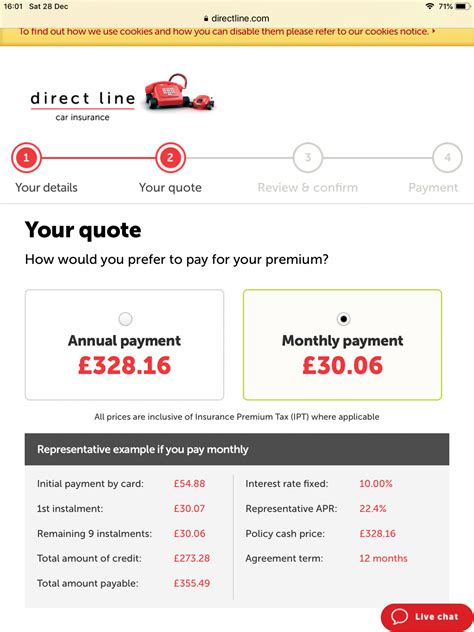

Direct Line Car Insurance Quote

Welcome to the ultimate guide to Direct Line car insurance! In this comprehensive article, we will delve into the world of Direct Line's insurance offerings, exploring the various aspects that make them a leading choice for vehicle protection. With a rich history spanning over three decades, Direct Line has established itself as a trusted provider, offering a wide range of insurance solutions tailored to meet the diverse needs of drivers across the United Kingdom.

As one of the UK's pioneering direct insurance companies, Direct Line has consistently innovated and adapted to the evolving landscape of the insurance industry. Their dedication to customer satisfaction and a commitment to providing comprehensive coverage at competitive prices have made them a household name. In this article, we will uncover the key features, benefits, and unique advantages of Direct Line's car insurance policies, empowering you to make an informed decision when it comes to safeguarding your vehicle.

A Legacy of Trust and Innovation

Direct Line was founded in 1985 with a revolutionary concept: to offer insurance directly to customers, eliminating the need for intermediaries. This direct-to-consumer approach revolutionized the insurance market, providing consumers with greater control and transparency in their insurance choices. Over the years, Direct Line has continued to innovate, introducing new products and services to cater to the evolving needs of its customers.

One of the key strengths of Direct Line lies in its ability to combine traditional insurance expertise with cutting-edge technology. Their online platform and mobile app provide users with convenient access to their insurance policies, allowing for quick and easy management of their coverage. This blend of tradition and innovation has positioned Direct Line as a leader in the digital insurance space, offering a seamless and efficient customer experience.

Comprehensive Car Insurance Coverage

Direct Line offers a comprehensive range of car insurance policies designed to cater to a wide spectrum of drivers and vehicle types. Whether you own a family sedan, a sports car, or a vintage automobile, Direct Line has a policy that fits your unique needs. Here’s a breakdown of the key coverage options available:

Third Party Only (TPO) Insurance

Direct Line’s TPO insurance provides a basic level of protection, covering you for liability arising from bodily injury or property damage to third parties. This policy is ideal for those seeking the most cost-effective option, as it offers the essential coverage required by law.

Third Party, Fire, and Theft (TPFT) Insurance

TPFT insurance takes the coverage a step further, offering protection not only for third-party liability but also for damage or loss caused by fire and theft. This policy provides added peace of mind, ensuring that you are covered for a wider range of eventualities.

Comprehensive Insurance

Direct Line’s comprehensive insurance policy is the ultimate choice for those seeking maximum protection. This policy covers not only third-party liability and damage caused by fire and theft but also provides coverage for your own vehicle in the event of an accident, regardless of fault. Comprehensive insurance offers the highest level of financial protection and is ideal for those who want to ensure their vehicle is safeguarded against a wide range of risks.

| Coverage Type | Description |

|---|---|

| Third Party Only (TPO) | Liability coverage for bodily injury and property damage to third parties. |

| Third Party, Fire, and Theft (TPFT) | TPO coverage plus protection against fire and theft. |

| Comprehensive Insurance | TPFT coverage plus protection for your own vehicle in case of accidents. |

Tailored Add-Ons and Additional Benefits

Direct Line understands that every driver has unique needs, which is why they offer a range of add-ons and additional benefits to customize your insurance policy. These enhancements allow you to create a coverage plan that perfectly aligns with your specific requirements.

