Car Insurance Comare

Comparing Car Insurance: A Comprehensive Guide

Navigating the complex world of car insurance can be a daunting task, but with the right knowledge and a systematic approach, you can make informed decisions to protect your vehicle and your finances. This comprehensive guide aims to provide an in-depth analysis of the car insurance landscape, helping you compare policies, understand coverage options, and make the best choice for your specific needs. Whether you're a seasoned driver or a first-time car owner, this article will equip you with the expertise to secure the most suitable car insurance coverage.

Understanding Car Insurance Coverage

Car insurance is a contract between you and an insurance provider, designed to financially protect you and your vehicle in the event of an accident, theft, or other covered incidents. It's a vital aspect of vehicle ownership, offering peace of mind and ensuring you're prepared for unexpected situations on the road.

The primary purpose of car insurance is to provide financial coverage for various types of losses, including:

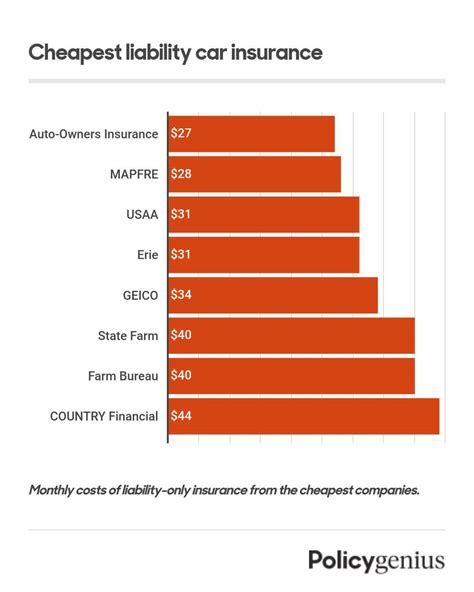

- Liability Coverage: This covers the costs if you're found at fault for an accident, including bodily injury and property damage to others.

- Comprehensive Coverage: This protects against non-collision incidents such as theft, vandalism, natural disasters, and animal collisions.

- Collision Coverage: As the name suggests, this covers damages to your vehicle resulting from a collision with another vehicle or object.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this pays for medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides coverage if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough coverage to pay for the damages.

Each of these coverage types plays a critical role in ensuring you're protected against a range of potential risks. However, it's important to understand that not all policies offer the same coverage, and the extent of protection can vary significantly between providers.

Key Factors to Consider When Comparing Policies

When comparing car insurance policies, it's essential to look beyond the price tag and consider several critical factors that can impact your overall coverage and experience. Here are some key aspects to evaluate:

- Coverage Options: Different providers offer varying coverage limits and types. Ensure you're comparing policies with similar coverage to get an accurate assessment of value.

- Policy Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can lead to lower premiums, but consider if you're financially prepared to cover a higher deductible in the event of a claim.

- Discounts: Many insurance companies offer discounts for various reasons, such as safe driving records, vehicle safety features, multi-policy bundles, and loyalty. These discounts can significantly reduce your overall premium.

- Customer Service and Claims Handling: The quality of customer service and claims handling can greatly impact your experience. Look for providers with a solid reputation for timely and efficient claims processing and positive customer reviews.

- Financial Stability: Choose an insurance company with a strong financial rating, ensuring they're capable of paying out claims even in the event of significant losses across their customer base.

- Policy Add-ons: Some providers offer additional coverage options, such as rental car reimbursement, roadside assistance, or gap insurance. These add-ons can provide extra peace of mind but may increase your premium.

By carefully considering these factors and understanding your specific needs, you can make an informed decision when choosing a car insurance policy. Remember, the best policy is not always the cheapest, but the one that provides the most comprehensive coverage and value for your unique circumstances.

Researching and Obtaining Quotes

Once you have a solid understanding of the different coverage options and factors to consider, the next step is to start researching and obtaining quotes from various insurance providers. This process will allow you to compare prices, coverage, and other critical aspects of the policies.

Online Quote Tools

Many insurance companies and comparison websites offer online quote tools that allow you to input your vehicle and personal details to generate an estimated quote. These tools can be a great starting point to quickly compare prices and coverage options from multiple providers.

However, it's important to note that online quotes are typically estimates and may not reflect the final cost of your policy. Factors such as your driving record, credit score, and specific vehicle details can impact the final premium, so it's always a good idea to follow up with a direct quote from the insurer.

