Gap Insurance On Car

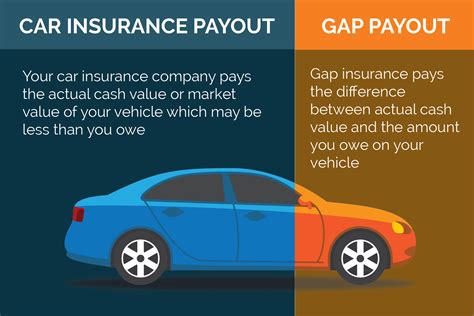

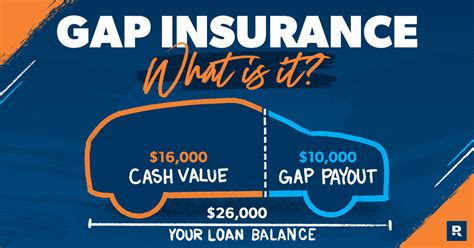

Gap insurance, or Guaranteed Asset Protection insurance, is a type of coverage that bridges the gap between the actual value of your vehicle and the amount owed to the finance company or leasing entity. It acts as a financial safety net for car owners, providing protection against potential losses that may arise from situations like total vehicle loss, theft, or write-offs.

In the event of a total loss, gap insurance steps in to cover the difference between the vehicle's market value and the outstanding loan or lease balance. This coverage is particularly crucial as it ensures car owners are not left with a substantial financial burden after an unfortunate incident. With gap insurance, you can rest assured that you won't be paying for a vehicle you no longer have.

Understanding Gap Insurance: A Comprehensive Overview

Gap insurance is an optional coverage that is typically offered when you purchase a new vehicle, either as an add-on to your existing auto insurance policy or as a standalone product. It is designed to address the depreciation that occurs as soon as you drive a new car off the dealership lot. While comprehensive and collision insurance cover the vehicle’s actual cash value, gap insurance provides an extra layer of protection to cover the difference between the insurance payout and the amount owed.

For instance, if your car is written off due to an accident and the insurance company assesses its value at $15,000, but you still owe $20,000 on your loan, gap insurance will step in to cover the remaining $5,000. This scenario often occurs with new car purchases, where the loan or lease amount can exceed the vehicle's market value, especially in the initial years of ownership.

Key Features of Gap Insurance

Gap insurance offers several benefits that make it an essential consideration for vehicle owners:

- Depreciation Protection: Vehicles depreciate rapidly, especially in the first few years of ownership. Gap insurance ensures that you’re not left paying for a vehicle that has significantly decreased in value.

- Financial Security: By covering the gap between the vehicle’s value and the outstanding loan/lease balance, gap insurance provides financial security and peace of mind.

- Broad Coverage: Gap insurance typically covers a wide range of scenarios, including total loss, theft, and write-offs due to accidents or natural disasters.

- Affordability: Despite its comprehensive coverage, gap insurance is relatively affordable, often costing a few hundred dollars for the entire term of your loan or lease.

When Gap Insurance is Recommended

Gap insurance is highly recommended for individuals who:

- Have a significant loan or lease balance on their vehicle.

- Are financing a high-value vehicle with a substantial down payment.

- Have a lease agreement where the residual value is likely to be lower than the actual market value at the end of the lease term.

- Live in areas with high rates of car theft or natural disasters.

How Gap Insurance Works: A Step-by-Step Guide

Understanding the process of gap insurance is crucial to making an informed decision. Here’s a breakdown of how gap insurance typically works:

Step 1: Purchasing Gap Insurance

You can purchase gap insurance either at the time of buying your vehicle or at a later date. Many dealerships offer gap insurance as an add-on, but it’s essential to compare quotes and understand the terms and conditions.

Step 2: Filing a Claim

In the event of a covered loss, such as an accident resulting in a total loss or theft, you’ll need to file a claim with your insurance provider. This process involves providing documentation of the loss and the vehicle’s current value.

Step 3: Gap Insurance Coverage

Once your insurance provider has assessed the vehicle’s value and confirmed the claim, gap insurance will step in to cover the difference between the vehicle’s actual cash value and the outstanding loan/lease balance. This coverage ensures you’re not left with a financial shortfall.

Step 4: Settlement

The gap insurance provider will pay the difference directly to the finance company or leasing entity, ensuring that your loan or lease balance is settled in full. You will then only be responsible for any deductible or excess charges outlined in your insurance policy.

