Health Insurance India

In a vast and diverse country like India, where healthcare services are essential yet often inaccessible for many, health insurance emerges as a vital tool to bridge the gap and ensure quality medical care. With a rapidly growing population and an evolving healthcare landscape, understanding the intricacies of health insurance is not just beneficial but crucial for individuals and families. This comprehensive guide aims to shed light on the world of health insurance in India, offering an in-depth analysis of its importance, the different types available, and how to navigate the complexities to make informed decisions.

Understanding the Need for Health Insurance in India

India, with its unique blend of traditional and modern healthcare practices, faces distinct challenges in providing equitable access to healthcare. The country’s vast size, diverse population, and varying levels of economic development create a complex healthcare scenario. Here’s why health insurance is pivotal in addressing these challenges:

1. Affordability of Healthcare

One of the primary concerns in India is the affordability of quality healthcare. Medical treatments, especially specialized procedures, can be expensive, often leading to financial strain or even catastrophic financial losses for individuals and families. Health insurance acts as a financial safety net, ensuring that medical expenses are covered and reducing the financial burden on patients.

| Example: Hospitalization Costs | Average Expenses (INR) |

|---|---|

| General Surgery | ₹200,000 - ₹500,000 |

| Critical Care (ICU) | ₹150,000 - ₹300,000 per day |

| Maternity (Normal Delivery) | ₹50,000 - ₹150,000 |

Key Takeaway: Health insurance can significantly reduce the financial risk associated with medical emergencies.

2. Access to Quality Healthcare

India’s healthcare infrastructure is unevenly distributed, with urban areas often having better access to quality medical facilities. Health insurance, especially with a wide network of hospitals, can help bridge this gap by providing coverage for treatments in these facilities, thus improving access to specialized care.

3. Preventive Healthcare

Health insurance policies often come with incentives for preventive care, such as annual health check-ups, vaccinations, and wellness programs. This encourages individuals to take a proactive approach to their health, potentially reducing the occurrence of chronic diseases and promoting overall well-being.

4. Legal and Ethical Considerations

The Insurance Regulatory and Development Authority of India (IRDAI) regulates the health insurance sector to ensure ethical practices and protect the rights of policyholders. Understanding these regulations is crucial for consumers to ensure they are not victims of unfair practices.

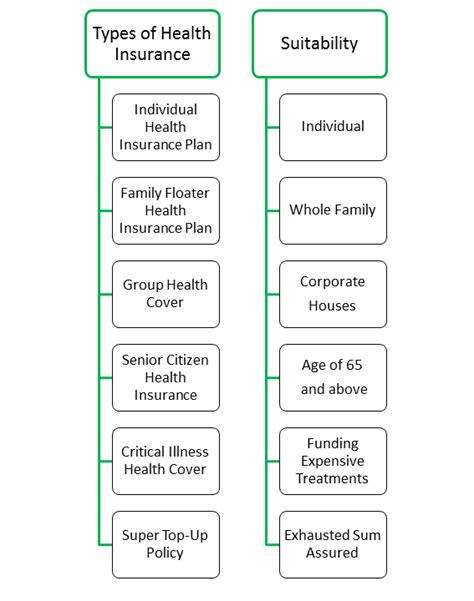

Types of Health Insurance in India

Health insurance in India is offered by both public and private sector companies, with a range of policies catering to diverse needs. Understanding the different types is essential to choose the right coverage.

1. Individual Health Insurance

As the name suggests, this type of insurance covers an individual person. It is ideal for singles, young professionals, or those who are the sole earners in their families. Individual plans offer flexibility in terms of coverage limits, add-ons, and premium amounts.

| Plan Type | Coverage | Premium |

|---|---|---|

| Basic | Inpatient hospitalization, day care procedures | ₹10,000 - ₹20,000 per year |

| Comprehensive | Basic coverage plus pre/post-hospitalization, OPD expenses | ₹20,000 - ₹50,000 per year |

| Super Comprehensive | Comprehensive coverage plus critical illness, organ donor | ₹50,000 - ₹100,000 per year |

2. Family Floater Health Insurance

This plan covers the entire family, typically including the policyholder, spouse, and dependent children. It offers a single sum insured that can be utilized by any family member. Family floater plans are cost-effective and provide comprehensive coverage for the entire family.

3. Senior Citizen Health Insurance

Designed specifically for individuals above the age of 60, these plans cater to the unique health needs of the elderly. They often include coverage for age-related ailments, pre-existing conditions, and home healthcare services.

4. Critical Illness Insurance

Critical illness insurance provides a lump-sum benefit upon diagnosis of specified critical illnesses like cancer, heart attack, or stroke. This policy can be a supplement to regular health insurance, providing additional financial support during critical medical conditions.