Direct Quotes from Insurers

Obtaining a direct quote from an insurance company involves providing them with detailed information about your vehicle, driving history, and personal circumstances. This process typically involves a phone call or online form, where you'll answer a series of questions to ensure an accurate quote.

Direct quotes from insurers are more reliable than online estimates, as they take into account all the specific factors that can impact your premium. They also allow you to ask questions and clarify any doubts you may have about the policy.

Comparing Quotes

When you have a collection of quotes from various insurers, it's time to compare them side by side. Look beyond the price and consider the coverage limits, deductibles, and any additional perks or discounts offered.

| Insurance Provider | Premium | Coverage Limits | Deductibles | Additional Perks |

|---|---|---|---|---|

| Provider A | $1,200 annually | $100,000 liability, $500 comprehensive/collision deductibles | 24/7 roadside assistance | |

| Provider B | $1,100 annually | $50,000 liability, $300 comprehensive/collision deductibles | Rental car reimbursement | |

| Provider C | $1,300 annually | $200,000 liability, $1,000 comprehensive/collision deductibles | No additional perks |

In the above example, Provider A offers higher liability coverage and a valuable roadside assistance perk, while Provider B has a slightly lower premium and rental car reimbursement. Provider C has the highest premium but also the highest liability coverage. Each policy has its own strengths and weaknesses, and the best choice will depend on your specific needs and preferences.

Remember, it's not just about finding the cheapest option. You want a policy that provides adequate coverage for your vehicle and financial situation, and offers value for money.

Analyzing Your Options and Making a Decision

With a collection of quotes and a thorough understanding of the coverage options and factors to consider, you're now equipped to make an informed decision about your car insurance.

Assessing Your Needs

Before finalizing your choice, take some time to assess your specific needs and circumstances. Consider the following:

- What type of vehicle do you drive, and what is its value? High-value vehicles may require more comprehensive coverage.

- How often do you drive, and for what purpose? Frequent commuters may want more robust coverage than occasional drivers.

- Do you have any specific concerns or potential risks you want to be covered for, such as living in an area prone to natural disasters or having a teen driver in the household?

- What is your budget for car insurance, and how flexible can you be with deductibles and coverage limits to stay within that budget?

Weighing the Pros and Cons

Once you've assessed your needs, it's time to weigh the pros and cons of each policy option. Look at the coverage limits, deductibles, additional perks, and of course, the premium.

Consider the potential scenarios you might face and how each policy would respond. For example, if you're concerned about potential theft, a policy with comprehensive coverage and a lower deductible might be more beneficial. On the other hand, if you're a safe driver and want to save money, a policy with higher deductibles and lower premiums could be a suitable choice.

Seeking Expert Advice

If you're still unsure or need further guidance, consider seeking advice from an insurance broker or financial advisor. These professionals can provide expert insights and help you navigate the complex world of car insurance, ensuring you make the right choice for your specific circumstances.

Remember, car insurance is a critical aspect of vehicle ownership, and making an informed decision can save you money and provide peace of mind. Take your time, research thoroughly, and choose a policy that offers the best value and coverage for your needs.

Frequently Asked Questions

What is the average cost of car insurance?

+The average cost of car insurance can vary significantly depending on factors such as your location, driving record, vehicle type, and coverage options. As a rough estimate, the average annual premium in the United States is around 1,500, but it can range from 500 to over $3,000.

How can I lower my car insurance premiums?

+There are several strategies to reduce your car insurance premiums. These include maintaining a clean driving record, shopping around for quotes from multiple providers, opting for higher deductibles, taking advantage of discounts (such as safe driver discounts or multi-policy discounts), and considering usage-based insurance programs.

What factors determine my car insurance rates?

+Your car insurance rates are influenced by various factors, including your age, gender, driving record, credit score, location, and the make and model of your vehicle. Insurers also consider the coverage options and limits you choose, as well as any additional discounts or perks you qualify for.

How often should I review and update my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and up-to-date. Major life events like getting married, having children, purchasing a new vehicle, or moving to a different location may require adjustments to your policy.

What should I do if I’m involved in an accident and need to file a claim?

+If you’re involved in an accident, remain calm and ensure the safety of yourself and others involved. Exchange information with the other parties, including their insurance details. Take photos of the accident scene and any damage to vehicles. Contact your insurance provider as soon as possible to report the accident and initiate the claims process. Follow their instructions and provide all necessary documentation to support your claim.