Breakdown Cover

Direct Line’s breakdown cover provides roadside assistance in the event of a vehicle malfunction or breakdown. This add-on ensures that you receive prompt help, minimizing the inconvenience and stress associated with vehicle breakdowns.

Legal Expenses Cover

With legal expenses cover, Direct Line provides financial protection in the event of legal disputes arising from your vehicle. This coverage can help cover the costs associated with legal fees, providing you with the support you need to navigate any legal challenges related to your vehicle.

Courtesy Car

If you opt for Direct Line’s courtesy car add-on, you’ll receive access to a replacement vehicle in the event your car is rendered unusable due to an accident or repair. This ensures that your daily routine remains unaffected, allowing you to continue your regular activities without disruption.

Personal Belongings Cover

Personal belongings cover provides protection for your personal items kept within your vehicle. This add-on ensures that if your belongings are lost, stolen, or damaged, you’ll receive compensation for their replacement or repair.

| Add-On | Description |

|---|---|

| Breakdown Cover | Roadside assistance in case of vehicle breakdowns. |

| Legal Expenses Cover | Financial protection for legal disputes related to your vehicle. |

| Courtesy Car | Access to a replacement vehicle in case your car is unusable. |

| Personal Belongings Cover | Protection for personal items kept within your vehicle. |

Unparalleled Customer Service and Support

Direct Line prides itself on delivering exceptional customer service and support. Their dedicated team of insurance professionals is readily available to assist you with any inquiries or concerns you may have. Whether you need assistance with your policy, want to make a claim, or simply have a question, Direct Line’s customer service representatives are known for their expertise, friendliness, and efficiency.

Additionally, Direct Line offers a range of online tools and resources to empower customers to manage their policies with ease. Their online platform and mobile app provide 24/7 access to policy information, allowing you to make changes, update details, and view important documents at your convenience.

Claiming Made Simple

In the unfortunate event of an accident or loss, Direct Line’s streamlined claims process ensures a hassle-free experience. Their dedicated claims team is trained to guide you through every step of the claims journey, providing clear and concise instructions to ensure a swift and efficient resolution.

Direct Line understands the importance of prompt claim settlements, which is why they aim to process claims as quickly as possible. Their efficient claims management system utilizes advanced technology to expedite the process, minimizing delays and ensuring that you receive the compensation you're entitled to in a timely manner.

Direct Line’s Commitment to Road Safety

Beyond providing comprehensive insurance coverage, Direct Line is deeply committed to promoting road safety. They actively engage in initiatives and campaigns aimed at raising awareness about safe driving practices and reducing road accidents.

Through educational programs, community outreach, and partnerships with road safety organizations, Direct Line plays a vital role in fostering a culture of responsible driving. Their efforts extend beyond their insurance offerings, making a positive impact on the broader community and contributing to a safer road environment for all.

Conclusion

Direct Line’s car insurance offerings represent a blend of comprehensive coverage, innovative technology, and a commitment to customer satisfaction. With a range of policy options, tailored add-ons, and exceptional customer service, they have established themselves as a trusted partner for drivers across the UK.

Whether you're seeking basic liability protection or comprehensive coverage for your vehicle, Direct Line has a policy that meets your needs. Their dedication to road safety and continuous innovation position them as a leader in the insurance industry, making them a top choice for those seeking reliable and affordable car insurance.

Frequently Asked Questions

Can I get a quote for car insurance online with Direct Line?

+

Absolutely! Direct Line offers a convenient online quoting process. Simply visit their website, enter your details, and you’ll receive a personalized quote within minutes.

What factors influence the cost of my car insurance quote with Direct Line?

+

The cost of your car insurance quote is determined by various factors, including your driving history, the make and model of your vehicle, your age, and the level of coverage you choose. Direct Line’s online quoting tool takes these factors into account to provide an accurate estimate.

How can I reduce the cost of my car insurance with Direct Line?

+

There are several ways to potentially reduce your car insurance costs with Direct Line. Some strategies include increasing your excess amount, opting for a higher level of security for your vehicle, and maintaining a clean driving record. Additionally, Direct Line may offer discounts for certain groups, such as students or those with a telematics policy.