Choosing the Right Health Insurance Policy

Selecting the appropriate health insurance policy involves careful consideration of various factors. Here’s a comprehensive guide to help you make an informed decision:

1. Understanding Your Health Needs

Assess your current and potential future health needs. Consider your age, lifestyle, family medical history, and any pre-existing conditions. This evaluation will help you determine the type of coverage required.

2. Evaluating Your Financial Capacity

Health insurance premiums can vary widely based on the type of policy, sum insured, and add-ons. It’s crucial to choose a plan that aligns with your financial capabilities without compromising on necessary coverage.

3. Researching Insurance Providers

Not all insurance companies are created equal. Research their reputation, customer reviews, claim settlement ratios, and financial stability. A reliable insurer ensures smooth processing of claims and provides better support during emergencies.

4. Comparing Policy Features

Look beyond just the sum insured and premium. Compare policy features like coverage limits, waiting periods, exclusions, and add-ons. Understand the terms and conditions to ensure you’re aware of any limitations or restrictions.

5. Network Hospitals and Cashless Treatment

Choose a policy that offers a wide network of hospitals, including those in your locality. Cashless treatment, where the insurance company directly settles the bill with the hospital, can be a significant advantage, reducing the hassle and financial burden during hospitalization.

6. Reading the Fine Print

Always read the policy document thoroughly. Understand the exclusions, sub-limits, and any specific conditions for claim settlement. This ensures you’re aware of what’s covered and what’s not, preventing any surprises during claim processing.

The Future of Health Insurance in India

The health insurance sector in India is evolving rapidly, driven by technological advancements, changing consumer preferences, and regulatory reforms. Here’s a glimpse into the potential future of health insurance in the country:

1. Digital Transformation

The digital revolution is transforming the health insurance landscape. Online policy purchases, digital claim settlements, and AI-driven risk assessment are becoming more prevalent. This shift towards digital health insurance is expected to enhance efficiency, reduce costs, and improve customer experience.

2. Focus on Preventive Care

There’s a growing emphasis on preventive healthcare in India. Insurance providers are offering incentives for regular health check-ups, fitness tracking, and healthy lifestyle choices. This shift towards prevention is expected to reduce the overall healthcare burden and improve the nation’s health outcomes.

3. Customized Plans

The future of health insurance may see the emergence of highly customized plans. These plans could be tailored to individual health needs, lifestyle choices, and even genetic predispositions. This level of customization could lead to more efficient risk management and better-targeted coverage.

4. Integration with Healthcare Providers

Health insurance companies are increasingly partnering with healthcare providers to offer integrated services. This could include bundled packages for specific treatments, or even the development of exclusive healthcare facilities. Such integrations could lead to more efficient and cost-effective healthcare delivery.

5. Regulatory Reforms

The IRDAI is actively working towards improving the health insurance sector. This includes initiatives like standardizing policy wordings, enhancing protection for policyholders, and promoting innovation. These reforms are expected to create a more transparent and consumer-friendly insurance market.

FAQs

How do I choose the right sum insured for my health insurance policy?

+

Choosing the right sum insured depends on various factors such as your age, health condition, family size, and financial capacity. It’s recommended to opt for a sum insured that covers your expected medical expenses for at least one year, with a buffer for unexpected emergencies. Regularly reviewing and updating your sum insured based on changing health needs and inflation is also advisable.

What are some common exclusions in health insurance policies?

+

Common exclusions in health insurance policies may include pre-existing conditions, cosmetic procedures, dental treatments, mental health disorders, pregnancy-related expenses, and certain types of injuries (like those caused by war or terrorism). It’s crucial to read the policy document carefully to understand the exclusions and limitations.

How do I make a claim on my health insurance policy?

+

To make a claim on your health insurance policy, you typically need to inform your insurance provider about the hospitalization or medical treatment. They will guide you through the process, which may involve filling out claim forms, providing medical reports, and submitting bills and receipts. It’s advisable to keep all the necessary documents ready and follow the claim process as outlined in your policy document.

Can I renew my health insurance policy if I have made a claim?

+

Yes, you can renew your health insurance policy even if you have made a claim. However, some insurers may apply loading (an additional premium) on the renewal, especially if the claim amount was significant. It’s important to disclose all previous claims while renewing to ensure the policy remains valid.

What is the role of the Insurance Regulatory and Development Authority of India (IRDAI) in health insurance?

+

IRDAI is the regulatory body for the insurance sector in India. It sets rules and regulations for insurance companies, ensures fair practices, and protects the interests of policyholders. IRDAI also standardizes certain aspects of health insurance policies, such as the minimum sum insured and coverage limits, to ensure consumers have a clear understanding of their rights and responsibilities.