ensure a smooth transition to your new health insurance plan. Different plans may have specific enrollment periods, so being aware of these dates is essential.

Open Enrollment Periods

Most health insurance plans have designated open enrollment periods, during which you can enroll or make changes to your coverage. These periods typically occur annually, providing an opportunity to evaluate and adjust your insurance plan based on changing needs.

Familiarize yourself with the open enrollment dates for your desired plan. Missing these deadlines may result in a lack of coverage or limited options for changes until the next open enrollment period.

Special Enrollment Periods

In certain circumstances, such as a life event like a marriage, birth, or loss of other health coverage, you may be eligible for a special enrollment period. These periods allow you to enroll outside of the regular open enrollment dates. Understanding the eligibility criteria and timelines for special enrollment periods is crucial to take advantage of these opportunities.

For instance, if a family member loses their job and their employer-provided health insurance, they may qualify for a special enrollment period to obtain new coverage. Being aware of these options can ensure that your family maintains continuous coverage during transitional periods.

Timelines for Coverage Activation

Once you’ve selected a health insurance plan and enrolled, understanding the timelines for coverage activation is essential. Some plans may have a waiting period before coverage begins, while others may provide immediate coverage upon enrollment.

Review the plan's policy to determine the coverage activation timeline. This information is crucial, especially if you anticipate immediate healthcare needs upon enrollment.

| Enrollment Period | Description |

|---|---|

| Open Enrollment | Designated period for enrolling or making changes to your coverage. |

| Special Enrollment | Opportunity to enroll outside of open enrollment due to specific life events. |

| Coverage Activation Timeline | Timeframe for coverage to become effective after enrollment. |

Conclusion: Making an Informed Decision

Choosing the best health insurance plan for your family is a critical decision that requires careful consideration. By evaluating your family’s specific health needs, assessing your budget and coverage requirements, understanding plan types and benefits, and staying informed about enrollment processes, you can make an informed choice that aligns with your family’s well-being and financial situation.

Remember, the best plan is one that provides comprehensive coverage, suits your family's healthcare preferences, and offers value for your investment. Take the time to research, compare, and understand the options available to ensure a healthy and secure future for your loved ones.

FAQ

Can I switch health insurance plans during the year if my needs change?

+

Yes, in certain circumstances, you may be eligible for a special enrollment period that allows you to switch plans outside