The Benefits of Gap Insurance: Real-World Examples

To illustrate the value of gap insurance, let’s consider a few real-world scenarios:

Scenario 1: Total Loss Due to Accident

Imagine you’ve purchased a new car for 30,000 and financed it with a 60-month loan. After 2 years, your car is involved in an accident and is declared a total loss. The insurance company assesses its value at 20,000, but you still owe 25,000 on the loan. Without gap insurance, you would be responsible for the 5,000 difference. However, with gap insurance, the provider covers this gap, ensuring you’re not left with a financial burden.

Scenario 2: Theft of a High-Value Vehicle

You own a luxury car worth 100,000, and you've leased it for 3 years. Unfortunately, your car is stolen, and the insurance company assesses its value at 80,000. With a gap insurance policy, you’re protected against this loss, as the insurance provider covers the $20,000 difference between the vehicle’s value and the lease balance.

Scenario 3: Natural Disaster

Your car is damaged beyond repair due to a natural disaster, such as a hurricane or flood. The insurance company determines the vehicle’s value at 18,000, but you owe 22,000 on the loan. With gap insurance, you’re covered for the $4,000 difference, ensuring you’re not left with a substantial debt.

Performance Analysis and Expert Insights

Gap insurance has proven to be a valuable asset for vehicle owners, providing essential financial protection in various scenarios. Its popularity and effectiveness have led to a growing number of providers offering gap insurance policies, each with unique features and benefits.

When considering gap insurance, it's crucial to compare providers and understand the specific terms and conditions of each policy. Factors such as the coverage amount, deductibles, and the scope of covered events can vary significantly between providers. Additionally, it's essential to review the policy's exclusions and limitations to ensure it meets your specific needs.

Expert advice highlights the importance of gap insurance, especially for individuals who are financing or leasing vehicles. By bridging the gap between the vehicle's value and the outstanding loan/lease balance, gap insurance ensures that vehicle owners are not left with a financial burden in the event of a total loss, theft, or write-off. This coverage provides peace of mind and financial security, allowing individuals to focus on their recovery and moving forward without the added stress of debt.

Future Implications and Trends

The future of gap insurance looks promising, with ongoing advancements in the automotive industry and the increasing awareness of its benefits. As vehicles continue to depreciate rapidly, especially in the early years of ownership, gap insurance is expected to remain a crucial component of comprehensive auto insurance coverage.

Industry trends suggest that gap insurance providers will continue to innovate and adapt their policies to meet the evolving needs of vehicle owners. This may include the introduction of new features, such as enhanced coverage for specific types of losses or the integration of technology to streamline the claims process. Additionally, as more individuals opt for leasing over traditional ownership, gap insurance policies are likely to evolve to cater specifically to lease agreements.

Furthermore, with the rise of electric vehicles (EVs) and the potential for rapid depreciation due to technological advancements and changing consumer preferences, gap insurance is expected to play a vital role in protecting EV owners. As the market for EVs expands, gap insurance providers will need to stay abreast of industry developments to ensure their policies remain relevant and effective.

In conclusion, gap insurance is a critical component of comprehensive auto insurance coverage, providing essential financial protection for vehicle owners. Its ability to bridge the gap between a vehicle's value and the outstanding loan/lease balance makes it an invaluable asset in various scenarios, from total losses to theft and natural disasters. With ongoing industry advancements and increasing awareness, gap insurance is set to play an even more significant role in the future, ensuring vehicle owners have the peace of mind and financial security they need.

What is the average cost of gap insurance?

+The average cost of gap insurance can vary depending on several factors, including the value of your vehicle, the length of your loan or lease term, and the provider you choose. Generally, gap insurance is relatively affordable, often costing a few hundred dollars for the entire term of your loan or lease. It’s a small price to pay for the financial protection it offers.

Does gap insurance cover all types of vehicles?

+Yes, gap insurance is available for a wide range of vehicles, including cars, motorcycles, trucks, and even some specialty vehicles. However, it’s important to note that the specific terms and conditions may vary depending on the type of vehicle and the provider you choose.

Can I purchase gap insurance at any time?

+While gap insurance is typically offered at the time of purchasing a new vehicle, it is possible to purchase it at a later date. However, it’s important to note that the coverage may be more limited if you wait too long. Some providers may have specific timelines or restrictions on when you can purchase gap insurance, so it’s best to inquire with your provider for more details.